Key Takeaways

- Allegiant's strategic capacity management and low fixed cost model enhance margins and position it to outperform competitors during economic challenges.

- Improvements in fleet, system enhancements, and potential asset sales drive financial performance, boost revenues, streamline operations, and strengthen the balance sheet.

- Economic uncertainty and strategic shifts, including selling non-core assets and managing fleet transitions, pose financial risks affecting Allegiant Travel's revenue growth and earnings stability.

Catalysts

About Allegiant Travel- A leisure travel company, provides travel and leisure services and products to residents of under-served cities in the United States.

- Allegiant's strategic focus on managing capacity by emphasizing peak leisure periods and cutting back during off-peak times is expected to drive improved margin performance and sustain profitability, even with current demand fluctuations. This approach aims to support net margins in the face of economic challenges.

- The introduction and operational success of the Boeing MAX fleet are set to enhance financial performance, with anticipated increases in ASM (Available Seat Mile) output from these aircraft supporting both operational efficiencies and cost savings. This improvement in fleet utilization is expected to impact overall earnings positively.

- Allegiant's structural advantages, such as minimizing competitive overlap and maintaining a low fixed cost model, are strategically designed to handle economic downturns, enabling the company to outperform peers and potentially increase its market share, ultimately impacting revenue positively.

- The expansion of Allegiant Extra and enhancements to the booking system Navitaire are contributing to record ancillary revenue per passenger, boosting total revenue even as base fares remain under pressure. Continued investment in these product enhancements is key to sustaining revenue growth.

- The potential sale of the Sunseeker Resort, with its financial performance already exceeding expectations, is anticipated to streamline the company’s focus back on its core airline operations, potentially reducing debt and improving the balance sheet, which could positively impact overall financial health and margins.

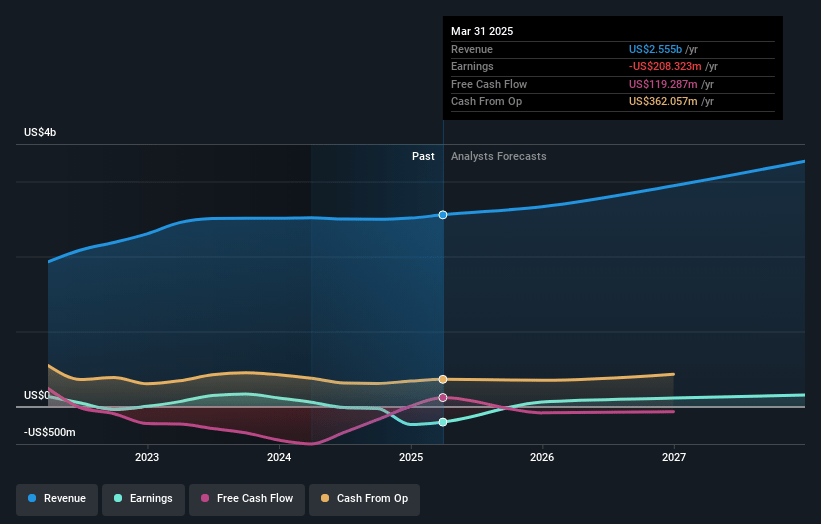

Allegiant Travel Future Earnings and Revenue Growth

Assumptions

How have these above catalysts been quantified?- Analysts are assuming Allegiant Travel's revenue will grow by 8.5% annually over the next 3 years.

- Analysts assume that profit margins will increase from -8.2% today to 6.8% in 3 years time.

