Key Takeaways

- Rapid technological shifts and industry commoditization threaten TE Connectivity's core products and market position, requiring heavy investment with uncertain payoff.

- Global supply chain risks, rising compliance burdens, and high exposure to automotive markets exert sustained pressure on margins and earnings quality.

- Growth in AI, industrial automation, energy infrastructure, and strategic acquisitions is driving robust revenue, margin expansion, and earnings resilience for TE Connectivity.

Catalysts

About TE Connectivity- Manufactures and sells connectivity and sensor solutions in Europe, the Middle East, Africa, the Asia–Pacific, and the Americas.

- TE Connectivity faces significant risk from accelerating technological disruption; as automation, AI, and new wireless or optical interconnectivity standards advance, many of TE's traditional connector and sensor products may face rapid obsolescence, which could undercut future revenue streams and require heavy R&D investment with uncertain returns.

- Increasing global protectionism and deglobalization threaten TE's localized yet globally interconnected manufacturing base, raising the risk of elevated supply chain costs, restricted access to materials, and delayed delivery times all of which can meaningfully compress operating margins and create long-term pressure on earnings growth.

- TE's heavy reliance on the automotive segment, particularly EVs and electrified powertrains, leaves the company exposed to cyclical downturns, inconsistent market growth across regions, and intensifying price competition, making future revenue growth more volatile and potentially below expectations.

- Industry commoditization and intensifying price competition in connectors and sensors threaten to erode TE Connectivity's market share and compress net margins, especially as new entrants, substitutes, and technological alternatives threaten the company's core markets.

- TE's high fixed operating costs, rising compliance burdens from ESG and regulatory scrutiny, and required capital expenditures to remain competitive with technological shifts in electrification and digital infrastructure may restrict improvements to net margins and place persistent pressure on long-term earnings quality.

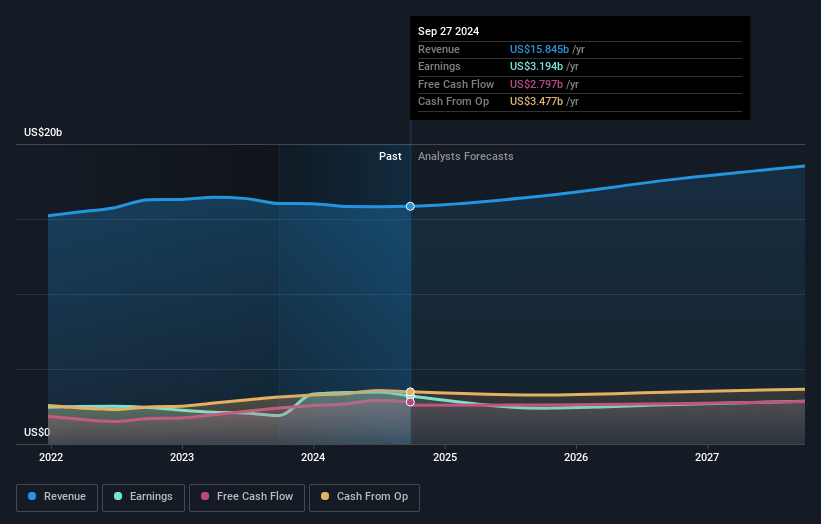

TE Connectivity Future Earnings and Revenue Growth

Assumptions

How have these above catalysts been quantified?- This narrative explores a more pessimistic perspective on TE Connectivity compared to the consensus, based on a Fair Value that aligns with the bearish cohort of analysts.

- The bearish analysts are assuming TE Connectivity's revenue will grow by 6.5% annually over the next 3 years.

- The bearish analysts assume that profit margins will increase from 8.7% today to 15.3% in 3 years time.

