Key Takeaways

- New facility launches, policy support, and technology partnerships will enhance revenue stability, operational margins, and long-term earnings growth.

- Expansion into biogenic CO₂ and adjacent markets diversifies revenue and reduces exposure to volatility in renewable gas markets.

- Exposure to regulatory shifts, operational setbacks, competitive pressures, and reliance on government credits heightens risks to revenue stability, margin strength, and long-term profitability.

Catalysts

About Montauk Renewables- Montauk Raenewables, Inc., a renewable energy company, engages in recovery and processing of biogas from landfills and other non-fossil fuel sources.

- Significant new production capacity and revenue generation are scheduled to come online in 2026 through Montauk’s North Carolina swine waste-to-energy facility, supported by favorable state renewable energy credits and active utility contract negotiations, which are expected to drive a step-change in future revenue and cash flow.

- Policy momentum is building as governments implement stricter emissions regulations, extend renewable fuel mandates, and expand incentives tied to carbon credits and RIN values; this legislative push is set to improve the economics of Montauk’s core RNG and environmental attributes businesses and accelerate long-term earnings growth.

- Expansion into food-grade biogenic CO2, demonstrated by the upcoming Rumpke project and the Atascocita facility, opens high-value adjacent markets beyond RNG and renewable electricity, providing new diversified revenue streams and reducing overall earnings volatility.

- Advancements in biogas and waste conversion technology—including partnerships (such as with Emvolon) and upgrades at existing sites—position Montauk to lower production costs, expand margins, and improve project returns as industry-wide technology adoption increases.

- Growing corporate ESG commitments and capital allocation toward clean energy are expected to reduce Montauk’s cost of capital, facilitate access to larger-scale financing for project buildouts and acquisitions, and support higher sustained long-term profitability and net margins.

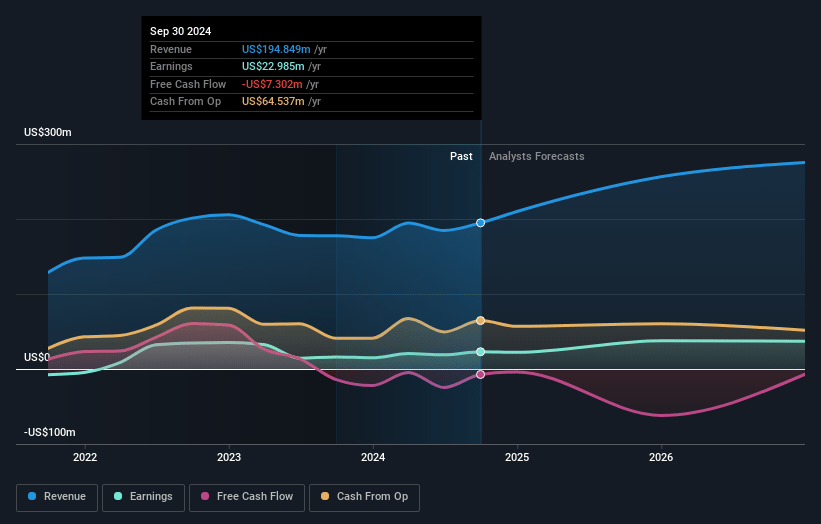

Montauk Renewables Future Earnings and Revenue Growth

Assumptions

How have these above catalysts been quantified?- This narrative explores a more optimistic perspective on Montauk Renewables compared to the consensus, based on a Fair Value that aligns with the bullish cohort of analysts.

- The bullish analysts are assuming Montauk Renewables's revenue will grow by 16.8% annually over the next 3 years.

- The bullish analysts assume that profit margins will increase from 4.1% today to 8.6% in 3 years time.

