Key Takeaways

- Accelerating population, industrial investment, and tightening regulations in Arizona could amplify service growth, pricing power, and open high-margin opportunities for Global Water Resources.

- Unique consolidation advantages and strong liquidity position the company to rapidly scale, capture synergies, and achieve superior long-term profitability versus peers.

- Slowing housing growth, rising costs, regulatory hurdles, and geographic concentration threaten long-term profitability and increase operational risk exposure.

Catalysts

About Global Water Resources- A water resource management company, owns, operates, and manages regulated water, wastewater, and recycled water systems in metropolitan Phoenix and Tucson, Arizona.

- Analyst consensus expects Arizona population and industrial expansion to drive stable growth, but the scale of committed capital – including TSMC's planned $165 billion direct investment and record-breaking multifamily development – has no historical precedent and could accelerate both service connection and consumption growth far beyond current forecasts, significantly boosting future revenue and long-term earnings.

- Analysts broadly agree that recent and pending rate cases will improve top-line growth and margins, but they may underestimate the company's ability to secure even larger, more regular rate hikes as water scarcity and drought pressures intensify, driving increased regulatory and public willingness to reward efficient, resilient utilities with premium pricing power, which could unlock structurally higher net margins.

- The company's "Total Water Management" platform positions it to benefit disproportionately as emerging regulations push municipal and commercial users to adopt advanced water reuse and recycling solutions, opening new lines of high-margin services and expanding wallet share per customer, resulting in higher recurring revenue and long-term margin expansion.

- Substantial, underappreciated upside exists in the company's unique ability to fast-track consolidation of distressed or noncompliant small utilities across Arizona, where tightening standards and capital requirements will force sales, allowing Global Water to scale rapidly through accretive tuck-in M&A and unlock both cost and revenue synergies that drive outsized growth in earnings per share.

- The company's large and flexible liquidity profile-over $50 million in cash and available credit-combined with proven success in deploying advanced digital metering, poises it to capture share and operational advantages as massive infrastructure investment flows to the Southwest, fueling both organic and inorganic growth well ahead of industry averages and accelerating overall return on invested capital.

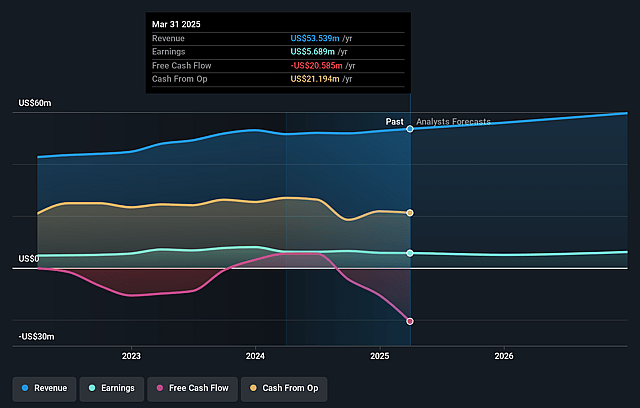

Global Water Resources Future Earnings and Revenue Growth

Assumptions

How have these above catalysts been quantified?- This narrative explores a more optimistic perspective on Global Water Resources compared to the consensus, based on a Fair Value that aligns with the bullish cohort of analysts.

- The bullish analysts are assuming Global Water Resources's revenue will grow by 7.1% annually over the next 3 years.

- The bullish analysts assume that profit margins will shrink from 10.6% today to 10.0% in 3 years time.

