Narratives are currently in beta

Key Takeaways

- PG&E's growth strategy combines increased capital investments aligned with customer demand and a disciplined financial approach to support EPS growth and optimize capital structure.

- Cost reduction efforts and strategic safety initiatives, like wildfire risk reduction, aim to enhance profitability, operational stability, and customer satisfaction.

- Wildfire risks, infrastructure investments, regulatory dependencies, competition, and policy shifts pose challenges to PG&E’s profitability and strategic execution.

Catalysts

About PG&E- Through its subsidiary, Pacific Gas and Electric Company, engages in the sale and delivery of electricity and natural gas to customers in northern and central California, the United States.

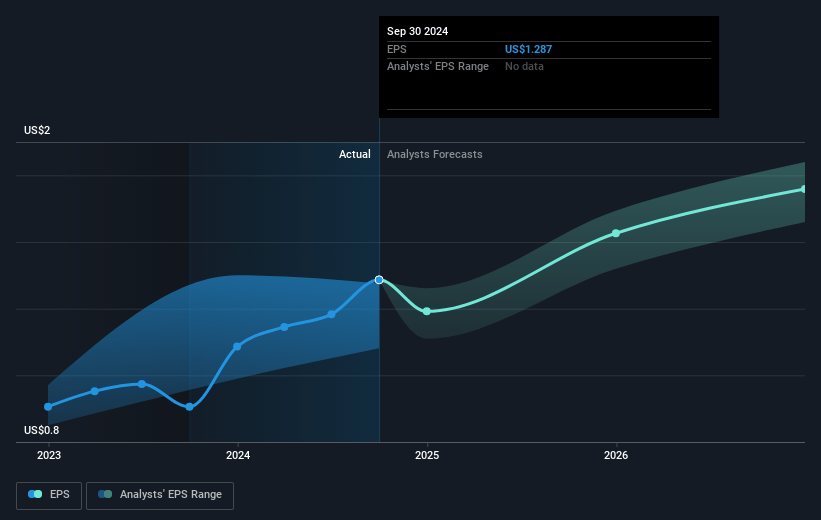

- PG&E is forecasting an increase in earnings per share (EPS) growth rate from 9% to 10% for 2025 and sustaining at least 9% annually from 2026 to 2028, driven by additional capital investments aligned with growing customer demand for electrification in California. This is expected to positively impact future earnings.

- The company is expanding its 5-year capital plan to $63 billion, incorporating an additional $1 billion capital raise for energization projects fueled by increased customer demand. This increase in capital expenditure is projected to contribute to a higher rate base growth, ultimately impacting revenue positively due to rate base expansion.

- PG&E is implementing a disciplined financial strategy by focusing on projects beneficial to both customers and investors and committing to no new equity issuance in 2024. The structured and efficient financing approach is likely to support EPS growth by enhancing financial efficiency and optimizing capital structure.

- Ongoing operational cost reduction efforts, such as reducing nonfuel operating and maintenance (O&M) expenses, are expected to release cash flow for reinvestment into the business, potentially enhancing net margins and supporting sustainable longer-term growth.

- The company's focus on reducing wildfire risks through strategic undergrounding initiatives and other safety measures could stabilize operational costs associated with safety mitigations, reduce future liabilities, and improve reliability, thereby positively influencing customer satisfaction and future earnings potential.

