Key Takeaways

- Sun Country Airlines' flexible scheduling and low-fixed cost model could sustain profitability, enhancing future revenue and margins.

- Enhanced cargo operations and cost management may boost revenue streams and support financial stability and earnings growth.

- Challenges in revenue and margins due to industry overcapacity, rising costs, and reduced service capacity, with uncertain cargo growth and cautious shareholder returns strategy.

Catalysts

About Sun Country Airlines Holdings- An air carrier company, operates scheduled passenger, air cargo, charter air transportation, and related services in the United States, Latin America, and internationally.

- The combination of Sun Country Airlines' schedule flexibility and low fixed cost model positions it to maintain profitability during industry fluctuations, potentially improving revenue and margins in the future.

- Expected industry capacity rationalization could lead to a healthier pricing environment, potentially benefiting Sun Country’s revenue growth in the near term.

- An anticipated increase in charter and cargo yields, along with intensified cargo operations in 2025 with new freighter aircraft, might enhance revenue streams and overall margins.

- Significant reduction of post-COVID inflationary pressures and a decrease in fuel costs could contribute to margin expansion, positively influencing earnings.

- Effective cost management and ability to self-fund growth projects suggest improved financial stability, supporting future cash flow and earnings growth.

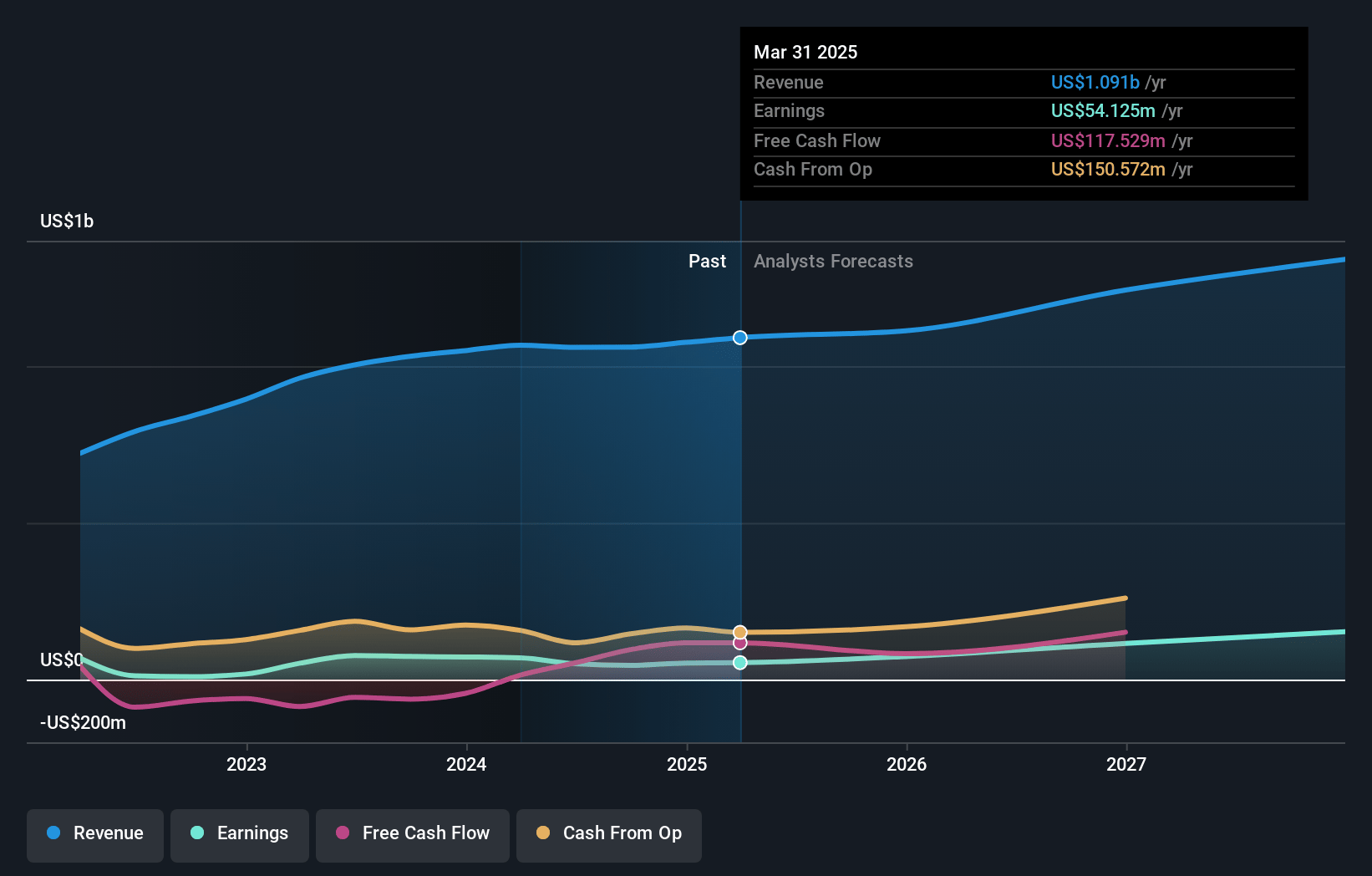

Sun Country Airlines Holdings Future Earnings and Revenue Growth

Assumptions

How have these above catalysts been quantified?- Analysts are assuming Sun Country Airlines Holdings's revenue will grow by 9.5% annually over the next 3 years.

- Analysts assume that profit margins will increase from 4.3% today to 13.8% in 3 years time.