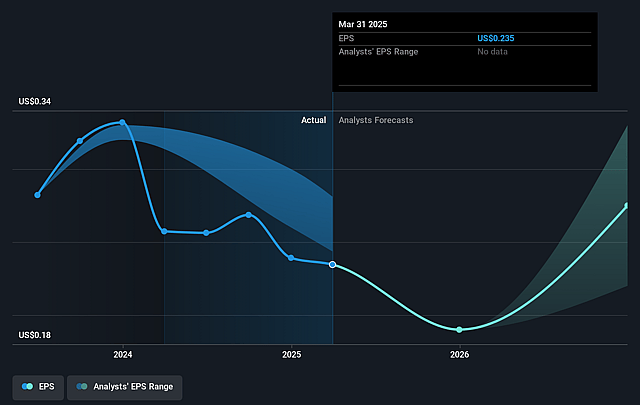

- The bullish analysts expect earnings to reach $6.6 million (and earnings per share of $0.39) by about July 2028, up from $5.7 million today. The analysts are largely in agreement about this estimate.

- In order for the above numbers to justify the price target of the more bullish analyst cohort, the company would need to trade at a PE ratio of 108.8x on those 2028 earnings, up from 49.5x today. This future PE is greater than the current PE for the US Water Utilities industry at 22.6x.

- Analysts expect the number of shares outstanding to grow by 7.0% per year for the next 3 years.

- To value all of this in today's terms, we will use a discount rate of 6.4%, as per the Simply Wall St company report.

Global Water Resources Future Earnings Per Share Growth

Risks

What could happen that would invalidate this narrative?- Declining building permits in both the Phoenix Greater Metropolitan Area and Maricopa, with 15 percent and over 40 percent year-over-year drops respectively in the first quarter, suggest a risk of slowing new customer additions which could limit long-term revenue growth.

- Rising operating expenses, including increased depreciation from capital investments and higher O&M costs attributable to power, chemicals, and repairs, create sustained pressure on net margins and may erode profitability unless offset by rate increases or demand growth.

- Heavy reliance on regulatory approvals for rate increases poses a risk; any adverse rulings by the Arizona Corporation Commission or regulatory pushback could cap allowable revenues and restrict earnings visibility.

- Ongoing capital expenditure requirements due to infrastructure improvements and acquisition activities, coupled with rising interest rates, may elevate debt servicing and depreciation costs, reducing the company's ability to expand net income over time.

- The company's focus on Arizona makes it susceptible to long-term demographic or economic shifts in the region, and exacerbates exposure to climate-induced water scarcity and regulatory costs, all of which could negatively impact both revenues and operating margins.

Valuation

How have all the factors above been brought together to estimate a fair value?- The assumed bullish price target for Global Water Resources is $18.0, which is the highest price target estimate amongst analysts. This valuation is based on what can be assumed as the expectations of Global Water Resources's future earnings growth, profit margins and other risk factors from analysts on the bullish end of the spectrum.

- However, there is a degree of disagreement amongst analysts, with the most bullish reporting a price target of $18.0, and the most bearish reporting a price target of just $13.0.

- In order for you to agree with the bullish analysts, you'd need to believe that by 2028, revenues will be $65.8 million, earnings will come to $6.6 million, and it would be trading on a PE ratio of 108.8x, assuming you use a discount rate of 6.4%.

- Given the current share price of $10.25, the bullish analyst price target of $18.0 is 43.1% higher.

- We always encourage you to reach your own conclusions though. So sense check these analyst numbers against your own assumptions and expectations based on your understanding of the business and what you believe is probable.

How well do narratives help inform your perspective?

Disclaimer

AnalystHighTarget is a tool utilizing a Large Language Model (LLM) that ingests data on consensus price targets, forecasted revenue and earnings figures, as well as the transcripts of earnings calls to produce qualitative analysis. The narratives produced by AnalystHighTarget are general in nature and are based solely on analyst data and publicly-available material published by the respective companies. These scenarios are not indicative of the company's future performance and are exploratory in nature. Simply Wall St has no position in the company(s) mentioned. Simply Wall St may provide the securities issuer or related entities with website advertising services for a fee, on an arm's length basis. These relationships have no impact on the way we conduct our business, the content we host, or how our content is served to users. The price targets and estimates used are consensus data, and do not constitute a recommendation to buy or sell any stock, and they do not take account of your objectives, or your financial situation. Note that AnalystHighTarget's analysis may not factor in the latest price-sensitive company announcements or qualitative material.