Key Takeaways

- Acceleration in global decarbonization and resource nationalism could enable higher platinum demand, premium pricing, and stable revenues, boosting Impala Platinum's long-term market position.

- Advanced mechanization, digital mining, and sustainability initiatives may significantly lower costs and unlock synergies, supporting increased margins and greater earnings resilience.

- Robust cost control, ongoing operational improvements, and strategic investments position the company to weather weak market conditions and capitalize on future demand shifts.

Catalysts

About Impala Platinum Holdings- Engages in the mining, processing, concentrating, refining, and sale of platinum group metals (PGMs) and associated base metals.

- Analyst consensus anticipates a sustained platinum deficit driven by hydrogen and fuel cell adoption, but accelerating global decarbonization policies and unexpected industrial applications may create demand shocks substantially above current forecasts, driving platinum prices and future revenue growth much higher than currently modeled.

- While consensus expects margin uplift from operational changes in Canada, ongoing mechanization, digital mining integration, and optimized smelter technology groupwide could yield a transformational drop in unit costs across all assets, leading to a rapid structural expansion of group net margins.

- Heightened global resource nationalism and PGMs' status as critical minerals could rapidly drive preferential trade contracts and government-backed offtake agreements, positioning Impala Platinum to secure super-premium pricing and highly stable revenue streams insulated from market volatility.

- Impala Platinum's established sustainability leadership and scalable renewables infrastructure uniquely position it to capture first-mover advantage as "green metal" demand accelerates, opening access to capital from ESG-focused investors and unlocking premium pricing for low-carbon PGMs, supporting superior free cash flow and earnings quality.

- Strategic consolidation opportunities, both within southern Africa and in North America, could allow Impala Platinum to further strengthen its global market share, unlock major operational synergies, and create step-change improvements in earnings resilience-potentially supporting a much higher long-term valuation than peers.

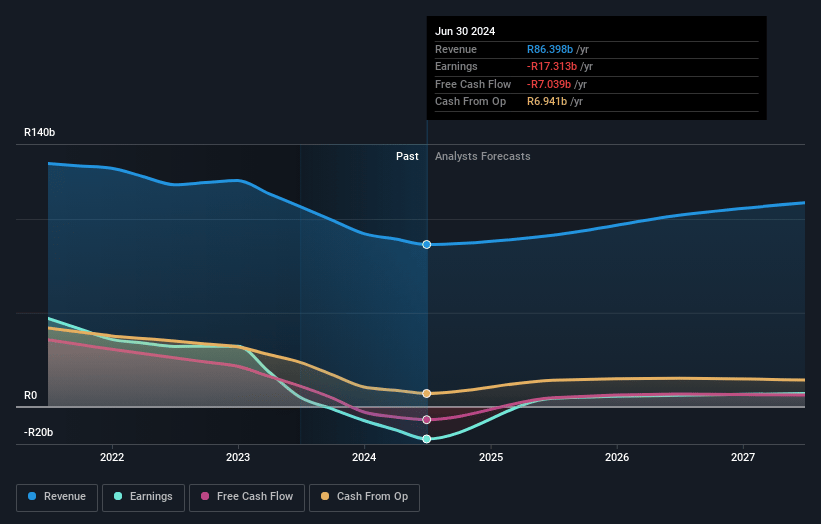

Impala Platinum Holdings Future Earnings and Revenue Growth

Assumptions

How have these above catalysts been quantified?- This narrative explores a more optimistic perspective on Impala Platinum Holdings compared to the consensus, based on a Fair Value that aligns with the bullish cohort of analysts.

- The bullish analysts are assuming Impala Platinum Holdings's revenue will grow by 15.0% annually over the next 3 years.

- The bullish analysts assume that profit margins will increase from -20.0% today to 19.9% in 3 years time.