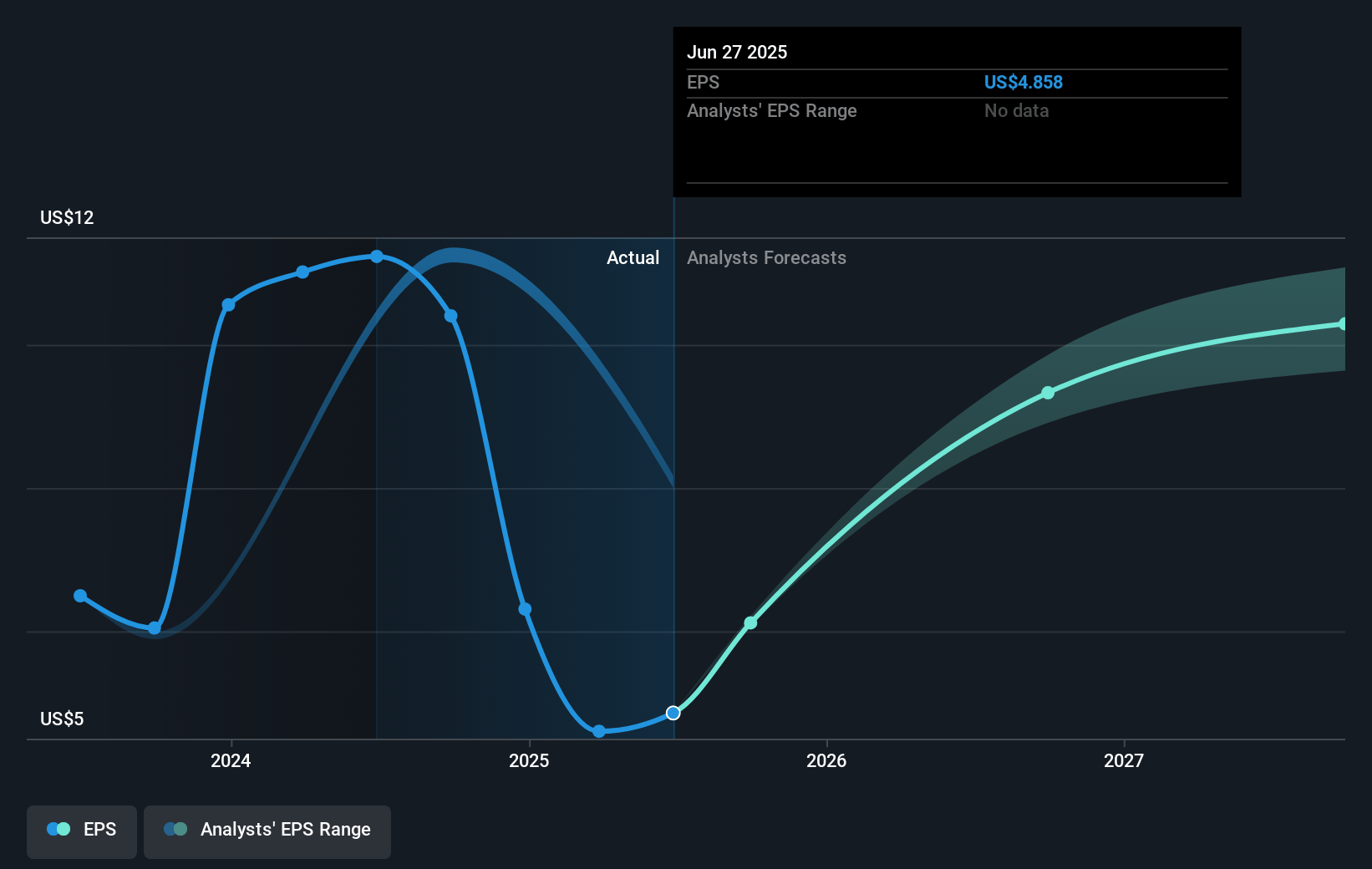

- The bearish analysts expect earnings to reach $3.0 billion (and earnings per share of $10.49) by about July 2028, up from $1.4 billion today. The analysts are largely in agreement about this estimate.

