Key Takeaways

- Rising distributed generation and regulatory pressures threaten traditional revenue models and could constrain long-term earnings potential.

- Increased capital needs for grid upgrades, renewables, and climate resilience heighten margin pressures and raise financial risk.

- Strategic investments in decarbonization, regulatory support, and infrastructure modernization are positioning Eversource for steady earnings growth, financial stability, and reduced risk.

Catalysts

About Eversource Energy- A public utility holding company, engages in the energy delivery business.

- Growing adoption of distributed generation, including rooftop solar and battery storage, is likely to further erode traditional utility-supplied electricity demand, which could threaten Eversource’s long-term volumetric sales and put sustained pressure on revenue growth.

- Regulatory and political risk, especially as aggressive decarbonization and affordability pushbacks intensify in Eversource’s New England service area, may result in more restrictive approval processes, limits on rate recovery, and less constructive rate frameworks, potentially constraining future authorized returns and long-term earnings power.

- Escalating capital expenditure requirements for grid modernization, renewables integration, and storm resilience—combined with recent regulatory moves to reduce allowed capital recovery rates—could lead to persistent margin compression and higher leverage, negatively impacting both net income and balance sheet strength.

- The accelerating transition to energy efficiency and electrification may fundamentally change demand profiles but not necessarily increase overall load, challenging the assumption of robust, long-term load growth and undermining top-line revenue expansion.

- Intensifying climate-related operational risks, including severe weather and increased storm restoration costs, are likely to create heightened earnings volatility and require even more capital outlay—raising the risk of future under-recovery and pressuring both margins and free cash flow.

