Key Takeaways

- Expansion into less-than-truckload and asset-based logistics, along with strategic M&A, reduces earnings volatility and strengthens the company’s competitive position.

- Advanced technology deployment and integration synergies are driving cost efficiencies, productivity gains, and improved margins, supporting sustained revenue and earnings growth.

- Aggressive expansion, market headwinds, rising costs, tech disruption, and decarbonization investments threaten margins and challenge Knight-Swift's earnings outlook.

Catalysts

About Knight-Swift Transportation Holdings- Provides freight transportation services in the United States and Mexico.

- The rapid expansion and integration of Knight-Swift’s less-than-truckload (LTL) network in key regions such as California and the Southwest positions the company to capture share as US domestic freight volumes increase due to reshoring and nearshoring of manufacturing. This strategic growth will drive higher shipment counts, better network optimization, and operating leverage, translating into rising revenue and expanding net margins as fixed costs are absorbed.

- The company’s deployment of advanced technology—improving routing, asset utilization, and variable cost control—puts it ahead of industry peers, especially as e-commerce growth demands more flexible, efficient, and reliable trucking and logistics solutions. These investments are expected to lead to higher asset productivity, lower operating costs per mile, and ultimately stronger EBITDA margins and earnings growth through the cycle.

- Tightening trucking fundamentals and indications of a pricing upcycle, combined with Knight-Swift’s contract exposure and focus on price discipline, create an environment where the company can exercise pricing power as demand increases faster than supply. This dynamic, supported by heightened supply chain resilience and inventory management trends among shippers, is likely to lead to significant revenue growth and improvement in operating ratios.

- The expansion of the company’s diversification beyond traditional truckload into asset-based logistics, LTL, and intermodal—supported by strategic M&A—is set to reduce earnings cyclicality, increase cross-selling opportunities, and improve customer relationships. As shippers consolidate spend with comprehensive providers, Knight-Swift’s broader service offering should support more consistent revenue and margin expansion over time.

- Accelerated cost-savings and synergy realization from the integration of acquisitions like DHE and U.S. Xpress—and the move to consolidate purchasing, reduce overhead, and use standardized technology—are already leading to marked improvements in utilization and operating costs. As these efficiencies are fully realized and pricing rebounds, Knight-Swift is poised for rapid earnings growth and a return to historically strong operating margins, underpinning the bullish case for future free cash flow and EPS expansion.

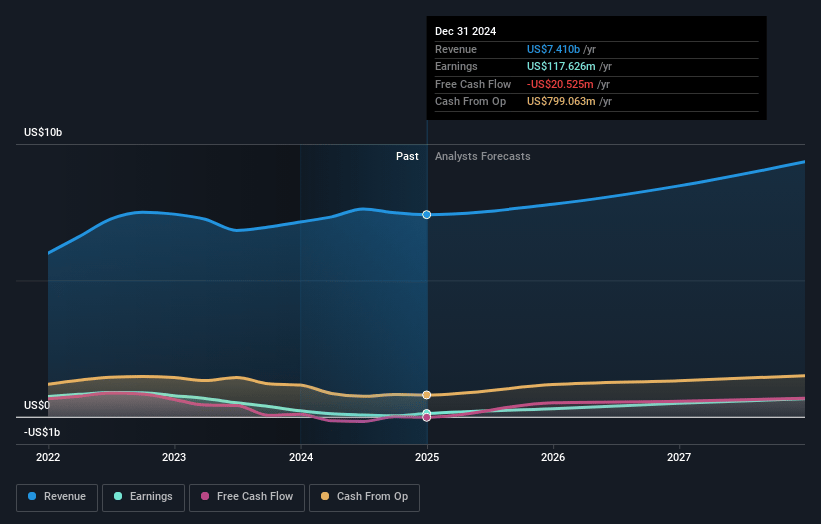

Knight-Swift Transportation Holdings Future Earnings and Revenue Growth

Assumptions

How have these above catalysts been quantified?- This narrative explores a more optimistic perspective on Knight-Swift Transportation Holdings compared to the consensus, based on a Fair Value that aligns with the bullish cohort of analysts.

- The bullish analysts are assuming Knight-Swift Transportation Holdings's revenue will grow by 9.8% annually over the next 3 years.

- The bullish analysts assume that profit margins will increase from 1.6% today to 6.8% in 3 years time.

