Last Update 14 Dec 25

TXNM: Pending Blackstone Deal And Dividend Policy Will Shape Future Share Performance

Analysts nudged their price target on TXNM Energy higher to $61.25 from $58.00, citing alignment with the assumed Blackstone Infrastructure takeover value and a more balanced risk reward profile that supports Hold or Neutral ratings.

Analyst Commentary

Analysts describe the new $61.25 price target as a ceiling defined by the assumed Blackstone Infrastructure takeover value, framing the equity story as largely event driven rather than driven by standalone growth or margin expansion.

With ratings clustered around Hold and Neutral, the Street broadly sees limited upside from current levels, but acknowledges reduced downside risk now that the deal price provides a visible reference point for valuation.

Taken together, recent research suggests a mostly balanced outlook, with the potential transaction offering support for the share price while also capping near term upside as execution and regulatory milestones are monitored.

Bullish Takeaways

- Bullish analysts see the $61.25 takeover assumption as anchoring valuation, arguing that the market now has a clear floor under the stock as deal progress continues.

- The modest increase in price targets is viewed as a sign that risk reward has improved, with less uncertainty around standalone cash flow and capital intensity, at least through the deal timeline.

- Supportive analysts highlight that a potential acquisition could accelerate value realization compared with waiting for organic earnings growth to fully re rate the shares.

- Some research notes that, even with a Hold stance, current trading levels appear reasonably aligned with the implied takeout, leaving room for small upside if regulatory or timing outcomes surprise positively.

Bearish Takeaways

- Bearish analysts emphasize that, at or near $61.25, the shares already discount the full deal value, leaving minimal additional upside from either execution or rerating.

- The shift from more positive ratings toward Hold reflects concern that, absent the transaction, organic growth and returns on invested capital may not justify a higher multiple.

- Cautious views also focus on deal execution risk, including timing and regulatory approvals, which could introduce volatility if the process extends or terms are revisited.

- Some on the Street warn that a failed or delayed transaction could expose earnings and balance sheet sensitivities that are currently masked by the takeover narrative, pressuring valuation back toward prior targets.

What's in the News

- The Board approved a 3.7% increase in the annual dividend to $1.69 per share. The new quarterly dividend of $0.4225 will be payable on February 13, 2026 to shareholders of record on January 30, 2026, aligning with terms contemplated in the proposed Blackstone Infrastructure acquisition agreement (Board meeting, December 2, 2025).

- TXNM Energy entered into a Bond Purchase Agreement to issue $70 million of 4.69% First Mortgage Bonds in a private placement. The bonds will mature on December 18, 2031, with semiannual interest payments beginning July 31, 2026, supporting ongoing capital investment plans (Private placement, November 18, 2025).

- The Board meeting on September 23, 2025 included declaration of the regular quarterly dividend of $0.4075 per share on common stock, extending the company dividend track record ahead of the proposed transaction (Board meeting, September 23, 2025).

Valuation Changes

- Fair Value, unchanged at approximately $60.63 per share, continues to reflect the assumed takeover framework rather than a shift in standalone fundamentals.

- Discount Rate, unchanged at about 6.96 percent, implying a consistent required return in the updated model.

- Revenue Growth, effectively flat at around 5.61 percent, signaling no material change in long term top line assumptions.

- Net Profit Margin, stable at roughly 20.11 percent, indicating consistent expectations for operating efficiency and earnings quality.

- Future P/E, unchanged at about 19.75 times, suggesting that forward valuation multiples remain aligned with prior estimates.

Key Takeaways

- State support and strong capital investment in transmission and renewables will drive sustained revenue and earnings growth opportunities.

- Regulatory mechanisms and resiliency initiatives improve earnings predictability and reduce risks from large infrastructure deployments.

- Mounting grid investment needs, regulatory constraints, and shifting energy trends threaten TXNM Energy’s earnings stability, revenue growth, and cost recovery flexibility.

Catalysts

About TXNM Energy- Through its subsidiaries, provides electricity and electric services in the United States.

- Accelerated demand growth driven by data centers and commercial expansion in Texas, combined with state-level initiatives facilitating infrastructure build-out, signals increasing electricity sales and sustained revenue expansion.

- Approval and timely cost recovery of over $546 million in capital improvements through resiliency plans and transmission upgrades will boost the regulated rate base, driving predictable increases in EBITDA and net income via scheduled rate hikes.

- Legislative support for prebuilding infrastructure and the introduction of rate mechanisms (like the unified tracker and resilience recovery tools) will reduce regulatory lag, improve earnings stability, and mitigate risks from large capital deployment, supporting earnings growth.

- Robust capital investment opportunities in transmission and resource development—highlighted by an unmodeled need for at least 500 megawatts of new capacity by 2030 and up to 2,900 megawatts by 2032—provide a pipeline for long-term asset base and revenue growth.

- Strategic focus on renewable energy and grid modernization, with stakeholder-backed investments in solar, storage, and resiliency, positions TXNM Energy to benefit from decarbonization policies while reducing fuel cost volatility and supporting margin expansion.

