Key Takeaways

- Stricter regulations, rising capex demands, and increased competition are squeezing margins, curbing growth, and complicating earnings expansion across Vodacom's operating regions.

- Shifts in consumer behavior toward alternative platforms and subdued economic conditions are undermining traditional revenue streams and weakening topline momentum.

- Geographic and service diversification, cost optimization, and market leadership in financial services and digital sectors are driving stronger earnings and improving valuation resilience.

Catalysts

About Vodacom Group- Operates as a voice, messaging, converged services, broadband, data connectivity, mobile financial services and other value-added services company in South Africa, Egypt, and internationally.

- Ongoing tightening of data sovereignty and localization regulations in key African markets is likely to drive up compliance costs, erode Vodacom's operational flexibility, and ultimately squeeze net margins across multiple geographies as local governments seek stricter control of digital infrastructure.

- The accelerating shift by consumers towards alternative communication platforms such as WhatsApp and Skype continues to cannibalize legacy voice and messaging revenues, undermining a core historical earnings pillar and putting sustained downward pressure on service revenue and profitability.

- Persistent macroeconomic weakness and high unemployment in major African economies are expected to dampen consumer spending power for the foreseeable future, causing growth in both average revenue per user and data consumption to slow materially, which threatens topline revenue growth across Vodacom's footprint.

- Increasing capital intensity required for 5G and ongoing fiber rollout, alongside the need to sustain investments in energy resilience due to unreliable power in key regions, will generate prolonged pressure on free cash flow, limit the ability to raise dividends, and elevate execution risk as return on capital employed normalizes to lower levels over time.

- Intensified price competition from both existing operators and new market entrants, combined with growing regulatory intervention (including the risk of blocked mergers and acquisition deals), will compress ARPU and make active margin expansion increasingly unachievable, further capping Vodacom's long-term earnings progression and reducing net income growth prospects.

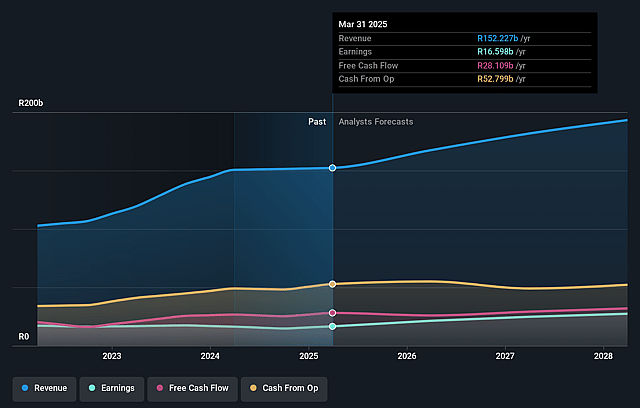

Vodacom Group Future Earnings and Revenue Growth

Assumptions

How have these above catalysts been quantified?- This narrative explores a more pessimistic perspective on Vodacom Group compared to the consensus, based on a Fair Value that aligns with the bearish cohort of analysts.

- The bearish analysts are assuming Vodacom Group's revenue will grow by 8.3% annually over the next 3 years.

- The bearish analysts assume that profit margins will increase from 10.9% today to 13.7% in 3 years time.

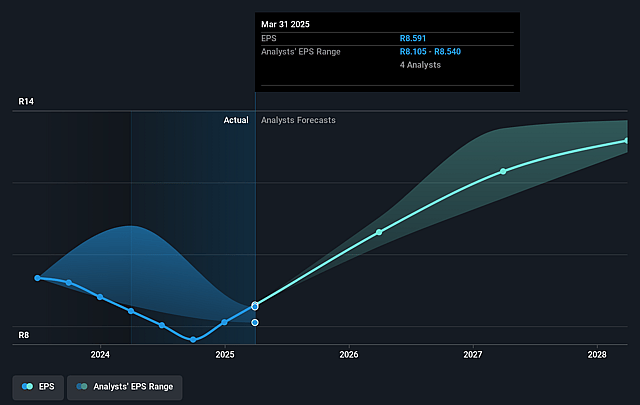

- The bearish analysts expect earnings to reach ZAR 26.4 billion (and earnings per share of ZAR 13.55) by about September 2028, up from ZAR 16.6 billion today. The analysts are largely in agreement about this estimate.

