Key Takeaways

- Optimizing linehaul operations and fleet investments is expected to improve margins and reduce transportation costs.

- Expanding service centers and strategic pricing strategies position XPO for market share gains and revenue growth.

- Company faces revenue declines and market risks due to fluctuating diesel prices and macroeconomic challenges, potentially impacting earnings and growth without effective cost-saving measures.

Catalysts

About XPO- Provides freight transportation services in the United States, North America, France, the United Kingdom, and rest of Europe.

- XPO is significantly optimizing its linehaul operations by reducing outsourced miles, with plans to bring outsourced miles to single digits by 2025, potentially improving net margins due to reduced transportation costs.

- The company continues to integrate and utilize 25 new service centers, giving XPO a competitive advantage in customer service capacity, which should positively impact revenue through market share gains and above-market yield growth.

- XPO has made strategic investments in its fleet, resulting in a younger average fleet age of 4.1 years, lowering operating costs per mile, which should contribute to improved net margins.

- The ongoing strategic alignment of service pricing with value and the development of premium services are expected to drive above-market yield growth, enhancing revenue and margin performance.

- With nearly 30% excess door capacity, XPO is positioned to capitalize on a freight market up-cycle, which could significantly boost operating leverage and drive earnings growth.

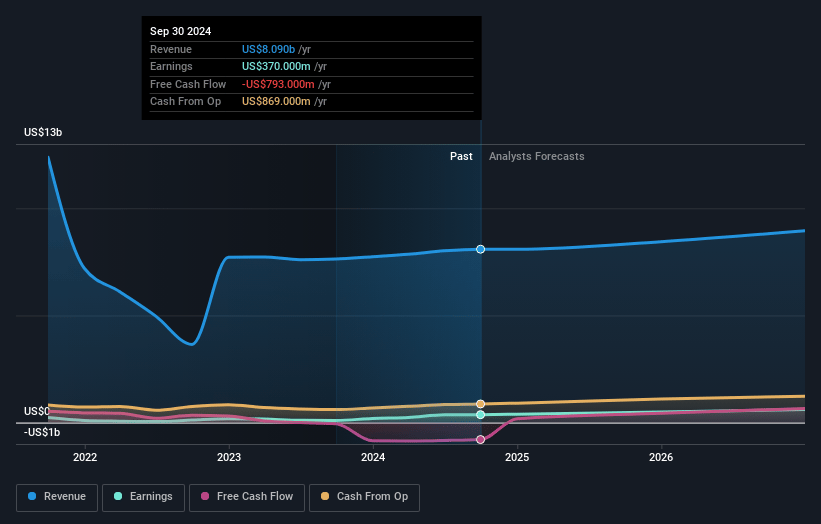

XPO Future Earnings and Revenue Growth

Assumptions

How have these above catalysts been quantified?- This narrative explores a more pessimistic perspective on XPO compared to the consensus, based on a Fair Value that aligns with the bearish cohort of analysts.

- The bearish analysts are assuming XPO's revenue will decrease by 0.6% annually over the next 3 years.

- The bearish analysts assume that profit margins will increase from 4.8% today to 5.9% in 3 years time.

