Key Takeaways

- Spectrum monetization, tower asset growth, and cost efficiencies are driving stronger balance sheet, profitability, and high-margin recurring revenue opportunities.

- Strategic rural market focus and digital initiatives position the company to benefit from rising demand for broadband and connectivity infrastructure.

- Sale of core business and industry headwinds expose the company to uncertainty, execution risk, declining relevance, and challenges sustaining revenues and shareholder returns.

Catalysts

About United States Cellular- Provides wireless telecommunications services in the United States.

- UScellular’s targeted spectrum monetization strategy, especially its large C-band holdings, provides a significant forward-looking catalyst as industry demand for prime 5G spectrum accelerates due to surging mobile data usage, IoT adoption, and expansion of smart devices; successful sales at values above book and market could unlock one-time gains and transform the balance sheet, directly impacting net income and opening capital return opportunities.

- The closing of the T-Mobile transaction and subsequent spectrum sales will generate substantial cash proceeds, which management expects to deploy into debt reduction, shareholder returns, and investment in core assets; these actions will strengthen the capital structure, improve net margins through lower interest expense, and offer the flexibility to fund new growth initiatives.

- Expansion and optimization of UScellular’s tower portfolio, with increased co-location commitments from T-Mobile and strong underlying demand for network densification from all carriers, positions the company to benefit from ongoing industry requirements for network reliability and coverage, which are essential for attracting and retaining customers and will drive recurring, high-margin revenue growth from tower leasing.

- The company's disciplined execution on operational efficiencies, including ongoing cost optimization and digital transformation efforts, has already driven improvements in EBITDA and free cash flow in 2024; these productive trends are expected to further enhance profitability and support higher earnings as scale and automation increase across remaining business lines.

- Long-term exposure to rural and underserved markets, coupled with new federal and state digital inclusion initiatives, places UScellular and its fiber operations in a unique position to accelerate revenue growth as broadband and wireless connectivity become mandatory infrastructure in these regions, broadening the addressable market and supporting resilient topline expansion for years to come.

