Last Update07 May 25Fair value Decreased 3.36%

Key Takeaways

- Technology investments in automation and AI are boosting efficiency and scalability, supporting higher margins and revenue growth in a shifting freight and logistics market.

- Strategic network optimization, cost discipline, and focus on high-margin, asset-light services strengthen operational performance and resilience to market fluctuations.

- Lagging digital adoption, labor reliance, industry consolidation, rising capital costs, and limited diversification collectively threaten ArcBest’s competitiveness, earnings stability, and long-term financial strength.

Catalysts

About ArcBest- An integrated logistics company, provides ground, air, and ocean transportation solutions worldwide.

- ArcBest’s accelerated investments in automation, AI-driven optimization, and technology platforms like Vaux Vision and Dynamic Routing are yielding immediate efficiency gains and productivity improvements, making the company more scalable and cost-competitive as e-commerce and domestic freight demand grow. These digital solutions are expected to drive higher net margins and improved earnings as the market rebounds.

- The company’s differentiated suite of flexible, tech-enabled logistics solutions and integrated managed transportation services directly address the ongoing shift toward integrated supply chains as e-commerce expands, positioning ArcBest to capture greater market share and expand its total addressable market, which should support top-line revenue growth.

- ArcBest is proactively positioned to benefit from the reshoring and nearshoring trend among North American manufacturers, as disruptions in global trade accelerate the push toward domestic sourcing. This shift will drive structurally higher domestic freight volumes, benefiting ArcBest’s revenue and shipment counts over the long term.

- Optimization of the LTL network, successful integration of acquired facilities, and strategic real estate investments are enhancing route density, asset utilization, and customer retention. This network optimization is expected to drive both operational leverage and margin expansion, especially as shipment growth resumes.

- Sustained focus on cost discipline, productivity gains, and portfolio management—including the strategic reduction of low-margin business and prioritization of asset-light, higher-margin services—positions ArcBest to structurally improve operating income and earnings per share even during periods of macro uncertainty, providing significant upside leverage as freight market conditions normalize.

