Narratives are currently in beta

Key Takeaways

- Expansion into RNG and renewable energy solutions enhances future revenue and net margins due to diversified income streams and tax incentives.

- Strategic growth in high-demand areas and technology investments positions Suburban Propane for increased market share and operational efficiency.

- Warm weather reduced propane demand, impacting margins, while renewable gas investments increased debt, posing sustainability challenges amid price volatility and policy risks.

Catalysts

About Suburban Propane Partners- Through its subsidiaries, engages in the retail marketing and distribution of propane, renewable propane, fuel oil, and refined fuels in the United States.

- Suburban Propane's expansion into RNG production, with increased production levels and new facilities, promises additional revenue streams from tipping fees, RNG sales, environmental credits, and fertilizer sales. This is expected to impact future revenue and earnings positively.

- The ongoing integration of acquired propane businesses in strategic high-growth markets such as Florida, Texas, and New Mexico positions Suburban Propane for increased market share and revenue growth.

- The company's investments in RNG facilities are expected to benefit from production and investment tax credits under the Inflation Reduction Act, which will favorable impact net margins by reducing construction costs and increasing profitability from RNG sales.

- Suburban Propane's emphasis on renewable and lower carbon energy solutions, including low carbon propane and rDME-blended propane, prepares the company to capitalize on the transition to greener energy, potentially enhancing revenue and net margins as customer demand shifts.

- The strategic expansion of greenfield markets, coupled with investments in technology for operating efficiencies, aims to improve customer retention and operational cost savings, likely strengthening net margins and future earnings.

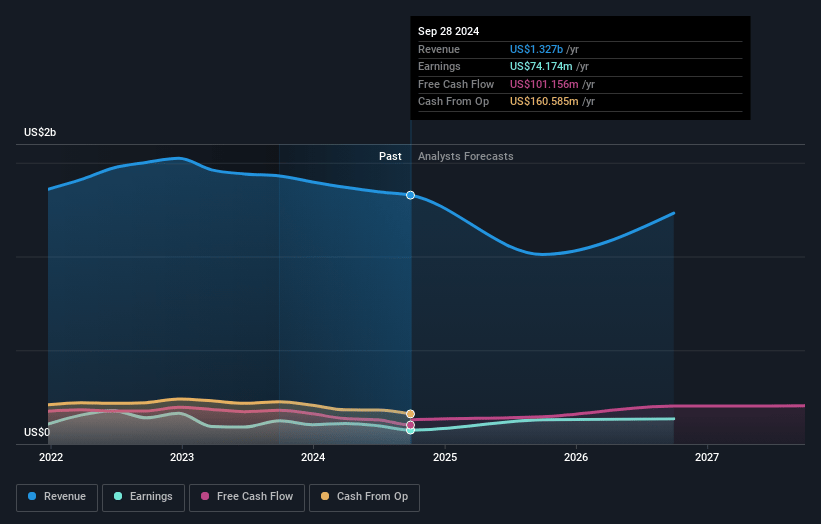

Suburban Propane Partners Future Earnings and Revenue Growth

Assumptions

How have these above catalysts been quantified?- Analysts are assuming Suburban Propane Partners's revenue will decrease by -3.8% annually over the next 3 years.

- Analysts assume that profit margins will increase from 5.6% today to 14.4% in 3 years time.