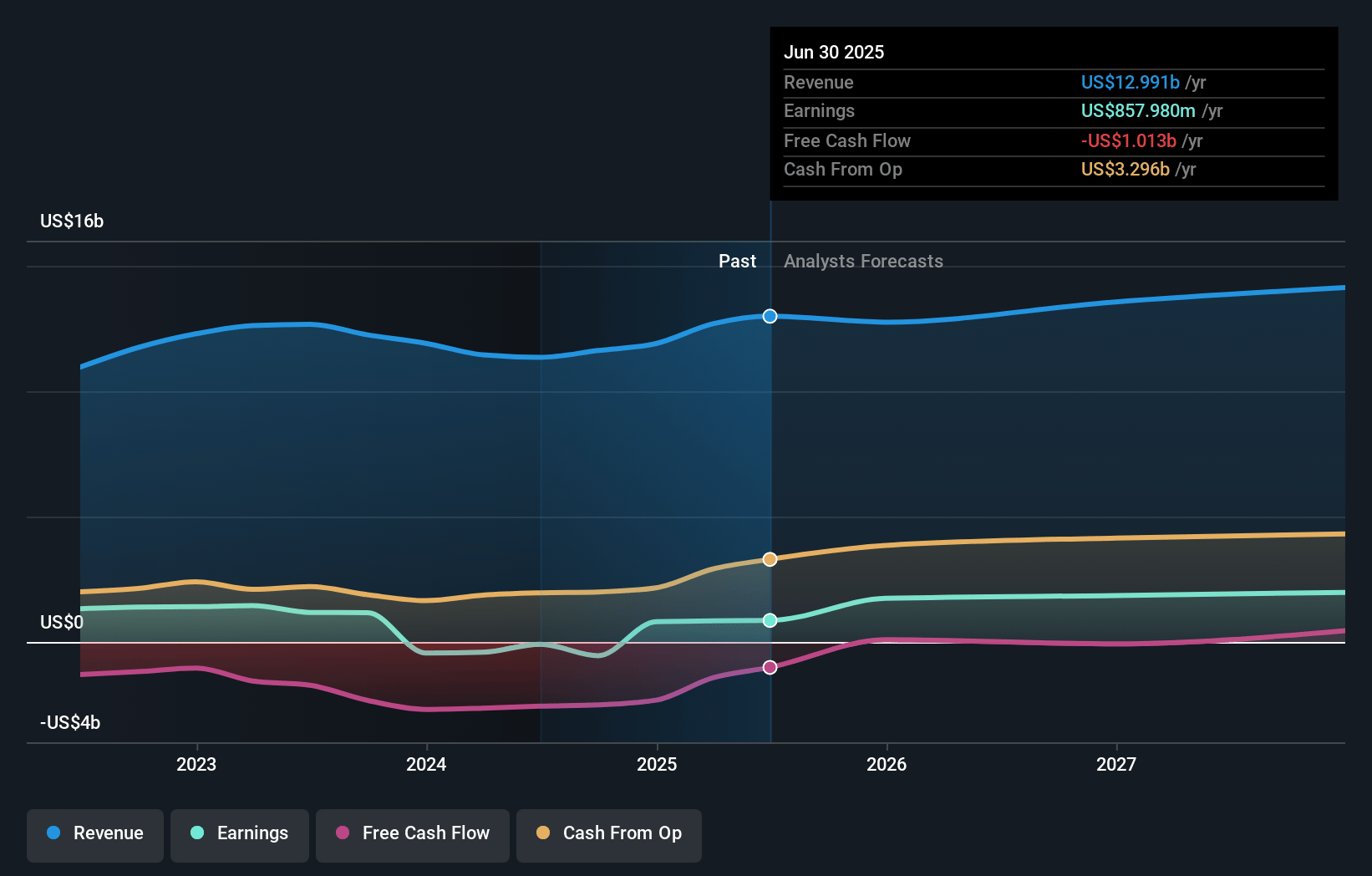

Eversource Energy Future Earnings and Revenue Growth

Assumptions

How have these above catalysts been quantified?- This narrative explores a more pessimistic perspective on Eversource Energy compared to the consensus, based on a Fair Value that aligns with the bearish cohort of analysts.

- The bearish analysts are assuming Eversource Energy's revenue will grow by 1.6% annually over the next 3 years.

- The bearish analysts assume that profit margins will increase from 6.6% today to 15.0% in 3 years time.

