Key Takeaways

- Surging electricity demand and digital infrastructure growth position NRG for sustained revenue and margin expansion through premium contracts and advanced energy solutions.

- Strategic partnerships, speed-to-market, and leveraging its retail base enable NRG to capture rising power prices, drive new profit streams, and achieve durable, above-market growth.

- Heavy reliance on fossil fuels and centralized generation strategies exposes the company to regulatory, market, and climate risks that threaten future profitability and revenue stability.

Catalysts

About NRG Energy- Operates as an energy and home services company in the United States and Canada.

- NRG is poised to capture a significant share of the massive, accelerating growth in electricity demand driven by rapid electrification, industrial onshoring, and the expansion of AI and data centers. With over 15 gigawatts of potential new capacity tied to premium long-term contracts, and Texas leading the nation in power demand growth, these structural changes support sustained, high-quality revenue expansion and improved earnings visibility well into the next decade.

- The proliferation of digital infrastructure, including smart homes and IoT devices, underpins rising demand for advanced, flexible energy solutions and home resiliency. NRG’s expansion of its Smart Home platform—bolstered by record customer retention and high-margin recurring revenue—sets the stage for margin accretion and durable, above-market growth in consumer services.

- Strategic partnerships with GE Vernova and Kiewit give NRG exclusive, rapid access to scarce turbine technology and construction expertise, enabling swift execution of new dispatchable generation. Speed-to-market advantages, paired with the ability to secure premium-priced, long-term power agreements ($70 to $90 per megawatt hour and higher) with data centers and hyperscalers, is expected to drive outsized growth in adjusted EBITDA and net margins.

- NRG’s large, diversified and integrated retail-customer base is being actively leveraged to cross-sell, monetize data, and efficiently aggregate flexible load and new distributed resources, including virtual power plants. These initiatives unlock new profit pools, increase customer lifetime value, and drive incremental growth in free cash flow and long-term earnings per share.

- Tightening reserve margins in competitive power markets, especially Texas, and a limited pipeline of new dispatchable generation, position NRG’s existing fleet and new projects to benefit from rising power prices. Every $10 increase in average megawatt hour pricing has the potential to add hundreds of millions in margin, directly lifting near

- and long-term profitability and supporting the company’s ambition for double-digit annual EPS growth.

