Last Update01 May 25

Key Takeaways

- Gogo's expansion into untapped business jet markets aims to boost revenue, especially from jets lacking broadband outside North America.

- Introduction of new terminals and strategic partnerships will diversify revenue, enhance margins, and reduce competition risk from single-network providers.

- Delays and execution risks in new technologies and competitive pressures may constrain revenue growth and impact cash flow, EBITDA, and market share.

Catalysts

About Gogo- Provides broadband connectivity services to the aviation industry in the United States and internationally.

- Gogo is betting on the growth of broadband in-flight connectivity, with only 36% of the world's business jets currently equipped. They aim to increase revenue by addressing the untapped market of 12,000 jets and turboprops lacking broadband solutions, particularly outside North America.

- The launch of the Galileo HDX and FDX terminals will diversify revenue streams and provide higher-margin service revenue starting in 2026, increasing earnings from new customers and reducing competition risk from current single-network providers like Starlink.

- Gogo's integration with Satcom Direct enhances their capabilities in international markets and MilGov sectors, positioning them for growth in these high-demand areas and expected increased service revenue and margins from governmental contracts.

- A significant free cash flow inflection is expected in 2026 due to the $60 million reduction in investments, as major programs are completed, leading to improved earnings and net margins.

- The combination of Gogo's multi-bearer, multi-band, and multi-orbit technologies is expected to extend customer lifetimes and increase recurring revenue from easily upgradable systems, improving overall earnings stability and reducing churn.