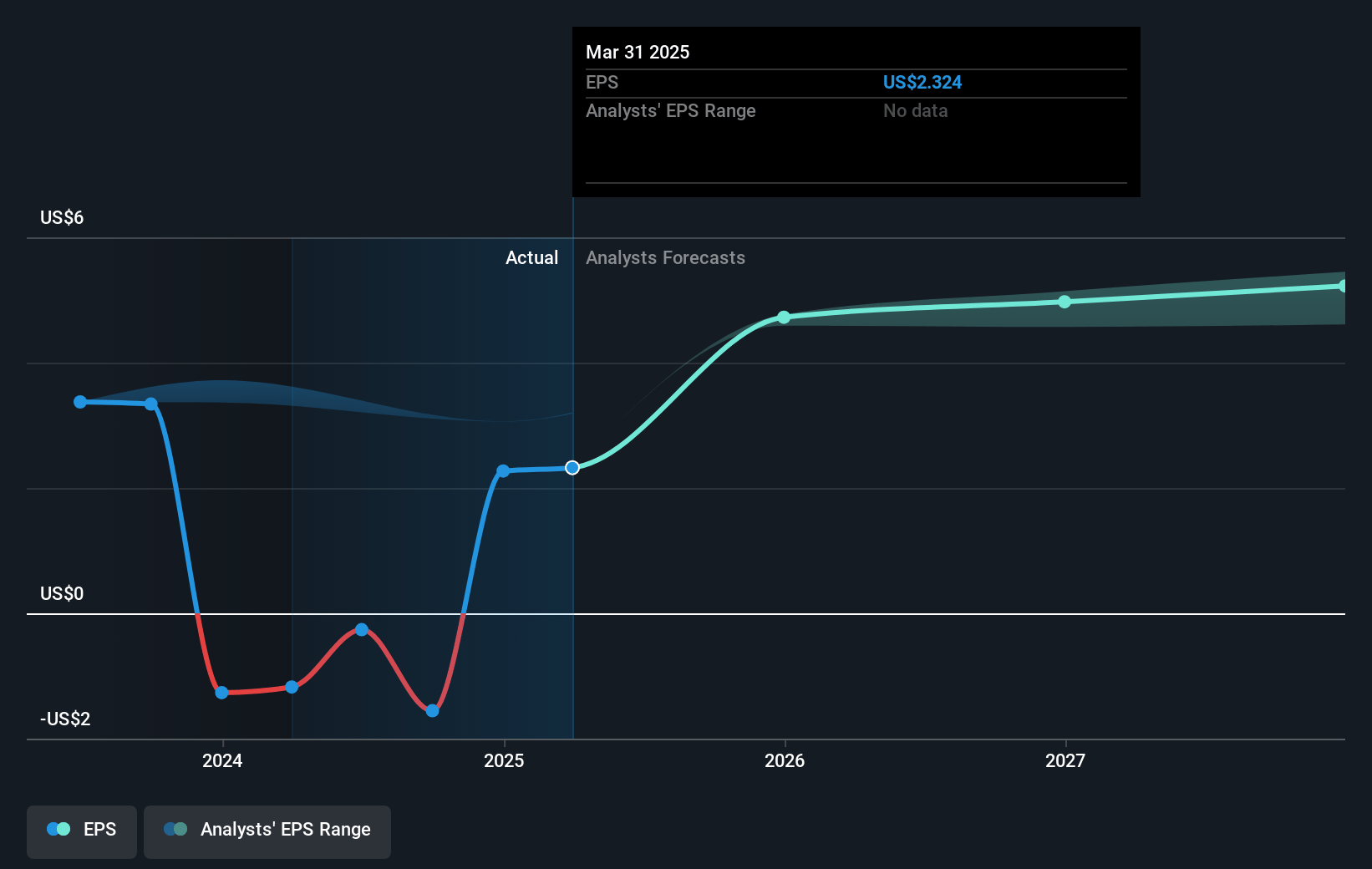

- The bearish analysts expect earnings to reach $2.0 billion (and earnings per share of $4.93) by about July 2028, up from $840.6 million today. The analysts are largely in agreement about this estimate.

- In order for the above numbers to justify the price target of the more bearish analyst cohort, the company would need to trade at a PE ratio of 12.5x on those 2028 earnings, down from 29.0x today. This future PE is lower than the current PE for the US Electric Utilities industry at 22.0x.

- Analysts expect the number of shares outstanding to grow by 2.8% per year for the next 3 years.

- To value all of this in today's terms, we will use a discount rate of 6.68%, as per the Simply Wall St company report.

Eversource Energy Future Earnings Per Share Growth

Risks

What could happen that would invalidate this narrative?- Eversource is guiding for a 5% to 7% long-term EPS growth rate through 2029, driven by 8% projected compound annual rate base growth and a substantial $24.2 billion capital plan, which should support sustained revenue and earnings growth over the medium and long term.

- Constructive regulatory frameworks and recently approved performance-based ratemaking mechanisms, especially in Massachusetts and anticipated in New Hampshire and Connecticut, are likely to allow timely cost recovery and inflation adjustments, helping to preserve net margins and earnings stability even as capital expenditures increase.

- The company’s focus on electrification, decarbonization investments, and grid modernization—including smart meters and advanced customer engagement technologies—aligns with secular energy transition trends, positioning Eversource to benefit from increased demand and supportive policy, which could drive top line and earnings higher over time.

- Eversource’s robust cash flow improvements and declining debt due to the planned Aquarion sale are driving improved FFO to debt ratios well above credit agency downgrade thresholds, reducing financial risk and supporting long-term financial strength and shareholder returns.

- There is ongoing strong investment in transmission infrastructure and offshore wind development, with near-term construction risks largely mitigated and new project opportunities arising from regional decarbonization goals, further underpinning future rate base expansion, revenue growth, and earnings visibility.

Valuation

How have all the factors above been brought together to estimate a fair value?- The assumed bearish price target for Eversource Energy is $51.48, which represents two standard deviations below the consensus price target of $69.9. This valuation is based on what can be assumed as the expectations of Eversource Energy's future earnings growth, profit margins and other risk factors from analysts on the more bearish end of the spectrum.

- However, there is a degree of disagreement amongst analysts, with the most bullish reporting a price target of $85.0, and the most bearish reporting a price target of just $47.0.

- In order for you to agree with the bearish analysts, you'd need to believe that by 2028, revenues will be $13.3 billion, earnings will come to $2.0 billion, and it would be trading on a PE ratio of 12.5x, assuming you use a discount rate of 6.7%.

- Given the current share price of $66.37, the bearish analyst price target of $51.48 is 28.9% lower. Despite analysts expecting the underlying buisness to improve, they seem to believe the market's expectations are too high.

- We always encourage you to reach your own conclusions though. So sense check these analyst numbers against your own assumptions and expectations based on your understanding of the business and what you believe is probable.

How well do narratives help inform your perspective?

Disclaimer

AnalystLowTarget is a tool utilizing a Large Language Model (LLM) that ingests data on consensus price targets, forecasted revenue and earnings figures, as well as the transcripts of earnings calls to produce qualitative analysis. The narratives produced by AnalystLowTarget are general in nature and are based solely on analyst data and publicly-available material published by the respective companies. These scenarios are not indicative of the company's future performance and are exploratory in nature. Simply Wall St has no position in the company(s) mentioned. Simply Wall St may provide the securities issuer or related entities with website advertising services for a fee, on an arm's length basis. These relationships have no impact on the way we conduct our business, the content we host, or how our content is served to users. The price targets and estimates used are consensus data, and do not constitute a recommendation to buy or sell any stock, and they do not take account of your objectives, or your financial situation. Note that AnalystLowTarget's analysis may not factor in the latest price-sensitive company announcements or qualitative material.