Narratives are currently in beta

Key Takeaways

- Strategic acquisition and infrastructure optimization could boost revenue and margins amid growing electricity demands from data centers.

- Increased market perception and liquidity, along with share repurchase plans, support shareholder value and earnings growth confidence.

- Regulatory challenges and market uncertainties may hinder revenue stability and necessitate cautious strategy execution to optimize asset utilization and profitability.

Catalysts

About Talen Energy- An independent power producer and infrastructure company, produces and sells electricity, capacity, and ancillary services into wholesale power markets in the United States.

- Talen Energy's strategic flexibility following the acquisition of TeraWulf's 25% share in Nautilus could allow it to optimize building and power use, potentially boosting generation revenue through more profitable power sales to the PJM wholesale market and Amazon.

- The company’s infrastructure placement in Pennsylvania offers an advantaged grid location, which, combined with increased demand forecasts for data centers, could lead to higher generation revenue and margins as Talen positions itself to meet growing electricity needs.

- Participation in five new equity indices and increased passive fund demand could improve market perception and stock value, indirectly supporting earnings growth through greater investment interest and liquidity.

- Talen plans to repurchase shares with significant remaining capacity in its share repurchase program, which is expected to enhance earnings per share, creating shareholder value by returning 70% of adjusted free cash flow to shareholders.

- The reaffirmation and narrowed guidance for increased 2024, 2025, and 2026 adjusted EBITDA and free cash flow indicate confidence in future earnings growth and financial stability, driven by operational efficiencies and strategic planning.

