Narratives are currently in beta

Key Takeaways

- Adoption of technologies and strategic partnerships like with Costco could drive revenue growth and strengthen market share.

- Investments in EV infrastructure solutions may support long-term revenue expansion by driving growth in adjacent markets.

- Unfavorable market conditions and shifting event schedules challenge revenue growth and margins, while strong aftermarket sales face sustainability concerns amidst macroeconomic pressures on consumer spending.

Catalysts

About Vontier- Provides mobility ecosystem solutions worldwide.

- Increased adoption of market-leading technologies, such as the FlexPay 6 payment terminal and vehicle identification system, is expected to drive revenue growth and possibly enhance net margins by improving operational efficiencies.

- The expansion of new site build activity and retrofit activity, supported by products like the FlexPay 6 and iNFX microservices software, may fuel future revenue growth.

- Strategic partnerships, like the one with Costco deploying payment solutions, could bolster market share and positively impact revenue.

- Wins in international tenders, especially in India, highlight growth opportunities in Environmental Fueling Solutions, likely boosting revenues and operating margins.

- Investments in innovative EV infrastructure solutions through offerings like the Konect EV charging stations could drive growth in adjacent markets, supporting long-term revenue expansion and possibly expanding net margins.

Vontier Future Earnings and Revenue Growth

Assumptions

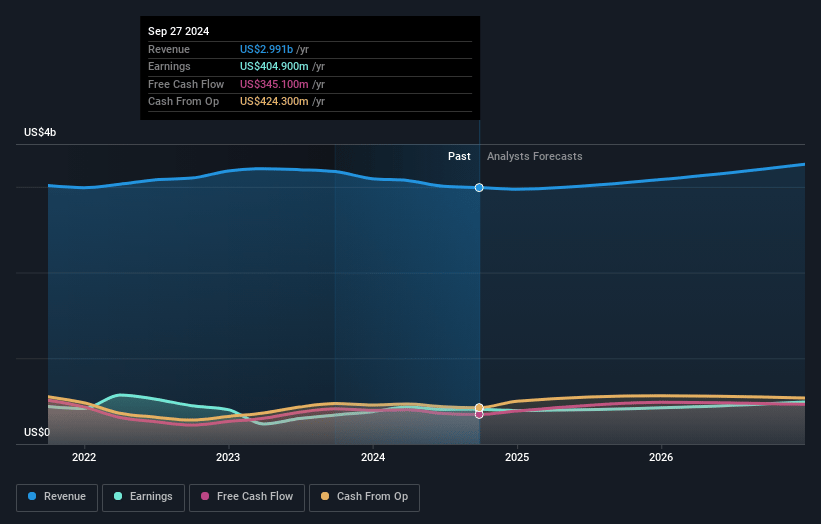

How have these above catalysts been quantified?- Analysts are assuming Vontier's revenue will grow by 5.9% annually over the next 3 years.

- Analysts assume that profit margins will increase from 13.5% today to 15.5% in 3 years time.

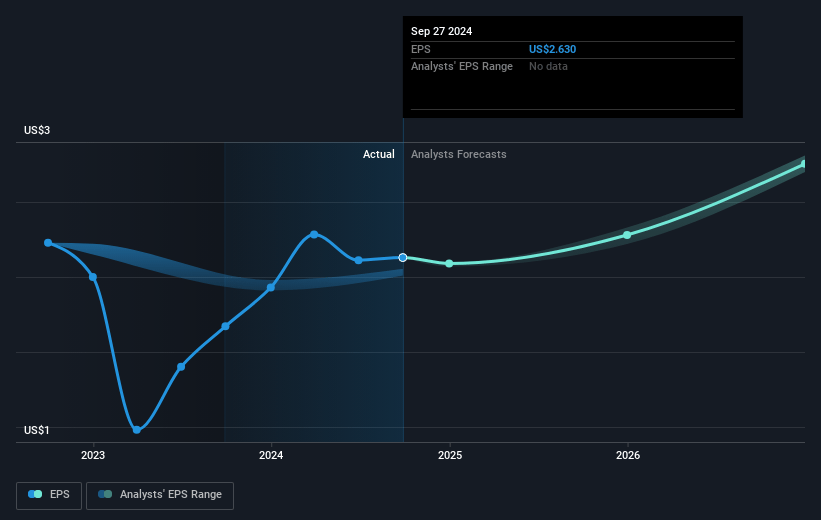

- Analysts expect earnings to reach $551.1 million (and earnings per share of $3.67) by about November 2027, up from $404.9 million today.

- In order for the above numbers to justify the analysts price target, the company would need to trade at a PE ratio of 14.5x on those 2027 earnings, which is the same as it is today today. This future PE is lower than the current PE for the US Electronic industry at 24.0x.

- Analysts expect the number of shares outstanding to remain consistent over the next 3 years.

- To value all of this in today's terms, we will use a discount rate of 7.97%, as per the Simply Wall St company report.

Vontier Future Earnings Per Share Growth

Risks

What could happen that would invalidate this narrative?- The car wash and auto repair markets are facing near-term pressure, which may lead to reduced revenues for Vontier in these segments. This could impact overall revenue growth.

- The adjusted operating profit margin declined by 80 basis points, primarily due to an unfavorable sales mix and reduced volumes in certain segments, which may continue to impact net margins if these trends persist.

- The shift of the Matco Expo event from Q1 to Q2 in 2025 could affect the typical revenue and earnings seasonality, potentially impacting quarterly earnings performance and investor expectations.

- The strong growth in aftermarket parts sales, while a positive for revenue, may not be sustainable long-term if the current surge in retrofitting and refresh activities slows down, impacting future revenue streams.

- Unfavorable macroeconomic conditions, especially affecting discretionary spending by consumers and service technicians, could continue to put pressure on certain business segments such as Repair Solutions, impacting future earnings potential.

Valuation

How have all the factors above been brought together to estimate a fair value?- The analysts have a consensus price target of $42.31 for Vontier based on their expectations of its future earnings growth, profit margins and other risk factors.

- In order for you to agree with the analyst's consensus, you'd need to believe that by 2027, revenues will be $3.5 billion, earnings will come to $551.1 million, and it would be trading on a PE ratio of 14.5x, assuming you use a discount rate of 8.0%.

- Given the current share price of $39.12, the analyst's price target of $42.31 is 7.5% higher. The relatively low difference between the current share price and the analyst consensus price target indicates that they believe on average, the company is fairly priced.

- We always encourage you to reach your own conclusions though. So sense check these analyst numbers against your own assumptions and expectations based on your understanding of the business and what you believe is probable.

How well do narratives help inform your perspective?

Disclaimer

Warren A.I. is a tool utilizing a Large Language Model (LLM) that ingests data on consensus price targets, forecasted revenue and earnings figures, as well as the transcripts of earnings calls to produce qualitative analysis. The narratives produced by Warren A.I. are general in nature and are based solely on analyst data and publicly-available material published by the respective companies. These scenarios are not indicative of the company's future performance and are exploratory in nature. Simply Wall St has no position in the company(s) mentioned. The price targets and estimates used are consensus data, and do not constitute a recommendation to buy or sell any stock, and they do not take account of your objectives, or your financial situation. Note that Warren A.I.'s analysis may not factor in the latest price-sensitive company announcements or qualitative material.

Read more narratives

US$48.67

FV

22.7% undervalued intrinsic discount9.23%

Revenue growth p.a.

4users have liked this narrative

0users have commented on this narrative

2users have followed this narrative

5 days ago author updated this narrative