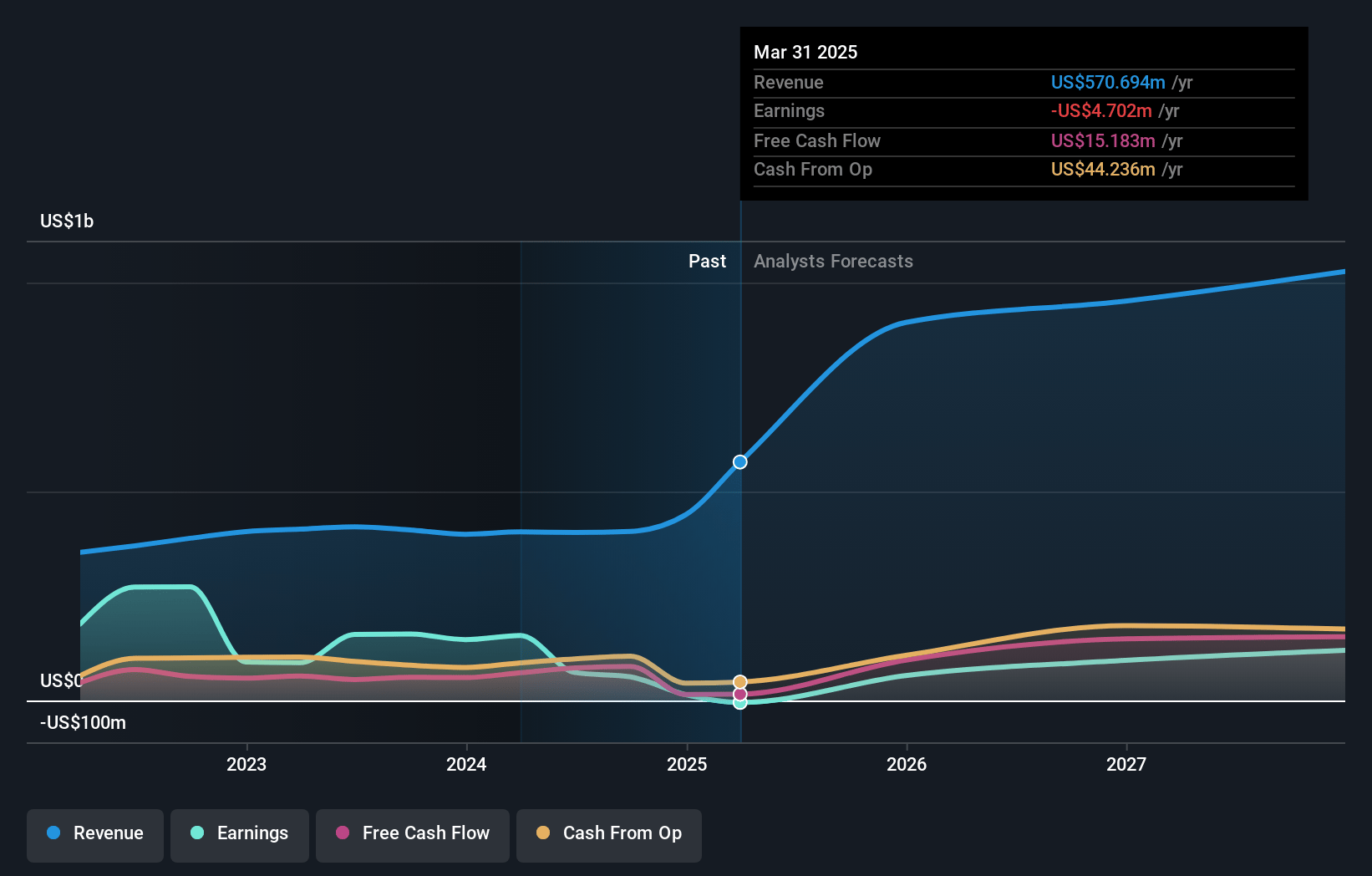

Gogo Future Earnings and Revenue Growth

Assumptions

How have these above catalysts been quantified?- Analysts are assuming Gogo's revenue will grow by 41.9% annually over the next 3 years.

- Analysts assume that profit margins will increase from 3.1% today to 12.2% in 3 years time.

