Hanwha Ocean Co., Ltd. (KRX:042660) Stocks Shoot Up 28% But Its P/E Still Looks Reasonable

Hanwha Ocean Co., Ltd. (KRX:042660) shares have continued their recent momentum with a 28% gain in the last month alone. The annual gain comes to 177% following the latest surge, making investors sit up and take notice.

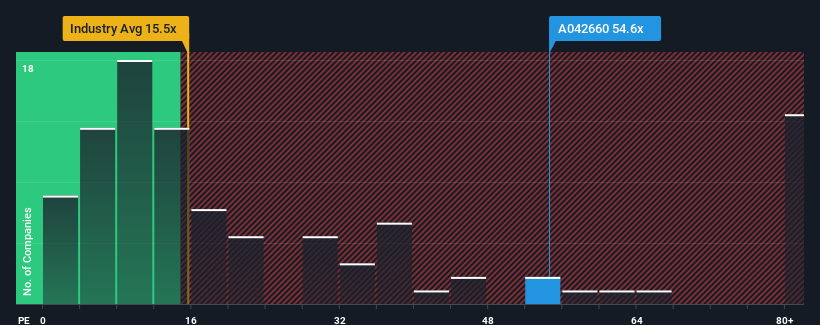

After such a large jump in price, Hanwha Ocean's price-to-earnings (or "P/E") ratio of 54.6x might make it look like a strong sell right now compared to the market in Korea, where around half of the companies have P/E ratios below 11x and even P/E's below 6x are quite common. Nonetheless, we'd need to dig a little deeper to determine if there is a rational basis for the highly elevated P/E.

Our free stock report includes 3 warning signs investors should be aware of before investing in Hanwha Ocean. Read for free now.With earnings growth that's superior to most other companies of late, Hanwha Ocean has been doing relatively well. It seems that many are expecting the strong earnings performance to persist, which has raised the P/E. If not, then existing shareholders might be a little nervous about the viability of the share price.

View our latest analysis for Hanwha Ocean

Is There Enough Growth For Hanwha Ocean?

In order to justify its P/E ratio, Hanwha Ocean would need to produce outstanding growth well in excess of the market.

If we review the last year of earnings growth, the company posted a terrific increase of 124%. Still, EPS has barely risen at all from three years ago in total, which is not ideal. Therefore, it's fair to say that earnings growth has been inconsistent recently for the company.

Shifting to the future, estimates from the analysts covering the company suggest earnings should grow by 29% per annum over the next three years. That's shaping up to be materially higher than the 18% each year growth forecast for the broader market.

With this information, we can see why Hanwha Ocean is trading at such a high P/E compared to the market. Apparently shareholders aren't keen to offload something that is potentially eyeing a more prosperous future.

The Key Takeaway

Hanwha Ocean's P/E is flying high just like its stock has during the last month. While the price-to-earnings ratio shouldn't be the defining factor in whether you buy a stock or not, it's quite a capable barometer of earnings expectations.

We've established that Hanwha Ocean maintains its high P/E on the strength of its forecast growth being higher than the wider market, as expected. At this stage investors feel the potential for a deterioration in earnings isn't great enough to justify a lower P/E ratio. Unless these conditions change, they will continue to provide strong support to the share price.

We don't want to rain on the parade too much, but we did also find 3 warning signs for Hanwha Ocean (2 shouldn't be ignored!) that you need to be mindful of.

It's important to make sure you look for a great company, not just the first idea you come across. So take a peek at this free list of interesting companies with strong recent earnings growth (and a low P/E).

If you're looking to trade Hanwha Ocean, open an account with the lowest-cost platform trusted by professionals, Interactive Brokers.

With clients in over 200 countries and territories, and access to 160 markets, IBKR lets you trade stocks, options, futures, forex, bonds and funds from a single integrated account.

Enjoy no hidden fees, no account minimums, and FX conversion rates as low as 0.03%, far better than what most brokers offer.

Sponsored Content가치 평가는 복잡하지만, 저희는 이를 단순화하고자 합니다.

공정가치 추정치, 잠재적 위험, 배당금, 내부자 거래 및 재무 상태를 포함한 자세한 분석을 통해 Hanwha Ocean 의 저평가 또는 고평가 여부를 알아보세요.

무료 분석에 액세스Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

This article has been translated from its original English version, which you can find here.