Last Update07 May 25Fair value Decreased 5.29%

Key Takeaways

- Expansion in e-commerce fulfillment, reshoring, and cross-border operations positions Werner for sustained revenue growth and improved margins through diversified, resilient freight demand.

- Investments in technology, asset-light logistics, and fleet modernization are driving cost efficiencies, margin stability, and alignment with sustainability priorities, enhancing long-term earnings potential.

- Heavy investment in legacy assets, labor pressures, regulatory costs, and exposure to high-value contracts and insurance claims threaten competitiveness, profitability, and financial flexibility.

Catalysts

About Werner Enterprises- Engages in transporting truckload shipments of general commodities in interstate and intrastate commerce in the United States, Mexico, and internationally.

- Werner is poised to benefit from continued expansion in e-commerce fulfillment and omnichannel retail, as their strong commitment to reliability and scale attracts more dedicated contracts from large retailers seeking dependable freight partners. This is likely to drive sustained revenue growth and enhance network optimization, supporting improved operating margins as these value-added services scale.

- The company is strategically positioned to capture growth from the ongoing shift of manufacturing to North America, as evidenced by their significant and growing cross-border operations with Mexico and expertise in supporting reshoring supply chains. This trend supports Werner’s core truckload and logistics segments, increasing domestic freight volumes and contributing to higher, more resilient revenues.

- Accelerated deployment of advanced supply chain technologies, including the rollout of the EDGE TMS platform and broader operational automation, is expected to drive meaningful cost efficiencies and productivity gains. As these technology investments reach completion late this year into 2026, Werner stands to significantly compress operating expenses and expand net income.

- The rapid growth of the asset-light Werner Logistics segment, including Intermodal and brokerage, provides attractive margin uplift and diversifies revenue streams away from cyclical trucking volatility. As these segments grow to a larger share of total revenue, overall margin stability and earnings quality are expected to improve, providing a platform for higher earnings multiples.

- Ongoing fleet modernization, including investment in newer, more sustainable vehicles, positions Werner to lower maintenance and fuel costs while meeting ESG mandates of major shippers. This should provide meaningful structural improvements to net margins and support long-term earnings growth, especially as customers increasingly prioritize sustainability in their procurement decisions.

