Key Takeaways

- Successful cost integration from Sprint assets is boosting net margins, with potential exceeding of savings targets expected through 2026.

- Expansion of data center footprint and enhancements in service capability are driving revenue growth and tapping into new market opportunities, with positive impacts on earnings and shareholder value.

- Increased competitive pressure and strategic challenges in revenue growth, along with financial strain, could impact Cogent's market position and investor confidence.

Catalysts

About Cogent Communications Holdings- Through its subsidiaries, provides high-speed Internet access, private network, and data center colocation space services in North America, South America, Europe, Oceania, and Africa.

- Cogent Communications Holdings is realizing significant cost savings from the integration of Sprint assets, achieving over 90% of its targeted $220 million in annual savings, projected to continue through 2026 and potentially exceed initial targets. This is likely to impact net margins positively.

- The company's wavelength revenue grew by 124% year-over-year and is expected to continue accelerating as Cogent enhances its service capability and reduces provisioning times, which could lead to increased revenue.

- Cogent's extensive data center footprint expansion and conversion of Sprint facilities into edge data centers position the company to tap into new market opportunities, supporting revenue growth and potential earnings expansion.

- The company's Board of Directors increased the quarterly dividend for the 50th consecutive time, indicating confidence in future cash flow generation, which is positive for earnings and shareholder value.

- Cogent plans to monetize excess IPv4 addresses and data center space, either through direct sales or long-term leases, expected to be finalized over the next several months, potentially improving revenue and net margins.

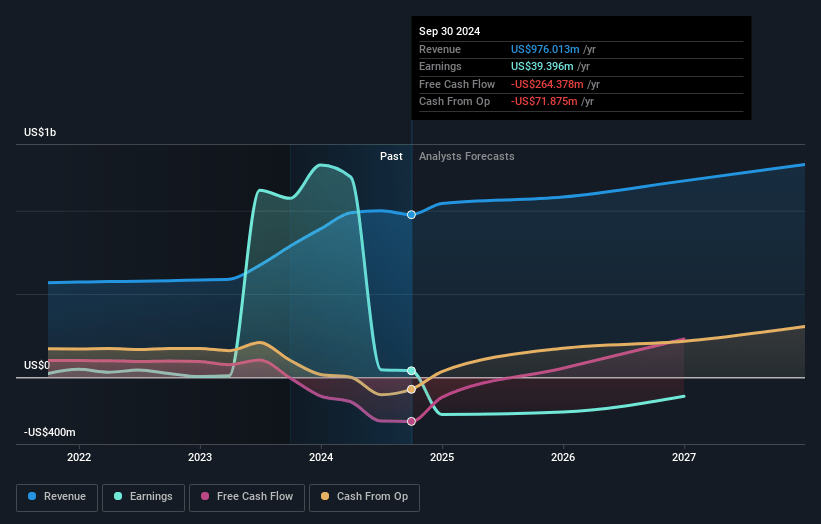

Cogent Communications Holdings Future Earnings and Revenue Growth

Assumptions

How have these above catalysts been quantified?- Analysts are assuming Cogent Communications Holdings's revenue will grow by 8.0% annually over the next 3 years.

- Analysts are not forecasting that Cogent Communications Holdings will become profitable in next 3 years. To represent the Analyst Price Target as a Future PE Valuation we will estimate Cogent Communications Holdings's profit margin will increase from -21.4% to the average US Telecom industry of 12.6% in 3 years.

