Unpleasant Surprises Could Be In Store For Nordic American Tankers Limited's (NYSE:NAT) Shares

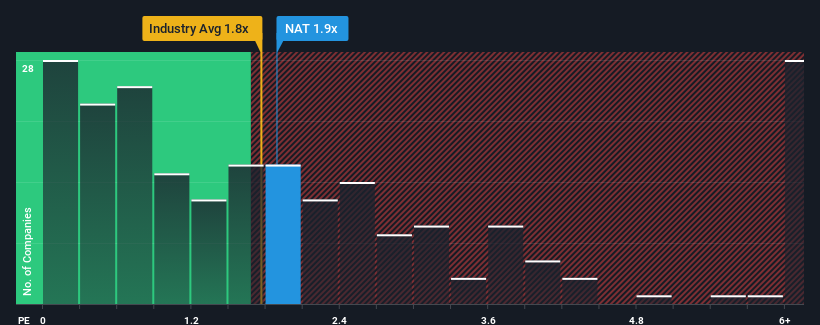

There wouldn't be many who think Nordic American Tankers Limited's (NYSE:NAT) price-to-sales (or "P/S") ratio of 1.9x is worth a mention when the median P/S for the Oil and Gas industry in the United States is similar at about 1.8x. However, investors might be overlooking a clear opportunity or potential setback if there is no rational basis for the P/S.

View our latest analysis for Nordic American Tankers

How Has Nordic American Tankers Performed Recently?

Nordic American Tankers certainly has been doing a good job lately as its revenue growth has been positive while most other companies have been seeing their revenue go backwards. It might be that many expect the strong revenue performance to deteriorate like the rest, which has kept the P/S ratio from rising. Those who are bullish on Nordic American Tankers will be hoping that this isn't the case, so that they can pick up the stock at a slightly lower valuation.

If you'd like to see what analysts are forecasting going forward, you should check out our free report on Nordic American Tankers.What Are Revenue Growth Metrics Telling Us About The P/S?

The only time you'd be comfortable seeing a P/S like Nordic American Tankers' is when the company's growth is tracking the industry closely.

If we review the last year of revenue growth, the company posted a terrific increase of 82%. Revenue has also lifted 6.4% in aggregate from three years ago, mostly thanks to the last 12 months of growth. Therefore, it's fair to say the revenue growth recently has been respectable for the company.

Looking ahead now, revenue is anticipated to slump, contracting by 12% each year during the coming three years according to the three analysts following the company. With the industry predicted to deliver 3.1% growth each year, that's a disappointing outcome.

In light of this, it's somewhat alarming that Nordic American Tankers' P/S sits in line with the majority of other companies. It seems most investors are hoping for a turnaround in the company's business prospects, but the analyst cohort is not so confident this will happen. Only the boldest would assume these prices are sustainable as these declining revenues are likely to weigh on the share price eventually.

The Key Takeaway

Using the price-to-sales ratio alone to determine if you should sell your stock isn't sensible, however it can be a practical guide to the company's future prospects.

While Nordic American Tankers' P/S isn't anything out of the ordinary for companies in the industry, we didn't expect it given forecasts of revenue decline. With this in mind, we don't feel the current P/S is justified as declining revenues are unlikely to support a more positive sentiment for long. If the poor revenue outlook tells us one thing, it's that these current price levels could be unsustainable.

Before you take the next step, you should know about the 1 warning sign for Nordic American Tankers that we have uncovered.

If you're unsure about the strength of Nordic American Tankers' business, why not explore our interactive list of stocks with solid business fundamentals for some other companies you may have missed.

가치 평가는 복잡하지만, 저희는 이를 단순화하고자 합니다.

공정가치 추정치, 잠재적 위험, 배당금, 내부자 거래 및 재무 상태를 포함한 자세한 분석을 통해 Nordic American Tankers 의 저평가 또는 고평가 여부를 알아보세요.

무료 분석에 액세스Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

This article has been translated from its original English version, which you can find here.