Narratives are currently in beta

Key Takeaways

- Strong charter backlog and newbuildings secure predictable revenue streams, mitigating market volatility and ensuring steady cash flow for future earnings growth.

- Enhanced balance sheet strength and shareholder returns through credit upgrades, share buybacks, and dividend increases boost financial flexibility and future profit potential.

- Potential trade tariffs, environmental legislation uncertainty, and increased costs could squeeze margins and limit Danaos' revenue growth and sustainability goals.

Catalysts

About Danaos- Provides container and drybulk vessels services in Australia, Asia, and Europe.

- Danaos has a strong contracted charter backlog that stands at $3.3 billion, providing solid earnings visibility with coverage of fleet operating days reaching 100% for 2024, 94% for 2025, and 73% for 2026. This forward-looking revenue clarity should ensure steady cash inflows and mitigate market volatility risks, positively impacting expected future revenues.

- The company is positioned to benefit from the strength of the container market with 14 newbuildings fixed for long-term charters, which secures predictable and stable future revenue streams and supports earnings growth.

- Danaos' balance sheet strength, highlighted by an upgrade in credit ratings from Moody's and S&P, provides the ability to access competitively priced capital through the U.S. bond market. This financial flexibility will facilitate accessing growth opportunities that could enhance future profits.

- Danaos has implemented a significant share buyback program and increased quarterly dividends, returning value directly to shareholders and potentially enhancing earnings per share (EPS) in the future.

- The company’s low net debt position, with a net debt-to-EBITDA ratio of 0.4x, and a high number of unencumbered vessels delivers an optimal capital structure to capitalize on future market opportunities and manage interest costs effectively.

