Narratives are currently in beta

Key Takeaways

- BlueEdge solutions and SaaS increase revenue through smart water solutions, analytics, and high attachment rates to hardware.

- R&D investments and strategic acquisitions enhance product offerings, supporting higher margins and sustained earnings growth.

- High US market concentration and uneven project schedules risk revenue instability amid environmental disruptions and personnel cost impacts.

Catalysts

About Badger Meter- Manufactures and markets flow measurement, quality, control, and communication solutions worldwide.

- The BlueEdge suite of solutions is expected to drive revenue growth through tailored offerings that address critical water challenges and increase customer reliance on smart water solutions. This growth is set to impact the top line as utilities integrate comprehensive monitoring and analytics into their operations.

- The Software as a Service (SaaS) revenue showed a 35% increase due to customer dependence on insights and analytics, and with a 100% attachment rate to hardware sales, this is likely to drive recurring revenue growth and positively impact earnings over the long term.

- The structural macro drivers such as the increased need for technology adoption in water management due to extreme weather and aging infrastructure may lead to continued high single-digit sales growth, impacting revenue positively across future cycles.

- Investment in R&D and potential inorganic growth through acquisitions focused on expanding sensor capabilities, which can enhance product offerings and support higher margins by integrating more high-value solutions into the portfolio.

- Leveraged operational efficiencies and strategic capital allocation, including consistent dividend increases and disciplined M&A activities, which together can improve net margins and sustain earnings growth over time.

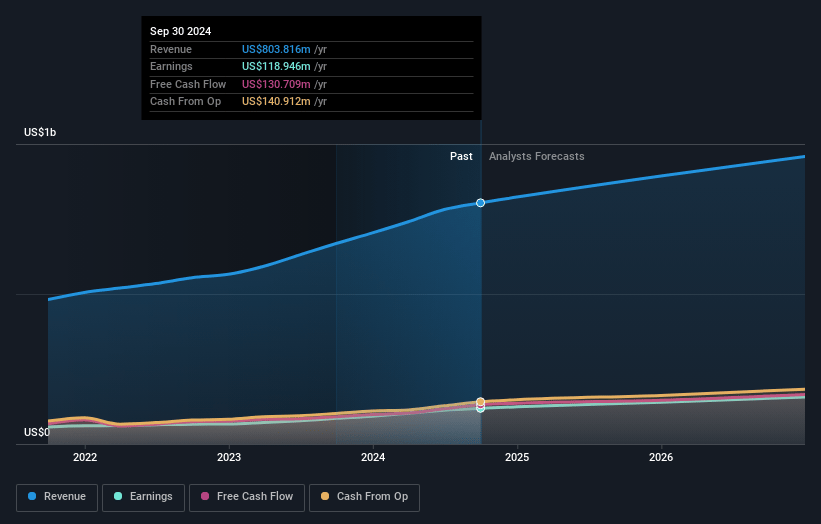

Badger Meter Future Earnings and Revenue Growth

Assumptions

How have these above catalysts been quantified?- Analysts are assuming Badger Meter's revenue will grow by 8.1% annually over the next 3 years.

- Analysts assume that profit margins will increase from 14.8% today to 16.1% in 3 years time.

