Key Takeaways

- Expansion in Texas and strategic partnerships aim to capitalize on growing power demand, enhancing revenue and operational efficiency through new capacity development.

- Focused shareholder returns and collaborations position NRG to benefit from electrification trends and rising power prices, driving margins and EPS growth.

- Regulatory changes, supply chain issues, and market dependency could increase costs and strain NRG's cash flow, impacting revenue stability and net margins.

Catalysts

About NRG Energy- Operates as an energy and home services company in the United States and Canada.

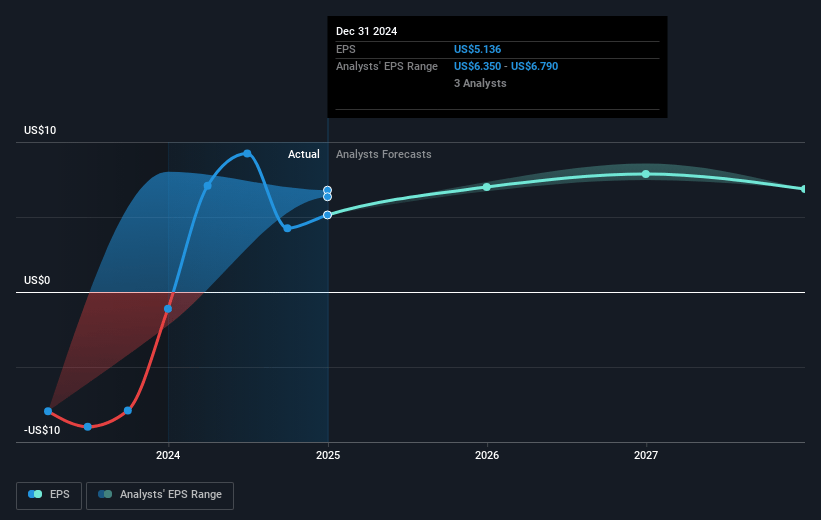

- NRG Energy is positioned to deliver at least 10% EPS CAGR through 2029, driven by a base plan that includes $750 million in adjusted EBITDA growth and $8.8 billion in capital returned to shareholders. This focus on consistent earnings and shareholder returns could enhance overall earnings and EPS growth.

- The company is advancing 1.5 gigawatts of brownfield development projects in Texas, with some projects already in due diligence and others having secured manufacturing slots for turbines. This expansion in generation capacity is likely to increase revenue and margins by capitalizing on growing power demand.

- NRG has signed multiple letters of intent with data center developers, indicating a strategy to capture value from a power demand super cycle driven by electrification and data center growth. This could lead to substantial long-term revenue increases.

- Collaborations such as the one with GE Vernova and Kiewit aim to expedite new capacity development with strategic access to best-in-class turbine technology and engineering support. This partnership is positioned to improve operational efficiency, potentially enhancing margins and reducing costs.

- The strong Texas power market offers significant upside due to rising power prices and tightening supply-demand dynamics. With existing generation assets and a strategy to expand dispatchable capacity, NRG is well-positioned to benefit from increasing electricity prices, bolstering revenue and net margins.

