Narratives are currently in beta

Key Takeaways

- Keysight's investments in defense modernization and AI technologies position it for future revenue growth in high-demand sectors.

- Progress in software and services, along with disciplined operations and share buybacks, signals potential for improved margins and shareholder value.

- Multiple sectoral challenges and macroeconomic uncertainties could hinder Keysight Technologies' revenue growth and margin stability, especially in automotive, aerospace, defense, and industrial markets.

Catalysts

About Keysight Technologies- Provides electronic design and test solutions to commercial communications, networking, aerospace, defense and government, automotive, energy, semiconductor, electronic, and education industries in the Americas, Europe, and the Asia Pacific.

- Keysight is capitalizing on the growing investment in defense modernization globally, especially in the U.S., Europe, and Asia, driven by increased demand in satellite communications, radar, and electromagnetic spectrum operations, which could bolster future revenue growth.

- The continued investment in AI-related technologies, including wireline infrastructure expansion and their high-fidelity emulation solutions for AI model training, suggests potential for increased revenue from these high-demand areas.

- Significant progress in the software and services division, with an 8% growth in quarterly revenue and a 16% increase in annual recurring revenue, can positively affect future margins and earnings due to higher-margin contributions from these business areas.

- Keysight's focus on innovation and industry collaborations, expanding its solutions portfolio through both organic growth and selective M&A, positions the company to optimize future earnings growth and potentially increase margins as these investments mature.

- The company's disciplined operating model, cost efficiencies, and substantial share buyback activities which returned approximately 50% of free cash flow to shareholders, indicate a strategy to enhance shareholder value and improve EPS over time.

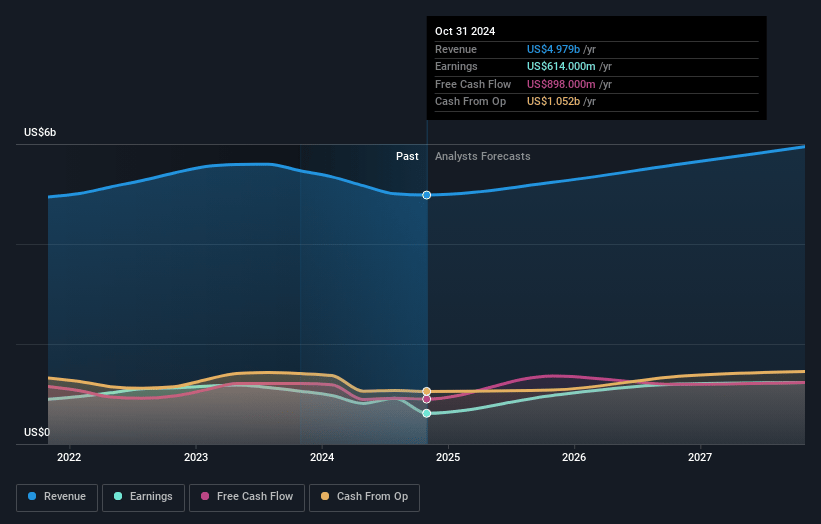

Keysight Technologies Future Earnings and Revenue Growth

Assumptions

How have these above catalysts been quantified?- Analysts are assuming Keysight Technologies's revenue will grow by 6.7% annually over the next 3 years.

- Analysts assume that profit margins will increase from 18.2% today to 20.5% in 3 years time.

