Narratives are currently in beta

Key Takeaways

- Fleet renewal and financial strategies are set to enhance earnings potential and increase cash distributions, improving investor appeal.

- Favorable market dynamics and strong TCE performance position Genco for increased revenue and earnings growth in upcoming cycles.

- Volatile freight rates, trade disruptions, and global economic uncertainties could challenge Genco's revenue stability, growth, and operational margins.

Catalysts

About Genco Shipping & Trading- Engages in the ocean transportation of drybulk cargoes worldwide.

- The acquisition of high-quality, fuel-efficient Capesize vessels and the exit from older vessels are part of Genco's fleet renewal strategy, projected to enhance earnings potential due to premium assets and $13 million in dry dock CapEx savings through 2025. (Earnings, Net Margins)

- Genco's enhanced dividend policy, removing the drydocking CapEx from calculations, aims to significantly increase cash distributions to shareholders, thus possibly attracting more investors and supporting share price valuation. (Earnings, Shareholder Returns)

- The company’s goal to achieve net debt 0, with over $330 million in undrawn revolver availability, provides financial flexibility and positions Genco to capitalize on accretive growth opportunities. This strategy may lead to improved earnings through strategic fleet expansions. (Earnings, Financial Flexibility)

- Strong TCE performance and the expectation for firm freight rates with 65% of Q4 days fixed at $18,786 per day suggests potential for continued revenue growth, outpacing cash flow breakeven rates. (Revenue, Net Income)

- Anticipated long-haul ton-mile trade growth from projects like the Simandou iron ore initiative in West Africa, coupled with low fleet supply growth, creates a favorable supply-demand dynamic for drybulk, positioning Genco for increased earnings in upcoming drybulk cycles. (Revenue, Earnings)

