Key Takeaways

- Strong fintech and digital platform growth, geographic expansion, and technology partnerships position Vodacom for higher margins and long-term earnings outperformance.

- Strategic network sharing and disciplined capital allocation drive efficiency, enhance cash flow, and support robust shareholder returns despite challenging macro conditions.

- Ongoing economic stagnation, regulatory hurdles, and currency volatility in key African markets threaten Vodacom's revenue growth and profitability, while intensifying competition depresses margins.

Catalysts

About Vodacom Group- Operates as a connectivity, digital, and financial services company in South Africa, Egypt, and internationally.

- Analyst consensus expects strong growth in Vodacom's fintech platforms, but current market projections significantly understate the earnings power given Vodacom's robust 15-20 percent compound annual growth guidance and USD 2 billion revenue from financial services, which, coupled with the lower capital intensity of these offerings, is already leading to outsized net margin expansion relative to traditional telcos.

- While analysts broadly agree that geographical and product diversification will reduce reliance on South Africa, they may be underestimating the potential for share gains and supernormal returns in Egypt, where service revenue grew over 45 percent in local currency and Vodafone Cash revenue soared by 80 percent; Egypt's net profit margin of 25 percent signals this region could anchor group-level earnings outperformance for years to come.

- Vodacom's early-mover advantage in deploying technology partnerships (spanning IoT, SD-WAN, and enterprise fixed services) positions it to tap into accelerating digitalization and surging enterprise digital demand across Africa, suggesting a multi-year runway for high-margin, premium B2B revenue growth and structural EBITDA margin uplift.

- The ongoing push toward network and infrastructure sharing-including active tower and fiber agreements within and across markets like South Africa, DRC, and with operators such as MTN and Orange-is a powerful structural catalyst to drive sustainable cost efficiencies and compound free cash flow and returns on capital, especially in difficult macro conditions.

- Vodacom's disciplined capital allocation, which includes consistently high dividend payouts (recently at 78 percent of earnings), continued deleveraging, and optionality to redeploy capital toward value-enhancing regional fiber and digital partnerships or M&A, creates a long-term underpin for total shareholder return far beyond what is currently reflected in the valuation.

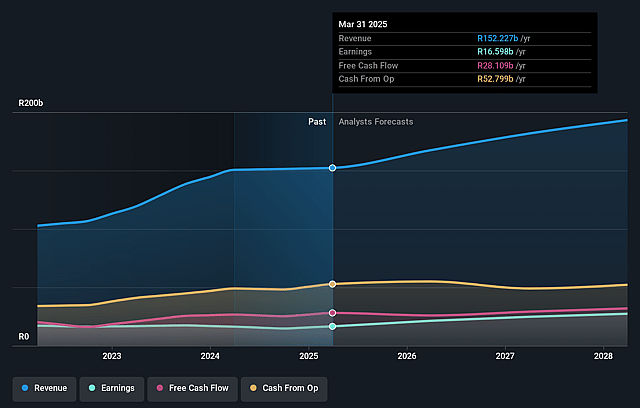

Vodacom Group Future Earnings and Revenue Growth

Assumptions

How have these above catalysts been quantified?- This narrative explores a more optimistic perspective on Vodacom Group compared to the consensus, based on a Fair Value that aligns with the bullish cohort of analysts.

- The bullish analysts are assuming Vodacom Group's revenue will grow by 10.4% annually over the next 3 years.

- The bullish analysts assume that profit margins will increase from 10.9% today to 16.8% in 3 years time.

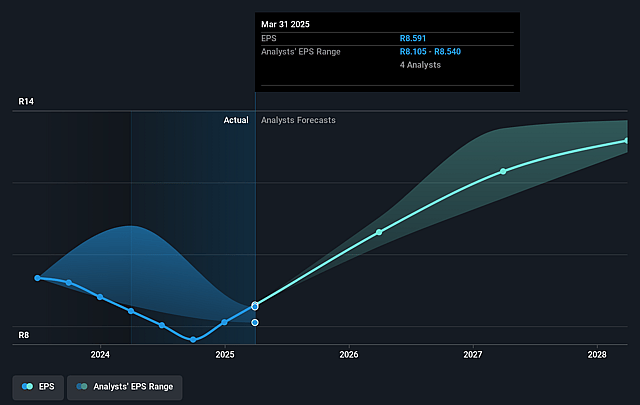

- The bullish analysts expect earnings to reach ZAR 34.4 billion (and earnings per share of ZAR 14.5) by about September 2028, up from ZAR 16.6 billion today. The analysts are largely in agreement about this estimate.

