Key Takeaways

- Sempra's expansion into high-voltage transmission in Texas is poised for revenue growth, driven by increased electricity demand from AI and data center infrastructures.

- Oncor's investment in grid modernization in Texas is expected to enhance earnings and margins, supported by strong demand from residential and commercial sectors.

- Sempra's dependency on regulatory decisions, infrastructure investments, and geopolitical changes presents substantial risks to revenue growth and financial stability.

Catalysts

About Sempra- Operates as an energy infrastructure company in the United States and internationally.

- Sempra's strategy of expanding high-voltage transmission infrastructure, particularly in Texas, positions the company to capture significant growth in revenue as demand for electricity and digital infrastructure increases, especially from AI and data centers.

- Oncor's aggressive capital plans, including a $24 billion 5-year investment aimed at expanding and modernizing the grid in Texas, could boost earnings through regulated transmission investments that go into rates, impacting future earnings positively.

- Increased load growth projections in Texas and planned infrastructure enhancements, like those in the Permian Basin, signify a robust revenue potential through increased consumption and service demand.

- Expectations of high growth from residential and large commercial and industrial customers in Oncor's territory, particularly in sectors like data centers, are likely to drive significant capital utilization, supporting higher revenues and expanded margins.

- Investment in North American LNG infrastructure to supply European and Asian markets could strengthen Sempra's revenue base, with added geopolitical tailwinds supporting demand and long-term earnings growth.

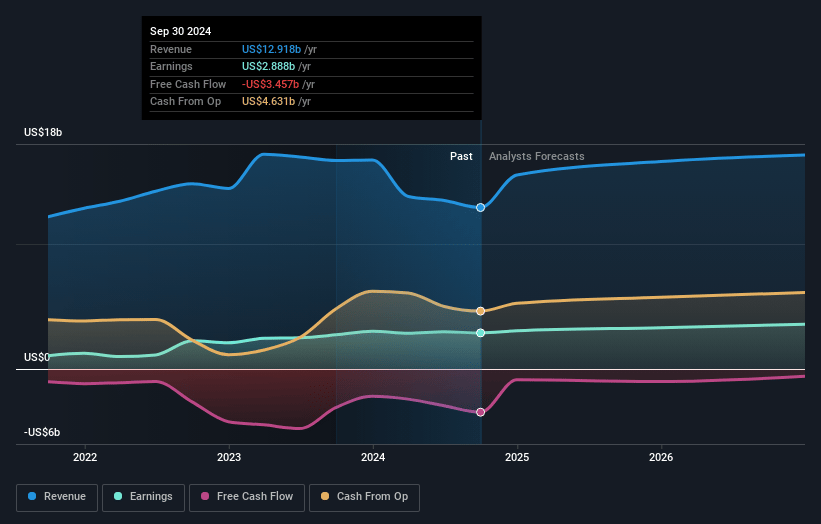

Sempra Future Earnings and Revenue Growth

Assumptions

How have these above catalysts been quantified?- Analysts are assuming Sempra's revenue will grow by 12.6% annually over the next 3 years.

- Analysts assume that profit margins will shrink from 22.4% today to 20.5% in 3 years time.

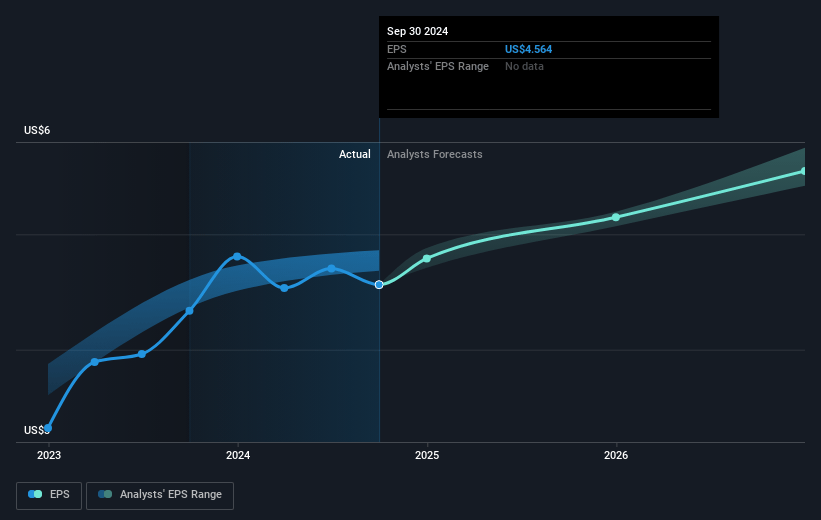

- Analysts expect earnings to reach $3.8 billion (and earnings per share of $5.82) by about January 2028, up from $2.9 billion today.

- In order for the above numbers to justify the analysts price target, the company would need to trade at a PE ratio of 19.2x on those 2028 earnings, up from 17.9x today. This future PE is greater than the current PE for the US Integrated Utilities industry at 18.5x.

- Analysts expect the number of shares outstanding to grow by 0.78% per year for the next 3 years.

- To value all of this in today's terms, we will use a discount rate of 5.92%, as per the Simply Wall St company report.

Sempra Future Earnings Per Share Growth

Risks

What could happen that would invalidate this narrative?- Sempra faces risks related to its dependency on regulatory decisions, such as pending approval from the California Public Utilities Commission (CPUC) General Rate Case (GRC). Delays or unfavorable rulings can alter revenue expectations and impact earnings.

- Aging infrastructure and extreme weather events necessitate significant investment. Failure to secure adequate funding or properly manage project execution could harm earnings and net margins.

- The significant capital needed for upgrades, like the $24 billion 5-year plan for Oncor, increases financial risk and reliance on external financing. This could affect net margins if costs overrun or expected returns are not realized.

- Changes in the geopolitical and regulatory landscape, such as export permits for LNG projects, may hinder Sempra’s ability to meet growth targets in international markets, impacting long-term revenue growth.

- The complex nature of large-scale energy infrastructure projects, including potential execution delays in the expected growth of new digital and AI-related infrastructure, could lead to lower-than-forecasted revenue and earnings.

Valuation

How have all the factors above been brought together to estimate a fair value?- The analysts have a consensus price target of $94.26 for Sempra based on their expectations of its future earnings growth, profit margins and other risk factors.

- In order for you to agree with the analyst's consensus, you'd need to believe that by 2028, revenues will be $18.4 billion, earnings will come to $3.8 billion, and it would be trading on a PE ratio of 19.2x, assuming you use a discount rate of 5.9%.

- Given the current share price of $81.75, the analyst's price target of $94.26 is 13.3% higher.

- We always encourage you to reach your own conclusions though. So sense check these analyst numbers against your own assumptions and expectations based on your understanding of the business and what you believe is probable.

How well do narratives help inform your perspective?

Disclaimer

Warren A.I. is a tool utilizing a Large Language Model (LLM) that ingests data on consensus price targets, forecasted revenue and earnings figures, as well as the transcripts of earnings calls to produce qualitative analysis. The narratives produced by Warren A.I. are general in nature and are based solely on analyst data and publicly-available material published by the respective companies. These scenarios are not indicative of the company's future performance and are exploratory in nature. Simply Wall St has no position in the company(s) mentioned. The price targets and estimates used are consensus data, and do not constitute a recommendation to buy or sell any stock, and they do not take account of your objectives, or your financial situation. Note that Warren A.I.'s analysis may not factor in the latest price-sensitive company announcements or qualitative material.

Read more narratives

There are no other narratives for this company.

View all narratives