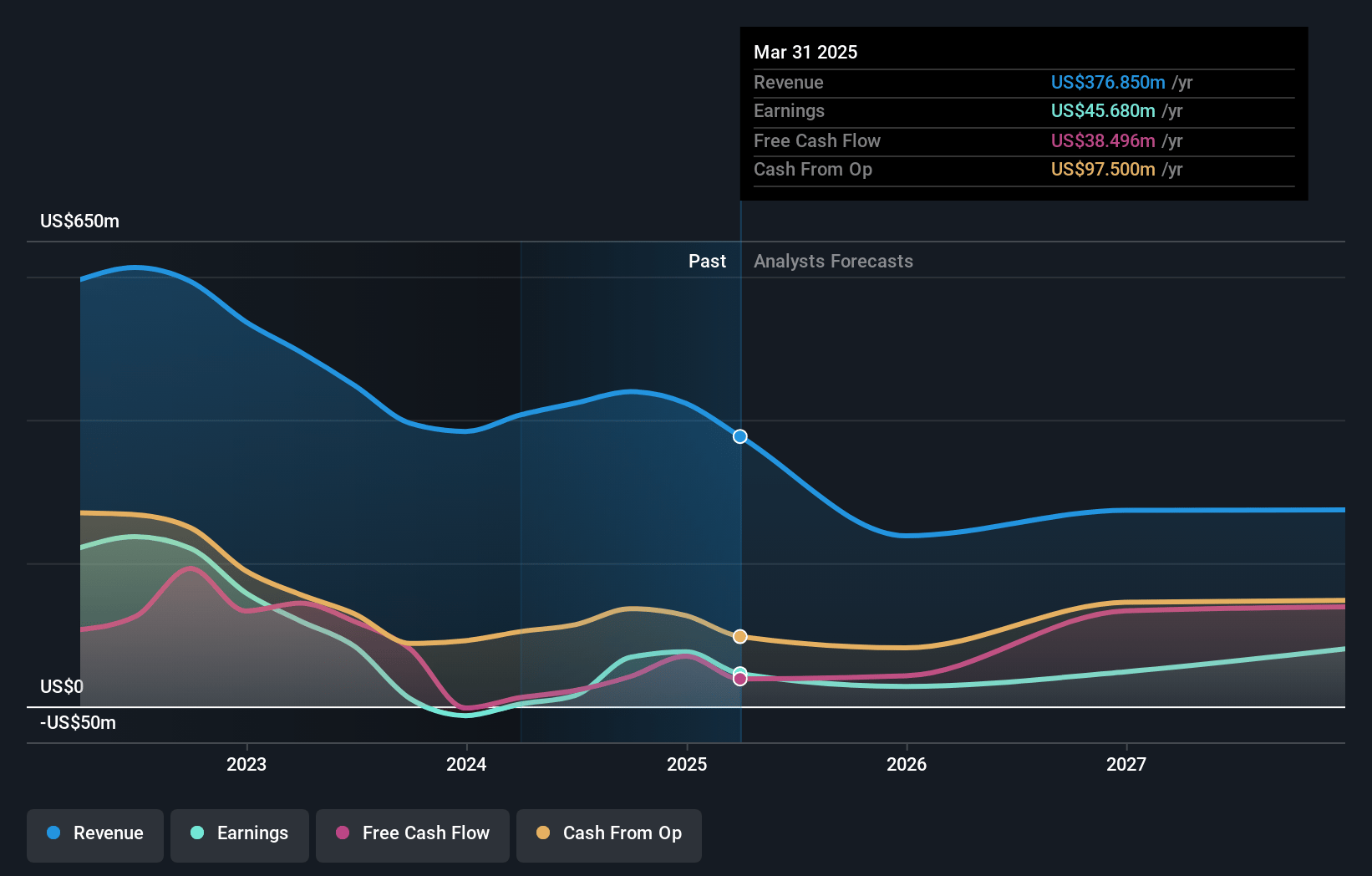

Genco Shipping & Trading Future Earnings and Revenue Growth

Assumptions

How have these above catalysts been quantified?- Analysts are assuming Genco Shipping & Trading's revenue will decrease by -17.5% annually over the next 3 years.

- Analysts assume that profit margins will increase from 15.6% today to 29.9% in 3 years time.