Talen Energy Future Earnings and Revenue Growth

Assumptions

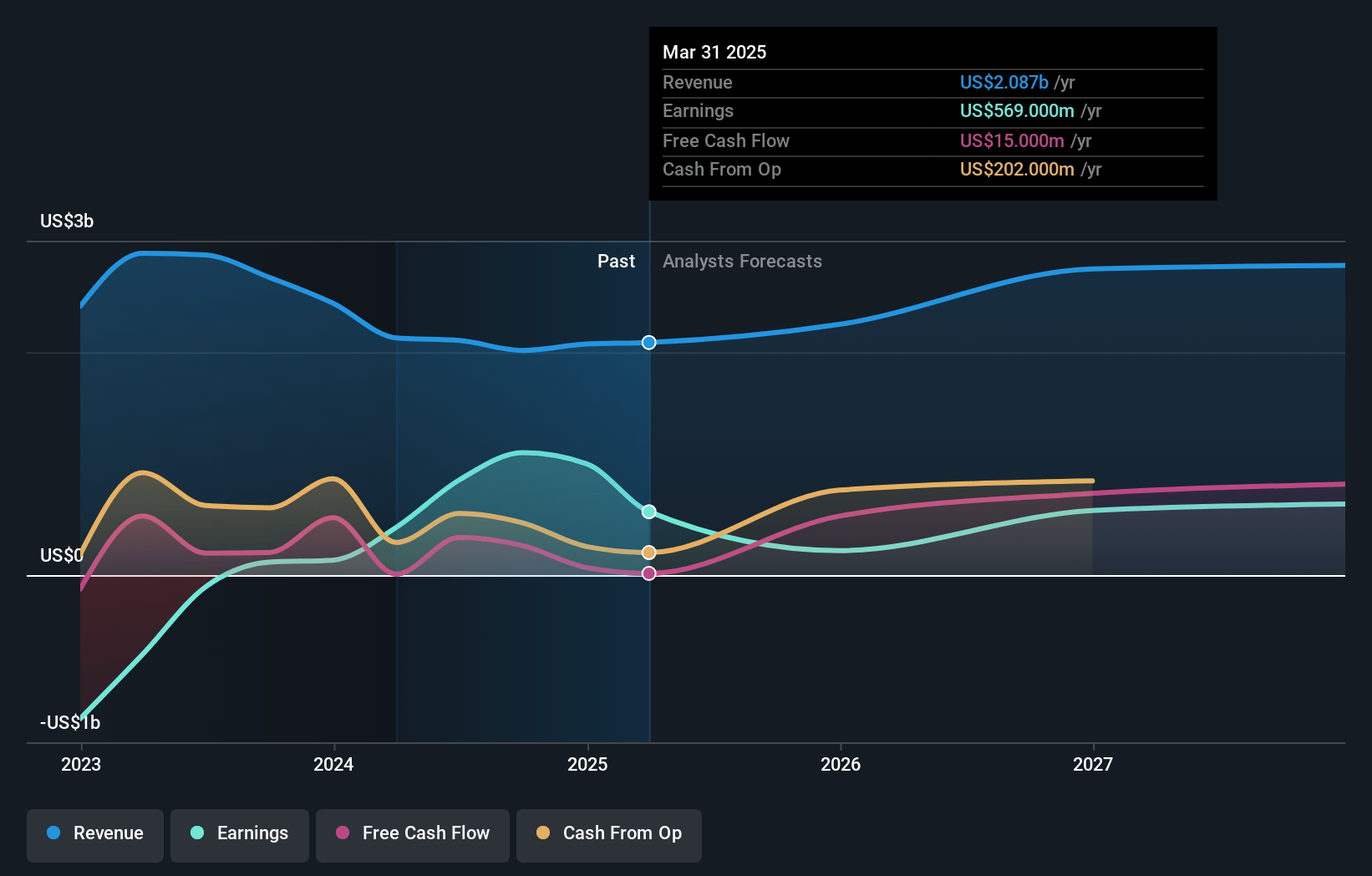

How have these above catalysts been quantified?- Analysts are assuming Talen Energy's revenue will grow by 11.9% annually over the next 3 years.

- Analysts assume that profit margins will shrink from 54.5% today to 22.5% in 3 years time.