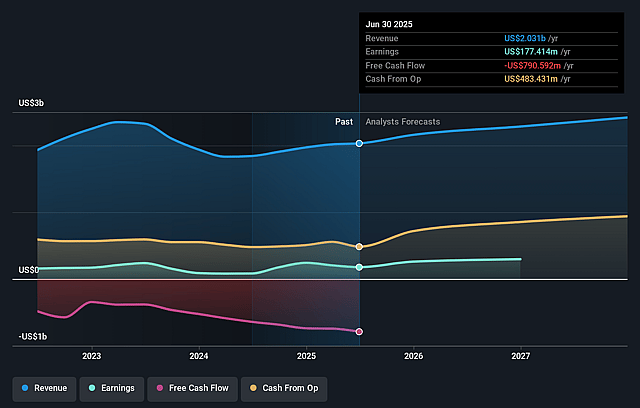

TXNM Energy Future Earnings and Revenue Growth

Assumptions

How have these above catalysts been quantified?- Analysts are assuming TXNM Energy's revenue will grow by 6.6% annually over the next 3 years.

- Analysts assume that profit margins will increase from 8.7% today to 19.0% in 3 years time.

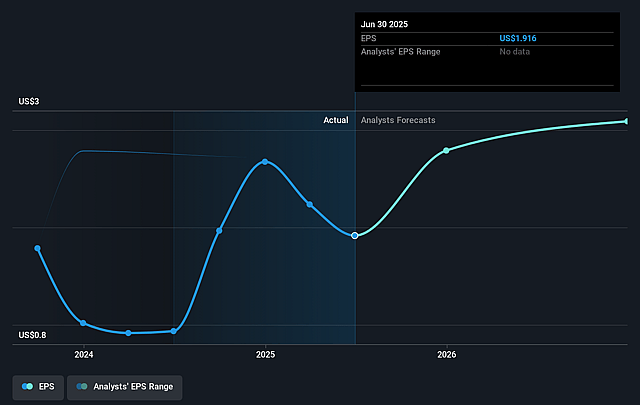

- Analysts expect earnings to reach $467.6 million (and earnings per share of $4.77) by about September 2028, up from $177.4 million today. The analysts are largely in agreement about this estimate.

- In order for the above numbers to justify the analysts price target, the company would need to trade at a PE ratio of 19.8x on those 2028 earnings, down from 33.8x today. This future PE is lower than the current PE for the US Electric Utilities industry at 19.9x.

- Analysts expect the number of shares outstanding to grow by 7.0% per year for the next 3 years.

- To value all of this in today's terms, we will use a discount rate of 6.78%, as per the Simply Wall St company report.

TXNM Energy Future Earnings Per Share Growth

Risks

What could happen that would invalidate this narrative?- Elevated capital expenditure requirements for grid resilience, transmission build-out, and compliance with wildfire prevention and mitigation legislation are likely to pressure TXNM Energy’s free cash flow and net margins in the medium term, especially given the lag between investment and regulatory recovery.

- Potential regulatory exposure from the implementation of new rate mechanisms, rate design updates after a seven-year gap, and customer affordability initiatives (such as low-income rate tools) may restrict TXNM Energy’s flexibility to pass through higher costs, increasing earnings volatility.

- Geographic concentration in New Mexico and Texas exposes the company to extreme weather events, wildfire-related liabilities, and region-specific regulatory or demographic shocks, risking revenue stability and higher insurance or compliance costs.

- Accelerated penetration and adoption of distributed energy resources (DERs), like rooftop solar and batteries, could reduce future baseline load growth and dampen long-term revenue expansion for centralized utilities like TXNM Energy, despite current data center-driven demand strength.

- Ongoing reliance on regulatory and legislative action for approval of significant transmission and resource investments, along with uncertainty over the pace and terms of capital recovery (especially for projects not yet in the five-year plan), creates risk around capital allocation, delayed project returns, and overall earnings trajectory.

Valuation

How have all the factors above been brought together to estimate a fair value?- The analysts have a consensus price target of $58.893 for TXNM Energy based on their expectations of its future earnings growth, profit margins and other risk factors.

- In order for you to agree with the analyst's consensus, you'd need to believe that by 2028, revenues will be $2.5 billion, earnings will come to $467.6 million, and it would be trading on a PE ratio of 19.8x, assuming you use a discount rate of 6.8%.

- Given the current share price of $56.84, the analyst price target of $58.89 is 3.5% higher. The relatively low difference between the current share price and the analyst consensus price target indicates that they believe on average, the company is fairly priced.

- We always encourage you to reach your own conclusions though. So sense check these analyst numbers against your own assumptions and expectations based on your understanding of the business and what you believe is probable.

Have other thoughts on TXNM Energy?

Create your own narrative on this stock, and estimate its Fair Value using our Valuator tool.

Create NarrativeHow well do narratives help inform your perspective?

Disclaimer

AnalystConsensusTarget is a tool utilizing a Large Language Model (LLM) that ingests data on consensus price targets, forecasted revenue and earnings figures, as well as the transcripts of earnings calls to produce qualitative analysis. The narratives produced by AnalystConsensusTarget are general in nature and are based solely on analyst data and publicly-available material published by the respective companies. These scenarios are not indicative of the company's future performance and are exploratory in nature. Simply Wall St has no position in the company(s) mentioned. Simply Wall St may provide the securities issuer or related entities with website advertising services for a fee, on an arm's length basis. These relationships have no impact on the way we conduct our business, the content we host, or how our content is served to users. The price targets and estimates used are consensus data, and do not constitute a recommendation to buy or sell any stock, and they do not take account of your objectives, or your financial situation. Note that AnalystConsensusTarget's analysis may not factor in the latest price-sensitive company announcements or qualitative material.