Key Takeaways

- Global infrastructure booms, tight fleet supply, and energy transition trends could drive prolonged high demand and revenue growth for Seanergy in coming years.

- Operational efficiencies and strategic vessel acquisitions position Seanergy for stronger margins, long-term earnings stability, and enhanced shareholder returns.

- Heavy dependence on volatile coal and iron ore shipping, an aging fleet, regulatory pressures, high debt, and shifting trade patterns threaten revenue stability and growth.

Catalysts

About Seanergy Maritime Holdings- A shipping company, provides seaborne dry bulk transportation services worldwide.

- While analyst consensus acknowledges the Simandou project as a catalyst for increased ton-miles and Capesize demand in late 2025, they may be underestimating the ripple effect of simultaneous West African bauxite export surges and new infrastructure pipelines, which could trigger a multi-year supercycle that sharply elevates Seanergy's revenue and sustained charter rates during 2026 and 2027.

- Analysts broadly agree that historically low net fleet growth will tighten supply and support improved margins, but with effective fleet growth possibly turning negative due to dry dockings, slow steaming, and rapid scrapping, a prolonged supply squeeze could send Capesize rates and asset values to new cyclical highs, driving substantial outperformance in Seanergy's EBITDA and return on equity.

- The accelerating global push for energy transition and decarbonization is leading to massive investment in renewable infrastructure and green steel, creating multi-decade structural demand for iron ore and coal transport; as a pure-play Capesize operator, Seanergy stands to amplify revenue growth and charter duration as project pipelines balloon, especially in emerging Asian markets.

- Operational improvements-specifically a steady reduction in daily operating expenses driven by in-house technical management and modern fleet upgrades-are set to compound over time, enabling Seanergy to achieve superior net margins and free cash flow conversion versus peers, which could rerate the company's profitability profile.

- The company's right of first offer on off-market Japanese-built Capesize vessels, combined with deep relationships with blue-chip charterers, positions Seanergy to opportunistically expand and secure above-market time charters during periods of tight supply, directly supporting growth in fleet value, long-term earnings stability, and higher dividend distributions.