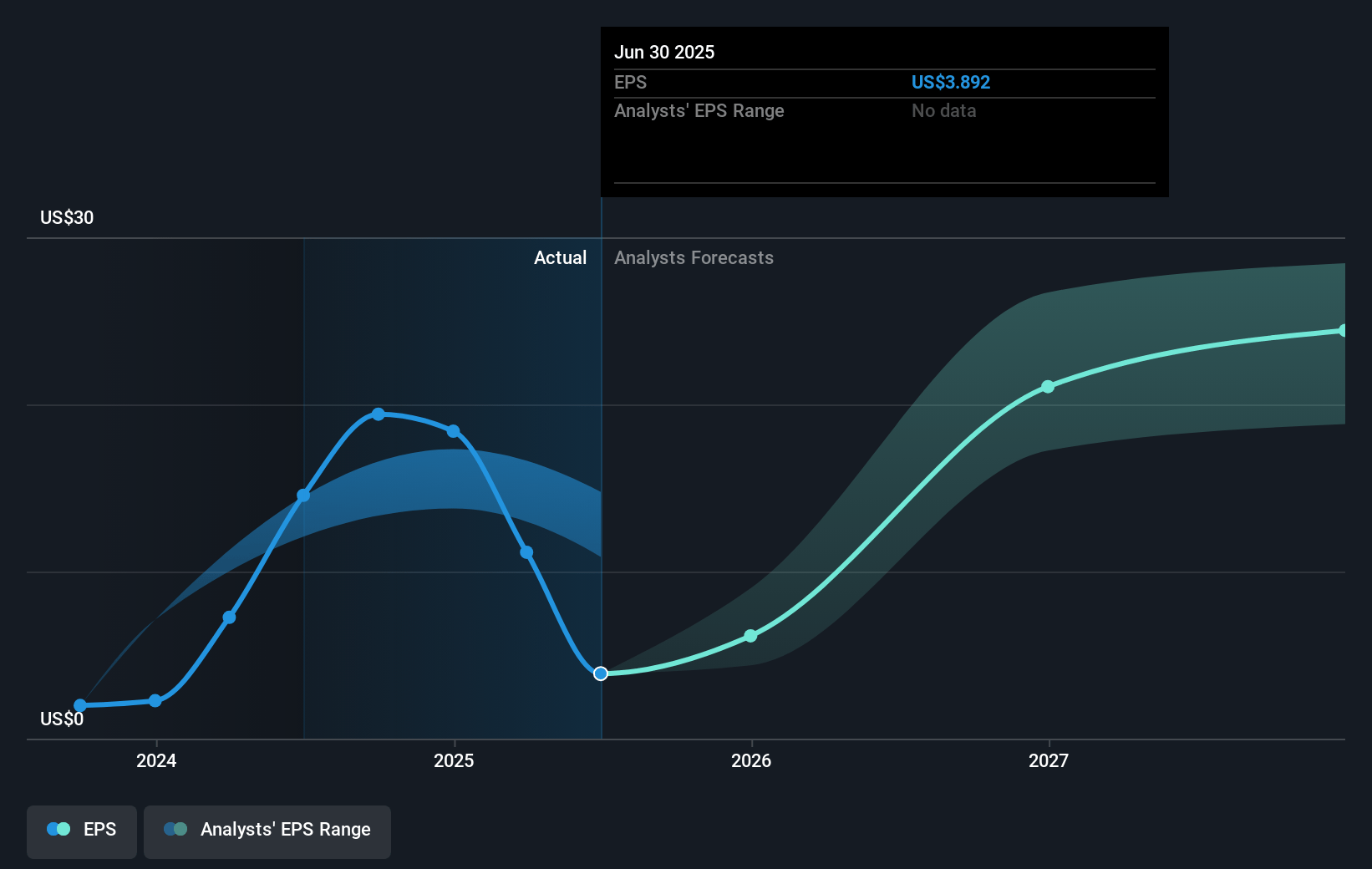

- Analysts expect earnings to reach $634.9 million (and earnings per share of $14.28) by about December 2027, down from $1.1 billion today. However, there is a considerable amount of disagreement amongst the analysts with the most bullish expecting $712.8 million in earnings, and the most bearish expecting $492 million.

- In order for the above numbers to justify the analysts price target, the company would need to trade at a PE ratio of 20.8x on those 2027 earnings, up from 9.6x today. This future PE is lower than the current PE for the US Renewable Energy industry at 22.1x.

- Analysts expect the number of shares outstanding to decline by 4.38% per year for the next 3 years.

- To value all of this in today's terms, we will use a discount rate of 6.09%, as per the Simply Wall St company report.

Talen Energy Future Earnings Per Share Growth

Risks

What could happen that would invalidate this narrative?- The regulatory environment poses significant risks, as Talen Energy faces challenges such as the rejection of the ISA amendment by FERC and ongoing negotiations for RMR settlements, which may affect the predictability of revenue streams and net margins.

- The delayed PJM capacity auctions and potential market distortions from RMR bidding create uncertainties around capacity market pricing, possibly impacting future revenue and earnings stability.

- Although Talen is exploring commercial solutions post-AWS contract, any prolonged resolution for the Susquehanna campus development could defer expected revenue growth and burden cash flow projections.

- Resource adequacy issues and the broader competitive landscape, particularly concerning the expansion of gas and nuclear assets, may strain capital expenditure budgets and affect net earnings.

- Talen’s strategy of leveraging co-location and hybrid power solutions includes execution risk that, if underestimated, could lead to suboptimal utilization of assets and impact future profitability.

Valuation

How have all the factors above been brought together to estimate a fair value?- The analysts have a consensus price target of $251.6 for Talen Energy based on their expectations of its future earnings growth, profit margins and other risk factors.

- In order for you to agree with the analyst's consensus, you'd need to believe that by 2027, revenues will be $2.8 billion, earnings will come to $634.9 million, and it would be trading on a PE ratio of 20.8x, assuming you use a discount rate of 6.1%.

- Given the current share price of $206.85, the analyst's price target of $251.6 is 17.8% higher. Despite analysts expecting the underlying buisness to decline, they seem to believe it's more valuable than what the market thinks.

- We always encourage you to reach your own conclusions though. So sense check these analyst numbers against your own assumptions and expectations based on your understanding of the business and what you believe is probable.

How well do narratives help inform your perspective?

Disclaimer

Warren A.I. is a tool utilizing a Large Language Model (LLM) that ingests data on consensus price targets, forecasted revenue and earnings figures, as well as the transcripts of earnings calls to produce qualitative analysis. The narratives produced by Warren A.I. are general in nature and are based solely on analyst data and publicly-available material published by the respective companies. These scenarios are not indicative of the company's future performance and are exploratory in nature. Simply Wall St has no position in the company(s) mentioned. The price targets and estimates used are consensus data, and do not constitute a recommendation to buy or sell any stock, and they do not take account of your objectives, or your financial situation. Note that Warren A.I.'s analysis may not factor in the latest price-sensitive company announcements or qualitative material.

Read more narratives

There are no other narratives for this company.

View all narratives