Last Update 11 Jan 26

N91: Dividend Increases And Margin Resilience Will Support Neutrally Priced Shares

Narrative Update: Ninety One Group

Analysts have lifted their price target for Ninety One Group from £1.90 to £2.26, a £0.36 change, citing updated views on the firm’s revenue growth, profit margins and forward P/E assumptions.

Analyst Commentary

Recent research updates from JPMorgan point to a modest reset in how the market is framing Ninety One Group, with price targets moving from £1.90 to £2.23 and then to £2.26, while the rating remains Neutral. Here is how you might think about the key takeaways behind those numbers.

Bullish Takeaways

- Repeated price target increases to £2.23 and then £2.26 suggest that analysts with a more positive view see improved support for the current valuation, even if they are not shifting to a positive rating.

- The tight gap between the latest target of £2.26 and the prior £2.23 points to more refined assumptions on revenue, margins and P/E rather than a one-off change in opinion, which can help investors frame expectations more clearly.

- Maintaining coverage with updated targets implies analysts still see Ninety One Group as relevant for investors focused on execution against its current earnings and cash generation profile.

- The move from a £1.90 target level to the low £2s can be read as cautious acknowledgment that the previous valuation framework may have been too conservative relative to recent inputs.

Bearish Takeaways

- Despite the higher targets, the Neutral stance from JPMorgan signals that more cautious analysts are not yet convinced there is a clear margin of safety between the current share price and their £2.26 valuation anchor.

- The relatively small £0.03 change from £2.23 to £2.26 suggests limited upside is being modeled, which can cap enthusiasm for investors looking for a strong re-rating story.

- Keeping the rating at Neutral alongside target raises hints at questions around execution consistency, such as how reliably current revenue and margin assumptions can be met.

- The focus on adjusting valuation inputs rather than upgrading the overall view indicates some caution on visibility around the business outlook and the durability of earnings that underpin the revised price target range.

What's in the News

- The Board declared an interim dividend of 6.0 pence per share for the six months ended 30 September 2025, with an estimated total payout of £53.8m, compared with 5.4 pence per share for the six months to 30 September 2024 (company announcement).

- The interim dividend is scheduled to be paid on 19 December 2025 to shareholders on the UK and South African registers as of 5 December 2025 (company announcement).

Valuation Changes

- Fair Value: Fair value per share is kept steady at £2.17, with no change between the previous narrative and the latest update.

- Discount Rate: The discount rate has edged down slightly from 12.18% to 12.15%, indicating a marginally lower required return in the updated model.

- Revenue Growth: The revenue growth assumption is adjusted slightly higher from 11.26% to 11.32%, reflecting a small uplift in expected top line expansion used in the valuation work.

- Net Profit Margin: The net profit margin assumption moves slightly up from 24.45% to 24.49%, representing a very modest change in the earnings profile feeding into the model.

- Future P/E: The future P/E multiple is trimmed gently from 12.39x to 12.35x, indicating a very small reduction in the valuation multiple applied to projected earnings.

Key Takeaways

- Overoptimism about the Sanlam partnership and cost-saving initiatives may not offset near-term earnings dilution and persistent structural margin pressure.

- Shifting investor preferences, regulatory tightening, and emerging market volatility present continued risks to asset flows, fees, and overall revenue stability.

- Strategic expansion, technology investments, and disciplined cost management position Ninety One for sustained growth, improved efficiency, and increased shareholder value across diverse markets.

Catalysts

About Ninety One Group- Operates as an independent global asset manager worldwide.

- Optimism around the Sanlam transaction may be driving overvaluation, with expectations for rapid AUM growth from access to Sanlam's distribution network; however, the actual impact appears long-dated, while near-term financials will be diluted by a significant share issuance-likely weighing on revenue per share and adjusted EPS in the medium term.

- Investors may be underestimating the continued shift in investor preferences from active to passive investment vehicles, with Ninety One's persistent net outflows (despite modest recent inflows) and average fee rate decline indicating ongoing revenue and net margin pressure as the firm contends with pricing competition and shrinking addressable markets for its core active strategies.

- There may be excessive confidence in the ability of technology and AI-driven efficiency initiatives to offset structural cost pressures, while in reality, increased technology spend and inflation-linked business expenses are expected to drive operating costs higher, potentially compressing operating margins further.

- Elevated expectations for emerging market inflows may not fully account for inherent volatility and sustained investor hesitance towards international and EM exposures, as evidenced by ongoing outflows in key categories-posing risk to AUM stability and topline revenue growth if market sentiment turns or macro/geopolitical headwinds persist.

- Anticipated regulatory tightening, including rising global minimum tax rates and increasing transparency requirements, is already resulting in higher effective tax rates and compliance costs, which could further erode net margins and earnings growth beyond current market expectations.

