Key Takeaways

- Expanding demand for AI data centers, electrified vehicles, and renewable energy supports strong top-line growth, outperformance, and a sustainable pipeline of high-margin projects.

- Manufacturing localization and operational optimizations are driving margin expansion and high earnings conversion, enabling further investment in growth opportunities and acquisitions.

- Heavy reliance on specific markets, geographic concentration, and shifting customer preferences expose the company to margin pressure, integration risks, and potential declines in long-term growth.

Catalysts

About TE Connectivity- Manufactures and sells connectivity and sensor solutions in Europe, the Middle East, Africa, the Asia–Pacific, and the Americas.

- TE Connectivity's rapid revenue growth in AI-driven data center infrastructure demonstrates the increasing global demand for high-performance connectivity, supported by a near tripling of AI-related revenue from $300M to over $800M in fiscal 2025; continued investment and scaling suggest this trend will fuel further top-line growth and maintain above-segment margins.

- The accelerating transition toward electrified powertrains and rising electronic content in vehicles, especially in Asia, positions TE Connectivity to outperform global auto production as demand for its sensors and power/data connectors expands, supporting sustained revenue outperformance versus the underlying market.

- Structural investments in manufacturing localization (over 70% now localized) and operational footprint optimization have enabled margin expansion-highlighted by Industrial segment margins rising nearly 400bps year-over-year-which should continue to support strong incremental earnings conversion as volumes grow.

- Robust momentum in grid hardening and renewable energy applications, bolstered by recent acquisitions in the Energy segment, is unlocking new addressable markets and building a sustainable pipeline of high-margin, mission-critical projects, underpinning both near

- and long-term revenue and earnings growth.

- Broad-based order growth, especially in Industrial and Energy markets, coupled with positive early signs of recovery in factory automation, creates a durable foundation for double-digit EPS growth and high free cash flow conversion (>100%), further strengthening the company's capacity to invest in secular tailwinds or execute value-accretive acquisitions.

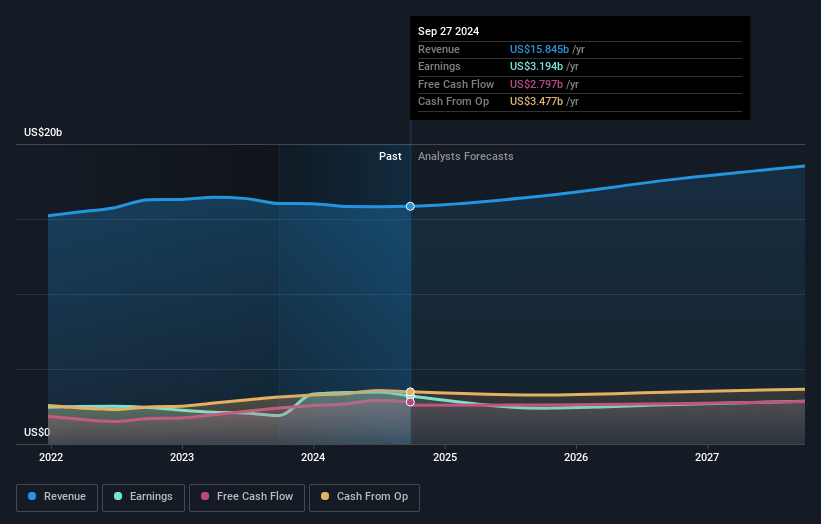

TE Connectivity Future Earnings and Revenue Growth

Assumptions

How have these above catalysts been quantified?- Analysts are assuming TE Connectivity's revenue will grow by 6.8% annually over the next 3 years.

- Analysts assume that profit margins will increase from 8.7% today to 14.6% in 3 years time.

