Key Takeaways

- If regulatory outcomes hinder cost recoveries, MDU Resources' profitability could suffer due to compressed net margins.

- Infrastructure investments may exceed revenue growth, potentially straining cash flows and squeezing net margins.

- Strategic spin-offs and positive momentum in utility and pipeline sectors boost operational efficiency, revenue potential, and shareholder returns through targeted rate adjustments and infrastructure investments.

Catalysts

About MDU Resources Group- Engages in the regulated energy delivery, and construction materials and services businesses in the United States.

- MDU Resources' focus on regulatory rate cases and settlements may compress net margins if regulatory decisions do not fully support cost recoveries and investments, impacting future profitability.

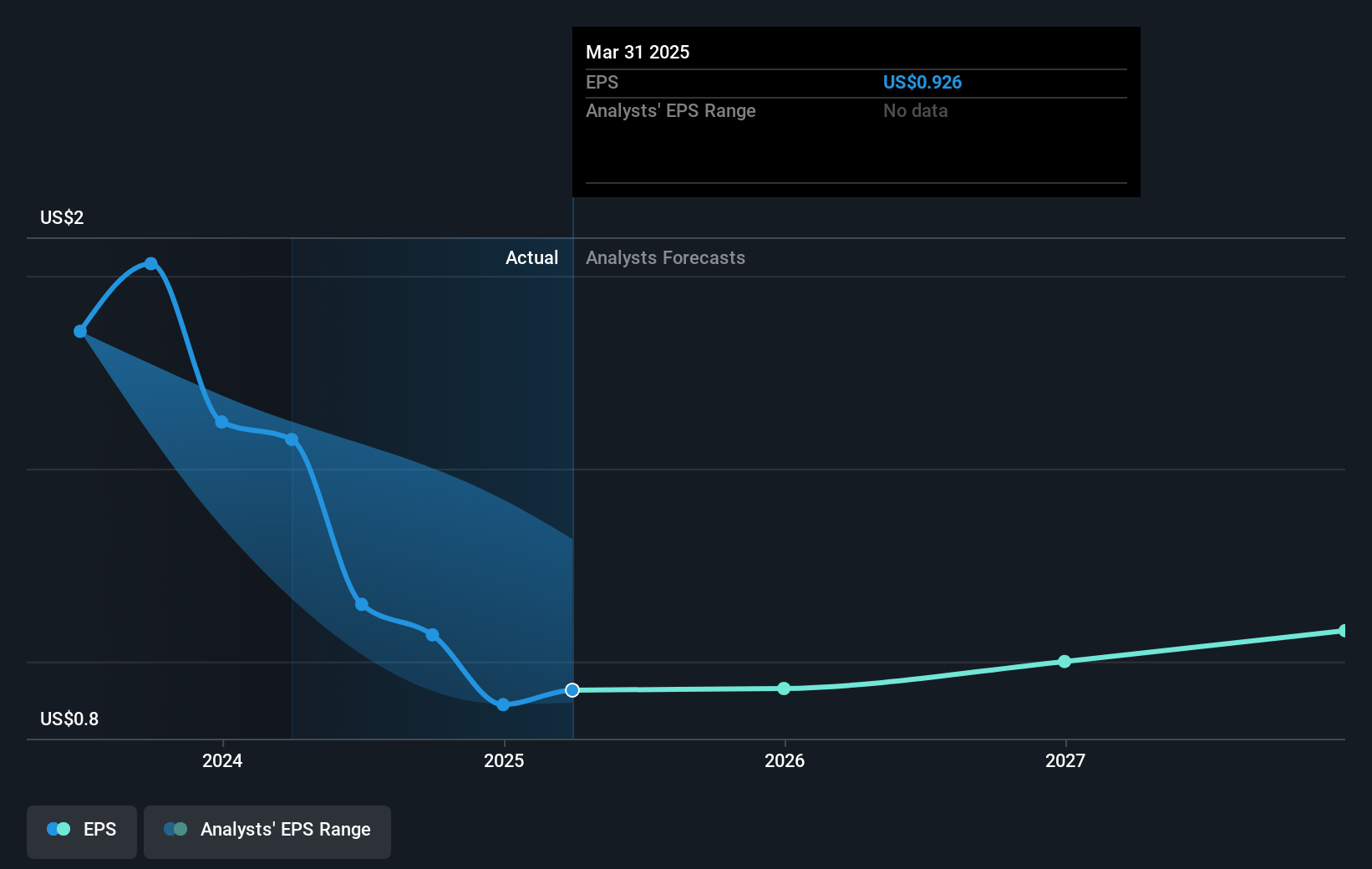

- The expected annual EPS growth of 6% to 8% may be overly optimistic if economic conditions or regulatory environments change unfavorably, leading to flatter earnings growth.