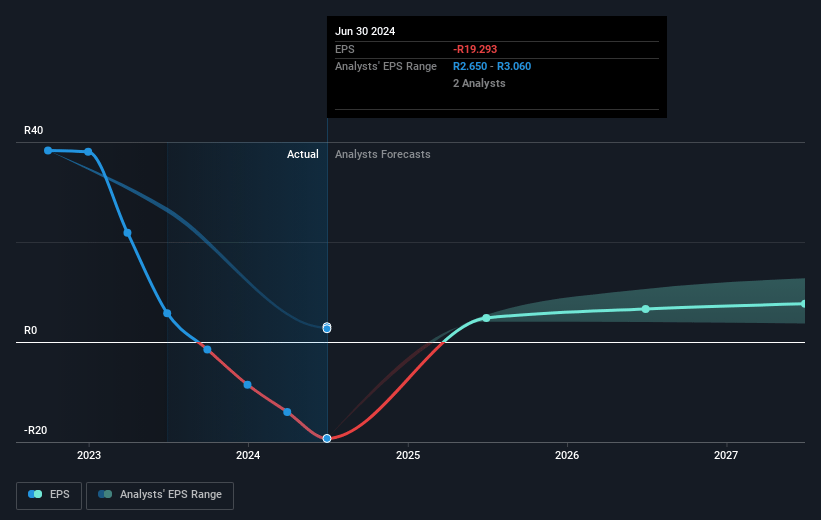

- The bullish analysts expect earnings to reach ZAR 25.8 billion (and earnings per share of ZAR 28.55) by about July 2028, up from ZAR -17.1 billion today. The analysts are largely in agreement about this estimate.

- In order for the above numbers to justify the price target of the more bullish analyst cohort, the company would need to trade at a PE ratio of 7.8x on those 2028 earnings, up from -8.8x today. This future PE is about the same as the current PE for the ZA Metals and Mining industry at 7.8x.

- Analysts expect the number of shares outstanding to decline by 0.32% per year for the next 3 years.

- To value all of this in today's terms, we will use a discount rate of 17.58%, as per the Simply Wall St company report.

Impala Platinum Holdings Future Earnings Per Share Growth

Risks

What could happen that would invalidate this narrative?- The company is demonstrating strong cost management and operational efficiency, as evidenced by unit cost increases being well below mining inflation and successful, non-disruptive labor restructuring, which could help support net margins and mitigate revenue declines in a weak pricing environment.

- Impala Platinum Holdings is actively investing in modernizing and expanding its processing and smelting capabilities, with recent projects in Zimbabwe and increased refining capacity, suggesting future potential for higher sales volumes and improved profitability if market conditions stabilize or improve.

- The management highlighted ongoing innovation and operational improvements, including advances in safety and digital monitoring, which could help the company maintain competitiveness and protect long-term earnings from the threat of rising extraction costs.

- Despite industry challenges, the company retains a strong balance sheet with positive free cash flow, significant liquidity, and minimal debt, providing resilience and the ability to invest in growth or return capital to shareholders, which could prevent steep declines in share price.

- While secular trends forecast falling demand for some PGMs, management anticipates sustained platinum deficits driven by the hydrogen economy, fuel cell electric vehicles, and strategic critical mineral status in major economies, which could underpin long-term revenue and support share price stability.

Valuation

How have all the factors above been brought together to estimate a fair value?- The assumed bullish price target for Impala Platinum Holdings is ZAR140.0, which is the highest price target estimate amongst analysts. This valuation is based on what can be assumed as the expectations of Impala Platinum Holdings's future earnings growth, profit margins and other risk factors from analysts on the bullish end of the spectrum.

- However, there is a degree of disagreement amongst analysts, with the most bullish reporting a price target of ZAR140.0, and the most bearish reporting a price target of just ZAR80.0.

- In order for you to agree with the bullish analysts, you'd need to believe that by 2028, revenues will be ZAR129.8 billion, earnings will come to ZAR25.8 billion, and it would be trading on a PE ratio of 7.8x, assuming you use a discount rate of 17.6%.

- Given the current share price of ZAR167.6, the bullish analyst price target of ZAR140.0 is 19.7% lower. Despite analysts expecting the underlying buisness to improve, they seem to believe the market's expectations are too high.

- We always encourage you to reach your own conclusions though. So sense check these analyst numbers against your own assumptions and expectations based on your understanding of the business and what you believe is probable.

How well do narratives help inform your perspective?

Disclaimer

AnalystHighTarget is a tool utilizing a Large Language Model (LLM) that ingests data on consensus price targets, forecasted revenue and earnings figures, as well as the transcripts of earnings calls to produce qualitative analysis. The narratives produced by AnalystHighTarget are general in nature and are based solely on analyst data and publicly-available material published by the respective companies. These scenarios are not indicative of the company's future performance and are exploratory in nature. Simply Wall St has no position in the company(s) mentioned. Simply Wall St may provide the securities issuer or related entities with website advertising services for a fee, on an arm's length basis. These relationships have no impact on the way we conduct our business, the content we host, or how our content is served to users. The price targets and estimates used are consensus data, and do not constitute a recommendation to buy or sell any stock, and they do not take account of your objectives, or your financial situation. Note that AnalystHighTarget's analysis may not factor in the latest price-sensitive company announcements or qualitative material.