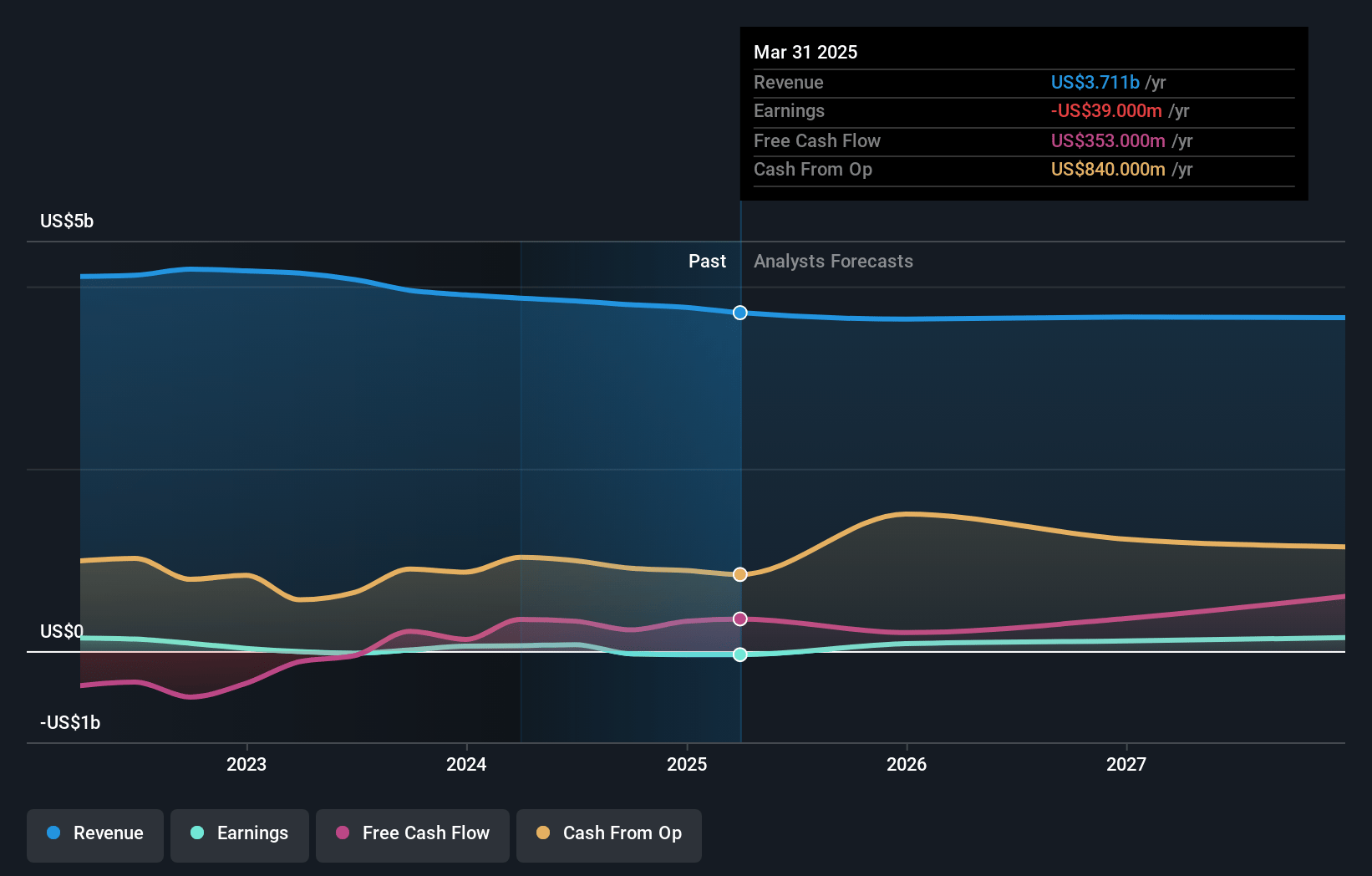

United States Cellular Future Earnings and Revenue Growth

Assumptions

How have these above catalysts been quantified?- This narrative explores a more optimistic perspective on United States Cellular compared to the consensus, based on a Fair Value that aligns with the bullish cohort of analysts.

- The bullish analysts are assuming United States Cellular's revenue will decrease by 0.6% annually over the next 3 years.

- The bullish analysts assume that profit margins will increase from -1.0% today to 5.9% in 3 years time.

