Last Update07 May 25

Key Takeaways

- The focus on AI and cloud strategies, including GreenLake, positions HPE for revenue and margin growth with high-margin offerings and AI workload capture.

- Strategic personnel reductions and the Juniper acquisition synergies aim to streamline operations, enhance margins, and boost earnings and revenue.

- HPE encounters regulatory, competitive, and operational challenges that threaten margins and growth, amid acquisition risks, tariffs, competitive pricing, AI transition, and workforce restructuring.

Catalysts

About Hewlett Packard Enterprise- Provides solutions that allow customers to capture, analyze, and act upon data seamlessly in the Americas, Europe, the Middle East, Africa, the Asia Pacific, and Japan.

- HPE expects to achieve synergies of at least $450 million from the Juniper Networks acquisition within three years of closing, which could enhance revenue and net margins if the deal is approved and successfully integrated.

- The company's focus on AI, with a significant backlog and pipeline of AI systems orders, suggests potential for substantial revenue growth in the second half of 2025, as inventory challenges are addressed and new product generations are deployed.

- The planned reduction of approximately 2,500 positions over the next 12 to 18 months aims to streamline operations and improve net margins through cost savings, thereby enhancing earnings.

- HPE's GreenLake Cloud and hybrid cloud strategy, which saw ARR surpass $2 billion for the first time, is positioned to capture new AI workloads, suggesting revenue growth and margin expansion due to higher-margin offerings.

- Measures to mitigate the impact of tariffs through supply chain adjustments and pricing actions could protect revenue and net margins, though implementation over time is necessary to observe full effects.