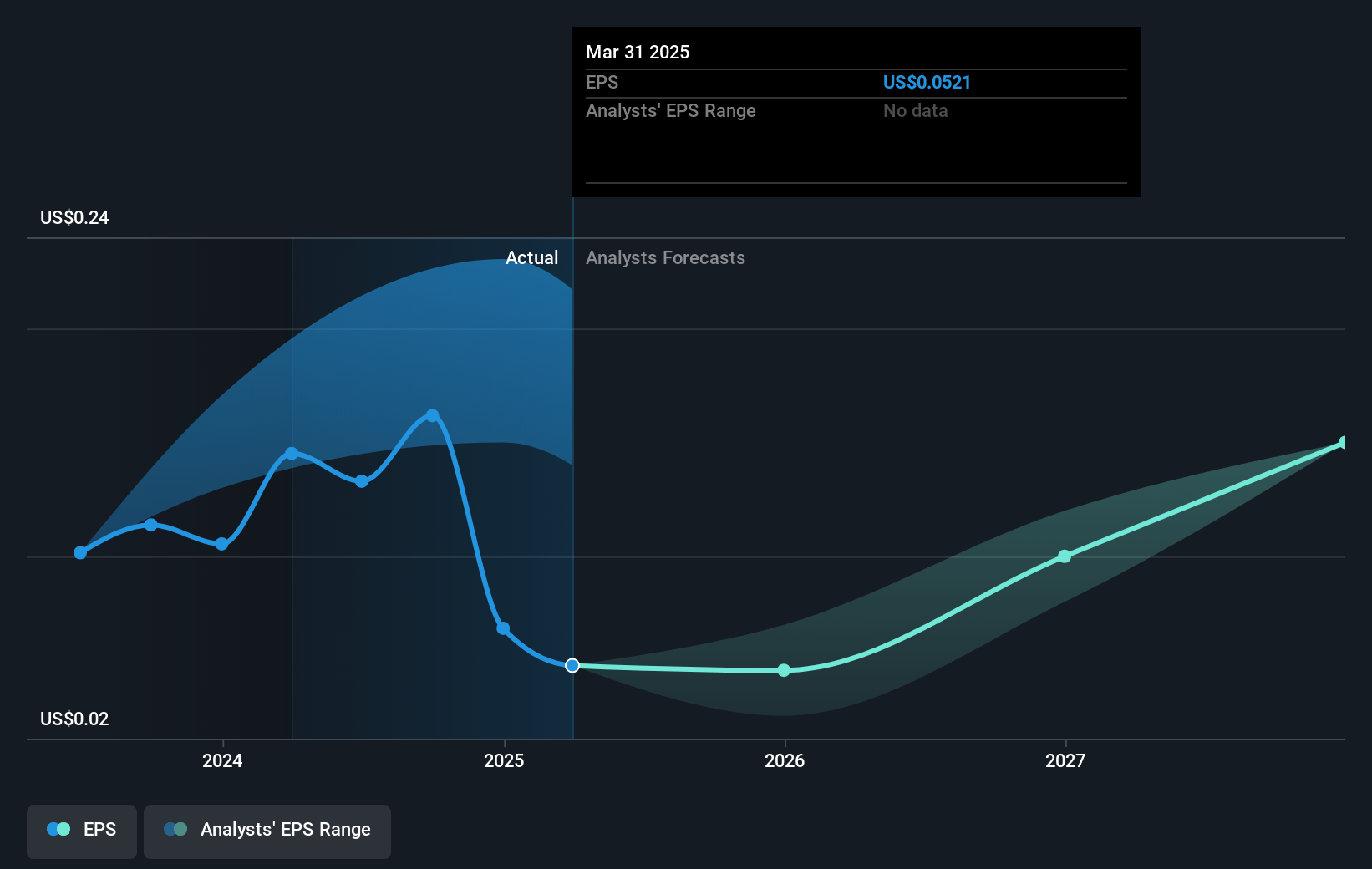

- The bullish analysts expect earnings to reach $24.8 million (and earnings per share of $0.17) by about July 2028, up from $7.4 million today. The analysts are largely in agreement about this estimate.