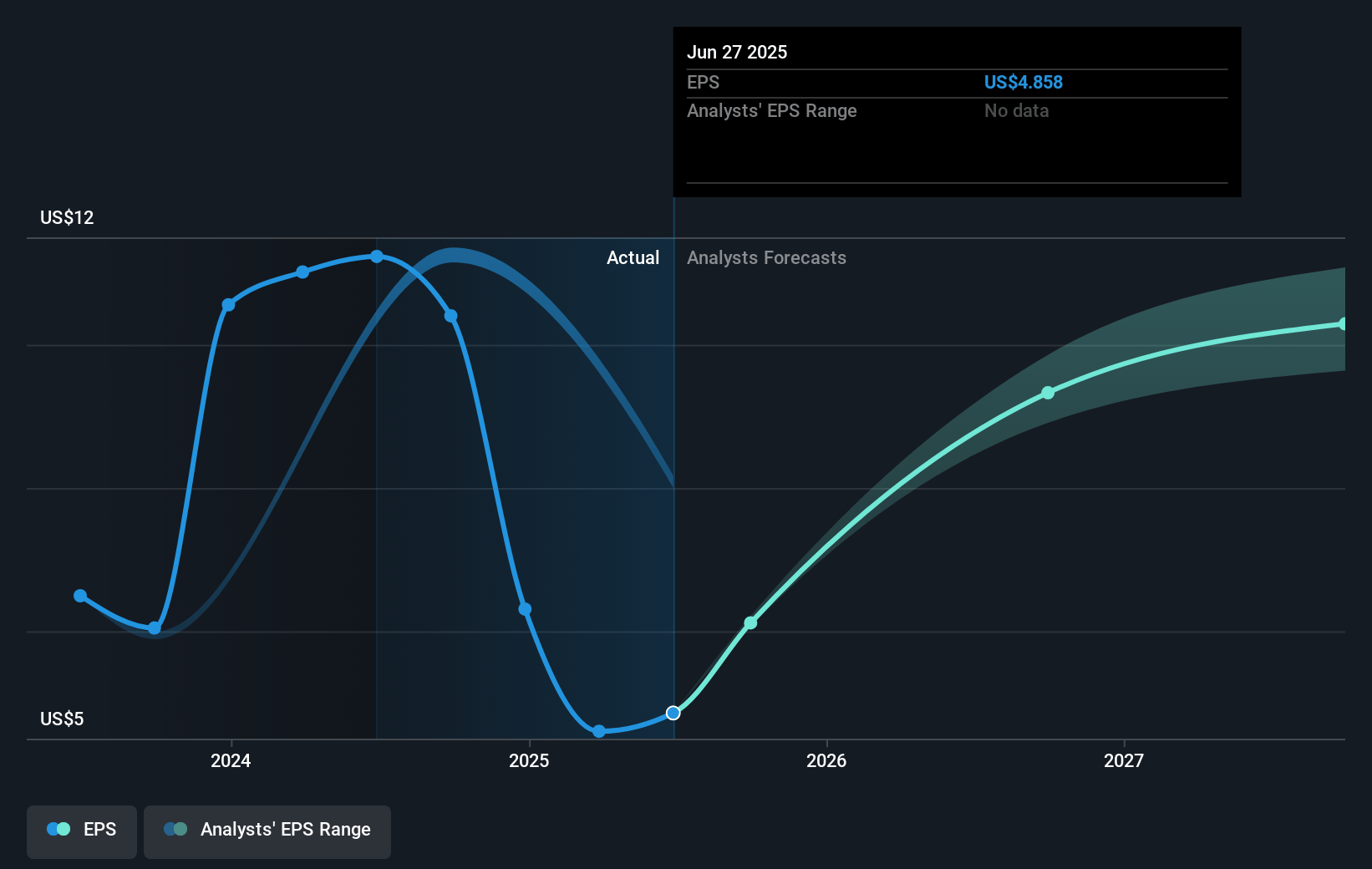

- Analysts expect earnings to reach $2.9 billion (and earnings per share of $10.15) by about July 2028, up from $1.4 billion today. The analysts are largely in agreement about this estimate.

- In order for the above numbers to justify the analysts price target, the company would need to trade at a PE ratio of 22.3x on those 2028 earnings, down from 38.5x today. This future PE is lower than the current PE for the US Electronic industry at 23.8x.

- Analysts expect the number of shares outstanding to decline by 2.43% per year for the next 3 years.

- To value all of this in today's terms, we will use a discount rate of 8.82%, as per the Simply Wall St company report.

TE Connectivity Future Earnings Per Share Growth

Risks

What could happen that would invalidate this narrative?- The company's heavy reliance on growth in the AI, energy, and Asian transportation segments introduces risk-should demand in these areas slow, or should competitive dynamics shift, TE Connectivity could see increases in customer concentration risk, potentially leading to top-line revenue instability.

- Despite strong gross and operating margin performance, the continued success of margin expansion relies on ongoing restructuring and footprint consolidation; any future inability to sustain productivity gains, or if supply chain and material cost volatility outpaces operational improvements, net margin expansion may be pressured.

- Geographic concentration of growth-in particular, ongoing weakness in Western auto production (U.S./Europe), with recent declines offset only by strength in Asia-suggests that regional deglobalization or onshoring trends could reduce global sales opportunities and disrupt existing manufacturing advantages, negatively impacting both revenue and longer-term earnings.

- The company is making significant investments in capacity and acquisitions (notably in Energy), but integration risks, changing regulatory environments (including escalating or shifting tariffs), or cost overruns could diminish expected returns on capital and compress future margins and free cash flow.

- Increasing adoption of miniaturized, wireless, and vertically-integrated electronics by OEMs may gradually reduce demand for traditional connectors and components and shrink TE Connectivity's addressable markets; if the company is slow to adapt or faces accelerated vertical integration by customers, both revenue growth and long-term earnings resilience could be impaired.

Valuation

How have all the factors above been brought together to estimate a fair value?- The analysts have a consensus price target of $180.183 for TE Connectivity based on their expectations of its future earnings growth, profit margins and other risk factors. However, there is a degree of disagreement amongst analysts, with the most bullish reporting a price target of $214.0, and the most bearish reporting a price target of just $140.0.

- In order for you to agree with the analyst's consensus, you'd need to believe that by 2028, revenues will be $19.5 billion, earnings will come to $2.9 billion, and it would be trading on a PE ratio of 22.3x, assuming you use a discount rate of 8.8%.

- Given the current share price of $180.47, the analyst price target of $180.18 is 0.2% lower. The relatively low difference between the current share price and the analyst consensus price target indicates that they believe on average, the company is fairly priced.

- We always encourage you to reach your own conclusions though. So sense check these analyst numbers against your own assumptions and expectations based on your understanding of the business and what you believe is probable.

How well do narratives help inform your perspective?

Disclaimer

AnalystConsensusTarget is a tool utilizing a Large Language Model (LLM) that ingests data on consensus price targets, forecasted revenue and earnings figures, as well as the transcripts of earnings calls to produce qualitative analysis. The narratives produced by AnalystConsensusTarget are general in nature and are based solely on analyst data and publicly-available material published by the respective companies. These scenarios are not indicative of the company's future performance and are exploratory in nature. Simply Wall St has no position in the company(s) mentioned. Simply Wall St may provide the securities issuer or related entities with website advertising services for a fee, on an arm's length basis. These relationships have no impact on the way we conduct our business, the content we host, or how our content is served to users. The price targets and estimates used are consensus data, and do not constitute a recommendation to buy or sell any stock, and they do not take account of your objectives, or your financial situation. Note that AnalystConsensusTarget's analysis may not factor in the latest price-sensitive company announcements or qualitative material.