Hewlett Packard Enterprise Future Earnings and Revenue Growth

Assumptions

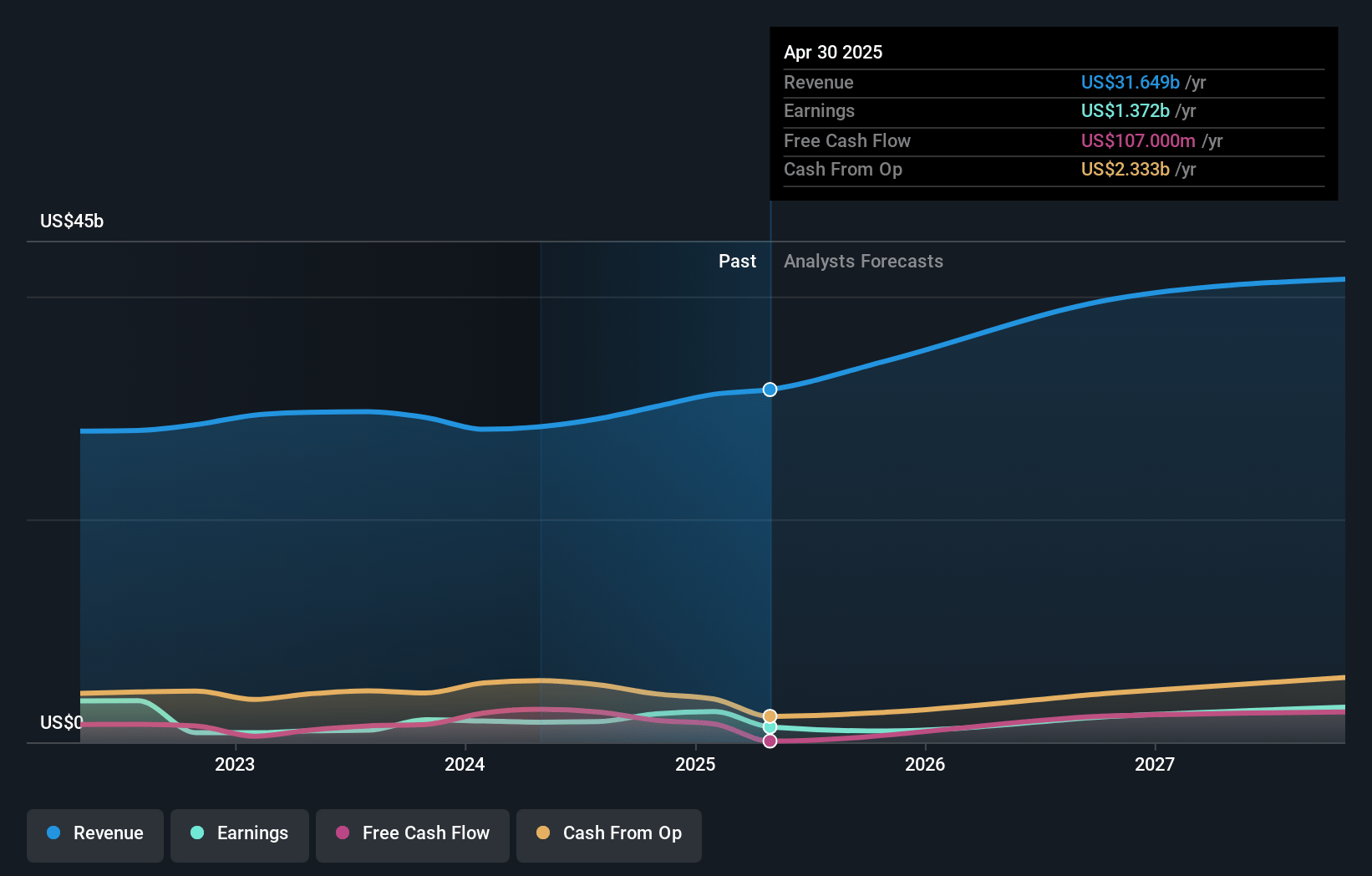

How have these above catalysts been quantified?- Analysts are assuming Hewlett Packard Enterprise's revenue will grow by 4.8% annually over the next 3 years.

- Analysts assume that profit margins will shrink from 8.9% today to 7.5% in 3 years time.