- In order for the above numbers to justify the price target of the more bullish analyst cohort, the company would need to trade at a PE ratio of 16.1x on those 2028 earnings, up from 16.0x today. This future PE is lower than the current PE for the ZA Wireless Telecom industry at 24.8x.

- Analysts expect the number of shares outstanding to remain consistent over the next 3 years.

- To value all of this in today's terms, we will use a discount rate of 16.74%, as per the Simply Wall St company report.

Vodacom Group Future Earnings Per Share Growth

Risks

What could happen that would invalidate this narrative?- Intensifying macroeconomic uncertainty and stagnant economic growth in core African markets such as South Africa and Mozambique may suppress consumer spending on advanced telecom services, creating headwinds for Vodacom's revenue growth in the long term.

- Regulatory risk, including spectrum allocation delays and unresolved mergers such as the "massive transaction" in South Africa, could impede network expansion, limit efficiency gains, and put downward pressure on both revenue and operating margins for Vodacom.

- Heightened competition from over-the-top services like WhatsApp and Zoom continues to erode traditional voice and messaging revenues, which may compress Vodacom's core ARPU and result in weaker net earnings over time.

- Ongoing infrastructure and network sharing across African markets, while reducing capital expenditure, may undermine product differentiation and intensify price competition, potentially leading to persistent margin pressure and lower industry-wide profitability for Vodacom.

- Structural currency devaluation and volatility, especially in key markets like Egypt and the DRC, may continue to erode reported revenues and profits in South African rand terms, adversely impacting headline earnings and possibly investor sentiment.

Valuation

How have all the factors above been brought together to estimate a fair value?- The assumed bullish price target for Vodacom Group is ZAR180.39, which represents two standard deviations above the consensus price target of ZAR142.67. This valuation is based on what can be assumed as the expectations of Vodacom Group's future earnings growth, profit margins and other risk factors from analysts on the bullish end of the spectrum.

- However, there is a degree of disagreement amongst analysts, with the most bullish reporting a price target of ZAR185.0, and the most bearish reporting a price target of just ZAR122.0.

- In order for you to agree with the bullish analysts, you'd need to believe that by 2028, revenues will be ZAR204.8 billion, earnings will come to ZAR34.4 billion, and it would be trading on a PE ratio of 16.1x, assuming you use a discount rate of 16.7%.

- Given the current share price of ZAR137.38, the bullish analyst price target of ZAR180.39 is 23.8% higher.

- We always encourage you to reach your own conclusions though. So sense check these analyst numbers against your own assumptions and expectations based on your understanding of the business and what you believe is probable.

How well do narratives help inform your perspective?

Disclaimer

AnalystHighTarget is a tool utilizing a Large Language Model (LLM) that ingests data on consensus price targets, forecasted revenue and earnings figures, as well as the transcripts of earnings calls to produce qualitative analysis. The narratives produced by AnalystHighTarget are general in nature and are based solely on analyst data and publicly-available material published by the respective companies. These scenarios are not indicative of the company's future performance and are exploratory in nature. Simply Wall St has no position in the company(s) mentioned. Simply Wall St may provide the securities issuer or related entities with website advertising services for a fee, on an arm's length basis. These relationships have no impact on the way we conduct our business, the content we host, or how our content is served to users. The price targets and estimates used are consensus data, and do not constitute a recommendation to buy or sell any stock, and they do not take account of your objectives, or your financial situation. Note that AnalystHighTarget's analysis may not factor in the latest price-sensitive company announcements or qualitative material.