Narratives are currently in beta

Key Takeaways

- Strategic investments in solar and storage, combined with strong pricing terms, are anticipated to drive significant revenue growth for Clearway Energy.

- Clearway aims to enhance margins and shareholder value by reinvesting cash flows and reducing equity reliance through a focused capital allocation strategy.

- The company's growth may be constrained by reliance on internal cash flow and refinancing, with potential risks impacting net margins and strategic flexibility.

Catalysts

About Clearway Energy- Operates in the renewable energy business in the United States.

- Clearway Energy is focusing on strategic growth investments in solar and storage projects, like Pine Forest and Honeycomb, which are expected to progressively increase revenues due to fully contracted capacities with strong pricing terms. This will likely drive revenue growth.

- The company plans to achieve a significant increase in CAFD per share by 2027, targeting $2.40 to $2.60, which implies a compounded annual growth rate from 2025. This leverage on their core asset base and accretive growth investment prospects is expected to enhance net margins.

- Clearway Energy intends to retain more cash flow for reinvestment, targeting a payout ratio of 70% to 80% by 2027. This approach aims to provide a greater source of capital for growth investments, positively influencing net margins and earnings stability.

- The company has articulated a capital allocation framework focusing on funding growth from retained cash flows and prudent leverage, intending to minimize reliance on external equity issuance. This strategy is expected to improve earnings per share and shareholder value over time.

- Clearway's refined capacity revenues and their strong resource adequacy pricing in California's energy market are providing confidence in their forward-looking financial targets. This strategic positioning is likely to support robust revenue growth.

