Key Takeaways

- Strategic shift to LNG carriers and asset sales capitalize on rising gas transport demand, enhancing revenue and margins.

- Initiatives in liquidity, significant revenue backlog, and CO2 vessel market entry support earnings growth and market differentiation.

- Heavy reliance on debt financing and market challenges in LNG and LCO2 may increase financial risk and impact revenue and earnings.

Catalysts

About Capital Clean Energy Carriers- A shipping company, provides marine transportation services in Greece.

- The strategic shift towards LNG carriers, coupled with the sale of non-core assets like container vessels, positions Capital Clean Energy Carriers to leverage a growing demand for gas transportation. This realignment can enhance revenue and operating margins as LNG demand increases.

- The refinancing activities undertaken by the company have improved liquidity and reduced interest costs, potentially leading to enhanced net income and earnings as debt servicing costs decrease.

- The significant revenue backlog of $2.6 billion, largely driven by LNG assets with over 7 years of charter duration, provides visibility and stability in revenue streams, which can positively impact future earnings and free cash flow.

- The launch of liquid CO2 vessels and entry into this nascent market presents a growth opportunity, as increasing carbon capture and storage initiatives are likely to drive demand for such transportation, potentially boosting revenue and profit margins.

- The strategic focus on modern, dual-fueled LNG carriers and multi-gas vessels ensures compliance with environmental regulations, positioning the fleet for higher utilization and improved revenue generation compared to older, less efficient vessels, thus positively impacting earnings.