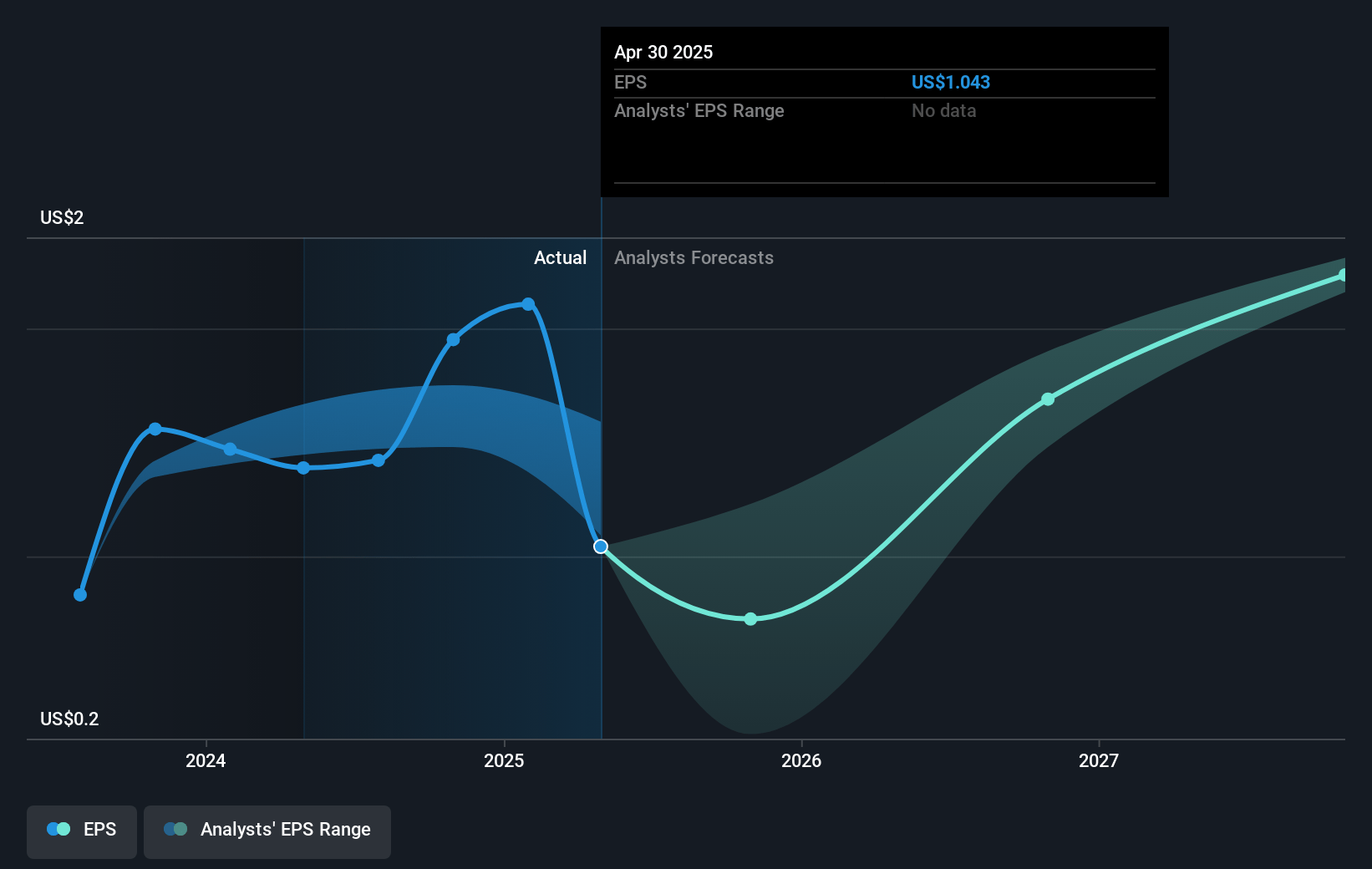

- Analysts expect earnings to reach $2.7 billion (and earnings per share of $1.95) by about May 2028, down from $2.8 billion today. However, there is a considerable amount of disagreement amongst the analysts with the most bullish expecting $3.7 billion in earnings, and the most bearish expecting $2.1 billion.

- In order for the above numbers to justify the analysts price target, the company would need to trade at a PE ratio of 12.8x on those 2028 earnings, up from 7.8x today. This future PE is greater than the current PE for the US Tech industry at 12.6x.

- Analysts expect the number of shares outstanding to grow by 1.07% per year for the next 3 years.

- To value all of this in today's terms, we will use a discount rate of 10.1%, as per the Simply Wall St company report.

Hewlett Packard Enterprise Future Earnings Per Share Growth

Risks

What could happen that would invalidate this narrative?- The lawsuit by the Department of Justice (DOJ) against HPE's proposed acquisition of Juniper Networks represents a significant regulatory risk. If the transaction is blocked, HPE might miss out on expected annual synergies of $450 million, which could impact future revenue and profit forecasts.

- Increased tariffs on imports from Mexico, Canada, and China could result in higher costs for HPE and potentially impact their revenue. Although the company is attempting to mitigate these impacts through global supply chain and pricing adjustments, the effectiveness of these measures is uncertain.

- The company faces intense pricing competition in its Server business, which has resulted in higher discounts and pressure on operating margins. This aggressive market environment could further squeeze net margins if HPE cannot effectively manage costs.

- HPE's AI systems segment faces challenges related to the transition to next-generation GPUs, causing inventory valuation issues and operating margin compression. These factors could undermine profitability forecasts if the company struggles to convert its pipeline to revenue efficiently.

- Proposed workforce reductions of about 2,500 positions raise concerns about HPE's employee morale and capacity to execute on its strategies successfully. Expected restructuring charges of $350 million could also temporarily hurt earnings and free cash flow.

Valuation

How have all the factors above been brought together to estimate a fair value?- The analysts have a consensus price target of $18.976 for Hewlett Packard Enterprise based on their expectations of its future earnings growth, profit margins and other risk factors. However, there is a degree of disagreement amongst analysts, with the most bullish reporting a price target of $26.0, and the most bearish reporting a price target of just $14.0.

- In order for you to agree with the analyst's consensus, you'd need to believe that by 2028, revenues will be $36.0 billion, earnings will come to $2.7 billion, and it would be trading on a PE ratio of 12.8x, assuming you use a discount rate of 10.1%.

- Given the current share price of $16.49, the analyst price target of $18.98 is 13.1% higher. Despite analysts expecting the underlying buisness to decline, they seem to believe it's more valuable than what the market thinks.

- We always encourage you to reach your own conclusions though. So sense check these analyst numbers against your own assumptions and expectations based on your understanding of the business and what you believe is probable.

How well do narratives help inform your perspective?

Disclaimer

AnalystConsensusTarget is a tool utilizing a Large Language Model (LLM) that ingests data on consensus price targets, forecasted revenue and earnings figures, as well as the transcripts of earnings calls to produce qualitative analysis. The narratives produced by AnalystConsensusTarget are general in nature and are based solely on analyst data and publicly-available material published by the respective companies. These scenarios are not indicative of the company's future performance and are exploratory in nature. Simply Wall St has no position in the company(s) mentioned. Simply Wall St may provide the securities issuer or related entities with website advertising services for a fee, on an arm's length basis. These relationships have no impact on the way we conduct our business, the content we host, or how our content is served to users. The price targets and estimates used are consensus data, and do not constitute a recommendation to buy or sell any stock, and they do not take account of your objectives, or your financial situation. Note that AnalystConsensusTarget's analysis may not factor in the latest price-sensitive company announcements or qualitative material.