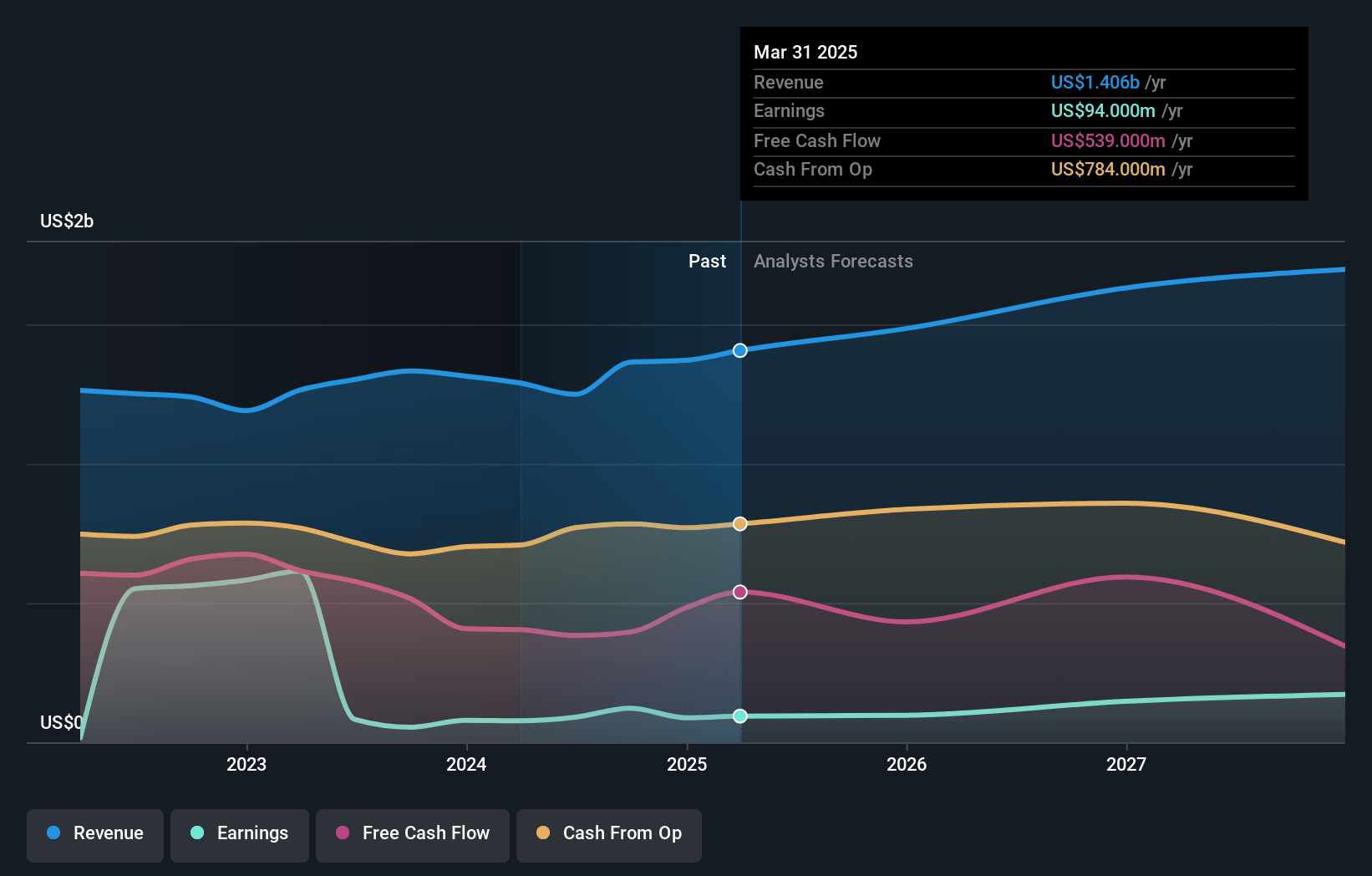

Clearway Energy Future Earnings and Revenue Growth

Assumptions

How have these above catalysts been quantified?- Analysts are assuming Clearway Energy's revenue will grow by 6.2% annually over the next 3 years.

- Analysts assume that profit margins will increase from 8.9% today to 14.2% in 3 years time.