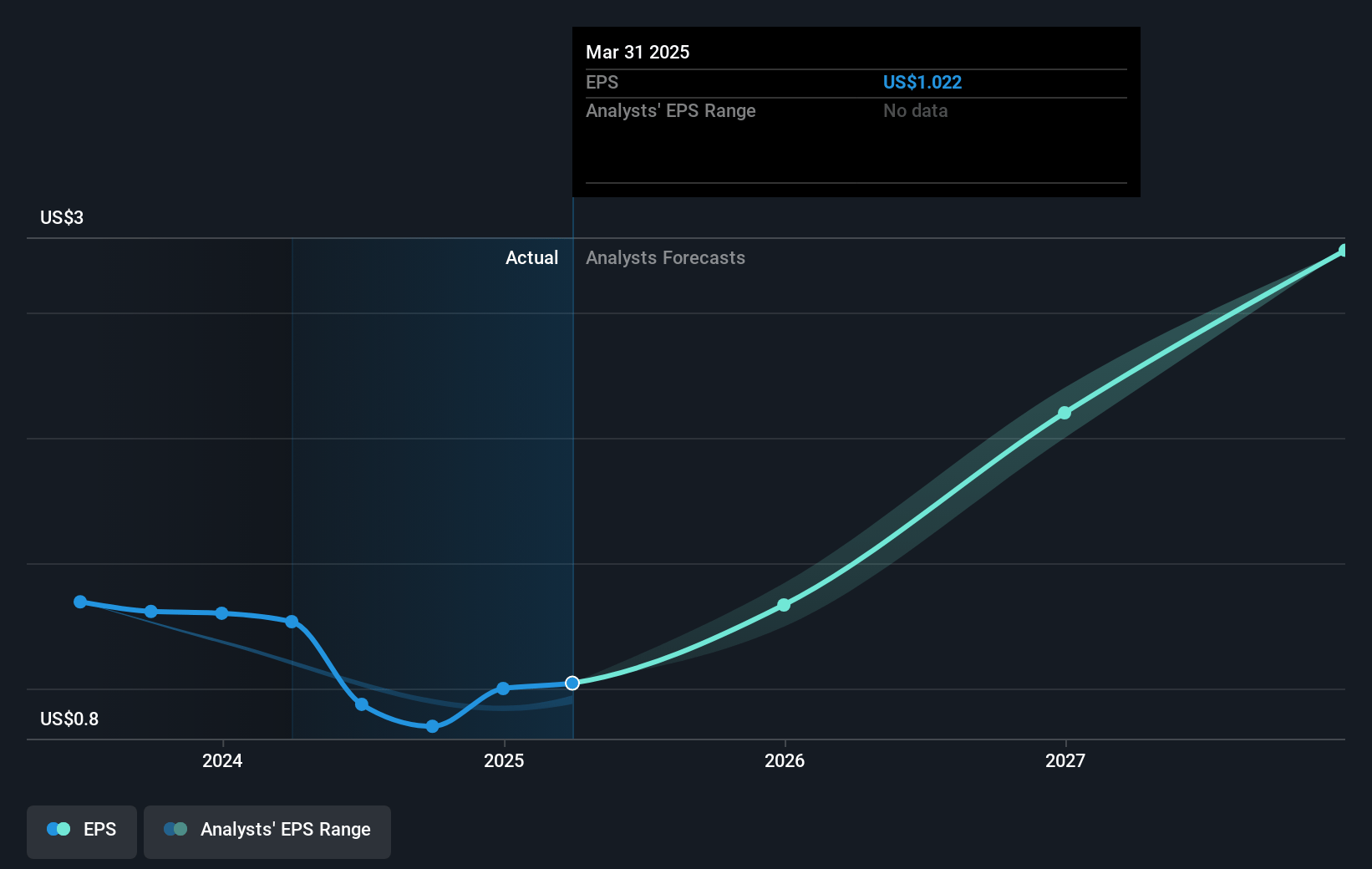

- Analysts expect earnings to reach $192.3 million (and earnings per share of $3.41) by about January 2028, up from $45.1 million today.

- In order for the above numbers to justify the analysts price target, the company would need to trade at a PE ratio of 7.5x on those 2028 earnings, down from 19.4x today. This future PE is lower than the current PE for the US Airlines industry at 12.5x.

- Analysts expect the number of shares outstanding to grow by 2.14% per year for the next 3 years.

- To value all of this in today's terms, we will use a discount rate of 8.27%, as per the Simply Wall St company report.

Sun Country Airlines Holdings Future Earnings Per Share Growth

Risks

What could happen that would invalidate this narrative?- The decline in scheduled service revenue, driven by an 11.1% drop in TRASM, indicates challenges in maintaining passenger revenue amidst industry overcapacity. This could pressure overall revenue and margins.

- Rising ground handling expenses and landing fees, partially due to the roll-off of COVID-era relief, contribute to increased operational costs, potentially squeezing net margins.

- A decline in scheduled service capacity is anticipated, with a possible high-single-digit reduction, which could reduce passenger revenue and impact overall earnings.

- Dependence on successful cargo growth, including the delivery and operational ramp-up of new aircraft, presents risks if timelines are delayed, potentially impacting future revenue sources.

- Share buybacks are not planned in the near term despite strong free cash flow, which might not appease shareholders seeking direct returns, impacting stockholder sentiment and indirectly affecting share price stability.

Valuation