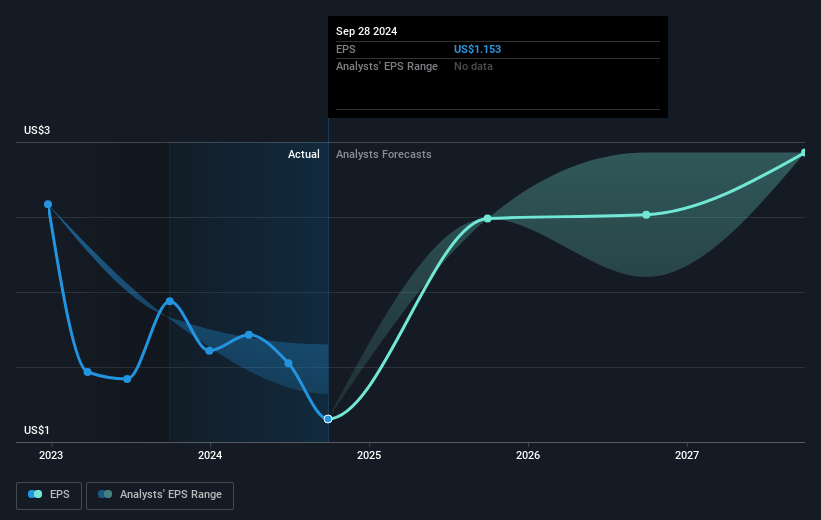

- Analysts expect earnings to reach $169.6 million (and earnings per share of $2.93) by about January 2028, up from $74.2 million today. The analysts are largely in agreement about this estimate.

- In order for the above numbers to justify the analysts price target, the company would need to trade at a PE ratio of 6.7x on those 2028 earnings, down from 15.3x today. This future PE is lower than the current PE for the US Gas Utilities industry at 17.8x.

- Analysts expect the number of shares outstanding to decline by 3.5% per year for the next 3 years.

- To value all of this in today's terms, we will use a discount rate of 6.52%, as per the Simply Wall St company report.

Suburban Propane Partners Future Earnings Per Share Growth

Risks

What could happen that would invalidate this narrative?- The company faced unseasonably warm weather, significantly reducing demand for propane for heating purposes, which negatively impacted revenue and net margins for fiscal 2024.

- Adjusted EBITDA for fiscal 2024 decreased to $250 million, down from $275 million the prior year, signaling potential sustainability challenges in maintaining operational profitability.

- Increased capital spending for renewable natural gas projects and acquisitions led to a higher debt level, thus potentially pressuring future earnings and the company’s ability to manage its financial obligations.

- The company is exposed to risks from fluctuations in propane wholesale prices, which could impact gross margins, as average prices remained volatile during the fiscal year.

- Changes in federal policies regarding tax credits for renewable energy projects pose a risk to the financial projections of the RNG business, potentially impacting expected revenue streams starting in 2025.

Valuation

How have all the factors above been brought together to estimate a fair value?- The analysts have a consensus price target of $16.5 for Suburban Propane Partners based on their expectations of its future earnings growth, profit margins and other risk factors.

- In order for you to agree with the analyst's consensus, you'd need to believe that by 2028, revenues will be $1.2 billion, earnings will come to $169.6 million, and it would be trading on a PE ratio of 6.7x, assuming you use a discount rate of 6.5%.

- Given the current share price of $17.64, the analyst's price target of $16.5 is 6.9% lower. The relatively low difference between the current share price and the analyst consensus price target indicates that they believe on average, the company is fairly priced.

- We always encourage you to reach your own conclusions though. So sense check these analyst numbers against your own assumptions and expectations based on your understanding of the business and what you believe is probable.

How well do narratives help inform your perspective?

Disclaimer

Warren A.I. is a tool utilizing a Large Language Model (LLM) that ingests data on consensus price targets, forecasted revenue and earnings figures, as well as the transcripts of earnings calls to produce qualitative analysis. The narratives produced by Warren A.I. are general in nature and are based solely on analyst data and publicly-available material published by the respective companies. These scenarios are not indicative of the company's future performance and are exploratory in nature. Simply Wall St has no position in the company(s) mentioned. The price targets and estimates used are consensus data, and do not constitute a recommendation to buy or sell any stock, and they do not take account of your objectives, or your financial situation. Note that Warren A.I.'s analysis may not factor in the latest price-sensitive company announcements or qualitative material.

Read more narratives

There are no other narratives for this company.

View all narratives