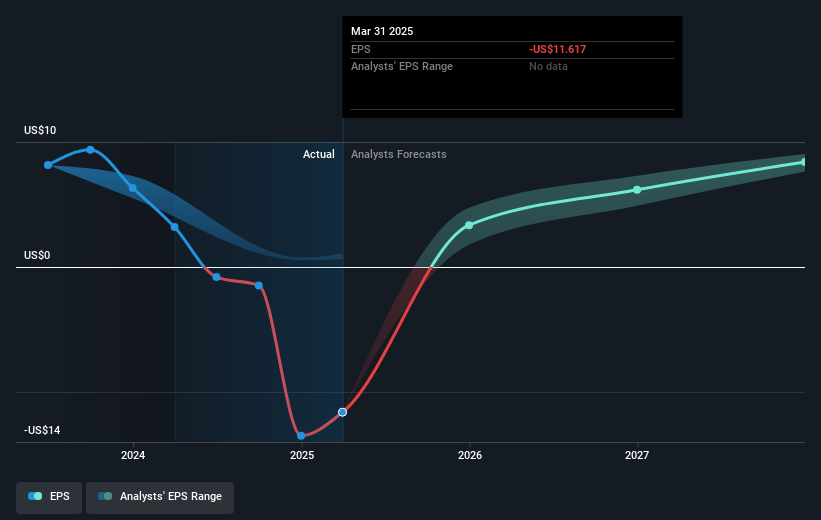

- Analysts expect earnings to reach $222.5 million (and earnings per share of $7.4) by about July 2028, up from $-208.3 million today.

- In order for the above numbers to justify the analysts price target, the company would need to trade at a PE ratio of 6.5x on those 2028 earnings, up from -4.4x today. This future PE is lower than the current PE for the US Airlines industry at 12.4x.

- Analysts expect the number of shares outstanding to decline by 0.24% per year for the next 3 years.

- To value all of this in today's terms, we will use a discount rate of 11.6%, as per the Simply Wall St company report.

Allegiant Travel Future Earnings Per Share Growth

Risks

What could happen that would invalidate this narrative?- Allegiant Travel faces economic uncertainty that may affect consumer confidence and discretionary spending, which could impact revenue growth as they may need to adjust capacity and pricing strategies.

- Despite strong performance, Allegiant has had to adapt its capacity plans due to demand softness, particularly during shoulder and off-peak periods, which could lead to fluctuations in net margins.

- The airline anticipates greater pressure on unit revenue performance in the second quarter compared to the first quarter, which could affect earnings stability.

- Allegiant plans to sell its Sunseeker Resort, highlighting a shift back to core airline operations due to financial priorities, but this divestiture carries execution risk that could affect financial statements in the interim.

- The airline's ongoing fleet transition to newer MAX aircraft, while currently beneficial, involves potential risks in fleet management and capital expenditure, which could affect cash flow and net margins if not managed efficiently.

Valuation

How have all the factors above been brought together to estimate a fair value?- The analysts have a consensus price target of $61.667 for Allegiant Travel based on their expectations of its future earnings growth, profit margins and other risk factors. However, there is a degree of disagreement amongst analysts, with the most bullish reporting a price target of $83.0, and the most bearish reporting a price target of just $45.0.

- In order for you to agree with the analyst's consensus, you'd need to believe that by 2028, revenues will be $3.3 billion, earnings will come to $222.5 million, and it would be trading on a PE ratio of 6.5x, assuming you use a discount rate of 11.6%.

- Given the current share price of $52.46, the analyst price target of $61.67 is 14.9% higher.

- We always encourage you to reach your own conclusions though. So sense check these analyst numbers against your own assumptions and expectations based on your understanding of the business and what you believe is probable.

How well do narratives help inform your perspective?

Disclaimer

AnalystConsensusTarget is a tool utilizing a Large Language Model (LLM) that ingests data on consensus price targets, forecasted revenue and earnings figures, as well as the transcripts of earnings calls to produce qualitative analysis. The narratives produced by AnalystConsensusTarget are general in nature and are based solely on analyst data and publicly-available material published by the respective companies. These scenarios are not indicative of the company's future performance and are exploratory in nature. Simply Wall St has no position in the company(s) mentioned. Simply Wall St may provide the securities issuer or related entities with website advertising services for a fee, on an arm's length basis. These relationships have no impact on the way we conduct our business, the content we host, or how our content is served to users. The price targets and estimates used are consensus data, and do not constitute a recommendation to buy or sell any stock, and they do not take account of your objectives, or your financial situation. Note that AnalystConsensusTarget's analysis may not factor in the latest price-sensitive company announcements or qualitative material.