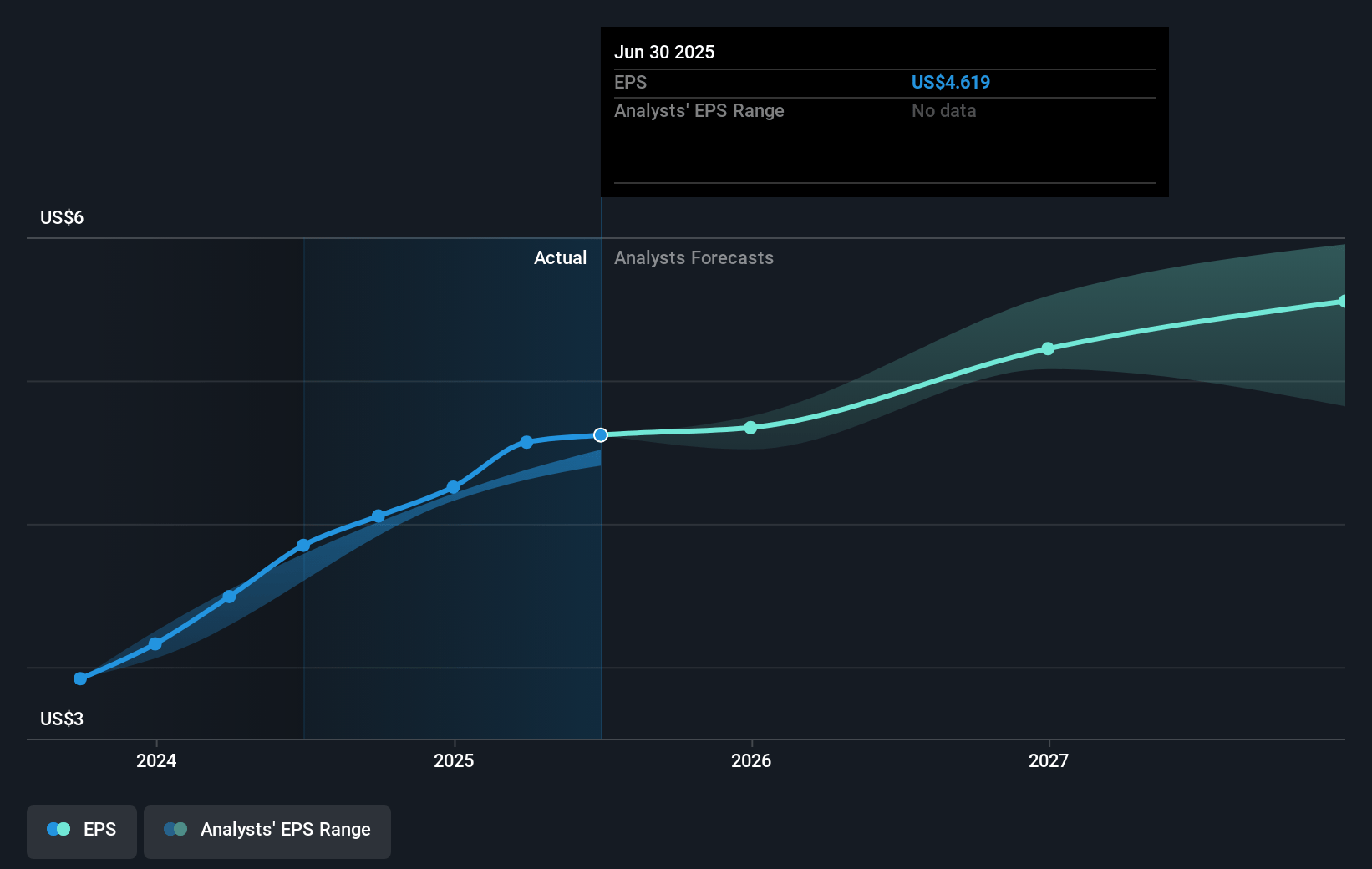

- Analysts expect earnings to reach $163.4 million (and earnings per share of $5.51) by about November 2027, up from $118.9 million today. The analysts are largely in agreement about this estimate.

- In order for the above numbers to justify the analysts price target, the company would need to trade at a PE ratio of 47.3x on those 2027 earnings, down from 52.2x today. This future PE is greater than the current PE for the US Electronic industry at 23.4x.

- Analysts expect the number of shares outstanding to grow by 0.25% per year for the next 3 years.

- To value all of this in today's terms, we will use a discount rate of 7.05%, as per the Simply Wall St company report.

Badger Meter Future Earnings Per Share Growth

Risks

What could happen that would invalidate this narrative?- Delays in hurricane-impacted regions could temporarily defer certain utility projects, potentially affecting short-term revenue growth.

- A high concentration of sales in U.S. markets exposes the company to region-specific economic and environmental impacts, which may lead to uneven revenue in quarters affected by disruptions like severe weather events.

- Increased spending on personnel-related costs without assurance of corresponding sales growth could negatively impact net margins.

- The substantial growth in SaaS revenues currently relies heavily on unit volumes; any slowdown in hardware sales could decelerate SaaS revenue growth, impacting overall earnings.

- Despite strong current performance, the company's strategy does not discount unevenness in the market driven by customer project schedules, which could lead to unpredictability in revenue and earnings growth.

Valuation

How have all the factors above been brought together to estimate a fair value?- The analysts have a consensus price target of $217.19 for Badger Meter based on their expectations of its future earnings growth, profit margins and other risk factors. However, there is a degree of disagreement amongst analysts, with the most bullish reporting a price target of $250.0, and the most bearish reporting a price target of just $196.12.

- In order for you to agree with the analyst's consensus, you'd need to believe that by 2027, revenues will be $1.0 billion, earnings will come to $163.4 million, and it would be trading on a PE ratio of 47.3x, assuming you use a discount rate of 7.0%.

- Given the current share price of $211.07, the analyst's price target of $217.19 is 2.8% higher. The relatively low difference between the current share price and the analyst consensus price target indicates that they believe on average, the company is fairly priced.

- We always encourage you to reach your own conclusions though. So sense check these analyst numbers against your own assumptions and expectations based on your understanding of the business and what you believe is probable.

How well do narratives help inform your perspective?

Disclaimer

Warren A.I. is a tool utilizing a Large Language Model (LLM) that ingests data on consensus price targets, forecasted revenue and earnings figures, as well as the transcripts of earnings calls to produce qualitative analysis. The narratives produced by Warren A.I. are general in nature and are based solely on analyst data and publicly-available material published by the respective companies. These scenarios are not indicative of the company's future performance and are exploratory in nature. Simply Wall St has no position in the company(s) mentioned. The price targets and estimates used are consensus data, and do not constitute a recommendation to buy or sell any stock, and they do not take account of your objectives, or your financial situation. Note that Warren A.I.'s analysis may not factor in the latest price-sensitive company announcements or qualitative material.

Read more narratives

There are no other narratives for this company.

View all narratives