Narratives are currently in beta

Key Takeaways

- Strong building permits and housing boom in metro-Phoenix and Maricopa predict revenue growth from new connections and residential demand.

- Industrial boom, coupled with political support and rate increases, enhances revenue and earnings potential through expanded service connections.

- Economic and regulatory challenges could constrain Global Water Resources' revenue growth and earnings stability, with uncertainties affecting cash flow and potential in service area expansion.

Catalysts

About Global Water Resources- A water resource management company, owns, operates, and manages regulated water, wastewater, and recycled water systems primarily in metropolitan Phoenix and Tucson, Arizona.

- The significant increase in building permits and the ongoing housing boom in the metro-Phoenix and Maricopa areas suggest strong future revenue growth from new utility connections and residential service demand. This impacts revenue positively.

- The industrial manufacturing boom, with substantial investments from major companies like TSMC and Intel, indicates potential for increased service demand and higher revenue from business connections and associated infrastructure requirements.

- The shift towards large-scale, high-density multifamily dwelling complexes in Maricopa is expected to drive substantial new service connections, increasing revenue from multifamily and commercial business, which can improve net margins.

- The strategic positioning in areas with anticipated political and economic support for infrastructure and growth, particularly in industrial and housing sectors, is likely to enhance earnings potential as these investments materialize.

- The upcoming rate cases for the company's largest utilities could lead to increased rates that align with inflation and cost increases, thereby providing a boost to the company's net margins and overall earnings once approved.