- In order for the above numbers to justify the price target of the more bearish analyst cohort, the company would need to trade at a PE ratio of 14.2x on those 2028 earnings, down from 16.0x today. This future PE is lower than the current PE for the ZA Wireless Telecom industry at 24.8x.

- Analysts expect the number of shares outstanding to remain consistent over the next 3 years.

- To value all of this in today's terms, we will use a discount rate of 16.74%, as per the Simply Wall St company report.

Vodacom Group Future Earnings Per Share Growth

Risks

What could happen that would invalidate this narrative?- The successful diversification into new geographies, particularly the acquisition of Vodafone Egypt and ramp up in Ethiopia, is sharply reducing dependence on South Africa and fueling robust revenue and profit growth, which could support higher group earnings and improve future valuations.

- Vodacom's rapid scaling in financial services, with 88 million customers and $2 billion in revenue generating 15-20% revenue CAGR guidance, increases higher-margin, lower-capital-intensity business that strengthens net margin and earnings resilience.

- Strategic infrastructure sharing and ongoing cost optimization initiatives, such as tower and network sharing with MTN, Airtel, and Orange, are expected to materially reduce operating and capital expenditure, which directly benefits net margins and free cash flow.

- Market leadership in high-growth African sectors-such as fintech, mobile money (including M-Pesa), IoT, and data-positions Vodacom to capitalize on secular trends like rising digital adoption, supporting long-term service revenue and ARPU increases.

- The stabilization or improvement in foreign exchange environments, especially with Egypt's local currency performance leading to a 99% local-currency net income increase and a 25% net profit margin, could mitigate prior FX headwinds and drive stronger reported earnings growth.

Valuation

How have all the factors above been brought together to estimate a fair value?- The assumed bearish price target for Vodacom Group is ZAR122.0, which represents the lowest price target estimate amongst analysts. This valuation is based on what can be assumed as the expectations of Vodacom Group's future earnings growth, profit margins and other risk factors from analysts on the more bearish end of the spectrum.

- However, there is a degree of disagreement amongst analysts, with the most bullish reporting a price target of ZAR185.0, and the most bearish reporting a price target of just ZAR122.0.

- In order for you to agree with the bearish analysts, you'd need to believe that by 2028, revenues will be ZAR193.1 billion, earnings will come to ZAR26.4 billion, and it would be trading on a PE ratio of 14.2x, assuming you use a discount rate of 16.7%.

- Given the current share price of ZAR137.38, the bearish analyst price target of ZAR122.0 is 12.6% lower. Despite analysts expecting the underlying buisness to improve, they seem to believe the market's expectations are too high.

- We always encourage you to reach your own conclusions though. So sense check these analyst numbers against your own assumptions and expectations based on your understanding of the business and what you believe is probable.

How well do narratives help inform your perspective?

Disclaimer

AnalystLowTarget is a tool utilizing a Large Language Model (LLM) that ingests data on consensus price targets, forecasted revenue and earnings figures, as well as the transcripts of earnings calls to produce qualitative analysis. The narratives produced by AnalystLowTarget are general in nature and are based solely on analyst data and publicly-available material published by the respective companies. These scenarios are not indicative of the company's future performance and are exploratory in nature. Simply Wall St has no position in the company(s) mentioned. Simply Wall St may provide the securities issuer or related entities with website advertising services for a fee, on an arm's length basis. These relationships have no impact on the way we conduct our business, the content we host, or how our content is served to users. The price targets and estimates used are consensus data, and do not constitute a recommendation to buy or sell any stock, and they do not take account of your objectives, or your financial situation. Note that AnalystLowTarget's analysis may not factor in the latest price-sensitive company announcements or qualitative material.