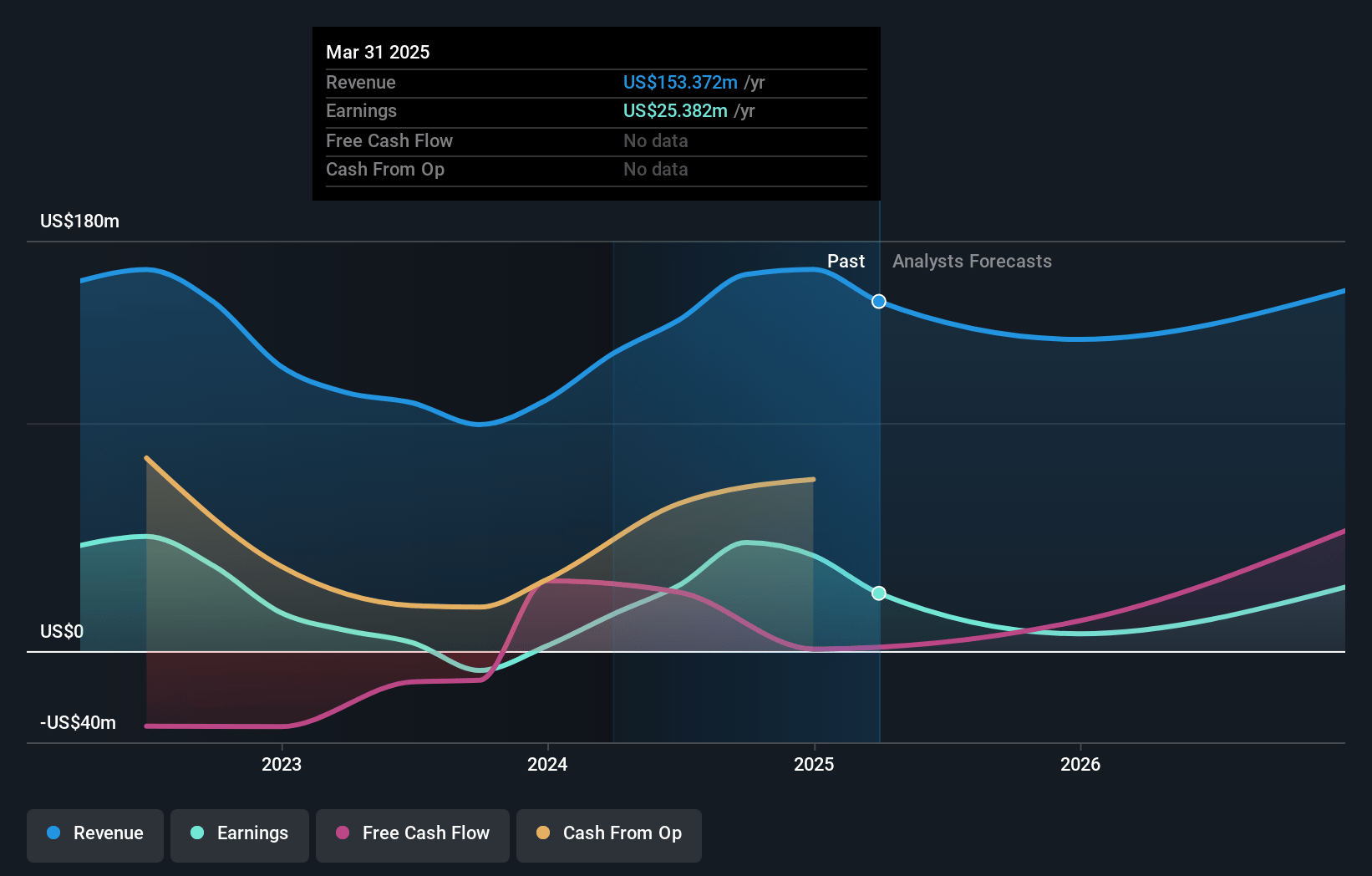

Seanergy Maritime Holdings Future Earnings and Revenue Growth

Assumptions

How have these above catalysts been quantified?- This narrative explores a more optimistic perspective on Seanergy Maritime Holdings compared to the consensus, based on a Fair Value that aligns with the bullish cohort of analysts.

- The bullish analysts are assuming Seanergy Maritime Holdings's revenue will grow by 3.8% annually over the next 3 years.

- The bullish analysts assume that profit margins will increase from 16.5% today to 23.3% in 3 years time.