- In order for the above numbers to justify the price target of the more bullish analyst cohort, the company would need to trade at a PE ratio of 27.7x on those 2028 earnings, down from 44.9x today. This future PE is lower than the current PE for the US Renewable Energy industry at 38.5x.

- Analysts expect the number of shares outstanding to decline by 0.32% per year for the next 3 years.

- To value all of this in today's terms, we will use a discount rate of 6.94%, as per the Simply Wall St company report.

Montauk Renewables Future Earnings Per Share Growth

Risks

What could happen that would invalidate this narrative?- Regulatory uncertainty around the EPA’s Renewable Fuel Standard and the delay or potential changes in RIN compliance deadlines, as well as new rules such as the Biogas Regulatory Reform Rule, could disrupt timing of sales, depress RIN prices, and create volatility, with a direct impact on revenue and net margins if low-carbon fuel policy support is weakened or withdrawn.

- The company reported stagnant RNG production volumes and faced higher operating and maintenance expenses at facilities like Apex and McCarty, with equipment failures and environmental issues impacting output and pushing operating costs up, ultimately pressuring earnings and net income over the longer term.

- Renewed competition in the RNG sector, including aggressive capacity expansions by larger waste and energy management companies, threatens Montauk’s project returns and market share, potentially resulting in slower revenue growth and tighter margins as the market becomes more saturated and pricing power declines.

- The decision by a local gas utility to stop accepting RNG from any producer, specifically impacting the Blue Granite project, highlights Montauk’s dependence on a limited number of counterparties for offtake, raising the risk of output curtailment and impairment charges that can reduce asset values and create unpredictable fluctuations in revenue streams.

- A persistent decrease in realized D3 RIN prices—down 24 percent year-over-year—compounded by Montauk’s heavy reliance on government-derived credits and subsidies, exposes the company to abrupt declines in revenue and profit margins should environmental credit pricing weaken or legislative frameworks change, threatening long-term profitability.

Valuation

How have all the factors above been brought together to estimate a fair value?- The assumed bullish price target for Montauk Renewables is $4.0, which is the highest price target estimate amongst analysts. This valuation is based on what can be assumed as the expectations of Montauk Renewables's future earnings growth, profit margins and other risk factors from analysts on the bullish end of the spectrum.

- However, there is a degree of disagreement amongst analysts, with the most bullish reporting a price target of $4.0, and the most bearish reporting a price target of just $1.5.

- In order for you to agree with the bullish analysts, you'd need to believe that by 2028, revenues will be $286.4 million, earnings will come to $24.8 million, and it would be trading on a PE ratio of 27.7x, assuming you use a discount rate of 6.9%.

- Given the current share price of $2.35, the bullish analyst price target of $4.0 is 41.2% higher.

- We always encourage you to reach your own conclusions though. So sense check these analyst numbers against your own assumptions and expectations based on your understanding of the business and what you believe is probable.

How well do narratives help inform your perspective?

Disclaimer

AnalystHighTarget is a tool utilizing a Large Language Model (LLM) that ingests data on consensus price targets, forecasted revenue and earnings figures, as well as the transcripts of earnings calls to produce qualitative analysis. The narratives produced by AnalystHighTarget are general in nature and are based solely on analyst data and publicly-available material published by the respective companies. These scenarios are not indicative of the company's future performance and are exploratory in nature. Simply Wall St has no position in the company(s) mentioned. Simply Wall St may provide the securities issuer or related entities with website advertising services for a fee, on an arm's length basis. These relationships have no impact on the way we conduct our business, the content we host, or how our content is served to users. The price targets and estimates used are consensus data, and do not constitute a recommendation to buy or sell any stock, and they do not take account of your objectives, or your financial situation. Note that AnalystHighTarget's analysis may not factor in the latest price-sensitive company announcements or qualitative material.