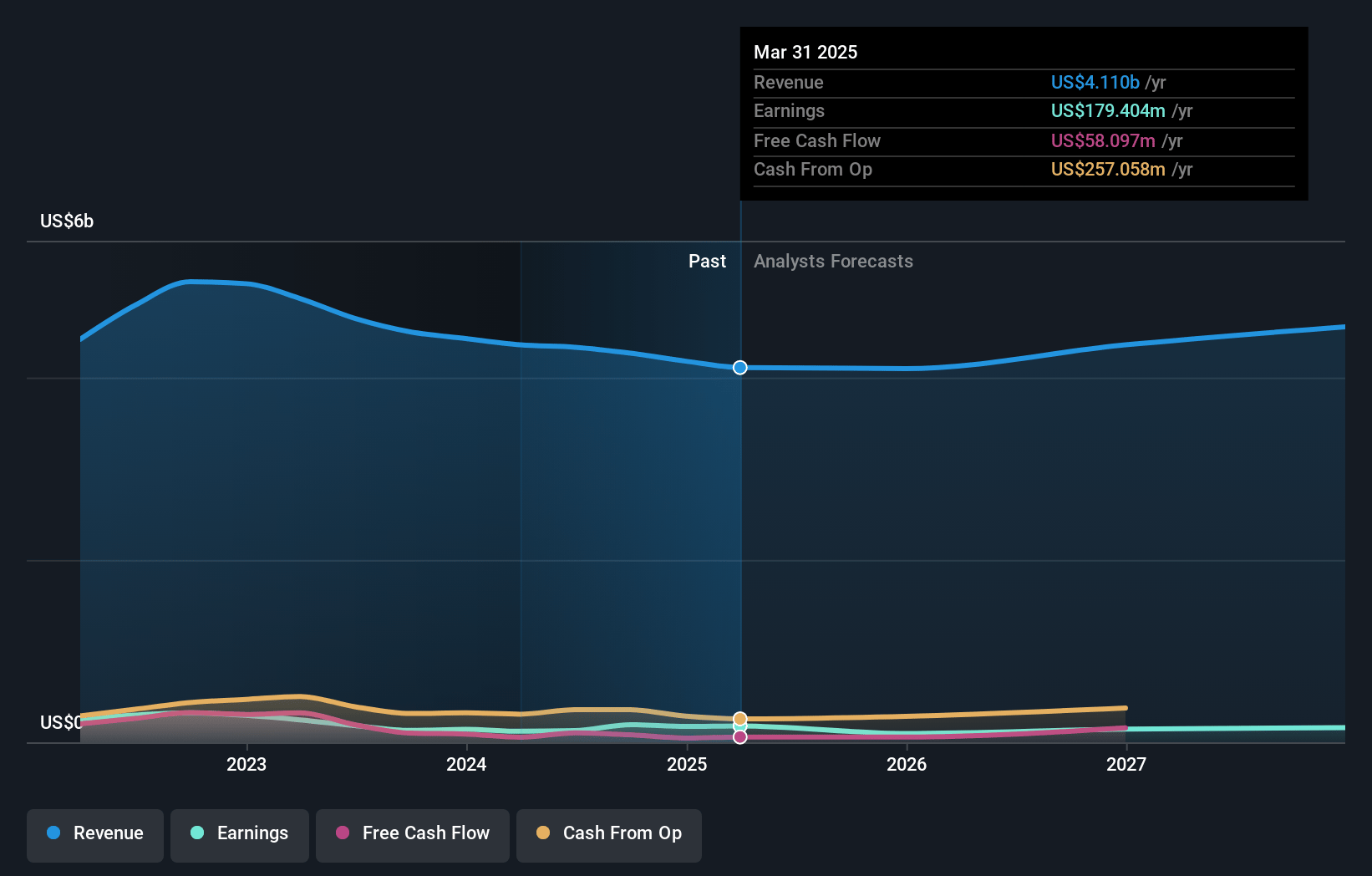

ArcBest Future Earnings and Revenue Growth

Assumptions

How have these above catalysts been quantified?- This narrative explores a more optimistic perspective on ArcBest compared to the consensus, based on a Fair Value that aligns with the bullish cohort of analysts.

- The bullish analysts are assuming ArcBest's revenue will grow by 5.0% annually over the next 3 years.

- The bullish analysts assume that profit margins will shrink from 4.4% today to 3.2% in 3 years time.

