Catalysts

About Ninety One Group

Ninety One Group is an international active asset manager focused on public and private markets with a capital light, technology enabled business model.

What are the underlying business or industry changes driving this perspective?

- Reaccelerating demand for active strategies, particularly in international and emerging market equities and fixed income, positions Ninety One to capture higher fee bearing flows and sustain revenue growth as net inflows build on the recent GBP 4.3 billion turnaround.

- Growing global appetite for geographic diversification in institutional portfolios, including renewed interest in emerging market equities and bonds where Ninety One is already a market leader, should support structurally higher AUM and fee income over the medium term.

- Expansion of private credit and broader private markets capabilities, reinforced by new senior talent and specialist transition credit strategies, creates a higher margin growth leg that can lift overall earnings and support operating margin resilience.

- Deepening in region presence through new offices in the Middle East, a domestic build out in Saudi Arabia and an alternatives focused joint venture in Asia is likely to accelerate institutional mandate wins, driving scalable AUM growth and improved operating leverage.

- Ongoing investment in AI, core technology platforms and a dedicated digital finance unit, combined with a capital light model, should enhance productivity, lower unit costs and support sustained operating margins above 30% even under continued headline fee pressure.

Assumptions

This narrative explores a more optimistic perspective on Ninety One Group compared to the consensus, based on a Fair Value that aligns with the bullish cohort of analysts. How have these above catalysts been quantified?

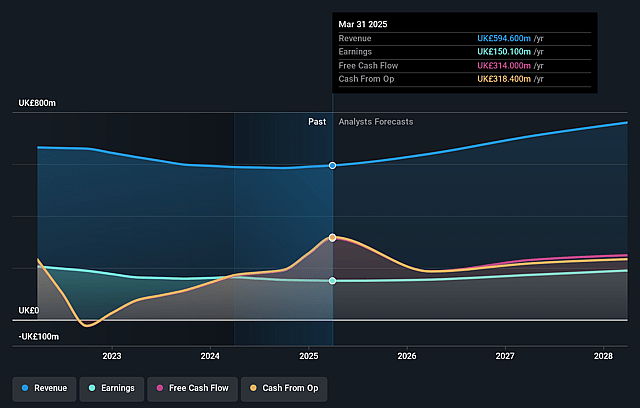

- The bullish analysts are assuming Ninety One Group's revenue will grow by 14.5% annually over the next 3 years.

- The bullish analysts assume that profit margins will shrink from 25.9% today to 23.6% in 3 years time.

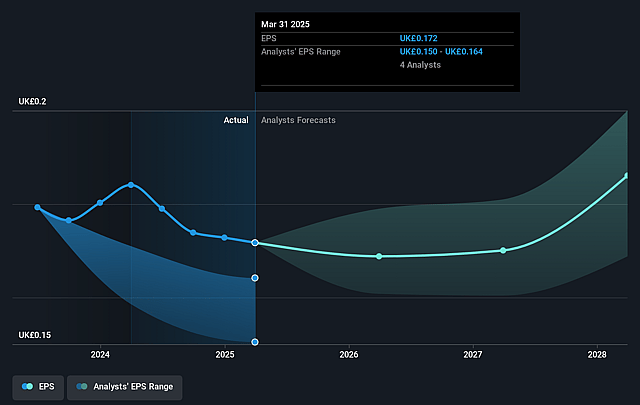

- The bullish analysts expect earnings to reach £215.4 million (and earnings per share of £0.21) by about December 2028, up from £158.0 million today. The analysts are largely in agreement about this estimate.

- In order for the above numbers to justify the price target of the more bullish analyst cohort, the company would need to trade at a PE ratio of 13.6x on those 2028 earnings, up from 11.6x today. This future PE is greater than the current PE for the GB Capital Markets industry at 12.6x.

- The bullish analysts expect the number of shares outstanding to decline by 1.14% per year for the next 3 years.

- To value all of this in today's terms, we will use a discount rate of 12.23%, as per the Simply Wall St company report.

Risks

What could happen that would invalidate this narrative?

- A sharp reversal in global equity and bond markets, especially in emerging markets where Ninety One has a high exposure and recent gains have been strong, would compress assets under management, reduce management and performance fees and stall the nascent recovery in net inflows, which would weigh directly on revenue and earnings growth.

- Persistent and possibly accelerating fee pressure, as large institutional clients and multi managers demand lower fee rates in exchange for larger mandates, combined with structurally lower fee business from Sanlam and other fixed income heavy flows, could cause the average management fee margin to grind down faster than the guided 1 basis point a year. This would erode net revenue yield and put sustained pressure on operating margins.

- Rising people and technology costs, including ongoing investment in AI, digital platforms, new offices and private markets capability, alongside headcount growth that does not translate into proportionate AUM and revenue gains, could push the compensation ratio and business expenses higher over time. This would undermine Ninety One's ability to hold operating margins near or above 30% and would limit earnings growth.

- The long term shift of institutional and retail capital toward passive products and low cost indexed solutions, plus any slowdown in the current cyclical rebound in demand for active and emerging market strategies, may cap organic inflows into Ninety One's core active long only franchise. This could lead to structurally lower net flows and slower compound growth in revenue and earnings.

- Execution and integration risks around the Sanlam transactions, new regional build outs in markets such as Saudi Arabia and Asia, and the build out of private markets and AI enabled capabilities could result in slower than expected scaling of new initiatives, potential client or asset attrition in acquired books and a heavier amortization and cost drag. All of this would dilute profit margins and constrain earnings per share growth.

Valuation

How have all the factors above been brought together to estimate a fair value?

- The assumed bullish price target for Ninety One Group is £2.5, which represents up to two standard deviations above the consensus price target of £2.17. This valuation is based on what can be assumed as the expectations of Ninety One Group's future earnings growth, profit margins and other risk factors from analysts on the bullish end of the spectrum.

- However, there is a degree of disagreement amongst analysts, with the most bullish reporting a price target of £2.5, and the most bearish reporting a price target of just £1.8.

- In order for you to agree with the more bullish analyst cohort, you'd need to believe that by 2028, revenues will be £913.4 million, earnings will come to £215.4 million, and it would be trading on a PE ratio of 13.6x, assuming you use a discount rate of 12.2%.

- Given the current share price of £2.06, the analyst price target of £2.5 is 17.4% higher.

- We always encourage you to reach your own conclusions though. So sense check these analyst numbers against your own assumptions and expectations based on your understanding of the business and what you believe is probable.

Have other thoughts on Ninety One Group?

Create your own narrative on this stock, and estimate its Fair Value using our Valuator tool.

Create NarrativeHow well do narratives help inform your perspective?

Disclaimer

AnalystHighTarget is a tool utilizing a Large Language Model (LLM) that ingests data on consensus price targets, forecasted revenue and earnings figures, as well as the transcripts of earnings calls to produce qualitative analysis. The narratives produced by AnalystHighTarget are general in nature and are based solely on analyst data and publicly-available material published by the respective companies. These scenarios are not indicative of the company's future performance and are exploratory in nature. Simply Wall St has no position in the company(s) mentioned. Simply Wall St may provide the securities issuer or related entities with website advertising services for a fee, on an arm's length basis. These relationships have no impact on the way we conduct our business, the content we host, or how our content is served to users. The price targets and estimates used are consensus data, and do not constitute a recommendation to buy or sell any stock, and they do not take account of your objectives, or your financial situation. Note that AnalystHighTarget's analysis may not factor in the latest price-sensitive company announcements or qualitative material.