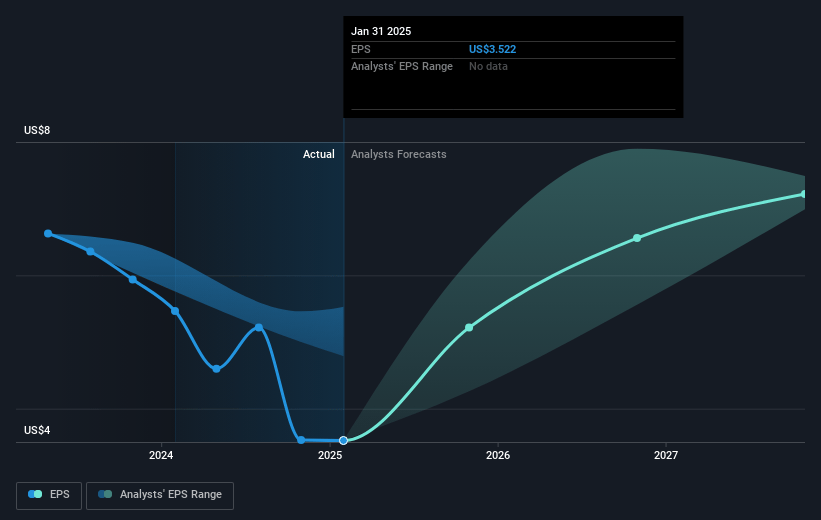

- Analysts expect earnings to reach $1.2 billion (and earnings per share of $7.43) by about November 2027, up from $913.0 million today.

- In order for the above numbers to justify the analysts price target, the company would need to trade at a PE ratio of 28.2x on those 2027 earnings, down from 28.9x today. This future PE is greater than the current PE for the US Electronic industry at 23.4x.

- Analysts expect the number of shares outstanding to decline by 1.2% per year for the next 3 years.

- To value all of this in today's terms, we will use a discount rate of 7.23%, as per the Simply Wall St company report.

Keysight Technologies Future Earnings Per Share Growth

Risks

What could happen that would invalidate this narrative?- Sluggish growth in automotive market, with continued headwinds expected in 2025 due to slowing EV sales and battery oversupply, could negatively impact Keysight's revenue from this segment.

- Declines in aerospace, defense, and government revenue by 6% in Q4 and uncertainties relating to federal spending and administration could impact future revenue and order intake from these sectors.

- Electronic Industrial Solutions Group experienced a year-over-year revenue decline and mixed orders due to automotive headwinds and potential slow recovery in industrial markets, impacting overall revenue growth.

- High exposure to software and services makes the company vulnerable to shifts in customer demand for simulation and prototyping solutions, potentially affecting margin stability.

- Overall macroeconomic uncertainties, particularly in the industrial and semiconductor markets, pose risks to the timing of demand recovery and the company's ability to meet growth targets, affecting both revenue and earnings.

Valuation

How have all the factors above been brought together to estimate a fair value?- The analysts have a consensus price target of $170.35 for Keysight Technologies based on their expectations of its future earnings growth, profit margins and other risk factors. However, there is a degree of disagreement amongst analysts, with the most bullish reporting a price target of $185.0, and the most bearish reporting a price target of just $150.0.

- In order for you to agree with the analyst's consensus, you'd need to believe that by 2027, revenues will be $6.1 billion, earnings will come to $1.2 billion, and it would be trading on a PE ratio of 28.2x, assuming you use a discount rate of 7.2%.

- Given the current share price of $152.13, the analyst's price target of $170.35 is 10.7% higher.

- We always encourage you to reach your own conclusions though. So sense check these analyst numbers against your own assumptions and expectations based on your understanding of the business and what you believe is probable.

How well do narratives help inform your perspective?

Disclaimer

Warren A.I. is a tool utilizing a Large Language Model (LLM) that ingests data on consensus price targets, forecasted revenue and earnings figures, as well as the transcripts of earnings calls to produce qualitative analysis. The narratives produced by Warren A.I. are general in nature and are based solely on analyst data and publicly-available material published by the respective companies. These scenarios are not indicative of the company's future performance and are exploratory in nature. Simply Wall St has no position in the company(s) mentioned. The price targets and estimates used are consensus data, and do not constitute a recommendation to buy or sell any stock, and they do not take account of your objectives, or your financial situation. Note that Warren A.I.'s analysis may not factor in the latest price-sensitive company announcements or qualitative material.

Read more narratives

There are no other narratives for this company.

View all narratives