Narratives are currently in beta

Key Takeaways

- Lean operating principles and cloud-based service investments are expected to enhance efficiency and profitability, improving margins and customer support.

- Growth initiatives in banking and Asia Pacific markets aim to boost revenue and strengthen service margins through strategic contracts and expansion.

- Challenging retail revenues, project delays, mixed sector performance, reintegration risks, and rising tax rates threaten Diebold Nixdorf's revenue growth and margins.

Catalysts

About Diebold Nixdorf- Engages in the automating, digitizing, and transforming the way people bank and shop worldwide.

- The company has invested in lean operating principles and continuous improvement initiatives that have resulted in margin expansion for 7 consecutive quarters. This suggests a structured plan to improve efficiency which is expected to continue improving net margins and profitability.

- Diebold Nixdorf is expanding its lean practices beyond manufacturing into service operations and investing in a cloud-based service suite to enhance efficiency. These efforts are aimed at improving customer support, which should positively impact service margins and drive profitability in the long term.

- There are expectations for revenue growth in the banking sector due to product revenue growth and improved service performance. The company has secured large multiyear product and service contracts in regions like the U.S., Netherlands, and Brazil, suggesting potential revenue increases and improvements in net margins in the future.

- The company is managing free cash flow more effectively, aiming for greater linearity and improved working capital efficiency. This trajectory should lead to higher free cash flow conversion rates, which is projected to reach 50% of adjusted EBITDA over the next 12-24 months, improving overall earnings and financial stability.

- Diebold Nixdorf is strategically re-entering Asia Pacific countries, including India, to capitalize on service revenue opportunities. This regional expansion is anticipated to strengthen their recurring service revenue base, improve overall revenue, and enhance service gross margins by leveraging their competitive cost structure and manufacturing capabilities in India.

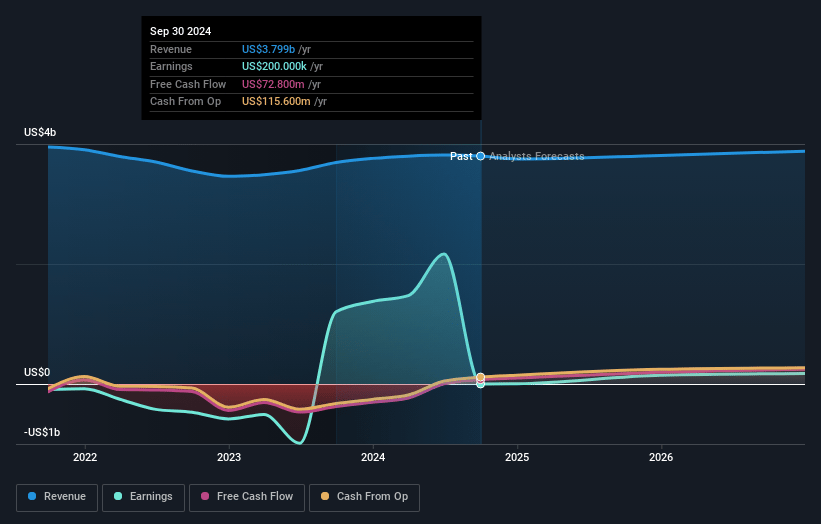

Diebold Nixdorf Future Earnings and Revenue Growth

Assumptions

How have these above catalysts been quantified?- Analysts are assuming Diebold Nixdorf's revenue will decrease by 1.0% annually over the next 3 years.

- Analysts assume that profit margins will increase from 0.0% today to 8.8% in 3 years time.