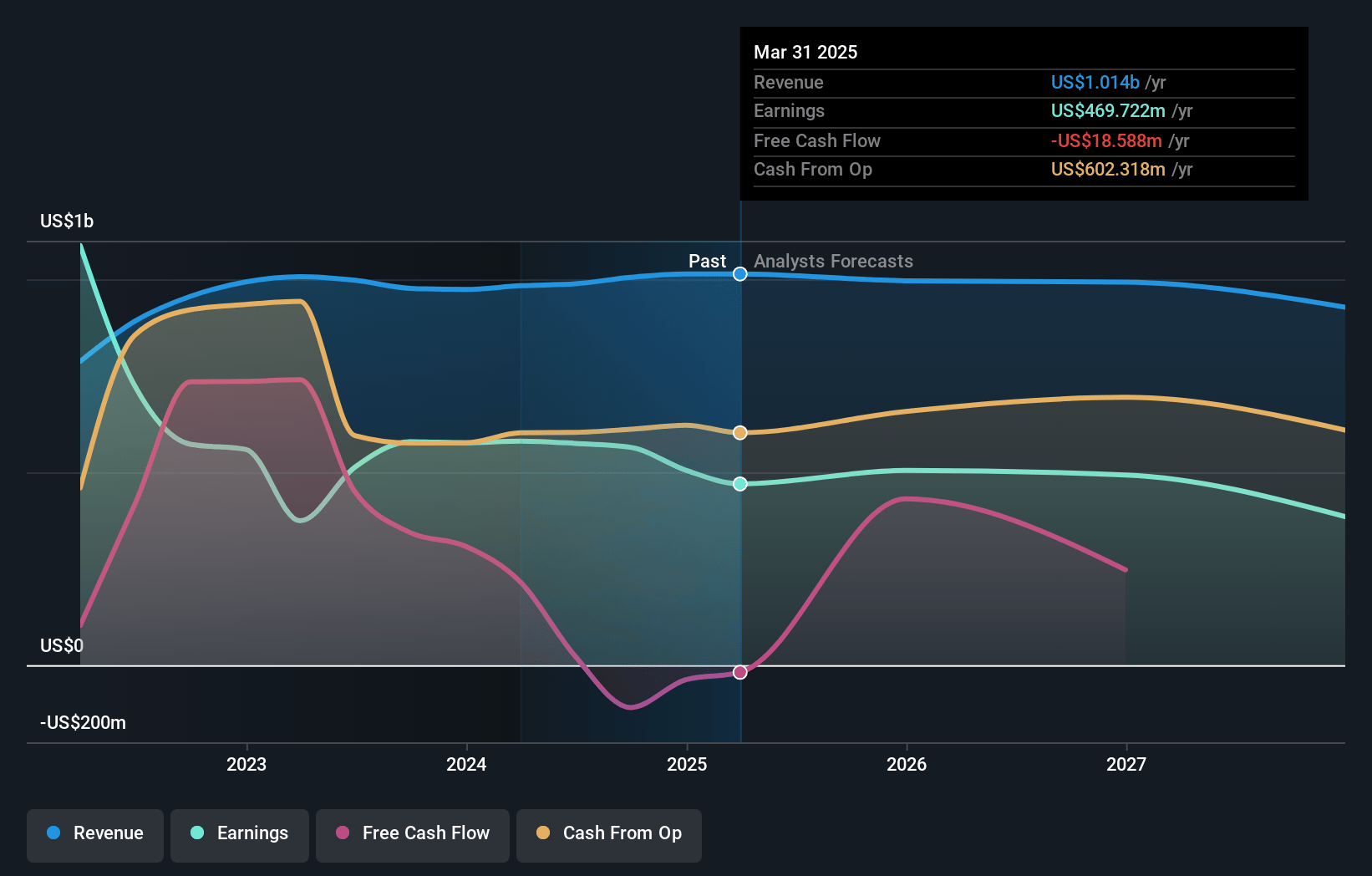

Danaos Future Earnings and Revenue Growth

Assumptions

How have these above catalysts been quantified?- Analysts are assuming Danaos's revenue will grow by 1.6% annually over the next 3 years.

- Analysts assume that profit margins will shrink from 56.2% today to 46.9% in 3 years time.