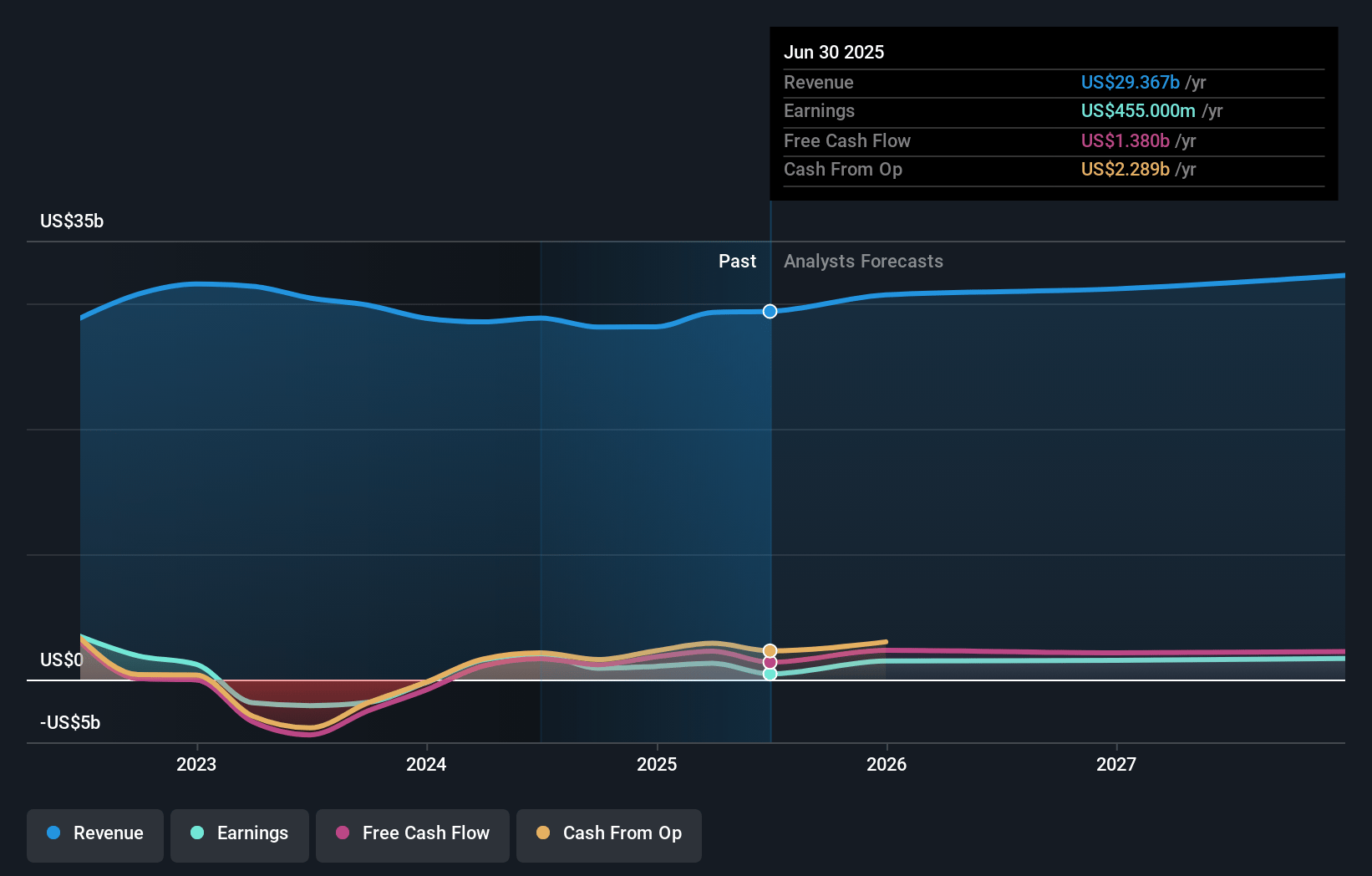

NRG Energy Future Earnings and Revenue Growth

Assumptions

How have these above catalysts been quantified?- Analysts are assuming NRG Energy's revenue will grow by 6.6% annually over the next 3 years.

- Analysts assume that profit margins will increase from 3.8% today to 3.9% in 3 years time.

- Analysts expect earnings to reach $1.3 billion (and earnings per share of $6.86) by about March 2028, up from $1.1 billion today. The analysts are largely in agreement about this estimate.

- In order for the above numbers to justify the analysts price target, the company would need to trade at a PE ratio of 17.4x on those 2028 earnings, down from 17.7x today. This future PE is lower than the current PE for the US Electric Utilities industry at 20.8x.

- Analysts expect the number of shares outstanding to decline by 4.99% per year for the next 3 years.

- To value all of this in today's terms, we will use a discount rate of 6.21%, as per the Simply Wall St company report.

NRG Energy Future Earnings Per Share Growth

Risks

What could happen that would invalidate this narrative?- Regulatory and legislative risks, such as changes in policies or regulations affecting the power market (e.g., SB6 in Texas), may impact operational costs and revenue structures, potentially affecting NRG's net margins.

- Supply chain constraints, particularly in securing critical components for natural gas generation, could delay project timelines and increase costs, impacting NRG's capital expenditures and EBITDA.

- Dependency on securing power purchase agreements with data centers and large load consumers could introduce revenue volatility if agreements are delayed or if market demand shifts.

- The capital-intensive nature of NRG's expansion strategy, including new builds, may strain financial resources and impact free cash flow if not matched with timely and favorable financing or revenue generation.

- Exposure to the Texas market and reliance on power demand growth may pose risks if projected demand does not materialize or if competitive pressures intensify, potentially affecting NRG's revenue and earnings stability.

Valuation

How have all the factors above been brought together to estimate a fair value?- The analysts have a consensus price target of $112.743 for NRG Energy based on their expectations of its future earnings growth, profit margins and other risk factors. However, there is a degree of disagreement amongst analysts, with the most bullish reporting a price target of $165.0, and the most bearish reporting a price target of just $52.0.

- In order for you to agree with the analyst's consensus, you'd need to believe that by 2028, revenues will be $34.1 billion, earnings will come to $1.3 billion, and it would be trading on a PE ratio of 17.4x, assuming you use a discount rate of 6.2%.

- Given the current share price of $94.68, the analyst price target of $112.74 is 16.0% higher.

- We always encourage you to reach your own conclusions though. So sense check these analyst numbers against your own assumptions and expectations based on your understanding of the business and what you believe is probable.

How well do narratives help inform your perspective?

Disclaimer

Warren A.I. is a tool utilizing a Large Language Model (LLM) that ingests data on consensus price targets, forecasted revenue and earnings figures, as well as the transcripts of earnings calls to produce qualitative analysis. The narratives produced by Warren A.I. are general in nature and are based solely on analyst data and publicly-available material published by the respective companies. These scenarios are not indicative of the company's future performance and are exploratory in nature. Simply Wall St has no position in the company(s) mentioned. Simply Wall St may provide the securities issuer or related entities with website advertising services for a fee, on an arm's length basis. These relationships have no impact on the way we conduct our business, the content we host, or how our content is served to users. The price targets and estimates used are consensus data, and do not constitute a recommendation to buy or sell any stock, and they do not take account of your objectives, or your financial situation. Note that Warren A.I.'s analysis may not factor in the latest price-sensitive company announcements or qualitative material.