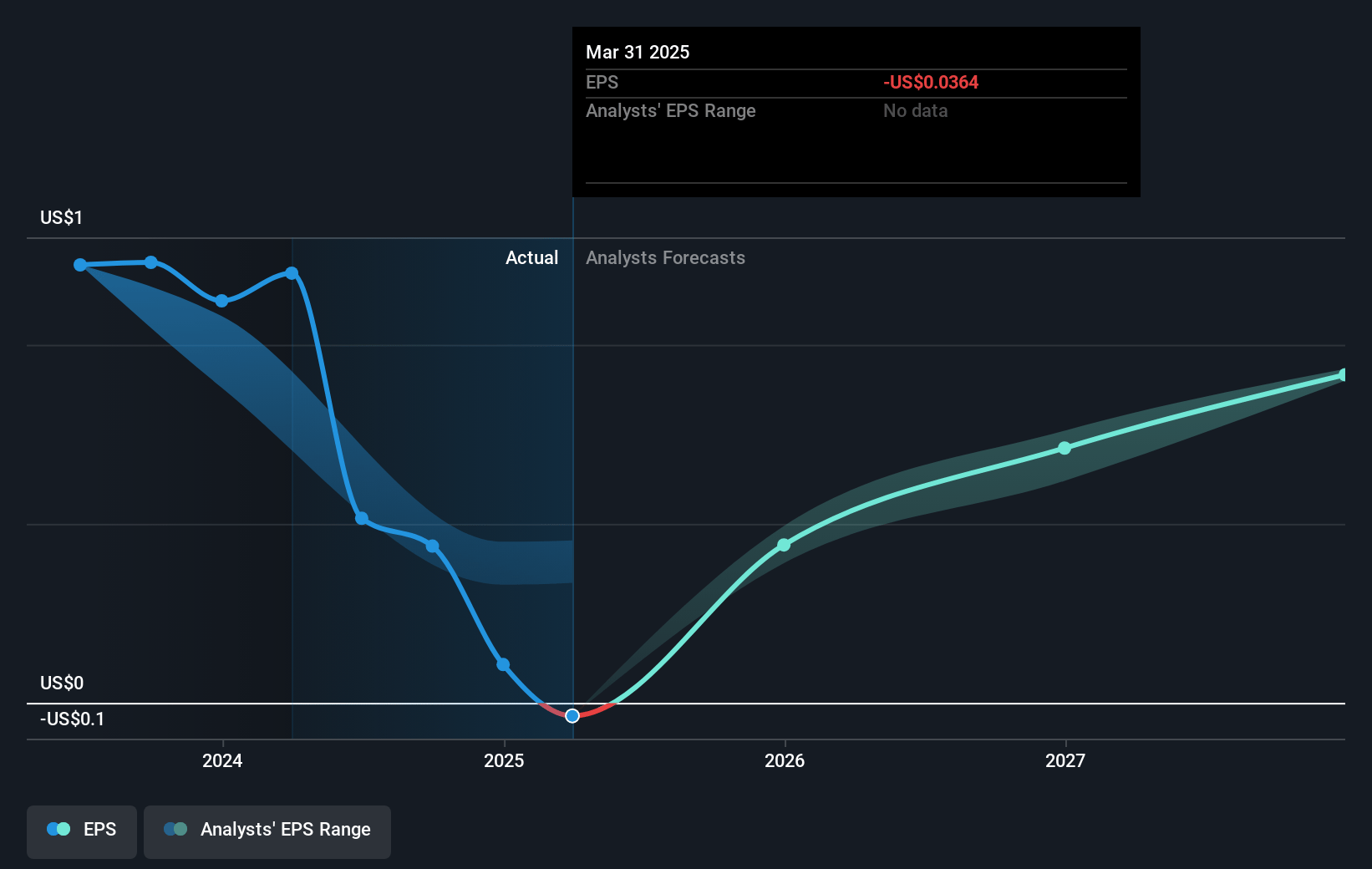

- Analysts expect earnings to reach $155.4 million (and earnings per share of $1.17) by about May 2028, up from $13.7 million today. The analysts are largely in agreement about this estimate.

- In order for the above numbers to justify the analysts price target, the company would need to trade at a PE ratio of 12.8x on those 2028 earnings, down from 74.2x today. This future PE is lower than the current PE for the US Wireless Telecom industry at 14.8x.

- Analysts expect the number of shares outstanding to grow by 3.34% per year for the next 3 years.

- To value all of this in today's terms, we will use a discount rate of 6.41%, as per the Simply Wall St company report.

Gogo Future Earnings Per Share Growth

Risks

What could happen that would invalidate this narrative?- Delays in obtaining PMA approval for the HDX terminal and slip-ups in the Gogo 5G timeline may disrupt revenue growth projections, affecting cash flow and EBITDA in the short term.

- Competitive pressures from companies like Starlink could impact Gogo's market share in business aviation, potentially limiting revenue potential and pressuring profit margins, particularly if they cannot maintain pricing power.

- High capital expenditures and investments related to updating network technologies, the Galileo product line, and Rip and Replace programs may limit free cash flow and affect Gogo's ability to return capital to shareholders, constraining near-term financial flexibility.

- The integration of Satcom Direct and realization of synergies involve execution risks, and any delays or setbacks could affect expected cost savings and operational efficiencies, impacting EBITDA margins.

- Dependence on the successful delivery and performance of new technologies like the 5G chip and the implementation of multiorbit capabilities means any technical or regulatory hurdles could delay revenue recognition, influencing top and bottom-line growth.

Valuation

How have all the factors above been brought together to estimate a fair value?- The analysts have a consensus price target of $11.5 for Gogo based on their expectations of its future earnings growth, profit margins and other risk factors. However, there is a degree of disagreement amongst analysts, with the most bullish reporting a price target of $13.0, and the most bearish reporting a price target of just $10.0.

- In order for you to agree with the analyst's consensus, you'd need to believe that by 2028, revenues will be $1.3 billion, earnings will come to $155.4 million, and it would be trading on a PE ratio of 12.8x, assuming you use a discount rate of 6.4%.

- Given the current share price of $7.77, the analyst price target of $11.5 is 32.4% higher.

- We always encourage you to reach your own conclusions though. So sense check these analyst numbers against your own assumptions and expectations based on your understanding of the business and what you believe is probable.

How well do narratives help inform your perspective?

Disclaimer

AnalystConsensusTarget is a tool utilizing a Large Language Model (LLM) that ingests data on consensus price targets, forecasted revenue and earnings figures, as well as the transcripts of earnings calls to produce qualitative analysis. The narratives produced by AnalystConsensusTarget are general in nature and are based solely on analyst data and publicly-available material published by the respective companies. These scenarios are not indicative of the company's future performance and are exploratory in nature. Simply Wall St has no position in the company(s) mentioned. Simply Wall St may provide the securities issuer or related entities with website advertising services for a fee, on an arm's length basis. These relationships have no impact on the way we conduct our business, the content we host, or how our content is served to users. The price targets and estimates used are consensus data, and do not constitute a recommendation to buy or sell any stock, and they do not take account of your objectives, or your financial situation. Note that AnalystConsensusTarget's analysis may not factor in the latest price-sensitive company announcements or qualitative material.