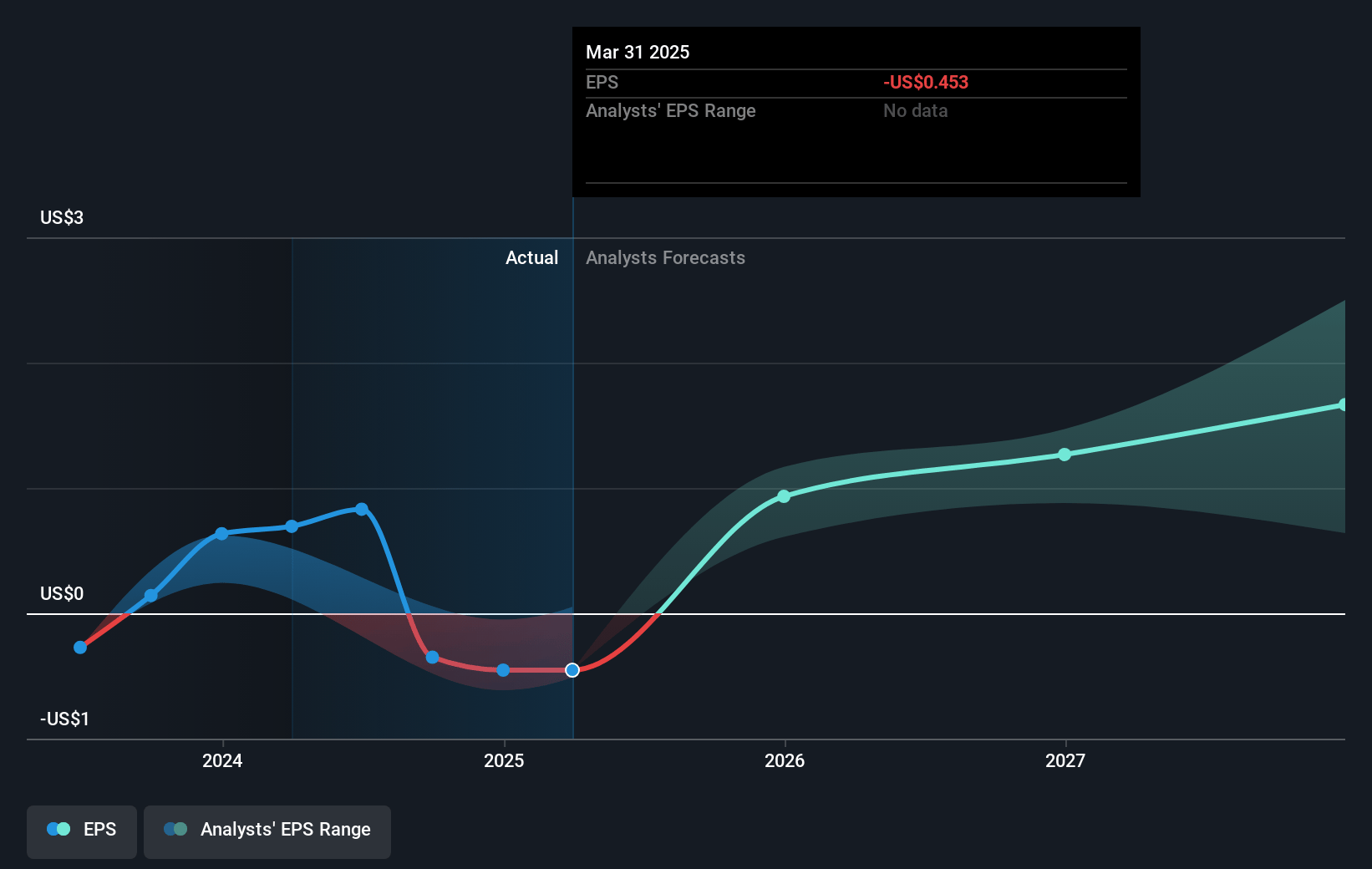

- The bullish analysts expect earnings to reach $220.3 million (and earnings per share of $2.5) by about April 2028, up from $-39.0 million today. The analysts are largely in agreement about this estimate.

- In order for the above numbers to justify the price target of the more bullish analyst cohort, the company would need to trade at a PE ratio of 40.7x on those 2028 earnings, up from -147.0x today. This future PE is greater than the current PE for the US Wireless Telecom industry at 14.8x.

- Analysts expect the number of shares outstanding to remain consistent over the next 3 years.

- To value all of this in today's terms, we will use a discount rate of 6.21%, as per the Simply Wall St company report.

United States Cellular Future Earnings Per Share Growth

Risks

What could happen that would invalidate this narrative?- The company's core wireless business is being sold to T-Mobile, and the remaining value relies heavily on the performance and monetization of its tower assets and retained spectrum. This exposes future revenues and cash flows to uncertainty around tower tenancy rates, decommissioning costs, and the ability to opportunistically sell spectrum at attractive prices, all of which could result in materially lower recurring earnings and reduce upside for shareholders.

- UScellular continues to lose retail wireless subscribers and saw a decline in service revenues, indicating persistent challenges in retaining customers in its legacy footprint. This trend, combined with secular population shifts away from rural areas, threatens long-term revenue stability and puts pressure on the sustainability of any remaining or new business lines.

- The company faces significant execution risk linked to the pending transaction with T-Mobile, which is not guaranteed to close due to regulatory and other conditions. If the transaction fails, UScellular will be left as a subscale regional carrier with declining market share, high capital requirements for network investment, and continued industry commoditization, likely negatively impacting both net margins and future earnings.

- Ongoing industry consolidation favors much larger, national operators that benefit from economies of scale in capital investment and vendor negotiations, leaving TDS and UScellular with structurally lower net margins and reduced ability to match competitors on price or technological advancement. This trend makes it harder for the company to defend or grow its revenue base over time.

- Technological disruption, including the emergence of satellite-based wireless broadband and aggressive fiber expansion by others, threatens UScellular’s and TDS's relevance in rural and regional broadband. This could not only erode long-term average revenue per user but also displace existing customers, placing downward pressure on revenues and future earnings streams.

Valuation

How have all the factors above been brought together to estimate a fair value?- The assumed bullish price target for United States Cellular is $88.0, which is the highest price target estimate amongst analysts. This valuation is based on what can be assumed as the expectations of United States Cellular's future earnings growth, profit margins and other risk factors from analysts on the bullish end of the spectrum.

- However, there is a degree of disagreement amongst analysts, with the most bullish reporting a price target of $88.0, and the most bearish reporting a price target of just $59.32.

- In order for you to agree with the bullish analysts, you'd need to believe that by 2028, revenues will be $3.7 billion, earnings will come to $220.3 million, and it would be trading on a PE ratio of 40.7x, assuming you use a discount rate of 6.2%.

- Given the current share price of $67.35, the bullish analyst price target of $88.0 is 23.5% higher.

- We always encourage you to reach your own conclusions though. So sense check these analyst numbers against your own assumptions and expectations based on your understanding of the business and what you believe is probable.

How well do narratives help inform your perspective?

Disclaimer

AnalystHighTarget is an employee of Simply Wall St, but has written this narrative in their capacity as an individual investor. AnalystHighTarget holds no position in NYSE:USM. Simply Wall St has no position in the company(s) mentioned. Simply Wall St may provide the securities issuer or related entities with website advertising services for a fee, on an arm's length basis. These relationships have no impact on the way we conduct our business, the content we host, or how our content is served to users. This narrative is general in nature and explores scenarios and estimates created by the author. The narrative does not reflect the opinions of Simply Wall St, and the views expressed are the opinion of the author alone, acting on their own behalf. These scenarios are not indicative of the company's future performance and are exploratory in the ideas they cover. The fair value estimate's are estimations only, and does not constitute a recommendation to buy or sell any stock, and they do not take account of your objectives, or your financial situation. Note that the author's analysis may not factor in the latest price-sensitive company announcements or qualitative material.