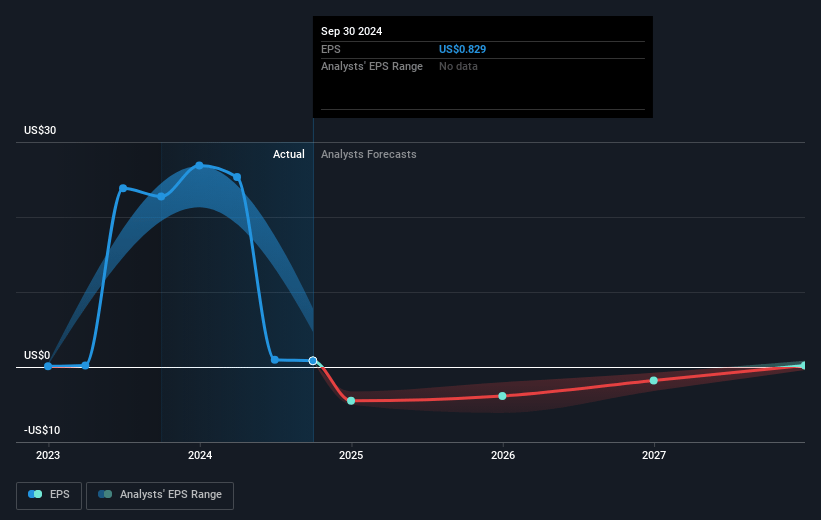

- If Cogent Communications Holdings's profit margin were to converge on the industry average, you could expect earnings to reach $152.1 million (and earnings per share of $3.17) by about April 2028, up from $-204.1 million today.

- In order for the above numbers to justify the analysts price target, the company would need to trade at a PE ratio of 30.6x on those 2028 earnings, up from -11.9x today. This future PE is greater than the current PE for the US Telecom industry at 12.8x.

- Analysts expect the number of shares outstanding to grow by 0.88% per year for the next 3 years.

- To value all of this in today's terms, we will use a discount rate of 6.21%, as per the Simply Wall St company report.

Cogent Communications Holdings Future Earnings Per Share Growth

Risks

What could happen that would invalidate this narrative?- Increased competition in wavelength services from established players like Lumen and Zayo, who are also investing in wave capabilities, could pressure Cogent's market share and potentially limit revenue growth.

- The company's reliance on price increases for IPv4 leasing to drive revenue growth might face resistance from customers, leading to potential decline in demand and affecting future revenue streams.

- Corporate and enterprise segments are experiencing declines due to grooming of non-core and low-margin services; this may take several quarters to stabilize and could continue to depress revenue and EBITDA in the short term.

- Elevated capital expenditures, particularly related to data center conversion and integration, could strain cash flows if expected monetization of these assets does not occur timely or at anticipated values.

- The leverage ratio is expected to increase, potentially surpassing targets, which could raise concerns among investors about the company’s financial health and its ability to sustain or grow dividends, thus affecting investor confidence and share valuation.

Valuation

How have all the factors above been brought together to estimate a fair value?- The analysts have a consensus price target of $80.909 for Cogent Communications Holdings based on their expectations of its future earnings growth, profit margins and other risk factors. However, there is a degree of disagreement amongst analysts, with the most bullish reporting a price target of $102.0, and the most bearish reporting a price target of just $60.0.

- In order for you to agree with the analyst's consensus, you'd need to believe that by 2028, revenues will be $1.2 billion, earnings will come to $152.1 million, and it would be trading on a PE ratio of 30.6x, assuming you use a discount rate of 6.2%.

- Given the current share price of $51.15, the analyst price target of $80.91 is 36.8% higher.

- We always encourage you to reach your own conclusions though. So sense check these analyst numbers against your own assumptions and expectations based on your understanding of the business and what you believe is probable.

How well do narratives help inform your perspective?

Disclaimer

Warren A.I. is a tool utilizing a Large Language Model (LLM) that ingests data on consensus price targets, forecasted revenue and earnings figures, as well as the transcripts of earnings calls to produce qualitative analysis. The narratives produced by Warren A.I. are general in nature and are based solely on analyst data and publicly-available material published by the respective companies. These scenarios are not indicative of the company's future performance and are exploratory in nature. Simply Wall St has no position in the company(s) mentioned. Simply Wall St may provide the securities issuer or related entities with website advertising services for a fee, on an arm's length basis. These relationships have no impact on the way we conduct our business, the content we host, or how our content is served to users. The price targets and estimates used are consensus data, and do not constitute a recommendation to buy or sell any stock, and they do not take account of your objectives, or your financial situation. Note that Warren A.I.'s analysis may not factor in the latest price-sensitive company announcements or qualitative material.