Narratives are currently in beta

Key Takeaways

- Strategic focus on engineered products and facility consolidation is set to improve operating margins and enhance profitability.

- Investments in new technology and facilities drive potential revenue growth in aerospace, defense, and commercial markets.

- Revenue challenges across various sectors and currency exposure in China and Malaysia pose risks to growth, compounded by operational and investment pressures.

Catalysts

About TTM Technologies- Manufactures and sells mission systems, radio frequency (RF) components and RF microwave/microelectronic assemblies, and printed circuit boards (PCB) worldwide.

- The record program backlog of approximately $1.49 billion in the aerospace and defense market can contribute to revenue growth, as the defense market is a robust segment with steady demand and long-term contracts.

- TTM's strategic shift towards engineered and integrated electronic products over traditional printed circuit boards, especially in aerospace and defense, is expected to enhance operating margins by offering higher value-added products.

- Investment in a new automated PCB manufacturing facility in Penang, Malaysia, supports the commercial end markets, such as data centers and medical, suggesting potential future revenue growth as production ramps up and operational efficiencies are realized.

- The consolidation of manufacturing facilities is expected to improve operational performance and profitability, which could enhance net margins through increased plant utilization and reduced overhead costs.

- The expansion of advanced technology capability at the Syracuse campus, including new high technology PCB production, is a catalyst for future revenue growth, aligning with growing national security demands and high-tech needs in the aerospace and defense sector.

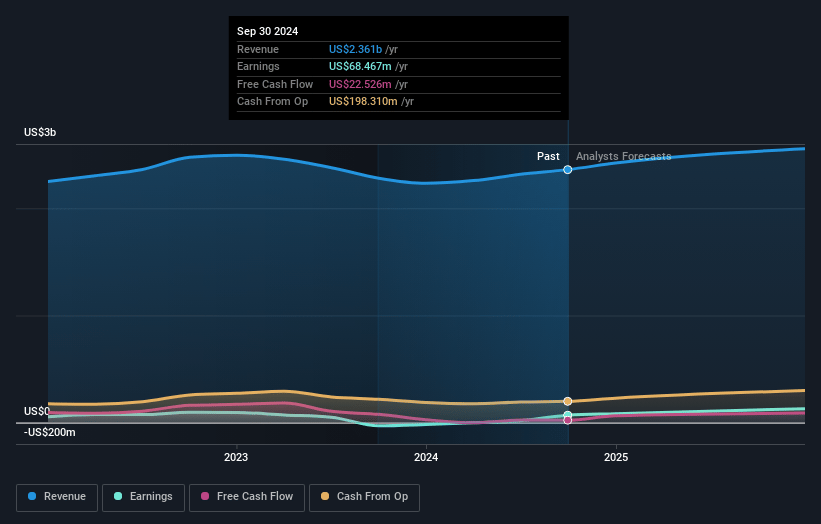

TTM Technologies Future Earnings and Revenue Growth

Assumptions

How have these above catalysts been quantified?- Analysts are assuming TTM Technologies's revenue will grow by 6.3% annually over the next 3 years.

- Analysts assume that profit margins will increase from 2.9% today to 9.4% in 3 years time.

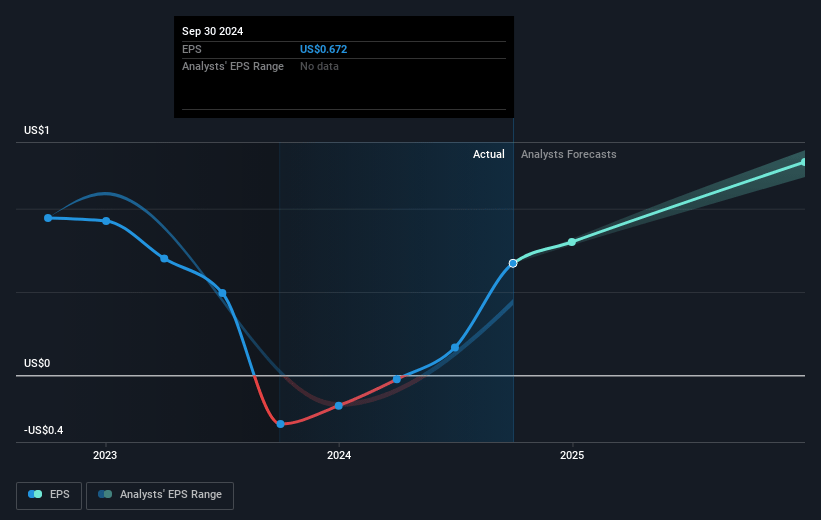

- Analysts expect earnings to reach $267.1 million (and earnings per share of $2.71) by about November 2027, up from $68.5 million today. The analysts are largely in agreement about this estimate.

- In order for the above numbers to justify the analysts price target, the company would need to trade at a PE ratio of 12.3x on those 2027 earnings, down from 36.1x today. This future PE is lower than the current PE for the US Electronic industry at 24.0x.

- Analysts expect the number of shares outstanding to decline by 1.07% per year for the next 3 years.

- To value all of this in today's terms, we will use a discount rate of 8.02%, as per the Simply Wall St company report.

TTM Technologies Future Earnings Per Share Growth

Risks

What could happen that would invalidate this narrative?- The company faces revenue challenges in its medical, industrial, and instrumentation, and automotive end markets, with year-over-year declines and ongoing inventory normalization, potentially impacting overall revenue growth.

- The translation effects of foreign exchange losses, especially from operations in China and Malaysia, resulted in substantial financial impacts in Q3, posing a risk to net income due to currency exposure.

- The Penang facility has been a consistent operational drag on margins, with a 180 basis point impact expected to continue into the next quarters, affecting the earnings until it reaches break-even mid-next year.

- The automotive sector is currently volatile with inventory adjustments and soft demand affecting sales, creating uncertainty and risk to future revenues and earnings from this market.

- The company has significant capital expenditure plans, such as the Syracuse expansion, which require substantial investment and are dependent on federal and state contributions, posing a risk if these projects do not lead to the expected revenue growth.

Valuation

How have all the factors above been brought together to estimate a fair value?- The analysts have a consensus price target of $26.5 for TTM Technologies based on their expectations of its future earnings growth, profit margins and other risk factors.

- In order for you to agree with the analyst's consensus, you'd need to believe that by 2027, revenues will be $2.8 billion, earnings will come to $267.1 million, and it would be trading on a PE ratio of 12.3x, assuming you use a discount rate of 8.0%.

- Given the current share price of $24.25, the analyst's price target of $26.5 is 8.5% higher. The relatively low difference between the current share price and the analyst consensus price target indicates that they believe on average, the company is fairly priced.

- We always encourage you to reach your own conclusions though. So sense check these analyst numbers against your own assumptions and expectations based on your understanding of the business and what you believe is probable.

How well do narratives help inform your perspective?

Disclaimer

Warren A.I. is a tool utilizing a Large Language Model (LLM) that ingests data on consensus price targets, forecasted revenue and earnings figures, as well as the transcripts of earnings calls to produce qualitative analysis. The narratives produced by Warren A.I. are general in nature and are based solely on analyst data and publicly-available material published by the respective companies. These scenarios are not indicative of the company's future performance and are exploratory in nature. Simply Wall St has no position in the company(s) mentioned. The price targets and estimates used are consensus data, and do not constitute a recommendation to buy or sell any stock, and they do not take account of your objectives, or your financial situation. Note that Warren A.I.'s analysis may not factor in the latest price-sensitive company announcements or qualitative material.

Read more narratives

There are no other narratives for this company.

View all narratives