Key Takeaways

- Increased domestic passenger tariffs and international traffic trends are expected to enhance revenue and operational resilience in Argentina.

- Expansion in infrastructure and strategic real estate deals could boost commercial and non-aeronautical revenue growth.

- Macroeconomic challenges and inflation in Argentina threaten revenue growth, while declining commercial revenues and Aerolíneas Argentinas' issues pose risks to earnings.

Catalysts

About Corporación América Airports- Through its subsidiaries, acquires, develops, and operates airport concessions.

- Recent approval to increase domestic passenger tariffs in Argentina by 124% starting November 1 is expected to boost revenue from local operations, contributing positively to overall revenue growth.

- Expansion plans and enhancements in airport infrastructure, such as the new parking facilities in Uruguay and the enlarged duty-free area at Ezeiza Airport in Argentina, are likely to drive commercial revenue growth.

- The company is actively pursuing real estate opportunities in Brazil with new agreements at Brasilia Airport, which could improve non-aeronautical revenues and margins.

- Ongoing negotiations with the Armenian government regarding CapEx plans indicate potential for extended concession duration, which could support long-term revenue and earnings growth.

- Improving international traffic trends, particularly in Argentina, along with anticipated stabilizing inflation and FX conditions, are expected to support operational resilience and revenue growth.

Corporación América Airports Future Earnings and Revenue Growth

Assumptions

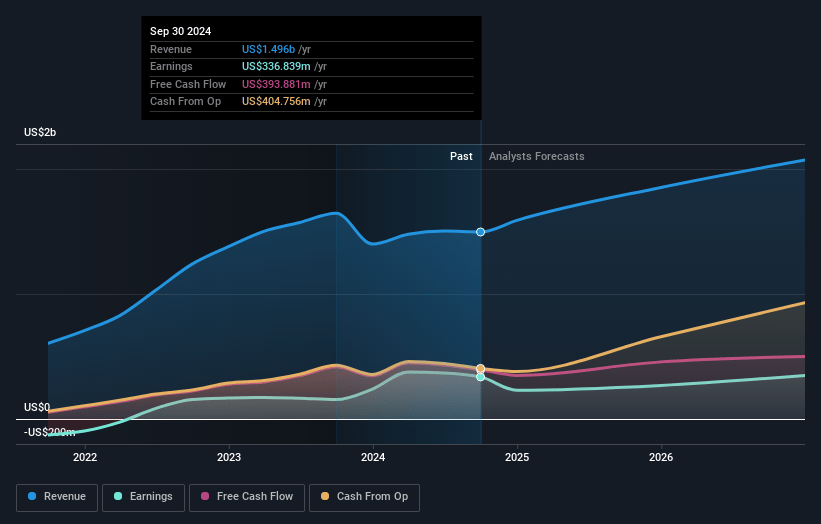

How have these above catalysts been quantified?- Analysts are assuming Corporación América Airports's revenue will grow by 12.2% annually over the next 3 years.

- Analysts assume that profit margins will shrink from 22.5% today to 16.9% in 3 years time.

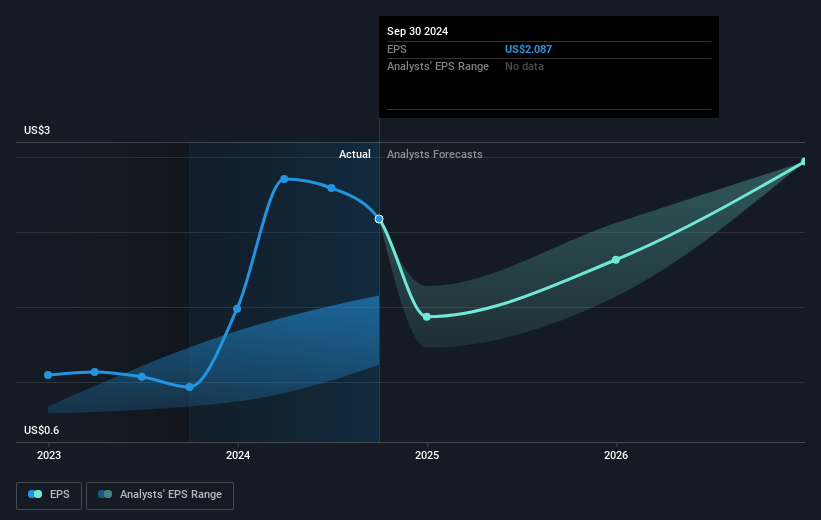

- Analysts expect earnings to reach $357.2 million (and earnings per share of $2.56) by about January 2028, up from $336.8 million today. However, there is a considerable amount of disagreement amongst the analysts with the most bullish expecting $394.8 million in earnings, and the most bearish expecting $303 million.

- In order for the above numbers to justify the analysts price target, the company would need to trade at a PE ratio of 10.8x on those 2028 earnings, up from 9.3x today. This future PE is greater than the current PE for the US Infrastructure industry at 9.3x.

- Analysts expect the number of shares outstanding to decline by 4.68% per year for the next 3 years.

- To value all of this in today's terms, we will use a discount rate of 8.74%, as per the Simply Wall St company report.

Corporación América Airports Future Earnings Per Share Growth

Risks

What could happen that would invalidate this narrative?- The ongoing macroeconomic challenges in Argentina are negatively impacting domestic traffic and increasing operational costs, which could suppress revenue growth and reduce net margins.

- Declining commercial revenues, notably from duty-free sales and cargo, particularly in Argentina, pose a risk to overall earnings if not offset by growth in other areas.

- Although international traffic in Argentina is robust, the domestic travel market remains weak due to economic conditions and the end of government support programs like Previaje, potentially limiting future revenue growth.

- Inflationary pressures in Argentina are expected to continue challenging cost controls, impacting net margins since a significant portion of costs are pegged in pesos and subject to inflation adjustments.

- The financial health and potential closure of Aerolíneas Argentinas raise concerns, given that it contributes significantly to CAAP’s revenues, which could lead to a reduction in earnings if not compensated by other airlines or increased international traffic.

Valuation

How have all the factors above been brought together to estimate a fair value?- The analysts have a consensus price target of $21.62 for Corporación América Airports based on their expectations of its future earnings growth, profit margins and other risk factors. However, there is a degree of disagreement amongst analysts, with the most bullish reporting a price target of $24.5, and the most bearish reporting a price target of just $19.0.

- In order for you to agree with the analyst's consensus, you'd need to believe that by 2028, revenues will be $2.1 billion, earnings will come to $357.2 million, and it would be trading on a PE ratio of 10.8x, assuming you use a discount rate of 8.7%.

- Given the current share price of $19.5, the analyst's price target of $21.62 is 9.8% higher.

- We always encourage you to reach your own conclusions though. So sense check these analyst numbers against your own assumptions and expectations based on your understanding of the business and what you believe is probable.

How well do narratives help inform your perspective?

Disclaimer

Warren A.I. is a tool utilizing a Large Language Model (LLM) that ingests data on consensus price targets, forecasted revenue and earnings figures, as well as the transcripts of earnings calls to produce qualitative analysis. The narratives produced by Warren A.I. are general in nature and are based solely on analyst data and publicly-available material published by the respective companies. These scenarios are not indicative of the company's future performance and are exploratory in nature. Simply Wall St has no position in the company(s) mentioned. The price targets and estimates used are consensus data, and do not constitute a recommendation to buy or sell any stock, and they do not take account of your objectives, or your financial situation. Note that Warren A.I.'s analysis may not factor in the latest price-sensitive company announcements or qualitative material.

Read more narratives

There are no other narratives for this company.

View all narratives