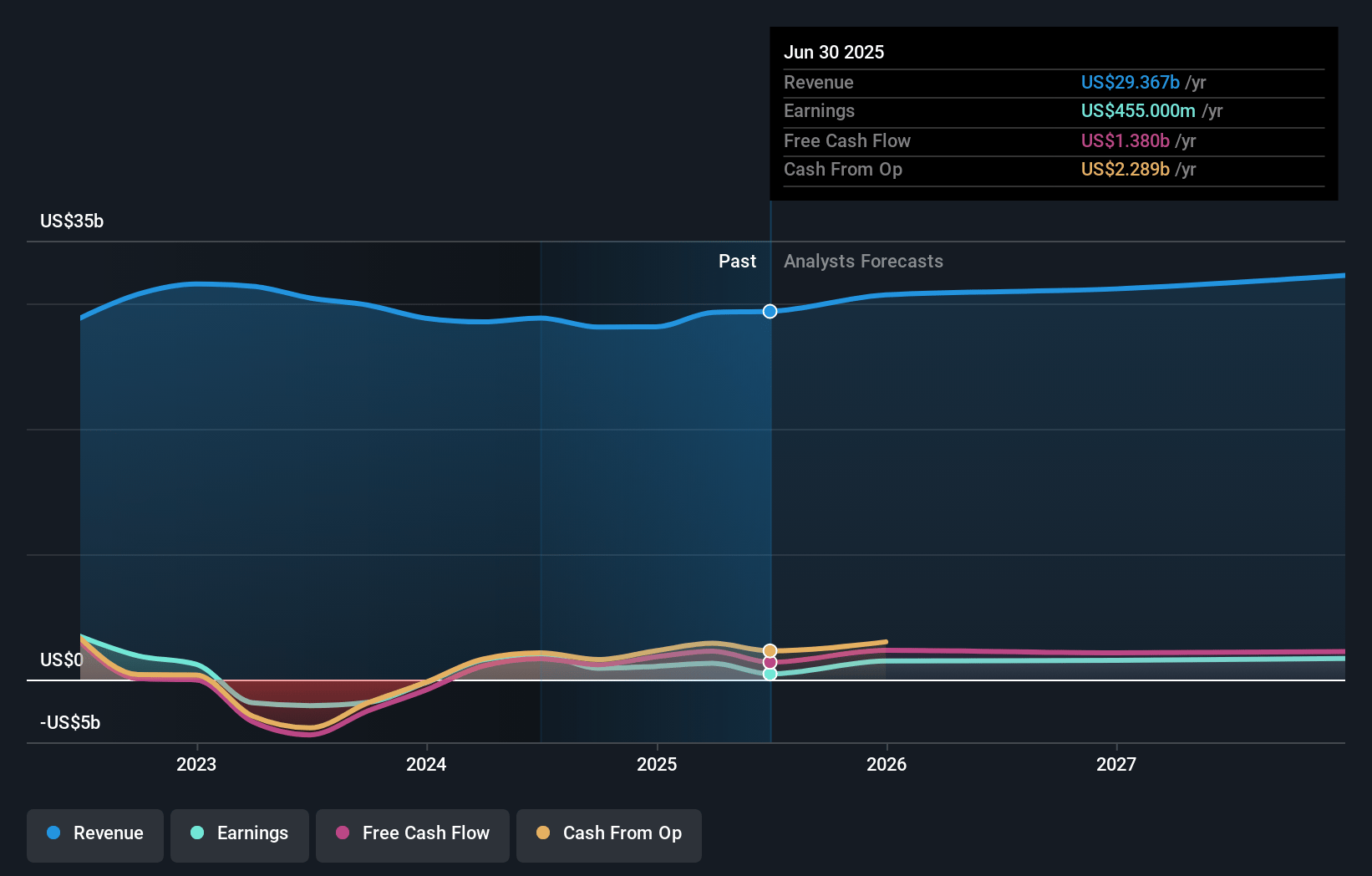

NRG Energy Future Earnings and Revenue Growth

Assumptions

How have these above catalysts been quantified?- This narrative explores a more optimistic perspective on NRG Energy compared to the consensus, based on a Fair Value that aligns with the bullish cohort of analysts.

- The bullish analysts are assuming NRG Energy's revenue will grow by 9.9% annually over the next 3 years.

- The bullish analysts assume that profit margins will increase from 3.8% today to 4.3% in 3 years time.

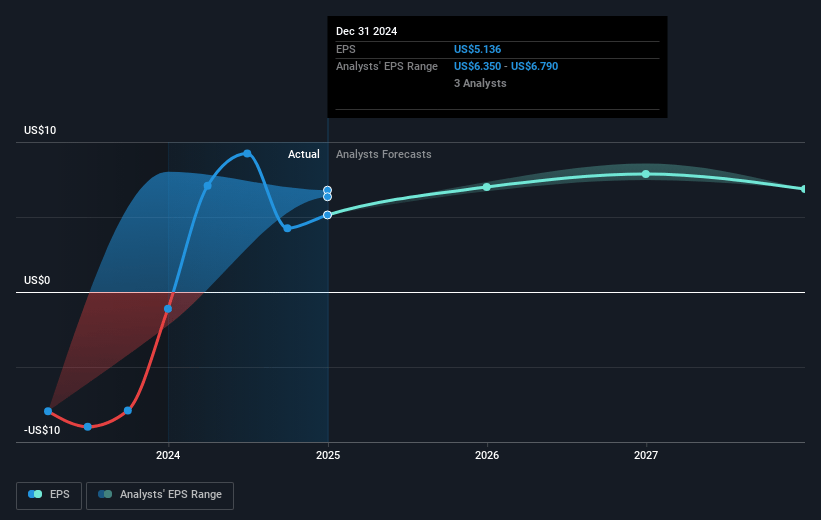

- The bullish analysts expect earnings to reach $1.6 billion (and earnings per share of $10.15) by about April 2028, up from $1.1 billion today. The analysts are largely in agreement about this estimate.