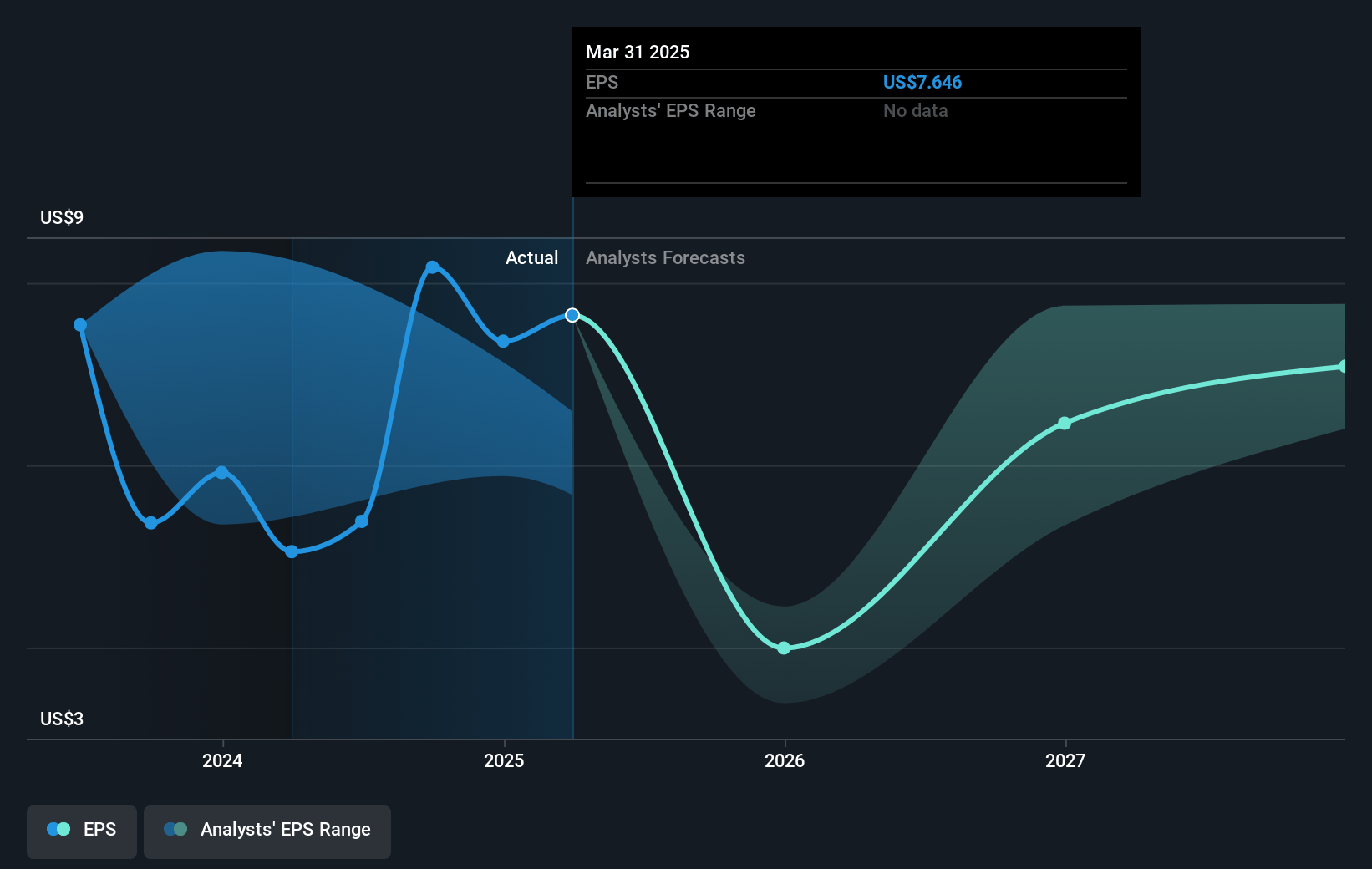

- The bullish analysts expect earnings to reach $151.3 million (and earnings per share of $6.95) by about May 2028, down from $179.4 million today. The analysts are largely in agreement about this estimate.

- In order for the above numbers to justify the price target of the more bullish analyst cohort, the company would need to trade at a PE ratio of 21.3x on those 2028 earnings, up from 7.5x today. This future PE is lower than the current PE for the US Transportation industry at 23.5x.

- Analysts expect the number of shares outstanding to decline by 2.22% per year for the next 3 years.

- To value all of this in today's terms, we will use a discount rate of 7.96%, as per the Simply Wall St company report.

ArcBest Future Earnings Per Share Growth

Risks

What could happen that would invalidate this narrative?- ArcBest’s slow pace of digital transformation compared to larger or technology-first competitors may hinder its ability to attract and retain customers, risking lower long-term revenue growth and weaker earnings resilience.

- The company’s high reliance on unionized labor in its ABF Freight division exposes it to structural wage inflation and the potential for labor disruptions, both of which could further compress net margins and negatively affect profitability over time.

- Ongoing industry consolidation and increasing market dominance by mega-scale logistics players and integrated networks threaten to erode ArcBest’s market share, making it more difficult to compete on price and service, with potential adverse impacts on future revenues and operating margins.

- Rising capital expenditure needs associated with fleet modernization, environmental compliance, and adoption of automation in response to regulatory and technological shifts could weigh on ArcBest’s cash flow and pressure net margins in the longer term.

- Overreliance on less-than-truckload freight and insufficient diversification of revenue streams make ArcBest more vulnerable to cyclical economic downturns and demand shifts, increasing volatility in earnings and reducing the company’s long-term financial resilience.

Valuation

How have all the factors above been brought together to estimate a fair value?- The assumed bullish price target for ArcBest is $121.7, which represents two standard deviations above the consensus price target of $79.08. This valuation is based on what can be assumed as the expectations of ArcBest's future earnings growth, profit margins and other risk factors from analysts on the bullish end of the spectrum.

- However, there is a degree of disagreement amongst analysts, with the most bullish reporting a price target of $140.0, and the most bearish reporting a price target of just $58.0.

- In order for you to agree with the bullish analysts, you'd need to believe that by 2028, revenues will be $4.8 billion, earnings will come to $151.3 million, and it would be trading on a PE ratio of 21.3x, assuming you use a discount rate of 8.0%.

- Given the current share price of $58.54, the bullish analyst price target of $121.7 is 51.9% higher. Despite analysts expecting the underlying buisness to decline, they seem to believe it's more valuable than what the market thinks.

- We always encourage you to reach your own conclusions though. So sense check these analyst numbers against your own assumptions and expectations based on your understanding of the business and what you believe is probable.

How well do narratives help inform your perspective?

Disclaimer

AnalystHighTarget is a tool utilizing a Large Language Model (LLM) that ingests data on consensus price targets, forecasted revenue and earnings figures, as well as the transcripts of earnings calls to produce qualitative analysis. The narratives produced by AnalystHighTarget are general in nature and are based solely on analyst data and publicly-available material published by the respective companies. These scenarios are not indicative of the company's future performance and are exploratory in nature. Simply Wall St has no position in the company(s) mentioned. Simply Wall St may provide the securities issuer or related entities with website advertising services for a fee, on an arm's length basis. These relationships have no impact on the way we conduct our business, the content we host, or how our content is served to users. The price targets and estimates used are consensus data, and do not constitute a recommendation to buy or sell any stock, and they do not take account of your objectives, or your financial situation. Note that AnalystHighTarget's analysis may not factor in the latest price-sensitive company announcements or qualitative material.