Narratives are currently in beta

Key Takeaways

- Strategic investments in China and design wins in EV/HEV markets are set to drive future revenue and margin growth.

- Diversity in product offerings, including medical devices and BESS, aims to enhance revenue and expand market reach.

- Challenges in EV/HEV and wireless segments, global automotive slowdown, and strategic risks may hinder Rogers' revenue and earnings growth.

Catalysts

About Rogers- Engages in the design, development, manufacture, and sale of engineered materials and components worldwide.

- Rogers is investing in two new manufacturing facilities in China for curamik Power substrates and BISCO silicone production. This investment positions the company to benefit from future growth in the EV/HEV market, impacting revenue.

- The company has secured significant design wins in both the AES and EMS businesses, particularly in the EV/HEV market. These design wins are expected to drive future revenue growth starting in 2025.

- Rogers is expanding its capacity and regional capabilities with a new curamik Power substrate factory in China. This positions the company well to support growing demand from Western and Asian power module customers, impacting both revenue and margins.

- Rogers is targeting growth opportunities in emerging industrial segments such as medical devices, data centers, and battery energy storage systems (BESS). This diversification could drive revenue and improve net margins.

- Rogers is focusing on driving product innovation and diversifying its customer base with emerging Asian players in the ADAS and automotive markets, which could enhance revenue and earnings.

Rogers Future Earnings and Revenue Growth

Assumptions

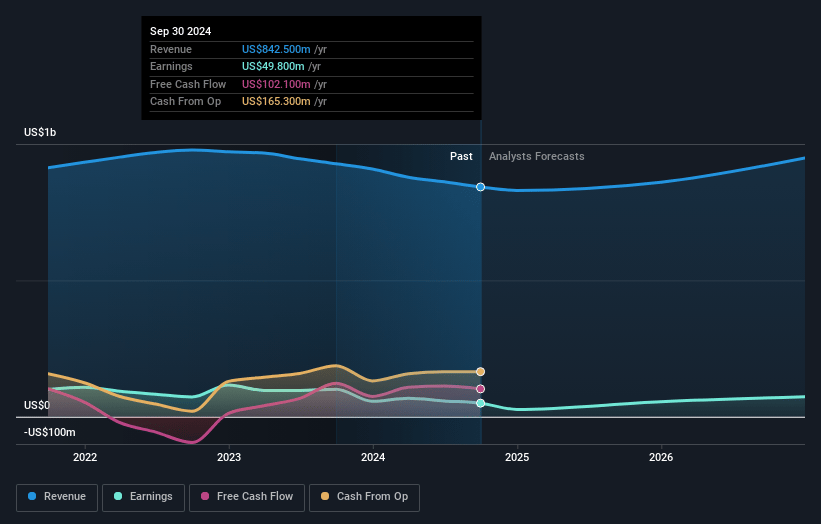

How have these above catalysts been quantified?- Analysts are assuming Rogers's revenue will grow by 5.1% annually over the next 3 years.

- Analysts assume that profit margins will increase from 5.9% today to 9.1% in 3 years time.

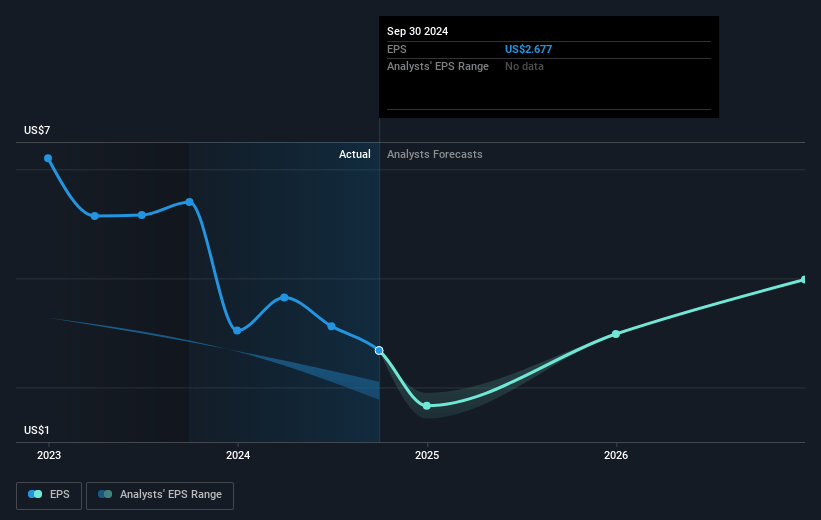

- Analysts expect earnings to reach $88.8 million (and earnings per share of $4.72) by about November 2027, up from $49.8 million today.

- In order for the above numbers to justify the analysts price target, the company would need to trade at a PE ratio of 31.1x on those 2027 earnings, down from 37.8x today. This future PE is greater than the current PE for the US Electronic industry at 23.4x.

- Analysts expect the number of shares outstanding to grow by 0.24% per year for the next 3 years.

- To value all of this in today's terms, we will use a discount rate of 7.08%, as per the Simply Wall St company report.

Rogers Future Earnings Per Share Growth

Risks

What could happen that would invalidate this narrative?- Lower-than-expected revenues due to softer order patterns in the EV/HEV segment and a lower seasonal peak in portable electronics could impact Rogers' overall revenue growth.

- Ongoing contraction in global manufacturing activity and slower global automotive production may continue to weigh on revenue in general industrial and EV markets.

- The competitive dynamics affecting ADAS sales, with increased competition and softer auto production, pose risks to revenue growth from these segments.

- The decline in wireless infrastructure sales following the conclusion of a project in India highlights the risk of revenue volatility linked to project dependencies and market demand.

- Continued planning for CFO succession and interim roles could introduce operational risks that may affect strategic financial management and earnings consistency.

Valuation

How have all the factors above been brought together to estimate a fair value?- The analysts have a consensus price target of $125.0 for Rogers based on their expectations of its future earnings growth, profit margins and other risk factors.

- In order for you to agree with the analyst's consensus, you'd need to believe that by 2027, revenues will be $978.0 million, earnings will come to $88.8 million, and it would be trading on a PE ratio of 31.1x, assuming you use a discount rate of 7.1%.

- Given the current share price of $101.0, the analyst's price target of $125.0 is 19.2% higher.

- We always encourage you to reach your own conclusions though. So sense check these analyst numbers against your own assumptions and expectations based on your understanding of the business and what you believe is probable.

How well do narratives help inform your perspective?

Disclaimer

Warren A.I. is a tool utilizing a Large Language Model (LLM) that ingests data on consensus price targets, forecasted revenue and earnings figures, as well as the transcripts of earnings calls to produce qualitative analysis. The narratives produced by Warren A.I. are general in nature and are based solely on analyst data and publicly-available material published by the respective companies. These scenarios are not indicative of the company's future performance and are exploratory in nature. Simply Wall St has no position in the company(s) mentioned. The price targets and estimates used are consensus data, and do not constitute a recommendation to buy or sell any stock, and they do not take account of your objectives, or your financial situation. Note that Warren A.I.'s analysis may not factor in the latest price-sensitive company announcements or qualitative material.

Read more narratives

There are no other narratives for this company.

View all narratives