Global Water Resources Future Earnings and Revenue Growth

Assumptions

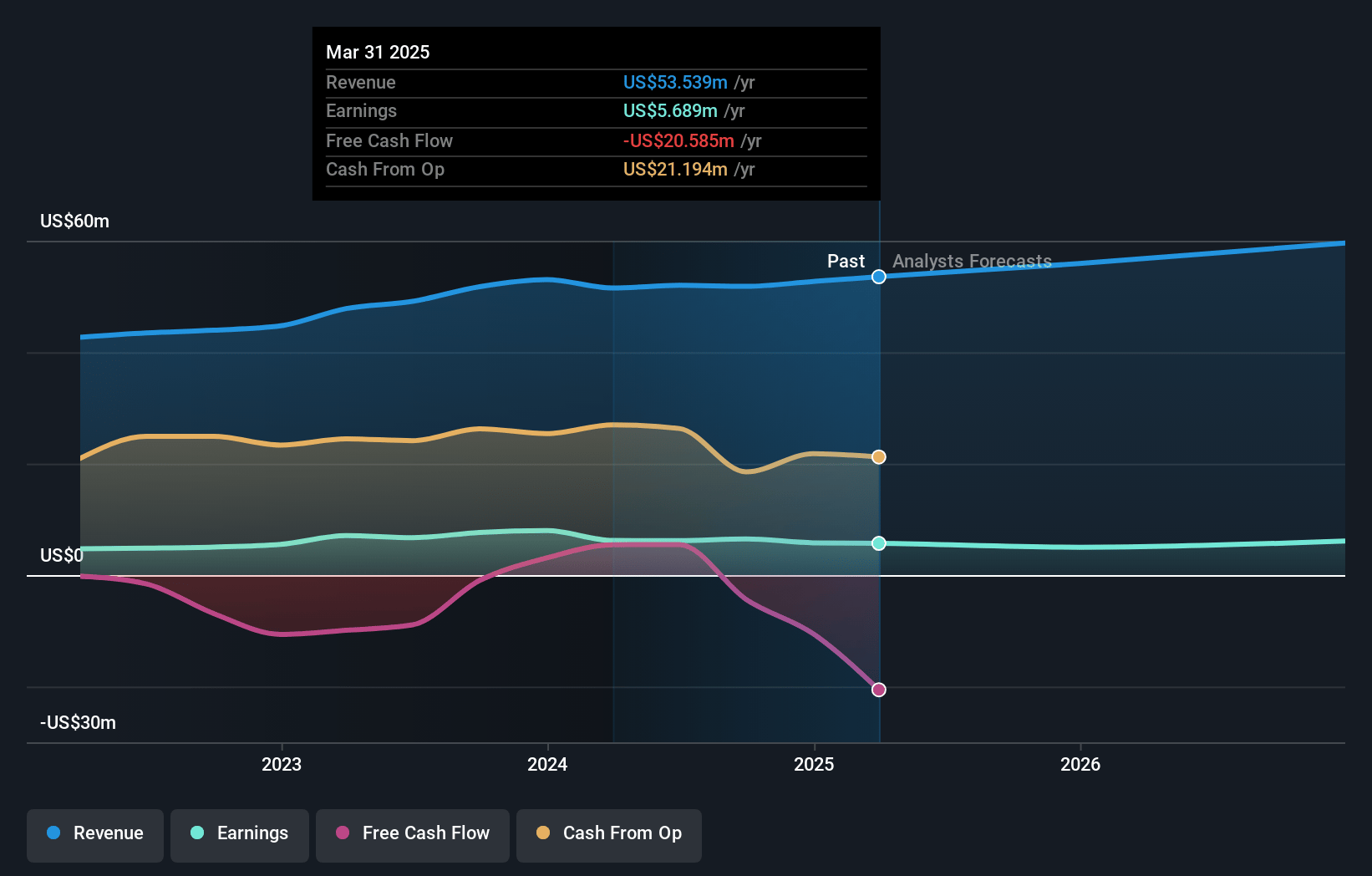

How have these above catalysts been quantified?- Analysts are assuming Global Water Resources's revenue will grow by 6.4% annually over the next 3 years.

- Analysts assume that profit margins will shrink from 12.5% today to 7.5% in 3 years time.

