Key Takeaways

- Expansion in global e-commerce and complex supply chains is boosting demand for C.H. Robinson’s advanced logistics solutions and increasing its market share.

- Investing in technology and value-added services enhances operational efficiency, customer relationships, and pricing power, supporting resilient margin and earnings growth.

- Rapid digital disruption, regulatory pressures, and shifting supply chains threaten margin stability and growth as C.H. Robinson faces intensified competition and evolving customer demands.

Catalysts

About C.H. Robinson Worldwide- Provides freight transportation and related logistics and supply chain services in the United States and internationally.

- C.H. Robinson is positioned to benefit from the sustained expansion in global e-commerce, which drives higher shipment volumes and necessitates sophisticated freight and logistics solutions; this tailwind supports multi-year revenue growth as online commerce penetration rises globally across both North America and international markets.

- The increasing complexity of international supply chains, fueled by ongoing globalization and frequent trade policy changes, is prompting more businesses to rely on expert third-party logistics providers. C.H. Robinson’s global footprint, proven ability to help customers diversify and reconfigure supply chains (as seen in its reduced dependency on China-U.S. trade lanes), and expertise in customs and cross-border transactions enable the company to win market share and grow revenue faster than underlying freight volumes.

- Broad implementation of proprietary artificial intelligence and digital automation tools is transforming operational execution at scale. With more than 3 million shipping tasks now handled by gen AI agents and a greater than 30 percent increase in productivity over two years, C.H. Robinson is structurally increasing employee efficiency and decoupling headcount from shipment volume, which should support sustained expansion of net and operating margins in future years.

- The company’s shift toward higher value-added, technology-powered offerings such as managed transportation, supply chain consulting, and advanced data analytics is leading to greater service penetration with existing clients. This “move up the value stack” increases revenue per customer, deepens customer relationships, and aids gross margin expansion, resulting in higher earnings resilience and growth through the cycle.

- C.H. Robinson’s scale, diverse network and continued investment in technology provide both cost advantages and pricing power, allowing the company to capitalize on industry trends such as consolidation, rising regulatory complexity, and network optimization. These advantages are likely to drive higher operating leverage and earnings growth as the economic and freight market environment recovers.

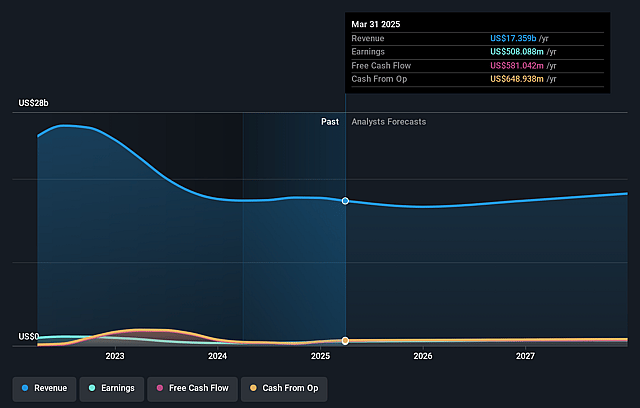

C.H. Robinson Worldwide Future Earnings and Revenue Growth

Assumptions

How have these above catalysts been quantified?- This narrative explores a more optimistic perspective on C.H. Robinson Worldwide compared to the consensus, based on a Fair Value that aligns with the bullish cohort of analysts.

- The bullish analysts are assuming C.H. Robinson Worldwide's revenue will grow by 4.1% annually over the next 3 years.

- The bullish analysts assume that profit margins will increase from 2.9% today to 3.9% in 3 years time.

- The bullish analysts expect earnings to reach $763.0 million (and earnings per share of $6.44) by about July 2028, up from $508.1 million today. The analysts are largely in agreement about this estimate.

- In order for the above numbers to justify the price target of the more bullish analyst cohort, the company would need to trade at a PE ratio of 25.9x on those 2028 earnings, up from 23.1x today. This future PE is greater than the current PE for the US Logistics industry at 16.1x.

- Analysts expect the number of shares outstanding to grow by 1.23% per year for the next 3 years.

- To value all of this in today's terms, we will use a discount rate of 7.37%, as per the Simply Wall St company report.

C.H. Robinson Worldwide Future Earnings Per Share Growth

Risks

What could happen that would invalidate this narrative?- The rapid digitalization of logistics, including direct shipper–carrier digital platforms, poses a significant disintermediation risk for C.H. Robinson’s brokerage model, potentially resulting in reduced revenue growth and margin compression as shippers bypass third-party intermediaries for lower-cost solutions.

- Despite recent advances in proprietary AI and productivity, C.H. Robinson may risk lagging behind more nimble, tech-native digital freight startups, which are driving pricing transparency and operational efficiencies that could erode the company’s gross margins and limit long-term earnings expansion.

- Increased regulatory scrutiny and evolving environmental standards may force C.H. Robinson to make heavy, ongoing investments in compliance and green technologies, leading to rising operating costs and further net margin pressure if costs cannot be offset by higher prices or productivity gains.

- Persistent industry-wide overcapacity, volatile freight cycles, and heightened bargaining power among large shippers are likely to keep contractual and spot pricing under pressure, threatening both revenue stability and the consistency of the company’s earnings.

- The ongoing trend of nearshoring and onshoring manufacturing is reducing demand for global long-distance freight, which may disproportionately impact C.H. Robinson’s Global Forwarding segment and cause a contraction in international-related revenues over time.

Valuation

How have all the factors above been brought together to estimate a fair value?- The assumed bullish price target for C.H. Robinson Worldwide is $130.0, which is the highest price target estimate amongst analysts. This valuation is based on what can be assumed as the expectations of C.H. Robinson Worldwide's future earnings growth, profit margins and other risk factors from analysts on the bullish end of the spectrum.

- However, there is a degree of disagreement amongst analysts, with the most bullish reporting a price target of $130.0, and the most bearish reporting a price target of just $71.0.

- In order for you to agree with the bullish analysts, you'd need to believe that by 2028, revenues will be $19.6 billion, earnings will come to $763.0 million, and it would be trading on a PE ratio of 25.9x, assuming you use a discount rate of 7.4%.

- Given the current share price of $98.94, the bullish analyst price target of $130.0 is 23.9% higher.

- We always encourage you to reach your own conclusions though. So sense check these analyst numbers against your own assumptions and expectations based on your understanding of the business and what you believe is probable.

How well do narratives help inform your perspective?

Disclaimer

AnalystHighTarget is a tool utilizing a Large Language Model (LLM) that ingests data on consensus price targets, forecasted revenue and earnings figures, as well as the transcripts of earnings calls to produce qualitative analysis. The narratives produced by AnalystHighTarget are general in nature and are based solely on analyst data and publicly-available material published by the respective companies. These scenarios are not indicative of the company's future performance and are exploratory in nature. Simply Wall St has no position in the company(s) mentioned. Simply Wall St may provide the securities issuer or related entities with website advertising services for a fee, on an arm's length basis. These relationships have no impact on the way we conduct our business, the content we host, or how our content is served to users. The price targets and estimates used are consensus data, and do not constitute a recommendation to buy or sell any stock, and they do not take account of your objectives, or your financial situation. Note that AnalystHighTarget's analysis may not factor in the latest price-sensitive company announcements or qualitative material.