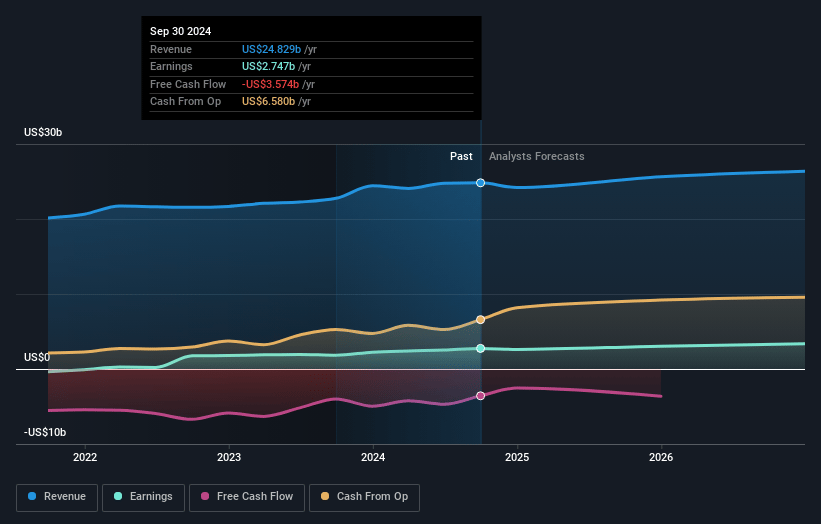

PG&E Future Earnings and Revenue Growth

Assumptions

How have these above catalysts been quantified?- Analysts are assuming PG&E's revenue will grow by 2.8% annually over the next 3 years.

- Analysts assume that profit margins will increase from 11.1% today to 13.7% in 3 years time.

- Analysts expect earnings to reach $3.7 billion (and earnings per share of $1.66) by about January 2028, up from $2.7 billion today. However, there is some disagreement amongst the analysts with the more bearish ones expecting earnings as low as $3.2 billion.

- In order for the above numbers to justify the analysts price target, the company would need to trade at a PE ratio of 16.4x on those 2028 earnings, up from 12.7x today. This future PE is lower than the current PE for the US Electric Utilities industry at 20.3x.

- Analysts expect the number of shares outstanding to grow by 0.73% per year for the next 3 years.

- To value all of this in today's terms, we will use a discount rate of 5.92%, as per the Simply Wall St company report.

PG&E Future Earnings Per Share Growth

Risks

What could happen that would invalidate this narrative?- Wildfire risk remains a significant concern despite mitigation efforts, as ignition rates in high fire-threat areas have increased, which could impact PG&E's operational costs and liability risks, ultimately affecting net margins.

- PG&E's planned undergrounding and infrastructure investments are necessary for safety but come at high costs, raising questions about rate hikes and capital expenditure, potentially impacting long-term earnings and profitability.

- The reliance on regulatory approval and funding for new energization projects introduces uncertainty, as delays or rejections could hinder PG&E's ability to meet customer demand and revenue growth targets.

- The increased competition for fulfilling electrification demand in California could lead to cost pressures and impact PG&E's anticipated load growth, influencing overall revenue forecasts and long-term financial projections.

- Potential changes in government policies or shifts in political priorities around energy infrastructure and affordability could disrupt PG&E's strategic plans, causing unforeseen impacts on revenues and profitability.

Valuation

How have all the factors above been brought together to estimate a fair value?- The analysts have a consensus price target of $22.84 for PG&E based on their expectations of its future earnings growth, profit margins and other risk factors. However, there is a degree of disagreement amongst analysts, with the most bullish reporting a price target of $26.0, and the most bearish reporting a price target of just $18.0.

- In order for you to agree with the analyst's consensus, you'd need to believe that by 2028, revenues will be $27.0 billion, earnings will come to $3.7 billion, and it would be trading on a PE ratio of 16.4x, assuming you use a discount rate of 5.9%.

- Given the current share price of $15.96, the analyst's price target of $22.84 is 30.1% higher.

- We always encourage you to reach your own conclusions though. So sense check these analyst numbers against your own assumptions and expectations based on your understanding of the business and what you believe is probable.

How well do narratives help inform your perspective?

Disclaimer

Warren A.I. is a tool utilizing a Large Language Model (LLM) that ingests data on consensus price targets, forecasted revenue and earnings figures, as well as the transcripts of earnings calls to produce qualitative analysis. The narratives produced by Warren A.I. are general in nature and are based solely on analyst data and publicly-available material published by the respective companies. These scenarios are not indicative of the company's future performance and are exploratory in nature. Simply Wall St has no position in the company(s) mentioned. The price targets and estimates used are consensus data, and do not constitute a recommendation to buy or sell any stock, and they do not take account of your objectives, or your financial situation. Note that Warren A.I.'s analysis may not factor in the latest price-sensitive company announcements or qualitative material.

Read more narratives

There are no other narratives for this company.

View all narratives