- In order for the above numbers to justify the price target of the more bullish analyst cohort, the company would need to trade at a PE ratio of 20.7x on those 2028 earnings, up from 18.5x today. This future PE is greater than the current PE for the US Electric Utilities industry at 20.5x.

- Analysts expect the number of shares outstanding to decline by 4.99% per year for the next 3 years.

- To value all of this in today's terms, we will use a discount rate of 6.21%, as per the Simply Wall St company report.

NRG Energy Future Earnings Per Share Growth

Risks

What could happen that would invalidate this narrative?- The company’s long-term strategy heavily relies on the continued expansion of natural gas generation and brownfield development, leaving it exposed to accelerating decarbonization policies and potential regulations that could increase compliance costs, reduce asset values, and ultimately constrain net margins and profitability.

- NRG's current pace of transition away from fossil-fuel generation is relatively slow, which heightens the possibility of future asset stranding as renewable technologies become increasingly cost competitive, leading to higher depreciation and potential write-downs that would negatively affect earnings.

- The company’s focus on large-scale centralized generation and data center partnerships could be undermined by ongoing grid decentralization and the growing adoption of distributed generation such as rooftop solar and energy storage, ultimately eroding traditional utility revenues and increasing revenue volatility.

- Despite the company’s optimism about premium pricing and its data center strategy, actual realization of long-term purchase agreements remains subject to uncertainties, including execution risk, customer hesitancy, and competitive pressures from regulated utilities, all of which could dampen expected revenue and pressure margins.

- The increasing frequency and severity of extreme weather events due to climate change pose mounting risks to physical infrastructure, with the potential for higher maintenance expenses, rising insurance costs, and significant outage-related liabilities, which could exert downward pressure on future free cash flow and net income.

Valuation

How have all the factors above been brought together to estimate a fair value?- The assumed bullish price target for NRG Energy is $165.0, which is the highest price target estimate amongst analysts. This valuation is based on what can be assumed as the expectations of NRG Energy's future earnings growth, profit margins and other risk factors from analysts on the bullish end of the spectrum.

- However, there is a degree of disagreement amongst analysts, with the most bullish reporting a price target of $165.0, and the most bearish reporting a price target of just $52.0.

- In order for you to agree with the bullish analysts, you'd need to believe that by 2028, revenues will be $37.3 billion, earnings will come to $1.6 billion, and it would be trading on a PE ratio of 20.7x, assuming you use a discount rate of 6.2%.

- Given the current share price of $98.8, the bullish analyst price target of $165.0 is 40.1% higher.

- We always encourage you to reach your own conclusions though. So sense check these analyst numbers against your own assumptions and expectations based on your understanding of the business and what you believe is probable.

How well do narratives help inform your perspective?

Disclaimer

AnalystHighTarget is an employee of Simply Wall St, but has written this narrative in their capacity as an individual investor. AnalystHighTarget holds no position in NYSE:NRG. Simply Wall St has no position in the company(s) mentioned. Simply Wall St may provide the securities issuer or related entities with website advertising services for a fee, on an arm's length basis. These relationships have no impact on the way we conduct our business, the content we host, or how our content is served to users. This narrative is general in nature and explores scenarios and estimates created by the author. The narrative does not reflect the opinions of Simply Wall St, and the views expressed are the opinion of the author alone, acting on their own behalf. These scenarios are not indicative of the company's future performance and are exploratory in the ideas they cover. The fair value estimate's are estimations only, and does not constitute a recommendation to buy or sell any stock, and they do not take account of your objectives, or your financial situation. Note that the author's analysis may not factor in the latest price-sensitive company announcements or qualitative material.

Read more narratives