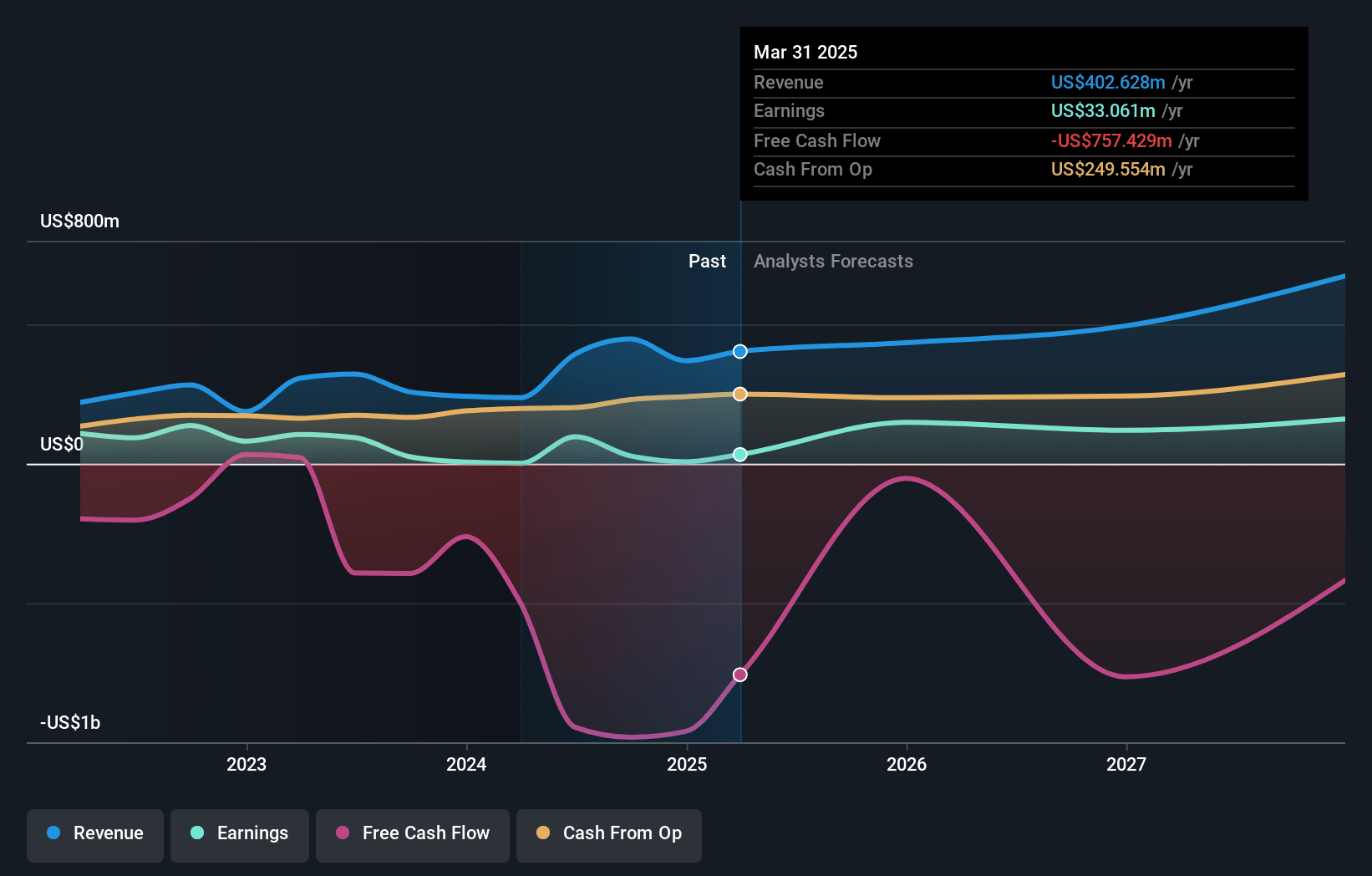

Capital Clean Energy Carriers Future Earnings and Revenue Growth

Assumptions

How have these above catalysts been quantified?- Analysts are assuming Capital Clean Energy Carriers's revenue will grow by 15.9% annually over the next 3 years.

- Analysts assume that profit margins will increase from 2.6% today to 38.4% in 3 years time.

