Key Takeaways

- Expanding device connectivity and focus on high-margin services are driving improved revenue quality, recurring earnings, and increased operating leverage.

- Investments in innovation and customer retention are strengthening cross-sell opportunities, while operational efficiency supports free cash flow and strategic flexibility.

- Ongoing revenue decline, customer concentration risk, commoditization, sustained net losses, and unclear reporting metrics threaten long-term growth, profitability, and financial transparency.

Catalysts

About KORE Group Holdings- Provides Internet of Things (IoT) services and solutions worldwide.

- The company is seeing accelerating growth in device connections (approaching 20 million, up 8% YoY) and a healthy pipeline of new customer logos, directly benefiting from the ongoing global proliferation of connected devices in industries like healthcare, logistics, and manufacturing. This expanding device base supports future recurring connectivity revenue growth.

- The maturation of 5G infrastructure and adoption of eSIM/multi-carrier technologies are enabling KORE to deliver new high-value solutions, increase average revenue per user in select use cases, and penetrate innovative verticals like connected vehicles and global HVAC—positioning the company to capitalize on new IoT use cases and technological upgrades. These trends are likely to raise both topline revenue and gross margins.

- The company is shifting its revenue mix toward higher-margin services by exiting low-margin hardware contracts and focusing on recurring connectivity and managed IoT solutions; this is already resulting in improved adjusted EBITDA margin (up 60 bps YoY), and is expected to continue driving net margin expansion and operating leverage.

- Strategic investments in product innovation (AI-driven workflow automation, Super SIM, cloud platform enhancements) and customer intimacy (partner integrations and increased “stickiness”) are expected to unlock further cross-sell opportunities and strengthen customer retention, leading to more stable and predictable earnings over time.

- Ongoing free cash flow improvement, driven by operational efficiency, cost structure optimization, and a multi-quarter focus on profitable growth, provides more flexibility for reinvestment and positions the company well to benefit from industry consolidation—supporting future earnings and shareholder value creation.

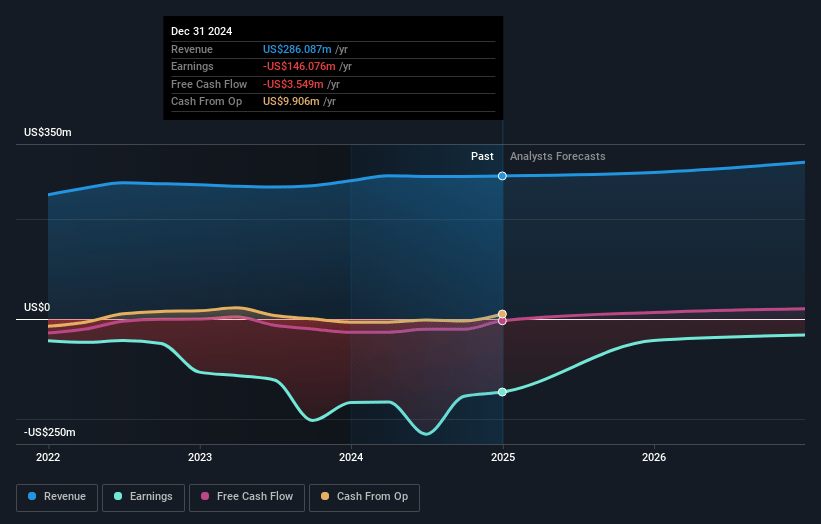

KORE Group Holdings Future Earnings and Revenue Growth

Assumptions

How have these above catalysts been quantified?- Analysts are assuming KORE Group Holdings's revenue will grow by 5.9% annually over the next 3 years.

- Analysts are not forecasting that KORE Group Holdings will become profitable in next 3 years. To represent the Analyst Price Target as a Future PE Valuation we will estimate KORE Group Holdings's profit margin will increase from -50.8% to the average US Wireless Telecom industry of 10.7% in 3 years.