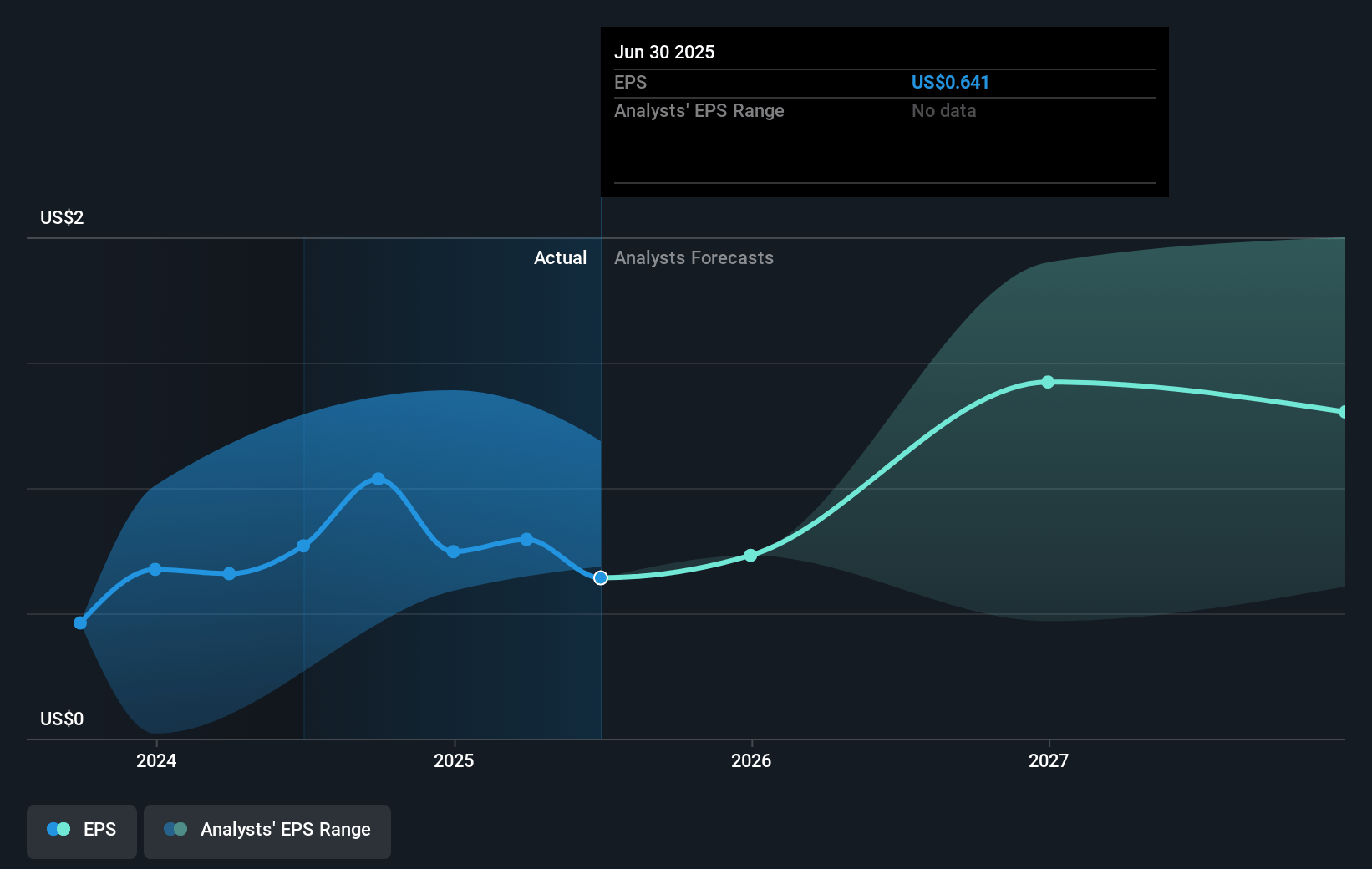

- Analysts expect earnings to reach $231.3 million (and earnings per share of $1.07) by about January 2028, up from $122.0 million today.

- In order for the above numbers to justify the analysts price target, the company would need to trade at a PE ratio of 39.7x on those 2028 earnings, up from 24.0x today. This future PE is greater than the current PE for the US Renewable Energy industry at 24.0x.

- Analysts expect the number of shares outstanding to grow by 2.14% per year for the next 3 years.

- To value all of this in today's terms, we will use a discount rate of 8.05%, as per the Simply Wall St company report.

Clearway Energy Future Earnings Per Share Growth

Risks

What could happen that would invalidate this narrative?- Forward-looking statements indicate there may be unforeseen risks and uncertainties which could impact actual financial results compared to projections, potentially affecting net margins.

- Dependence on retained cash flow to fund growth might limit capital available for deployment if internal cash generation falls short, impacting revenue and growth.

- Rising principal and interest payments from refinancing activities could increase costs and reduce earnings, affecting net profit margins.

- There is potential risk if market conditions affect power marketing and resource adequacy capacity revenues, which could lead to variability in cash available for distribution and profit margins.

- Tight capital allocation and reliance on internal funding might constrain strategic flexibility, potentially impacting revenue growth if market opportunities require quick capitalization.

Valuation

How have all the factors above been brought together to estimate a fair value?- The analysts have a consensus price target of $33.83 for Clearway Energy based on their expectations of its future earnings growth, profit margins and other risk factors.

- In order for you to agree with the analyst's consensus, you'd need to believe that by 2028, revenues will be $1.6 billion, earnings will come to $231.3 million, and it would be trading on a PE ratio of 39.7x, assuming you use a discount rate of 8.1%.

- Given the current share price of $24.95, the analyst's price target of $33.83 is 26.3% higher.

- We always encourage you to reach your own conclusions though. So sense check these analyst numbers against your own assumptions and expectations based on your understanding of the business and what you believe is probable.

How well do narratives help inform your perspective?

Disclaimer

Warren A.I. is a tool utilizing a Large Language Model (LLM) that ingests data on consensus price targets, forecasted revenue and earnings figures, as well as the transcripts of earnings calls to produce qualitative analysis. The narratives produced by Warren A.I. are general in nature and are based solely on analyst data and publicly-available material published by the respective companies. These scenarios are not indicative of the company's future performance and are exploratory in nature. Simply Wall St has no position in the company(s) mentioned. The price targets and estimates used are consensus data, and do not constitute a recommendation to buy or sell any stock, and they do not take account of your objectives, or your financial situation. Note that Warren A.I.'s analysis may not factor in the latest price-sensitive company announcements or qualitative material.

Read more narratives

There are no other narratives for this company.

View all narratives