- There is a risk that anticipated infrastructure investments for customer growth and expansions in the utility and pipeline segments could outpace revenue growth, potentially straining cash flows and affecting net margins.

- The storage business segment has shown unexpected strength, but if this trend reverses due to market conditions, it could negatively impact revenue and earnings.

- High expectations for pipeline business growth through organic projects and acquisitions could be vulnerable to shifts in market demand or operational challenges, which may impact anticipated earnings growth.

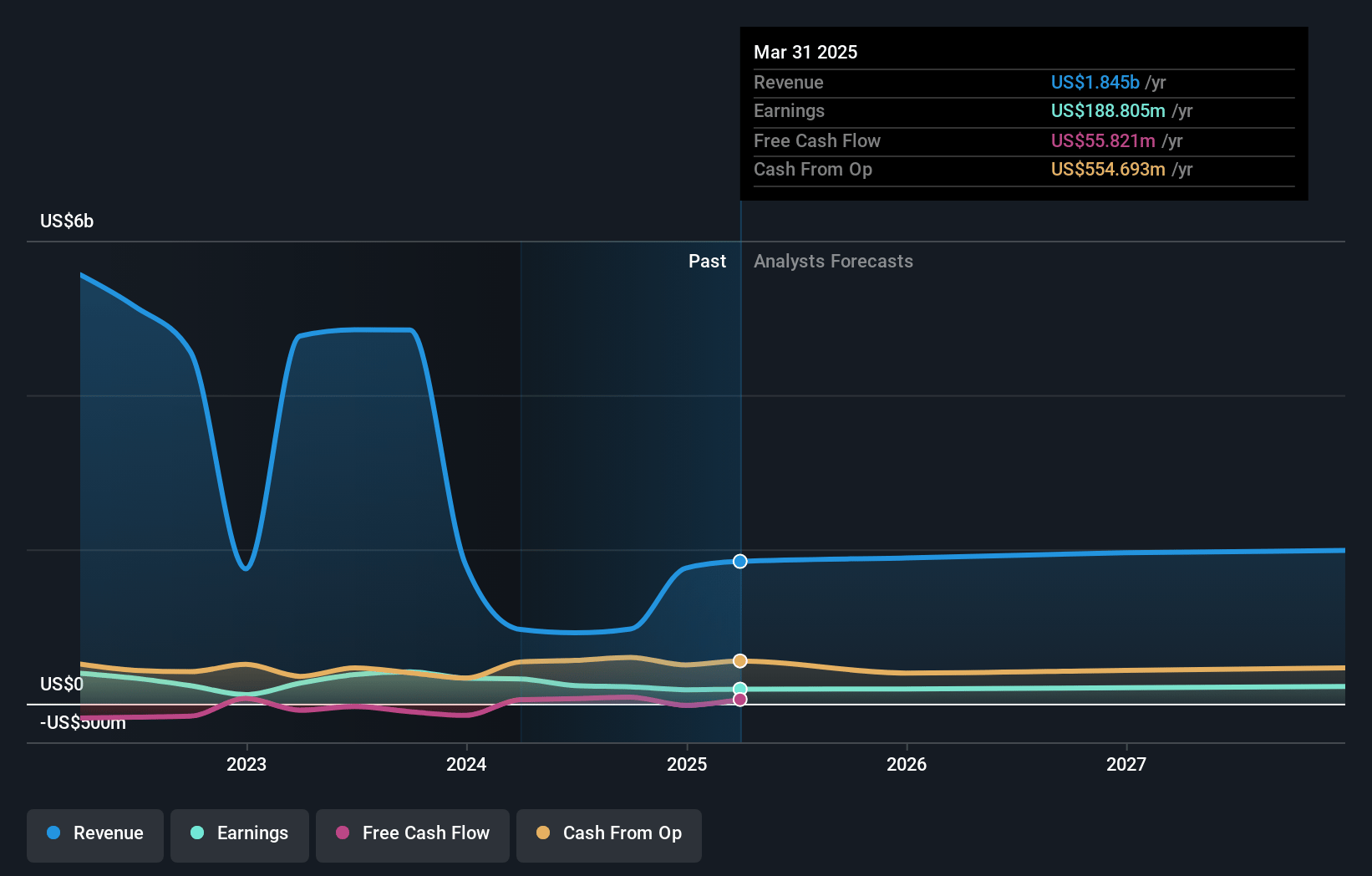

MDU Resources Group Future Earnings and Revenue Growth

Assumptions

How have these above catalysts been quantified?- Analysts are assuming MDU Resources Group's revenue will decrease by -38.5% annually over the next 3 years.

- Analysts assume that profit margins will shrink from 8.9% today to 6.0% in 3 years time.

- Analysts expect earnings to reach $61.7 million (and earnings per share of $0.3) by about December 2027, down from $394.3 million today. The analysts are largely in agreement about this estimate.

- In order for the above numbers to justify the analysts price target, the company would need to trade at a PE ratio of 82.3x on those 2027 earnings, up from 9.8x today. This future PE is greater than the current PE for the US Gas Utilities industry at 18.6x.

- Analysts expect the number of shares outstanding to remain consistent over the next 3 years.

- To value all of this in today's terms, we will use a discount rate of 5.97%, as per the Simply Wall St company report.

MDU Resources Group Future Earnings Per Share Growth

Risks

What could happen that would invalidate this narrative?- MDU Resources Group completed significant strategic spin-offs, positioning it as a pure-play regulated energy delivery business, which could enhance focus and operational efficiency, potentially strengthening revenue and earnings.

- The company is seeing positive momentum and growth opportunities in its utility and pipeline businesses, particularly driven by strategic rate adjustments, infrastructure investments, and record transportation volumes, which could support sustained revenue and earnings growth.

- MDU reported expected long-term EPS growth of 6% to 8% and a targeted dividend payout ratio of 60% to 70%, suggesting a strong outlook for both earnings and shareholder returns.