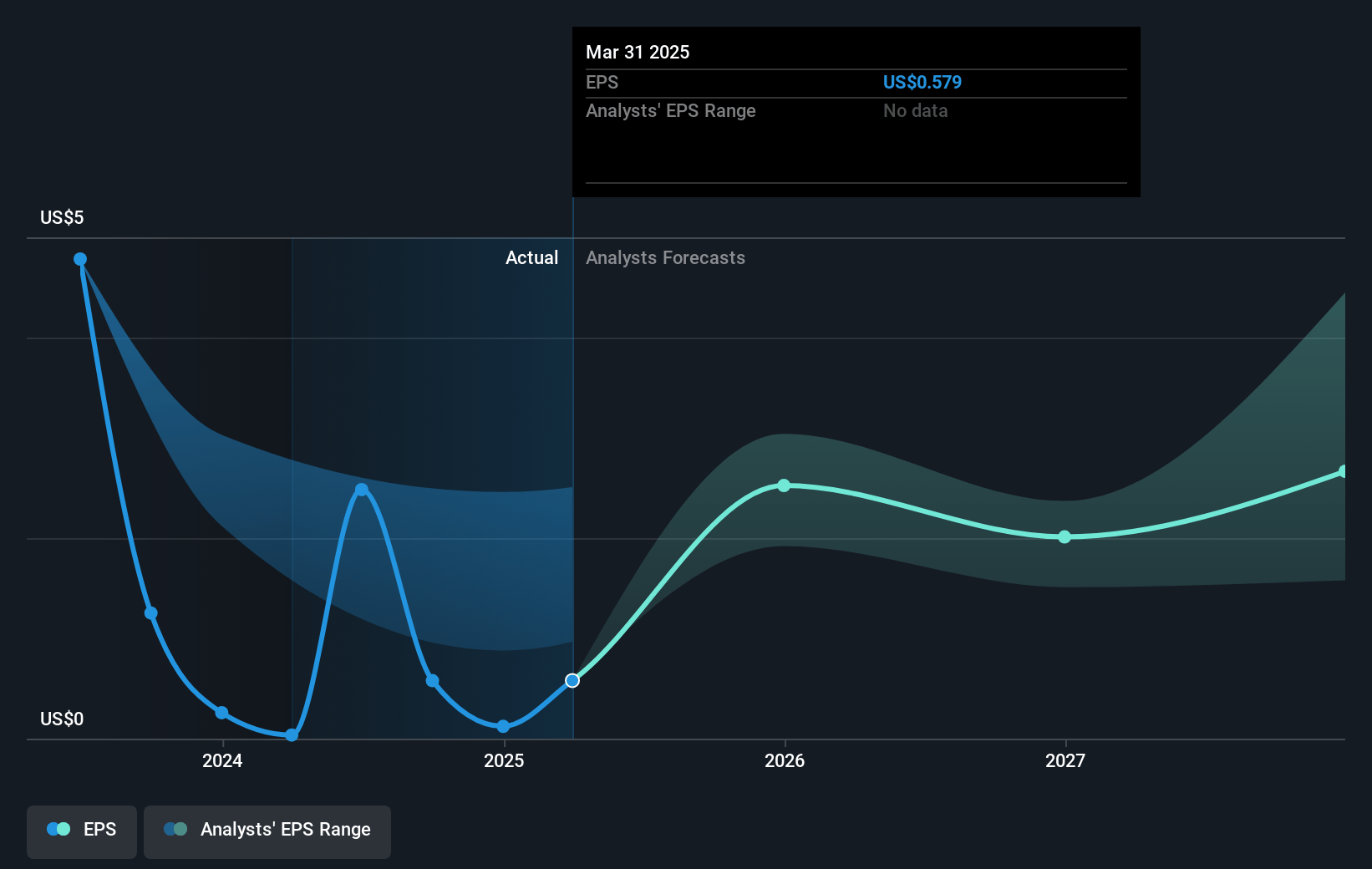

- Analysts expect earnings to reach $267.5 million (and earnings per share of $4.55) by about January 2028, up from $11.8 million today.

- In order for the above numbers to justify the analysts price target, the company would need to trade at a PE ratio of 7.7x on those 2028 earnings, down from 91.1x today. This future PE is greater than the current PE for the US Shipping industry at 3.4x.

- Analysts expect the number of shares outstanding to grow by 0.2% per year for the next 3 years.

- To value all of this in today's terms, we will use a discount rate of 16.29%, as per the Simply Wall St company report.

Capital Clean Energy Carriers Future Earnings Per Share Growth

Risks

What could happen that would invalidate this narrative?- The company's heavy reliance on debt financing, as indicated by its expectation to raise more than $1.5 billion in debt, may increase financial risk and negatively impact net margins if interest rates do not fall as forecasted.

- The current weak spot market for LNG, characterized by oversupply and reduced rates, could create revenue challenges if long-term market conditions do not improve as expected by 2026.

- The strategic pivot towards LNG carriers and other gas assets introduces execution risks, which, if not managed effectively, could impact revenue and future earnings negatively.

- The need for increased liquidity and a thinly traded stock, as the company highlights its efforts to enhance trading liquidity, suggests potential challenges in attracting investment, which could impact share value and earnings.

- The emergent market for LCO2 carriers is still nascent with supply constraints, which introduces market entry risks that could affect projected revenue increases from these new ventures.

Valuation

How have all the factors above been brought together to estimate a fair value?- The analysts have a consensus price target of $22.67 for Capital Clean Energy Carriers based on their expectations of its future earnings growth, profit margins and other risk factors. However, there is a degree of disagreement amongst analysts, with the most bullish reporting a price target of $26.0, and the most bearish reporting a price target of just $18.0.

- In order for you to agree with the analyst's consensus, you'd need to believe that by 2028, revenues will be $695.9 million, earnings will come to $267.5 million, and it would be trading on a PE ratio of 7.7x, assuming you use a discount rate of 16.3%.

- Given the current share price of $18.47, the analyst's price target of $22.67 is 18.5% higher.

- We always encourage you to reach your own conclusions though. So sense check these analyst numbers against your own assumptions and expectations based on your understanding of the business and what you believe is probable.

How well do narratives help inform your perspective?

Disclaimer

Warren A.I. is a tool utilizing a Large Language Model (LLM) that ingests data on consensus price targets, forecasted revenue and earnings figures, as well as the transcripts of earnings calls to produce qualitative analysis. The narratives produced by Warren A.I. are general in nature and are based solely on analyst data and publicly-available material published by the respective companies. These scenarios are not indicative of the company's future performance and are exploratory in nature. Simply Wall St has no position in the company(s) mentioned. The price targets and estimates used are consensus data, and do not constitute a recommendation to buy or sell any stock, and they do not take account of your objectives, or your financial situation. Note that Warren A.I.'s analysis may not factor in the latest price-sensitive company announcements or qualitative material.

Read more narratives

There are no other narratives for this company.

View all narratives