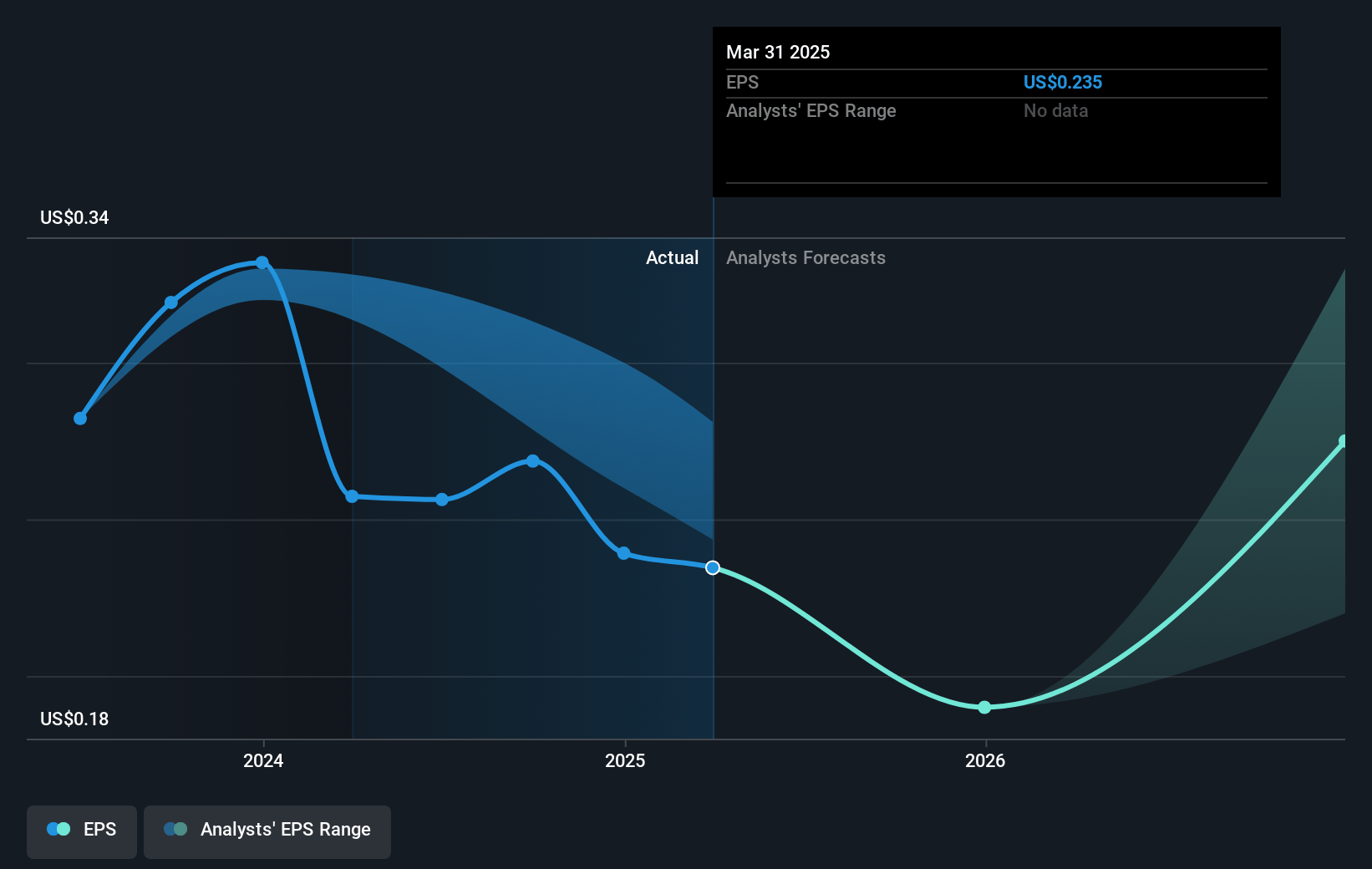

- Analysts expect earnings to reach $4.7 million (and earnings per share of $0.43) by about January 2028, down from $6.5 million today. The analysts are largely in agreement about this estimate.

- In order for the above numbers to justify the analysts price target, the company would need to trade at a PE ratio of 42.4x on those 2028 earnings, down from 44.4x today. This future PE is greater than the current PE for the US Water Utilities industry at 20.3x.

- Analysts expect the number of shares outstanding to decline by 23.36% per year for the next 3 years.

- To value all of this in today's terms, we will use a discount rate of 5.92%, as per the Simply Wall St company report.

Global Water Resources Future Earnings Per Share Growth

Risks

What could happen that would invalidate this narrative?- The decrease in total revenue by 1.5% compared to the previous year due to non-recurring ICFA revenue could impact future revenue consistency if such non-recurring items are not offset by organic growth or other revenue streams.

- High inflation and other cost drivers have caught up with the company, impacting earnings growth, which could continue to pressure net margins if costs rise faster than rate increases.

- Regulatory uncertainties, such as the outcome of pending rate cases and acquisition approvals, might affect future earnings unpredictability and cash flow if unfavorable decisions are made by the Arizona Corporation Commission.

- The reliance on expanding service areas in relatively less developed regions could lead to overestimation of growth potential, which may unexpectedly limit revenue growth and return on investment if these areas do not develop as projected.

- Economic factors such as affordability and availability of housing and power supply constraints could limit growth prospects in key service regions, impacting potential new service connections and future revenue streams.

Valuation

How have all the factors above been brought together to estimate a fair value?- The analysts have a consensus price target of $16.8 for Global Water Resources based on their expectations of its future earnings growth, profit margins and other risk factors.

- In order for you to agree with the analyst's consensus, you'd need to believe that by 2028, revenues will be $62.4 million, earnings will come to $4.7 million, and it would be trading on a PE ratio of 42.4x, assuming you use a discount rate of 5.9%.

- Given the current share price of $11.9, the analyst's price target of $16.8 is 29.2% higher.

- We always encourage you to reach your own conclusions though. So sense check these analyst numbers against your own assumptions and expectations based on your understanding of the business and what you believe is probable.

How well do narratives help inform your perspective?

Disclaimer

Warren A.I. is a tool utilizing a Large Language Model (LLM) that ingests data on consensus price targets, forecasted revenue and earnings figures, as well as the transcripts of earnings calls to produce qualitative analysis. The narratives produced by Warren A.I. are general in nature and are based solely on analyst data and publicly-available material published by the respective companies. These scenarios are not indicative of the company's future performance and are exploratory in nature. Simply Wall St has no position in the company(s) mentioned. The price targets and estimates used are consensus data, and do not constitute a recommendation to buy or sell any stock, and they do not take account of your objectives, or your financial situation. Note that Warren A.I.'s analysis may not factor in the latest price-sensitive company announcements or qualitative material.

Read more narratives

There are no other narratives for this company.

View all narratives