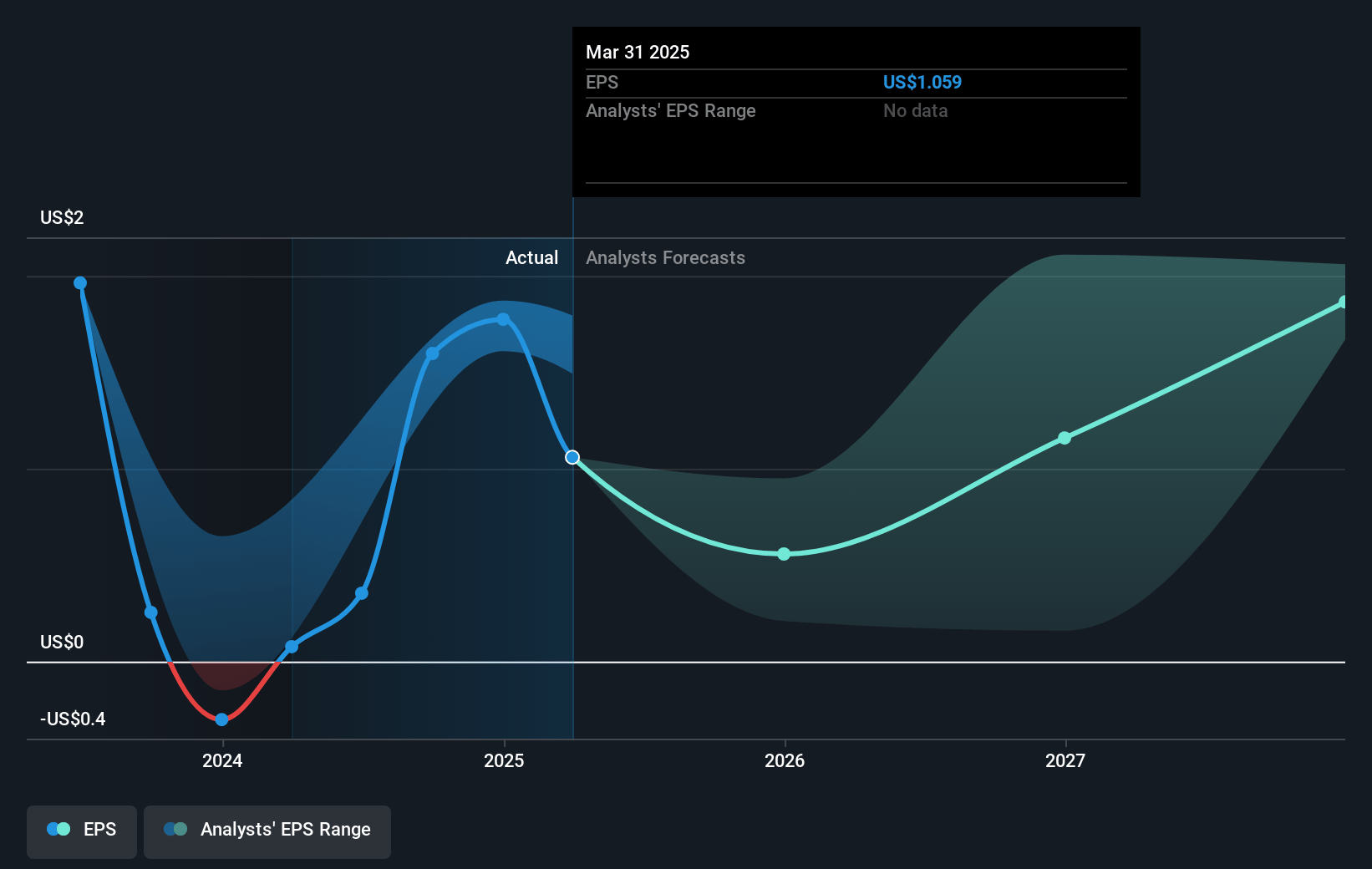

- Analysts expect earnings to reach $74.0 million (and earnings per share of $1.94) by about January 2028, up from $68.7 million today. However, there is a considerable amount of disagreement amongst the analysts with the most bullish expecting $126.1 million in earnings, and the most bearish expecting $13 million.

- In order for the above numbers to justify the analysts price target, the company would need to trade at a PE ratio of 14.5x on those 2028 earnings, up from 8.7x today. This future PE is greater than the current PE for the US Shipping industry at 4.0x.

- Analysts expect the number of shares outstanding to decline by 3.8% per year for the next 3 years.

- To value all of this in today's terms, we will use a discount rate of 6.48%, as per the Simply Wall St company report.

Genco Shipping & Trading Future Earnings Per Share Growth

Risks

What could happen that would invalidate this narrative?- The recent pullback in freight rates due to concerns about China's economic stimulus and customs-related bauxite issues in West Africa highlights the volatility and cyclicality of the drybulk shipping market, which could impact Genco's future revenue stability.

- The potential impact of global trade disruptions related to geopolitical tensions, such as tariffs from the incoming Trump administration, could lead to unintended trade inefficiencies, affecting Genco's ton-mile growth and ultimately its revenue and earnings.

- Although China's fiscal policies aim to support its economy, continued issues in the property sector could dampen China's domestic steel demand, impacting global steel production and Genco’s revenue as exports need to compensate for domestic shortfalls.

- The volatility in commodity exports, such as the bauxite disruptions that led to force majeure declarations, underscores the risk of fluctuating demand and rates, which might affect Genco's revenue growth and operational stability.

- While Genco aims for net debt 0 to maintain financial flexibility, unforeseen macroeconomic conditions, such as a prolonged high interest rate environment, could affect the cost of capital and impact net margins and future earnings.

Valuation

How have all the factors above been brought together to estimate a fair value?- The analysts have a consensus price target of $23.37 for Genco Shipping & Trading based on their expectations of its future earnings growth, profit margins and other risk factors. However, there is a degree of disagreement amongst analysts, with the most bullish reporting a price target of $30.0, and the most bearish reporting a price target of just $17.6.

- In order for you to agree with the analyst's consensus, you'd need to believe that by 2028, revenues will be $247.1 million, earnings will come to $74.0 million, and it would be trading on a PE ratio of 14.5x, assuming you use a discount rate of 6.5%.

- Given the current share price of $14.02, the analyst's price target of $23.37 is 40.0% higher.

- We always encourage you to reach your own conclusions though. So sense check these analyst numbers against your own assumptions and expectations based on your understanding of the business and what you believe is probable.

How well do narratives help inform your perspective?

Disclaimer

Warren A.I. is a tool utilizing a Large Language Model (LLM) that ingests data on consensus price targets, forecasted revenue and earnings figures, as well as the transcripts of earnings calls to produce qualitative analysis. The narratives produced by Warren A.I. are general in nature and are based solely on analyst data and publicly-available material published by the respective companies. These scenarios are not indicative of the company's future performance and are exploratory in nature. Simply Wall St has no position in the company(s) mentioned. The price targets and estimates used are consensus data, and do not constitute a recommendation to buy or sell any stock, and they do not take account of your objectives, or your financial situation. Note that Warren A.I.'s analysis may not factor in the latest price-sensitive company announcements or qualitative material.

Read more narratives

There are no other narratives for this company.

View all narratives