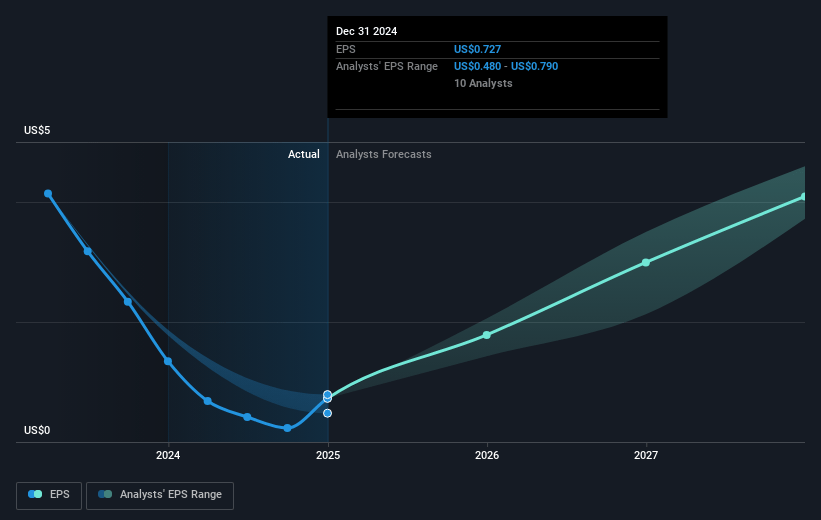

- The bullish analysts expect earnings to reach $670.7 million (and earnings per share of $4.1) by about April 2028, up from $117.6 million today. The analysts are largely in agreement about this estimate.

- In order for the above numbers to justify the price target of the more bullish analyst cohort, the company would need to trade at a PE ratio of 21.0x on those 2028 earnings, down from 53.8x today. This future PE is lower than the current PE for the US Transportation industry at 24.4x.

- Analysts expect the number of shares outstanding to grow by 0.23% per year for the next 3 years.

- To value all of this in today's terms, we will use a discount rate of 8.29%, as per the Simply Wall St company report.

Knight-Swift Transportation Holdings Future Earnings Per Share Growth

Risks

What could happen that would invalidate this narrative?- Integration risks and higher-than-expected costs tied to the aggressive expansion in the LTL segment, particularly with the DHE acquisition and rapid network buildout, have already resulted in significant margin drag and declining operating income in the near term, with potential for these challenges to continue to weigh on earnings if execution falters.

- Heavy exposure to the cyclical US truckload market, which remains highly commoditized and subject to economic downturns and freight rate declines, exposes Knight-Swift to ongoing revenue volatility and net margin pressure, especially if normalization does not occur as quickly as management anticipates.

- Industry-wide driver shortages and persistent wage inflation are highlighted as continual cost challenges that may erode operational efficiency and reduce net margins, especially if Knight-Swift cannot continue to offset these pressures through cost-cutting and productivity gains.

- The growing presence of technology-driven, asset-light freight brokerage competitors threatens pricing power for traditional truckload carriers like Knight-Swift; this could lead to long-term margin erosion and diminished revenue growth as shippers increasingly seek lower-cost or more flexible solutions.

- The accelerating shift toward decarbonization and tighter environmental regulations for fleets will likely require substantial capital investment for Knight-Swift as it transitions its large diesel fleet to lower emissions alternatives, raising capital expenditures and reducing free cash flow and profit margins in the future.

Valuation

How have all the factors above been brought together to estimate a fair value?- The assumed bullish price target for Knight-Swift Transportation Holdings is $67.93, which represents two standard deviations above the consensus price target of $53.61. This valuation is based on what can be assumed as the expectations of Knight-Swift Transportation Holdings's future earnings growth, profit margins and other risk factors from analysts on the bullish end of the spectrum.

- However, there is a degree of disagreement amongst analysts, with the most bullish reporting a price target of $68.0, and the most bearish reporting a price target of just $42.0.

- In order for you to agree with the bullish analysts, you'd need to believe that by 2028, revenues will be $9.8 billion, earnings will come to $670.7 million, and it would be trading on a PE ratio of 21.0x, assuming you use a discount rate of 8.3%.

- Given the current share price of $39.03, the bullish analyst price target of $67.93 is 42.5% higher.

- We always encourage you to reach your own conclusions though. So sense check these analyst numbers against your own assumptions and expectations based on your understanding of the business and what you believe is probable.

How well do narratives help inform your perspective?

Disclaimer

AnalystHighTarget is an employee of Simply Wall St, but has written this narrative in their capacity as an individual investor. AnalystHighTarget holds no position in NYSE:KNX. Simply Wall St has no position in the company(s) mentioned. Simply Wall St may provide the securities issuer or related entities with website advertising services for a fee, on an arm's length basis. These relationships have no impact on the way we conduct our business, the content we host, or how our content is served to users. This narrative is general in nature and explores scenarios and estimates created by the author. The narrative does not reflect the opinions of Simply Wall St, and the views expressed are the opinion of the author alone, acting on their own behalf. These scenarios are not indicative of the company's future performance and are exploratory in the ideas they cover. The fair value estimate's are estimations only, and does not constitute a recommendation to buy or sell any stock, and they do not take account of your objectives, or your financial situation. Note that the author's analysis may not factor in the latest price-sensitive company announcements or qualitative material.