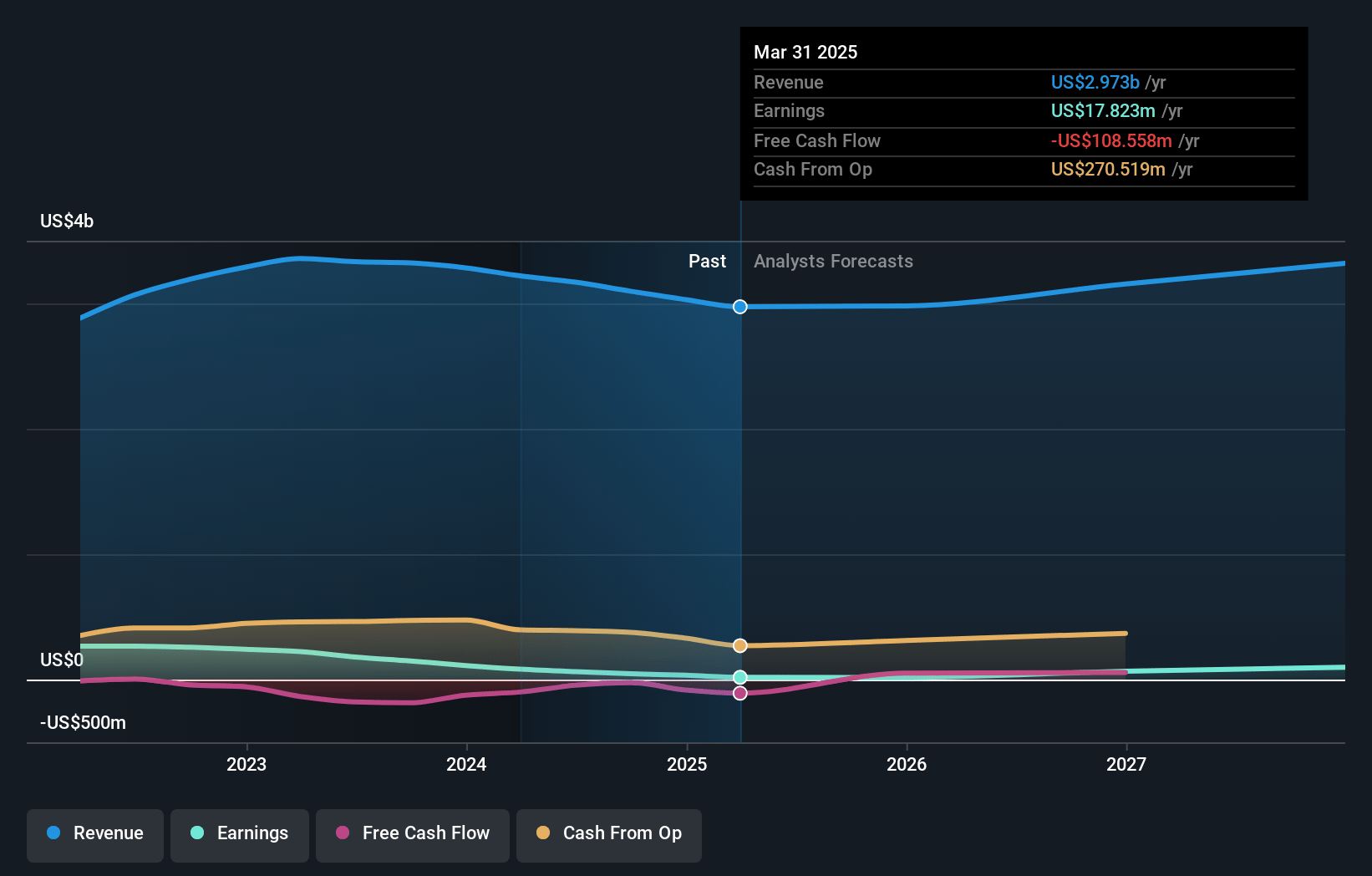

Werner Enterprises Future Earnings and Revenue Growth

Assumptions

How have these above catalysts been quantified?- This narrative explores a more optimistic perspective on Werner Enterprises compared to the consensus, based on a Fair Value that aligns with the bullish cohort of analysts.

- The bullish analysts are assuming Werner Enterprises's revenue will grow by 6.9% annually over the next 3 years.

- The bullish analysts assume that profit margins will increase from 0.6% today to 3.3% in 3 years time.