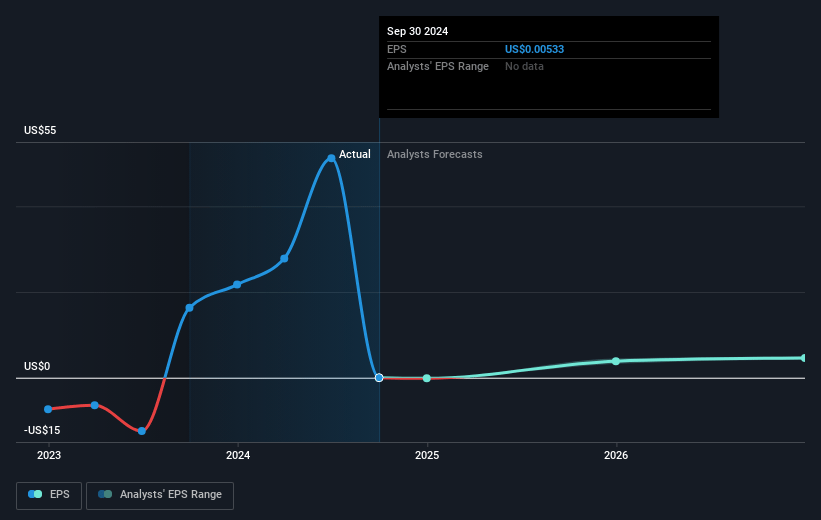

- Analysts expect earnings to reach $342.8 million (and earnings per share of $9.0) by about November 2027, up from $200.0 thousand today.

- In order for the above numbers to justify the analysts price target, the company would need to trade at a PE ratio of 8.3x on those 2027 earnings, down from 7609.1x today. This future PE is lower than the current PE for the GB Tech industry at 22.8x.

- Analysts expect the number of shares outstanding to grow by 0.47% per year for the next 3 years.

- To value all of this in today's terms, we will use a discount rate of 9.21%, as per the Simply Wall St company report.

Diebold Nixdorf Future Earnings Per Share Growth

Risks

What could happen that would invalidate this narrative?- The macro environment continues to challenge retail revenues, with a 15% decline year-over-year due to lower self-service shipments. If this trend persists, it could harm overall revenue growth projections.

- The pushout of large retail service projects from Q3 to Q4 impacted service gross margins negatively, indicating potential risks in meeting revenue and margin expectations if such delays continue.

- The banking sector's favorable performance is contrasted by a mixed outlook in the retail segment, which may affect balanced growth across the company's sectors, thus impacting net margins.

- Reintegration into competitive markets like India, with historically low hardware margins, poses a risk to gross margins, particularly if cost efficiencies do not materialize as expected.

- Despite operational improvements, an unexpected rise in effective tax rates could erode net income, as seen with a 65% non-GAAP tax rate impacting net earnings negatively.

Valuation

How have all the factors above been brought together to estimate a fair value?- The analysts have a consensus price target of $57.5 for Diebold Nixdorf based on their expectations of its future earnings growth, profit margins and other risk factors. However, there is a degree of disagreement amongst analysts, with the most bullish reporting a price target of $65.0, and the most bearish reporting a price target of just $50.0.

- In order for you to agree with the analyst's consensus, you'd need to believe that by 2027, revenues will be $3.9 billion, earnings will come to $342.8 million, and it would be trading on a PE ratio of 8.3x, assuming you use a discount rate of 9.2%.

- Given the current share price of $40.51, the analyst's price target of $57.5 is 29.5% higher.

- We always encourage you to reach your own conclusions though. So sense check these analyst numbers against your own assumptions and expectations based on your understanding of the business and what you believe is probable.

How well do narratives help inform your perspective?

Disclaimer

Warren A.I. is a tool utilizing a Large Language Model (LLM) that ingests data on consensus price targets, forecasted revenue and earnings figures, as well as the transcripts of earnings calls to produce qualitative analysis. The narratives produced by Warren A.I. are general in nature and are based solely on analyst data and publicly-available material published by the respective companies. These scenarios are not indicative of the company's future performance and are exploratory in nature. Simply Wall St has no position in the company(s) mentioned. The price targets and estimates used are consensus data, and do not constitute a recommendation to buy or sell any stock, and they do not take account of your objectives, or your financial situation. Note that Warren A.I.'s analysis may not factor in the latest price-sensitive company announcements or qualitative material.

Read more narratives

There are no other narratives for this company.

View all narratives