Key Takeaways

- Oversupply risk in the containership market may pressure future charter rates, negatively impacting revenue.

- Fleet renewal caution may slow growth, leading to earnings stagnation if market conditions remain unfavorable.

- Costamare's focus on larger vessels and robust leasing and trading activities enhances operational efficiency, revenue potential, and earnings stability amidst a strong financial position.

Catalysts

About Costamare- Owns and operates containerships and dry bulk vessels that are chartered to liner companies providing transportation of cargoes worldwide.

- The ongoing injection of newbuilding capacity in the containership market is a principal threat, potentially leading to oversupply and putting pressure on future charter rates, which could negatively impact future revenue.

- While significant time charter income is contracted for the next few years, the heavy reliance on index-linked agreements could make Costamare vulnerable to market volatility, impacting future net margins.

- The company’s decision to redeem and refinance certain assets, despite their competitive rates, due to tax and legal implications suggests potential challenges in maintaining cost efficiencies, which could impact future earnings.

- Asset prices in both the dry bulk and containership segments are high relative to historical norms. Continued high prices could lead to a slowdown in fleet expansion, limiting revenue growth opportunities.

- The cautious approach to fleet renewal and avoidance of newbuilding commitments indicate a potential slowdown in growth, which might lead to stagnation in earnings if market conditions don't improve.

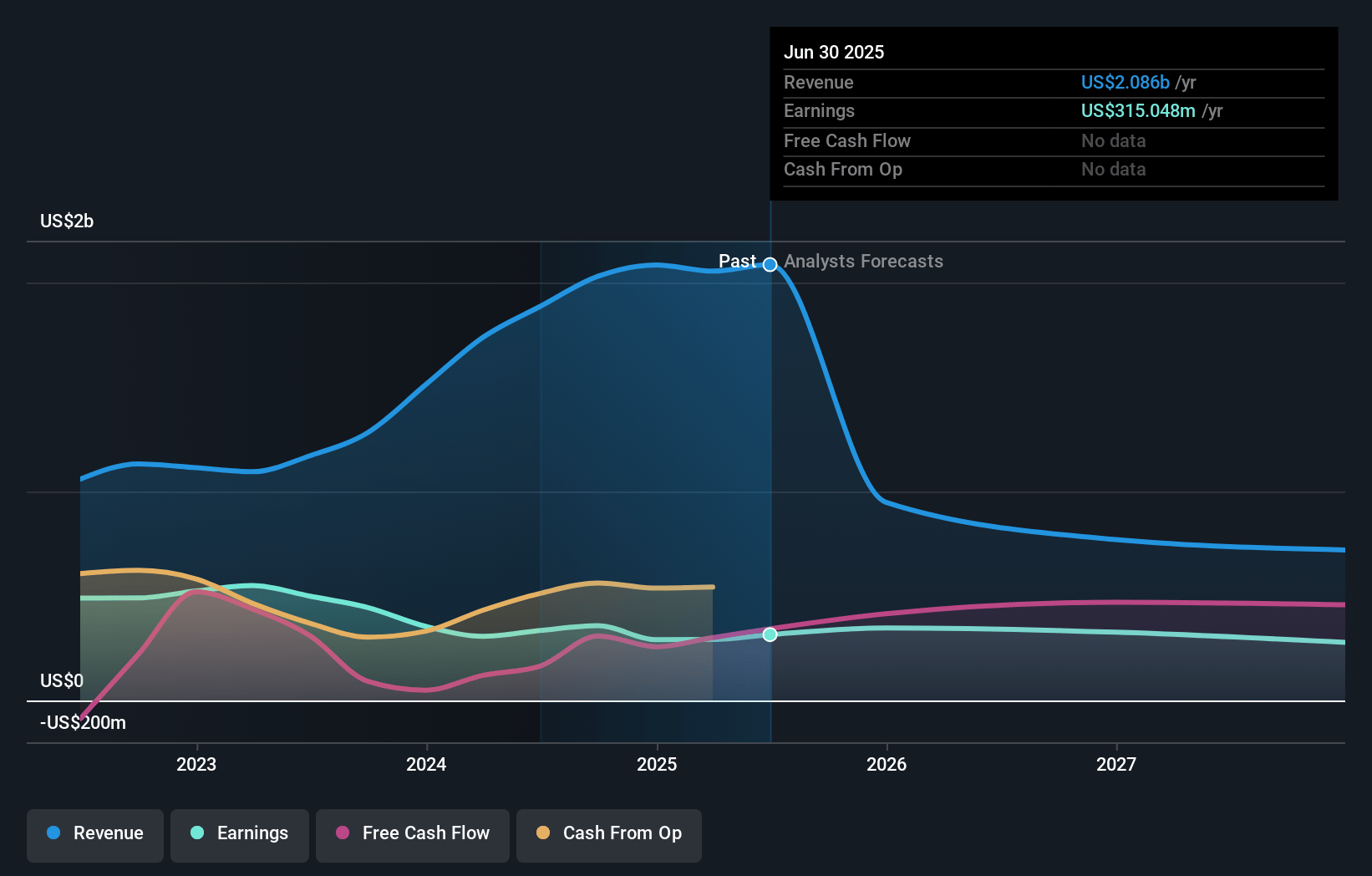

Costamare Future Earnings and Revenue Growth

Assumptions

How have these above catalysts been quantified?- Analysts are assuming Costamare's revenue will decrease by -22.8% annually over the next 3 years.