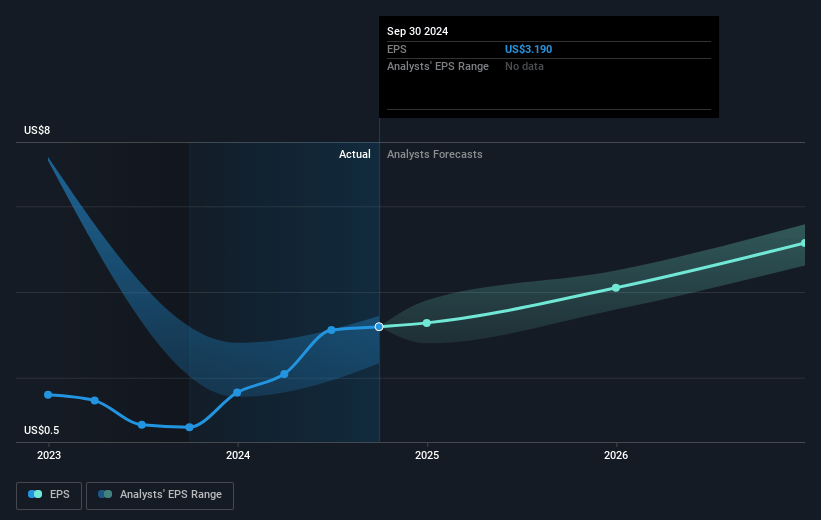

- The bearish analysts expect earnings to reach $484.0 million (and earnings per share of $4.14) by about April 2028, up from $387.0 million today. The analysts are largely in agreement about this estimate.

- In order for the above numbers to justify the price target of the more bearish analyst cohort, the company would need to trade at a PE ratio of 33.6x on those 2028 earnings, up from 30.4x today. This future PE is greater than the current PE for the US Transportation industry at 24.4x.

- Analysts expect the number of shares outstanding to grow by 0.78% per year for the next 3 years.

- To value all of this in today's terms, we will use a discount rate of 7.93%, as per the Simply Wall St company report.

XPO Future Earnings Per Share Growth

Risks

What could happen that would invalidate this narrative?- The company experienced a 3% year-over-year decline in LTL segment revenue, influenced by a 23% decline in fuel surcharge revenue due to diesel price fluctuations, which affected total revenue.

- Shipments per day decreased by 4.4% and weight per shipment decreased by 1.3% year-over-year, which led to a 5.7% drop in tonnage per day, potentially impacting overall earnings stability.

- European operations have been facing a softer macro environment, especially in France, despite outperformance, indicating potential vulnerabilities in global revenue streams.

- The company's expectation of flattish tonnage for 2025 suggests limited growth, which could impact net margins if cost savings or revenue enhancements are not effectively realized.

- The anticipation of a flattish tonnage environment and reliance on external conditions like an upturn in the freight cycle for significant gains present notable execution and market risks, potentially affecting earnings outlook.

Valuation

How have all the factors above been brought together to estimate a fair value?- The assumed bearish price target for XPO is $107.71, which represents one standard deviation below the consensus price target of $128.0. This valuation is based on what can be assumed as the expectations of XPO's future earnings growth, profit margins and other risk factors from analysts on the more bearish end of the spectrum.

- However, there is a degree of disagreement amongst analysts, with the most bullish reporting a price target of $165.0, and the most bearish reporting a price target of just $85.0.

- In order for you to agree with the bearish analysts, you'd need to believe that by 2028, revenues will be $8.2 billion, earnings will come to $484.0 million, and it would be trading on a PE ratio of 33.6x, assuming you use a discount rate of 7.9%.

- Given the current share price of $99.96, the bearish analyst price target of $107.71 is 7.2% higher. The relatively low difference between the current share price and the analyst bearish price target indicates that they believe on average, the company is fairly priced.

- We always encourage you to reach your own conclusions though. So sense check these analyst numbers against your own assumptions and expectations based on your understanding of the business and what you believe is probable.

How well do narratives help inform your perspective?

Disclaimer

AnalystLowTarget is an employee of Simply Wall St, but has written this narrative in their capacity as an individual investor. AnalystLowTarget holds no position in NYSE:XPO. Simply Wall St has no position in the company(s) mentioned. Simply Wall St may provide the securities issuer or related entities with website advertising services for a fee, on an arm's length basis. These relationships have no impact on the way we conduct our business, the content we host, or how our content is served to users. This narrative is general in nature and explores scenarios and estimates created by the author. The narrative does not reflect the opinions of Simply Wall St, and the views expressed are the opinion of the author alone, acting on their own behalf. These scenarios are not indicative of the company's future performance and are exploratory in the ideas they cover. The fair value estimate's are estimations only, and does not constitute a recommendation to buy or sell any stock, and they do not take account of your objectives, or your financial situation. Note that the author's analysis may not factor in the latest price-sensitive company announcements or qualitative material.

Read more narratives