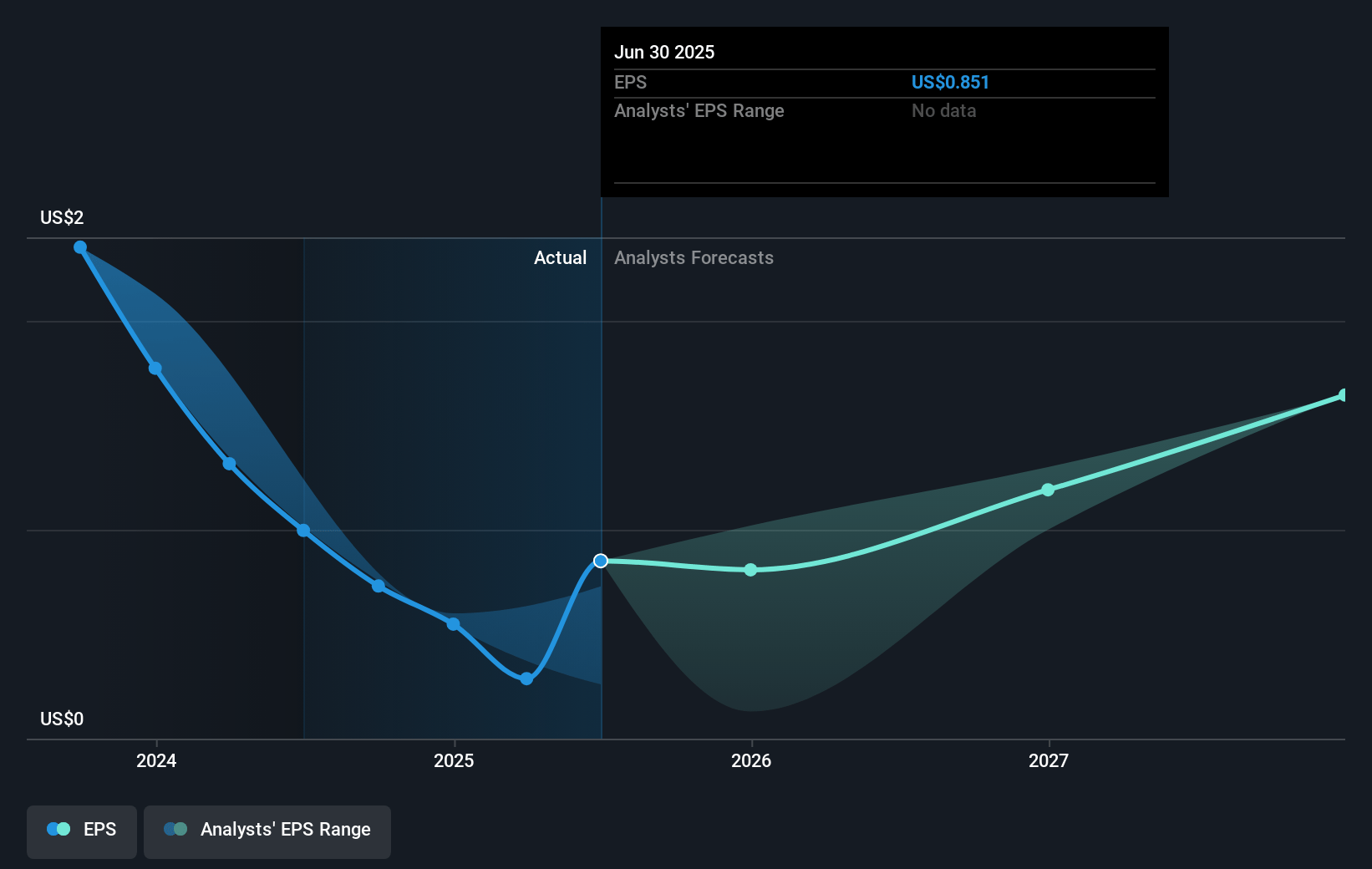

- The bullish analysts expect earnings to reach $120.8 million (and earnings per share of $1.95) by about May 2028, up from $17.8 million today. The analysts are largely in agreement about this estimate.

- In order for the above numbers to justify the price target of the more bullish analyst cohort, the company would need to trade at a PE ratio of 22.9x on those 2028 earnings, down from 87.5x today. This future PE is lower than the current PE for the US Transportation industry at 23.5x.

- Analysts expect the number of shares outstanding to decline by 2.35% per year for the next 3 years.

- To value all of this in today's terms, we will use a discount rate of 8.13%, as per the Simply Wall St company report.

Werner Enterprises Future Earnings Per Share Growth

Risks

What could happen that would invalidate this narrative?- Margin and earnings growth could be hampered by rapid acceleration in autonomous vehicle technology and digital freight platforms, as Werner’s heavy investments in fleet and legacy infrastructure may become less competitive versus more nimble, tech-driven logistics providers, ultimately risking margin compression and lower return on invested capital.

- Ongoing driver shortages, wage pressure due to an aging workforce, and the threat of more stringent enforcement on English-language requirements could exacerbate recruiting challenges and inflate labor costs, directly impacting Werner’s ability to maintain service levels and eroding net margins.

- Substantial exposure to concentrated Dedicated contract freight creates customer concentration risk, meaning loss or renegotiation of large contracts could lead to sudden, unpredictable revenue volatility and pressure both revenue growth and EBITDA margins.

- High and rising compliance costs from decarbonization efforts, stricter climate regulations, and necessary fleet modernization are likely to increase ongoing capital expenditures and operating expenses, limiting financial flexibility and constraining free cash flow, especially if rates and volumes remain under pressure.

- Persistent exposure to nuclear verdicts and escalating insurance claims costs—as highlighted by recent quarters with outsized claim settlements well above historical averages—poses a long-term threat to profitability, with recurring expenses undermining earnings and increasing volatility in net income.

Valuation

How have all the factors above been brought together to estimate a fair value?- The assumed bullish price target for Werner Enterprises is $38.36, which represents two standard deviations above the consensus price target of $27.29. This valuation is based on what can be assumed as the expectations of Werner Enterprises's future earnings growth, profit margins and other risk factors from analysts on the bullish end of the spectrum.

- However, there is a degree of disagreement amongst analysts, with the most bullish reporting a price target of $45.0, and the most bearish reporting a price target of just $21.0.

- In order for you to agree with the bullish analysts, you'd need to believe that by 2028, revenues will be $3.6 billion, earnings will come to $120.8 million, and it would be trading on a PE ratio of 22.9x, assuming you use a discount rate of 8.1%.

- Given the current share price of $25.17, the bullish analyst price target of $38.36 is 34.4% higher.

- We always encourage you to reach your own conclusions though. So sense check these analyst numbers against your own assumptions and expectations based on your understanding of the business and what you believe is probable.

How well do narratives help inform your perspective?

Disclaimer

AnalystHighTarget is a tool utilizing a Large Language Model (LLM) that ingests data on consensus price targets, forecasted revenue and earnings figures, as well as the transcripts of earnings calls to produce qualitative analysis. The narratives produced by AnalystHighTarget are general in nature and are based solely on analyst data and publicly-available material published by the respective companies. These scenarios are not indicative of the company's future performance and are exploratory in nature. Simply Wall St has no position in the company(s) mentioned. Simply Wall St may provide the securities issuer or related entities with website advertising services for a fee, on an arm's length basis. These relationships have no impact on the way we conduct our business, the content we host, or how our content is served to users. The price targets and estimates used are consensus data, and do not constitute a recommendation to buy or sell any stock, and they do not take account of your objectives, or your financial situation. Note that AnalystHighTarget's analysis may not factor in the latest price-sensitive company announcements or qualitative material.