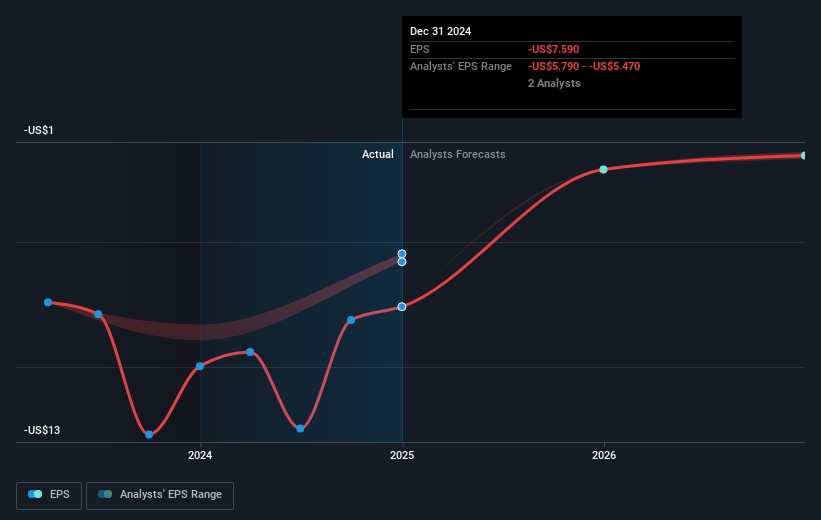

- If KORE Group Holdings's profit margin were to converge on the industry average, you could expect earnings to reach $36.0 million (and earnings per share of $2.12) by about May 2028, up from $-143.4 million today. The analysts are largely in agreement about this estimate.

- In order for the above numbers to justify the analysts price target, the company would need to trade at a PE ratio of 3.9x on those 2028 earnings, up from -0.2x today. This future PE is lower than the current PE for the US Wireless Telecom industry at 16.9x.

- Analysts expect the number of shares outstanding to grow by 1.04% per year for the next 3 years.

- To value all of this in today's terms, we will use a discount rate of 11.41%, as per the Simply Wall St company report.

KORE Group Holdings Future Earnings Per Share Growth

Risks

What could happen that would invalidate this narrative?- Declining year-over-year revenue, driven primarily by lower IoT Connectivity revenue and a notable decrease in ARPU, signals ongoing pressures in KORE’s core business and threatens long-term revenue growth if not reversed. (Revenue)

- Heavy reliance on growth from new logos versus expansion within the existing customer base may indicate underlying customer concentration risk and make future earnings less predictable; overdependence on new customer acquisition is vulnerable to cyclical slowdowns and competitive pressures. (Revenue/Earnings Volatility)

- Commoditization and expansion into lower-ARPU use cases, as highlighted by the influx of lower ARPU connections, could continue to depress average revenue per user and exert downward pressure on gross margins. (Net Margins)

- Although operating expenses have been reduced due to restructuring, the company continues to operate at a net loss, and any reversal of these cost cuts or failure to sustain operational efficiency gains could again erode profitability. (Net Margins/Earnings)

- Absence of clear historic comparables for new reporting metrics (such as eARR over TCV) and the lack of visibility on pipeline conversion rates may obscure true long-term recurring revenue growth, increasing the risk that reported financial improvements are not sustainable or indicative of broader market success. (Revenue Predictability)

Valuation

How have all the factors above been brought together to estimate a fair value?- The analysts have a consensus price target of $6.0 for KORE Group Holdings based on their expectations of its future earnings growth, profit margins and other risk factors. However, there is a degree of disagreement amongst analysts, with the most bullish reporting a price target of $9.0, and the most bearish reporting a price target of just $3.0.

- In order for you to agree with the analyst's consensus, you'd need to believe that by 2028, revenues will be $335.3 million, earnings will come to $36.0 million, and it would be trading on a PE ratio of 3.9x, assuming you use a discount rate of 11.4%.

- Given the current share price of $2.05, the analyst price target of $6.0 is 65.8% higher.

- We always encourage you to reach your own conclusions though. So sense check these analyst numbers against your own assumptions and expectations based on your understanding of the business and what you believe is probable.

How well do narratives help inform your perspective?

Disclaimer

AnalystConsensusTarget is a tool utilizing a Large Language Model (LLM) that ingests data on consensus price targets, forecasted revenue and earnings figures, as well as the transcripts of earnings calls to produce qualitative analysis. The narratives produced by AnalystConsensusTarget are general in nature and are based solely on analyst data and publicly-available material published by the respective companies. These scenarios are not indicative of the company's future performance and are exploratory in nature. Simply Wall St has no position in the company(s) mentioned. Simply Wall St may provide the securities issuer or related entities with website advertising services for a fee, on an arm's length basis. These relationships have no impact on the way we conduct our business, the content we host, or how our content is served to users. The price targets and estimates used are consensus data, and do not constitute a recommendation to buy or sell any stock, and they do not take account of your objectives, or your financial situation. Note that AnalystConsensusTarget's analysis may not factor in the latest price-sensitive company announcements or qualitative material.