Key Takeaways

- Strong regional development and infrastructure investments are driving growth in recurring revenue, operating efficiency, and long-term earnings stability.

- Expansion in natural gas demand, smart debt management, and supportive regulatory environment bolster resilience, margin health, and future financial strength.

- Heavy reliance on a concentrated customer base and region, plus regulatory and market shifts, exposes the company to elevated long-term operational and financial risks.

Catalysts

About RGC Resources- Through its subsidiaries, operates as an energy services company.

- Sustained customer and main line growth in the Roanoke region-driven by new residential and commercial developments, ongoing urbanization, and potential large-scale investments like the announced Google project-positions RGC Resources for higher recurring revenue and operating efficiency in coming years.

- The need for reliable backup energy sources amid elevated and volatile electricity prices in the PJM region is expected to support steady demand for natural gas connections and fuel conversions, offering resilience in base revenues and maintaining healthy net margins.

- Ongoing infrastructure modernization through the SAVE program and planned expansions (e.g., Franklin County) are likely to create new rate-based assets that support regular rate increases and long-term earnings growth through stable regulatory cost recovery.

- The refinancing and extension of Midstream debt at favorable long-term rates reduces financial uncertainty, supports ongoing capital investment, and is likely to result in improved interest expense management and stronger net income stability.

- Active engagement with regional economic development, coupled with capacity expansion via the operational MVP pipeline, enhances the company's ability to capture incremental customer growth and new investment opportunities, positively impacting future earnings and cash flows.

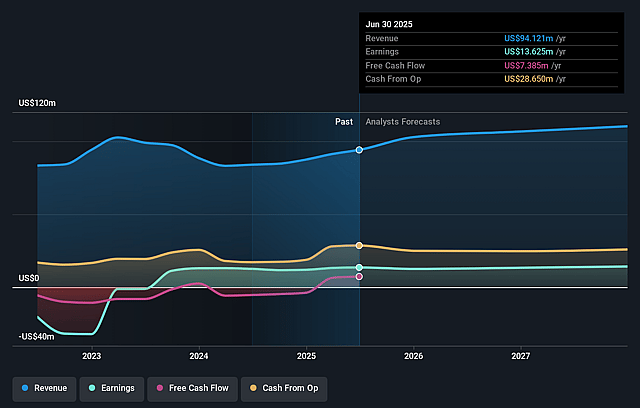

RGC Resources Future Earnings and Revenue Growth

Assumptions

How have these above catalysts been quantified?- Analysts are assuming RGC Resources's revenue will grow by 5.9% annually over the next 3 years.

- Analysts assume that profit margins will shrink from 14.5% today to 13.0% in 3 years time.

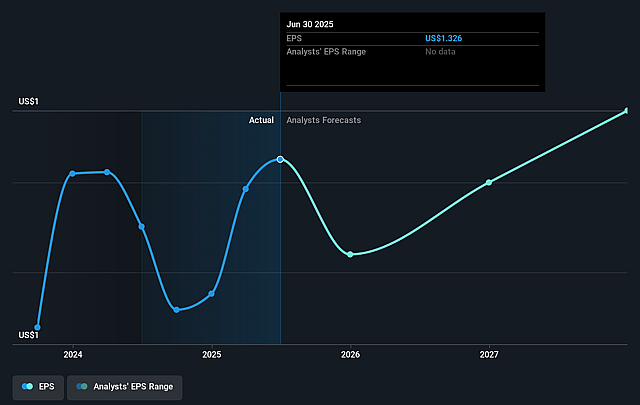

- Analysts expect earnings to reach $14.5 million (and earnings per share of $1.41) by about September 2028, up from $13.6 million today.

- In order for the above numbers to justify the analysts price target, the company would need to trade at a PE ratio of 21.3x on those 2028 earnings, up from 16.6x today. This future PE is greater than the current PE for the US Gas Utilities industry at 17.6x.

- Analysts expect the number of shares outstanding to grow by 0.61% per year for the next 3 years.

- To value all of this in today's terms, we will use a discount rate of 6.78%, as per the Simply Wall St company report.

RGC Resources Future Earnings Per Share Growth

Risks

What could happen that would invalidate this narrative?- Dependence on a single major industrial customer for volume growth poses a concentration risk-if this customer reduces or shifts away from natural gas (e.g., fuel-switching or electrification), it could cause significant declines in delivered volumes and revenues.

- RGC Resources' highly localized geographic footprint (centered around Roanoke and Franklin County) limits its ability to scale, constraining long-term revenue growth and making earnings more vulnerable to regional economic cycles and demographic shifts.

- The company's long-term financial outlook is heavily dependent on the success and continued operation of the Mountain Valley Pipeline; regulatory, legal, or environmental setbacks to MVP or customer contracts could result in cost overruns or stranded asset risk, negatively impacting net margins and earnings.

- Persistently high capital expenditures for infrastructure expansion and system upgrades, combined with modest or potentially negative free cash flow, may restrict RGC Resources' ability to invest in diversification or to consistently grow dividends, which could pressure long-term earnings growth.

- Secular trends toward electrification, tightening environmental policy (such as the Virginia Clean Economy Act), and increased ESG scrutiny threaten natural gas demand in the residential and commercial sectors, leading to structural volume/revenue headwinds and elevated compliance costs over the long term.

Valuation

How have all the factors above been brought together to estimate a fair value?- The analysts have a consensus price target of $25.4 for RGC Resources based on their expectations of its future earnings growth, profit margins and other risk factors. However, there is a degree of disagreement amongst analysts, with the most bullish reporting a price target of $28.0, and the most bearish reporting a price target of just $22.8.

- In order for you to agree with the analyst's consensus, you'd need to believe that by 2028, revenues will be $111.9 million, earnings will come to $14.5 million, and it would be trading on a PE ratio of 21.3x, assuming you use a discount rate of 6.8%.

- Given the current share price of $21.88, the analyst price target of $25.4 is 13.9% higher.

- We always encourage you to reach your own conclusions though. So sense check these analyst numbers against your own assumptions and expectations based on your understanding of the business and what you believe is probable.

How well do narratives help inform your perspective?

Disclaimer

AnalystConsensusTarget is a tool utilizing a Large Language Model (LLM) that ingests data on consensus price targets, forecasted revenue and earnings figures, as well as the transcripts of earnings calls to produce qualitative analysis. The narratives produced by AnalystConsensusTarget are general in nature and are based solely on analyst data and publicly-available material published by the respective companies. These scenarios are not indicative of the company's future performance and are exploratory in nature. Simply Wall St has no position in the company(s) mentioned. Simply Wall St may provide the securities issuer or related entities with website advertising services for a fee, on an arm's length basis. These relationships have no impact on the way we conduct our business, the content we host, or how our content is served to users. The price targets and estimates used are consensus data, and do not constitute a recommendation to buy or sell any stock, and they do not take account of your objectives, or your financial situation. Note that AnalystConsensusTarget's analysis may not factor in the latest price-sensitive company announcements or qualitative material.