- Record earnings in the pipeline segment, driven by increased transportation volumes and storage revenues, indicate robust demand and successful strategic expansions, potentially leading to higher net margins and profitability.

- Active management of franchise rate cases and strategic filing of electric service agreements with new and expanded data center loads show proactive regulatory actions and customer base expansion, which may positively impact revenue and earnings stability.

Valuation

How have all the factors above been brought together to estimate a fair value?- The analysts have a consensus price target of $21.0 for MDU Resources Group based on their expectations of its future earnings growth, profit margins and other risk factors. However, there is a degree of disagreement amongst analysts, with the most bullish reporting a price target of $24.0, and the most bearish reporting a price target of just $18.0.

- In order for you to agree with the analyst's consensus, you'd need to believe that by 2027, revenues will be $1.0 billion, earnings will come to $61.7 million, and it would be trading on a PE ratio of 82.3x, assuming you use a discount rate of 6.0%.

- Given the current share price of $19.05, the analyst's price target of $21.0 is 9.3% higher. Despite analysts expecting the underlying buisness to decline, they seem to believe it's more valuable than what the market thinks.

- We always encourage you to reach your own conclusions though. So sense check these analyst numbers against your own assumptions and expectations based on your understanding of the business and what you believe is probable.

How well do narratives help inform your perspective?

Disclaimer

Warren A.I. is a tool utilizing a Large Language Model (LLM) that ingests data on consensus price targets, forecasted revenue and earnings figures, as well as the transcripts of earnings calls to produce qualitative analysis. The narratives produced by Warren A.I. are general in nature and are based solely on analyst data and publicly-available material published by the respective companies. These scenarios are not indicative of the company's future performance and are exploratory in nature. Simply Wall St has no position in the company(s) mentioned. The price targets and estimates used are consensus data, and do not constitute a recommendation to buy or sell any stock, and they do not take account of your objectives, or your financial situation. Note that Warren A.I.'s analysis may not factor in the latest price-sensitive company announcements or qualitative material.

Read more narratives

There are no other narratives for this company.

View all narratives