- In order for the above numbers to justify the price target of the more bearish analyst cohort, the company would need to trade at a PE ratio of 16.7x on those 2028 earnings, down from 43.1x today. This future PE is lower than the current PE for the US Electronic industry at 23.8x.

- Analysts expect the number of shares outstanding to decline by 2.43% per year for the next 3 years.

- To value all of this in today's terms, we will use a discount rate of 8.81%, as per the Simply Wall St company report.

TE Connectivity Future Earnings Per Share Growth

Risks

What could happen that would invalidate this narrative?- TE Connectivity's rapid expansion into AI applications, with AI-related revenues expected to surpass one billion dollars next year and above-average segment margins, indicates robust demand and margin expansion opportunities that could continue boosting operating income and earnings per share over the long term.

- The company's successful investments in industrial automation, energy infrastructure (particularly grid hardening and renewables), and localization strategies have led to double-digit organic growth, broad-based order momentum, and record free cash flow generation, supporting top-line growth and strengthening the balance sheet.

- Strategic acquisitions, such as the Richards acquisition in the Energy segment, are broadening TE Connectivity's addressable market, especially in grid modernization and utility applications, creating additional revenue streams and enhancing their ability to capitalize on long-term electrification trends.

- Margin expansion initiatives, including operational performance improvements, footprint consolidation, and disciplined cost management, are resulting in both operating segments sustaining or exceeding twenty percent adjusted operating margins, which underpins resilience and capacity for earnings growth even in cyclical or uneven end markets.

- Secular growth drivers like the proliferation of EVs, factory automation recovery, global demand for high-speed data connectivity, and expanding AI and 5G/6G infrastructure, are all segments where TE Connectivity has already demonstrated leading capabilities, suggesting durable revenue and margin growth drivers that could present upside risk to any expectation of a declining share price.

Valuation

How have all the factors above been brought together to estimate a fair value?- The assumed bearish price target for TE Connectivity is $140.0, which represents the lowest price target estimate amongst analysts. This valuation is based on what can be assumed as the expectations of TE Connectivity's future earnings growth, profit margins and other risk factors from analysts on the more bearish end of the spectrum.

- However, there is a degree of disagreement amongst analysts, with the most bullish reporting a price target of $220.0, and the most bearish reporting a price target of just $140.0.

- In order for you to agree with the bearish analysts, you'd need to believe that by 2028, revenues will be $19.4 billion, earnings will come to $3.0 billion, and it would be trading on a PE ratio of 16.7x, assuming you use a discount rate of 8.8%.

- Given the current share price of $202.04, the bearish analyst price target of $140.0 is 44.3% lower. Despite analysts expecting the underlying buisness to improve, they seem to believe the market's expectations are too high.

- We always encourage you to reach your own conclusions though. So sense check these analyst numbers against your own assumptions and expectations based on your understanding of the business and what you believe is probable.

How well do narratives help inform your perspective?

Disclaimer

AnalystLowTarget is a tool utilizing a Large Language Model (LLM) that ingests data on consensus price targets, forecasted revenue and earnings figures, as well as the transcripts of earnings calls to produce qualitative analysis. The narratives produced by AnalystLowTarget are general in nature and are based solely on analyst data and publicly-available material published by the respective companies. These scenarios are not indicative of the company's future performance and are exploratory in nature. Simply Wall St has no position in the company(s) mentioned. Simply Wall St may provide the securities issuer or related entities with website advertising services for a fee, on an arm's length basis. These relationships have no impact on the way we conduct our business, the content we host, or how our content is served to users. The price targets and estimates used are consensus data, and do not constitute a recommendation to buy or sell any stock, and they do not take account of your objectives, or your financial situation. Note that AnalystLowTarget's analysis may not factor in the latest price-sensitive company announcements or qualitative material.