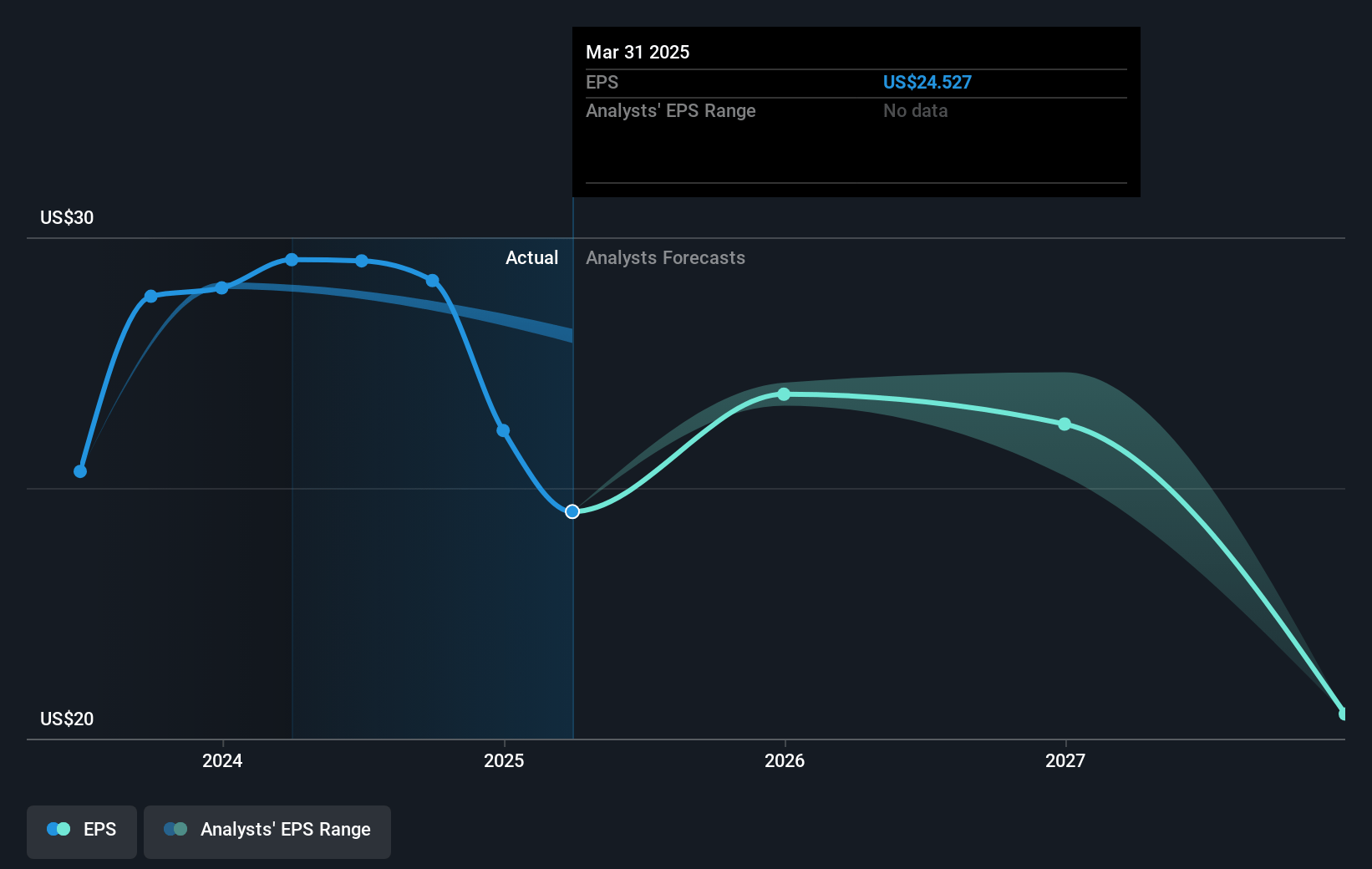

- Analysts expect earnings to reach $494.9 million (and earnings per share of $25.21) by about January 2028, down from $564.6 million today.

- In order for the above numbers to justify the analysts price target, the company would need to trade at a PE ratio of 5.2x on those 2028 earnings, up from 2.6x today. This future PE is greater than the current PE for the US Shipping industry at 3.9x.

- Analysts expect the number of shares outstanding to grow by 0.52% per year for the next 3 years.

- To value all of this in today's terms, we will use a discount rate of 10.31%, as per the Simply Wall St company report.

Danaos Future Earnings Per Share Growth

Risks

What could happen that would invalidate this narrative?- The introduction of potential trade tariffs by the new U.S. administration may decrease container movements, reshuffling trade lanes and negatively affecting future revenue and net margins.

- Uncertainty in future environmental legislation, particularly regarding carbon taxes and levies, combined with the high cost of newbuildings, could impact Danaos’ operational strategy and limit potential earnings growth.

- The possibility of a slowdown in energy transition initiatives under the new U.S. administration may affect Danaos' competitiveness in achieving future sustainability goals, potentially impacting long-term earnings and profitability.

- With a significant increase in operating expenses and interest costs, there is a risk of squeezed net margins, potentially hindering the company's ability to maintain current earnings levels.

- The fluctuating dry bulk market, driven by reduced Chinese steel production and uncertain global trade dynamics, could lead to volatile revenue from this segment and negatively affect overall financial performance.

Valuation

How have all the factors above been brought together to estimate a fair value?- The analysts have a consensus price target of $101.0 for Danaos based on their expectations of its future earnings growth, profit margins and other risk factors.

- In order for you to agree with the analyst's consensus, you'd need to believe that by 2028, revenues will be $1.1 billion, earnings will come to $494.9 million, and it would be trading on a PE ratio of 5.2x, assuming you use a discount rate of 10.3%.

- Given the current share price of $76.71, the analyst's price target of $101.0 is 24.0% higher. Despite analysts expecting the underlying buisness to decline, they seem to believe it's more valuable than what the market thinks.

- We always encourage you to reach your own conclusions though. So sense check these analyst numbers against your own assumptions and expectations based on your understanding of the business and what you believe is probable.

How well do narratives help inform your perspective?

Disclaimer

Warren A.I. is a tool utilizing a Large Language Model (LLM) that ingests data on consensus price targets, forecasted revenue and earnings figures, as well as the transcripts of earnings calls to produce qualitative analysis. The narratives produced by Warren A.I. are general in nature and are based solely on analyst data and publicly-available material published by the respective companies. These scenarios are not indicative of the company's future performance and are exploratory in nature. Simply Wall St has no position in the company(s) mentioned. The price targets and estimates used are consensus data, and do not constitute a recommendation to buy or sell any stock, and they do not take account of your objectives, or your financial situation. Note that Warren A.I.'s analysis may not factor in the latest price-sensitive company announcements or qualitative material.

Read more narratives

There are no other narratives for this company.

View all narratives