- Analysts assume that profit margins will increase from 17.6% today to 33.7% in 3 years time.

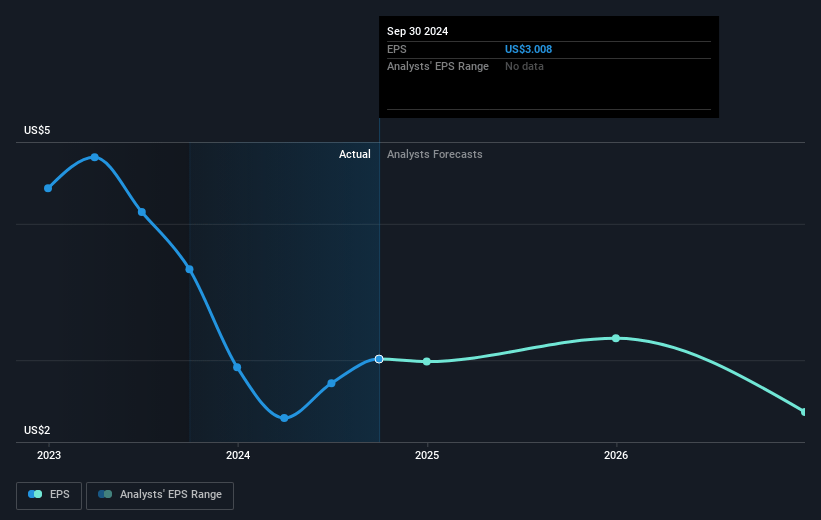

- Analysts expect earnings to reach $315.2 million (and earnings per share of $2.62) by about January 2028, down from $357.5 million today.

- In order for the above numbers to justify the analysts price target, the company would need to trade at a PE ratio of 7.6x on those 2028 earnings, up from 4.3x today. This future PE is greater than the current PE for the US Shipping industry at 4.1x.

- Analysts expect the number of shares outstanding to grow by 0.1% per year for the next 3 years.

- To value all of this in today's terms, we will use a discount rate of 12.77%, as per the Simply Wall St company report.

Costamare Future Earnings Per Share Growth

Risks

What could happen that would invalidate this narrative?- Costamare generated a strong net income of $80 million for the third quarter and maintains a robust liquidity position of over $1 billion, providing a financial cushion and enabling potential growth opportunities which could positively impact future revenue and earnings.

- The company has a high level of fixed contracted revenues amounting to $2.3 billion with significant fleet employment rates of 100% for 2024 and 94% for 2025, ensuring stable revenue streams and mitigating risks associated with market volatility.

- Costamare's strategy of acquiring larger vessels, such as Capesize and Ultramax ships, while disposing of smaller tonnage, could enhance operational efficiencies and profitability, positively impacting net margins.

- The firm's conservative approach to newbuildings and focus on cash flow generation from existing assets shields it from residual value risks associated with potentially overpriced containership assets, aiding in maintaining a healthy balance sheet.

- Neptune Maritime Leasing platform and CBI dry bulk trading and ownership activities are growing robustly, contributing to increased revenue potential and strengthening the company’s diversified asset portfolio, which positively influences earnings stability.

Valuation

How have all the factors above been brought together to estimate a fair value?- The analysts have a consensus price target of $14.0 for Costamare based on their expectations of its future earnings growth, profit margins and other risk factors.

- In order for you to agree with the analyst's consensus, you'd need to believe that by 2028, revenues will be $934.2 million, earnings will come to $315.2 million, and it would be trading on a PE ratio of 7.6x, assuming you use a discount rate of 12.8%.

- Given the current share price of $12.85, the analyst's price target of $14.0 is 8.2% higher. The relatively low difference between the current share price and the analyst consensus price target indicates that they believe on average, the company is fairly priced.

- We always encourage you to reach your own conclusions though. So sense check these analyst numbers against your own assumptions and expectations based on your understanding of the business and what you believe is probable.

How well do narratives help inform your perspective?

Disclaimer

Warren A.I. is a tool utilizing a Large Language Model (LLM) that ingests data on consensus price targets, forecasted revenue and earnings figures, as well as the transcripts of earnings calls to produce qualitative analysis. The narratives produced by Warren A.I. are general in nature and are based solely on analyst data and publicly-available material published by the respective companies. These scenarios are not indicative of the company's future performance and are exploratory in nature. Simply Wall St has no position in the company(s) mentioned. The price targets and estimates used are consensus data, and do not constitute a recommendation to buy or sell any stock, and they do not take account of your objectives, or your financial situation. Note that Warren A.I.'s analysis may not factor in the latest price-sensitive company announcements or qualitative material.

Read more narratives

There are no other narratives for this company.

View all narratives