How have all the factors above been brought together to estimate a fair value?- The analysts have a consensus price target of $20.33 for Sun Country Airlines Holdings based on their expectations of its future earnings growth, profit margins and other risk factors. However, there is a degree of disagreement amongst analysts, with the most bullish reporting a price target of $24.0, and the most bearish reporting a price target of just $16.0.

- In order for you to agree with the analyst's consensus, you'd need to believe that by 2028, revenues will be $1.4 billion, earnings will come to $192.3 million, and it would be trading on a PE ratio of 7.5x, assuming you use a discount rate of 8.3%.

- Given the current share price of $16.57, the analyst's price target of $20.33 is 18.5% higher.

- We always encourage you to reach your own conclusions though. So sense check these analyst numbers against your own assumptions and expectations based on your understanding of the business and what you believe is probable.

How well do narratives help inform your perspective?

Disclaimer

Warren A.I. is a tool utilizing a Large Language Model (LLM) that ingests data on consensus price targets, forecasted revenue and earnings figures, as well as the transcripts of earnings calls to produce qualitative analysis. The narratives produced by Warren A.I. are general in nature and are based solely on analyst data and publicly-available material published by the respective companies. These scenarios are not indicative of the company's future performance and are exploratory in nature. Simply Wall St has no position in the company(s) mentioned. The price targets and estimates used are consensus data, and do not constitute a recommendation to buy or sell any stock, and they do not take account of your objectives, or your financial situation. Note that Warren A.I.'s analysis may not factor in the latest price-sensitive company announcements or qualitative material.

Read more narratives

There are no other narratives for this company.

View all narratives