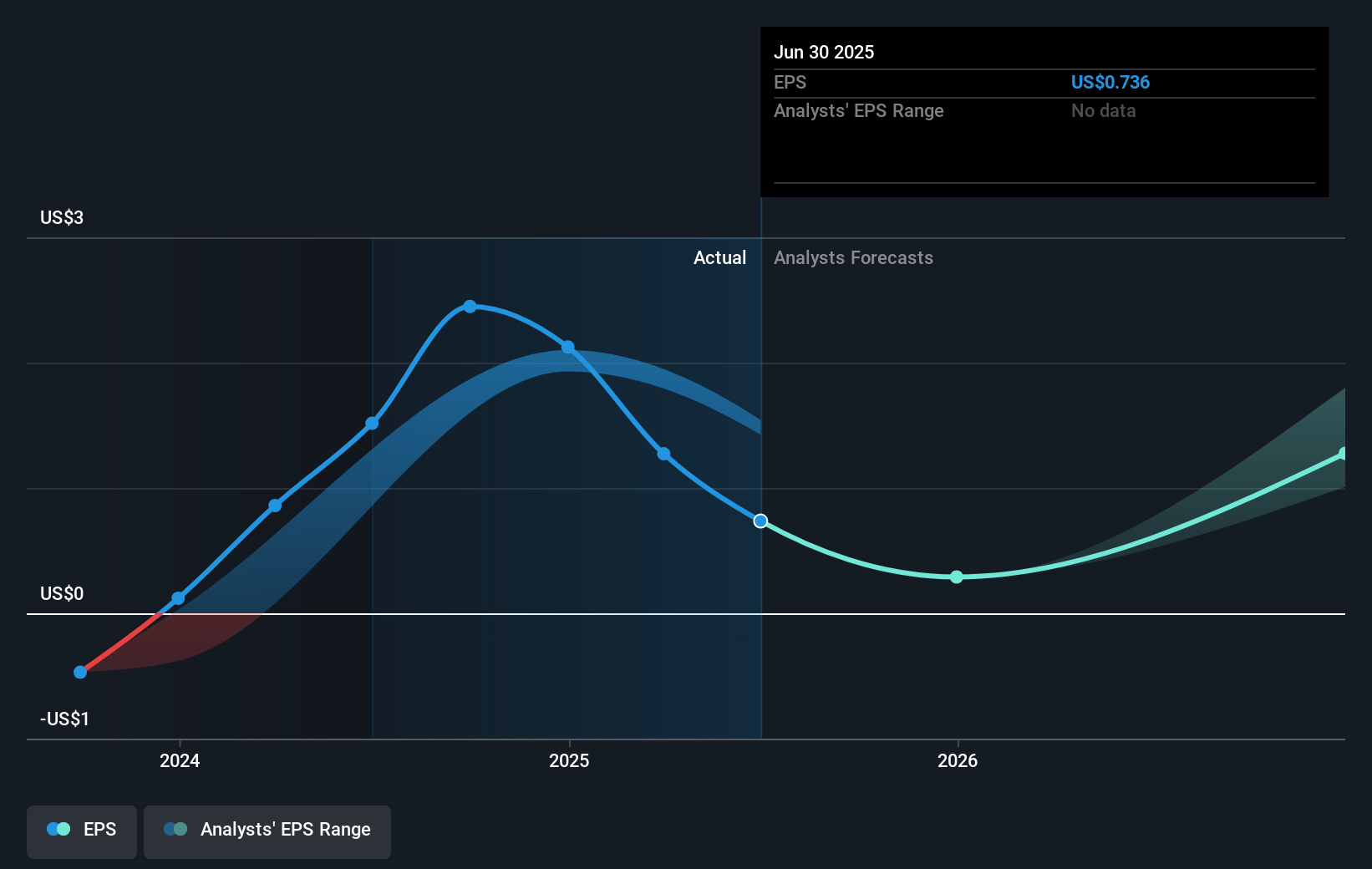

- The bullish analysts expect earnings to reach $39.9 million (and earnings per share of $1.88) by about July 2028, up from $25.4 million today. The analysts are largely in agreement about this estimate.

- In order for the above numbers to justify the price target of the more bullish analyst cohort, the company would need to trade at a PE ratio of 11.2x on those 2028 earnings, up from 5.7x today. This future PE is greater than the current PE for the US Shipping industry at 5.8x.

- Analysts expect the number of shares outstanding to decline by 2.21% per year for the next 3 years.

- To value all of this in today's terms, we will use a discount rate of 16.1%, as per the Simply Wall St company report.

Seanergy Maritime Holdings Future Earnings Per Share Growth

Risks

What could happen that would invalidate this narrative?- Seanergy's significant reliance on the Capesize segment exposes it to acute volatility, as demand and charter rates remain highly sensitive to fluctuations in coal and iron ore trades, risking continued revenue instability during downturns or secular declines in these commodities.

- An aging fleet, with multiple vessels requiring costly dry dockings and retrofits in the near future, creates elevated capital expenditure needs that could pressure free cash flow and compress net margins if not matched by rising charter rates or operational improvements.

- Growing global decarbonization efforts and stricter emissions regulations threaten to both increase Seanergy's operating costs (due to compliance and retrofitting) and gradually reduce demand for coal transport, which would negatively affect operating margins and the company's core revenue base.

- The company's elevated debt position, as evidenced by $323.7 million in debt and frequent refinancing activities, heightens the risk that adverse market conditions or rising interest rates could erode net margins and increase the risk of financial distress, undermining long-term earnings potential.

- Secular trends such as the potential for global supply chain reshoring and the pivot toward regional production could reduce overall seaborne bulk trade volumes over time, diminishing the structural demand for Seanergy's services and constraining long-term revenue growth.

Valuation

How have all the factors above been brought together to estimate a fair value?- The assumed bullish price target for Seanergy Maritime Holdings is $15.0, which is the highest price target estimate amongst analysts. This valuation is based on what can be assumed as the expectations of Seanergy Maritime Holdings's future earnings growth, profit margins and other risk factors from analysts on the bullish end of the spectrum.

- However, there is a degree of disagreement amongst analysts, with the most bullish reporting a price target of $15.0, and the most bearish reporting a price target of just $9.0.

- In order for you to agree with the bullish analysts, you'd need to believe that by 2028, revenues will be $171.6 million, earnings will come to $39.9 million, and it would be trading on a PE ratio of 11.2x, assuming you use a discount rate of 16.1%.

- Given the current share price of $6.88, the bullish analyst price target of $15.0 is 54.1% higher.

- We always encourage you to reach your own conclusions though. So sense check these analyst numbers against your own assumptions and expectations based on your understanding of the business and what you believe is probable.

How well do narratives help inform your perspective?

Disclaimer

AnalystHighTarget is a tool utilizing a Large Language Model (LLM) that ingests data on consensus price targets, forecasted revenue and earnings figures, as well as the transcripts of earnings calls to produce qualitative analysis. The narratives produced by AnalystHighTarget are general in nature and are based solely on analyst data and publicly-available material published by the respective companies. These scenarios are not indicative of the company's future performance and are exploratory in nature. Simply Wall St has no position in the company(s) mentioned. Simply Wall St may provide the securities issuer or related entities with website advertising services for a fee, on an arm's length basis. These relationships have no impact on the way we conduct our business, the content we host, or how our content is served to users. The price targets and estimates used are consensus data, and do not constitute a recommendation to buy or sell any stock, and they do not take account of your objectives, or your financial situation. Note that AnalystHighTarget's analysis may not factor in the latest price-sensitive company announcements or qualitative material.