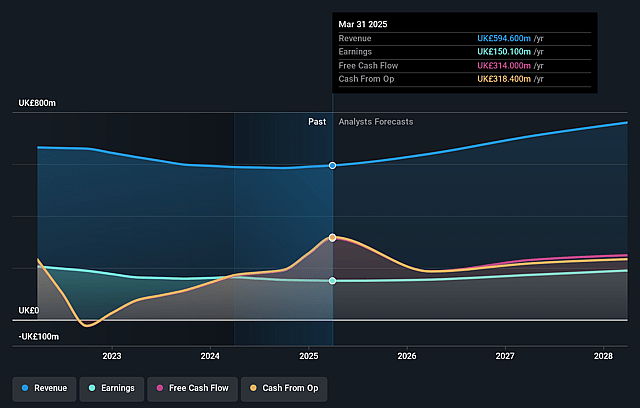

Ninety One Group Future Earnings and Revenue Growth

Assumptions

How have these above catalysts been quantified?- Analysts are assuming Ninety One Group's revenue will grow by 5.6% annually over the next 3 years.

- Analysts assume that profit margins will shrink from 26.2% today to 23.9% in 3 years time.

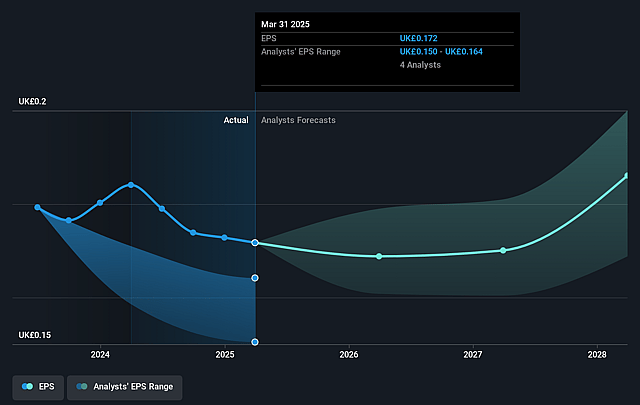

- Analysts expect earnings to reach £164.0 million (and earnings per share of £0.16) by about June 2028, up from £153.4 million today. The analysts are largely in agreement about this estimate.

- In order for the above numbers to justify the analysts price target, the company would need to trade at a PE ratio of 11.3x on those 2028 earnings, up from 10.2x today. This future PE is lower than the current PE for the GB Capital Markets industry at 12.4x.

- Analysts expect the number of shares outstanding to remain consistent over the next 3 years.

- To value all of this in today's terms, we will use a discount rate of 11.38%, as per the Simply Wall St company report.

Ninety One Group Future Earnings Per Share Growth

Risks

What could happen that would invalidate this narrative?- The Sanlam transaction is expected to add approximately £17 billion to Ninety One's assets under management (AUM), provide preferred access to a major retail distribution network in South Africa, anchor investment in new strategies, and broaden the client base; these factors can drive sustained AUM growth and revenue expansion over the long term.

- Ongoing investments in AI and technology are anticipated to increase operational efficiency and effectiveness, aiding in offsetting structural cost inflation and helping the company maintain profit margins even in a period of industry-wide fee pressure.

- Ninety One's established brand, improved investment performance, and deep client relationships-especially in emerging markets and with large institutional clients-position the firm to capture new inflows as clients reallocate portfolios, supporting topline revenues and earnings resilience.

- Geographic expansion and diversification efforts, such as opening offices in the Middle East and building a pipeline in the Americas, are increasing Ninety One's addressable market and creating opportunities for cross-sell and growth in regions with rising savings pools, which can drive future revenue and margin growth.

- The business remains capital-light, margin-rich, has continued disciplined cost management, and regularly returns capital to shareholders via buybacks and dividends; these features support robust long-term earnings, cash flow generation, and return on equity, increasing the firm's long-term intrinsic value.

Valuation

How have all the factors above been brought together to estimate a fair value?- The analysts have a consensus price target of £1.522 for Ninety One Group based on their expectations of its future earnings growth, profit margins and other risk factors. However, there is a degree of disagreement amongst analysts, with the most bullish reporting a price target of £1.8, and the most bearish reporting a price target of just £1.25.

- In order for you to agree with the analyst's consensus, you'd need to believe that by 2028, revenues will be £687.7 million, earnings will come to £164.0 million, and it would be trading on a PE ratio of 11.3x, assuming you use a discount rate of 11.4%.

- Given the current share price of £1.78, the analyst price target of £1.52 is 16.7% lower.

- We always encourage you to reach your own conclusions though. So sense check these analyst numbers against your own assumptions and expectations based on your understanding of the business and what you believe is probable.

Have other thoughts on Ninety One Group?

Create your own narrative on this stock, and estimate its Fair Value using our Valuator tool.

Create NarrativeHow well do narratives help inform your perspective?

Disclaimer

AnalystConsensusTarget is a tool utilizing a Large Language Model (LLM) that ingests data on consensus price targets, forecasted revenue and earnings figures, as well as the transcripts of earnings calls to produce qualitative analysis. The narratives produced by AnalystConsensusTarget are general in nature and are based solely on analyst data and publicly-available material published by the respective companies. These scenarios are not indicative of the company's future performance and are exploratory in nature. Simply Wall St has no position in the company(s) mentioned. Simply Wall St may provide the securities issuer or related entities with website advertising services for a fee, on an arm's length basis. These relationships have no impact on the way we conduct our business, the content we host, or how our content is served to users. The price targets and estimates used are consensus data, and do not constitute a recommendation to buy or sell any stock, and they do not take account of your objectives, or your financial situation. Note that AnalystConsensusTarget's analysis may not factor in the latest price-sensitive company announcements or qualitative material.