Key Takeaways

- Heavy investment in Aerospace and Defense, advanced tech, and consolidating facilities aims to drive growth, improve efficiency, and boost margins.

- Strategic shifts to engineered products and high-tech PCB production are enhancing profitability and operational performance.

- Declines in key markets and operational challenges from new and consolidating facilities could affect revenue, efficiency, and profitability amid uncertain macroeconomic conditions.

Catalysts

About TTM Technologies- Manufactures and sells mission systems, radio frequency (RF) components and RF microwave/microelectronic assemblies, and printed circuit boards (PCB) worldwide.

- The company is heavily investing in its Aerospace and Defense segment, which now represents a significant portion of its revenue. With a record program backlog of approximately $1.56 billion, this segment is expected to drive future revenue growth.

- TTM Technologies is expanding its advanced technology capabilities through acquisitions and the construction of a new facility in Syracuse, focusing on high-technology printed circuit board production. This development is anticipated to increase domestic capacity, reduce lead times, and improve operational efficiency, positively impacting future net margins.

- The new state-of-the-art, highly automated PCB manufacturing facility in Penang, Malaysia, is expected to support significant growth in the Data Center Computing and Networking markets. As volume production ramps up, this facility should enhance revenue and eventually improve operating margins as production costs decrease.

- Consolidating its manufacturing footprint by closing smaller, less efficient facilities and transferring operations to remaining ones is expected to improve total plant utilization and operational performance. This consolidation should lead to enhanced profitability and potentially increase net margins.

- The focus on engineered and integrated electronic products rather than traditional printed circuit boards in the Aerospace and Defense sector is helping to improve operating margins. This strategic shift is projected to lead to further increases in non-GAAP operating margins as the product mix becomes more profitable.

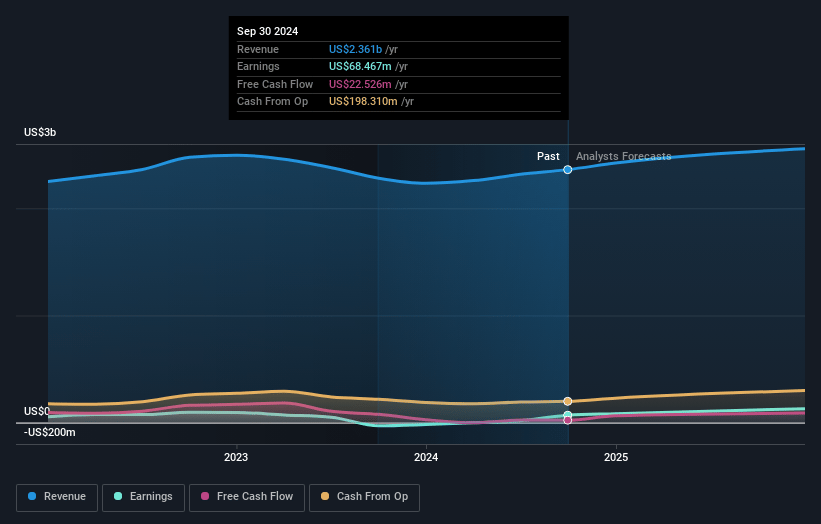

TTM Technologies Future Earnings and Revenue Growth

Assumptions

How have these above catalysts been quantified?- Analysts are assuming TTM Technologies's revenue will grow by 5.1% annually over the next 3 years.

- Analysts assume that profit margins will increase from 2.3% today to 9.4% in 3 years time.

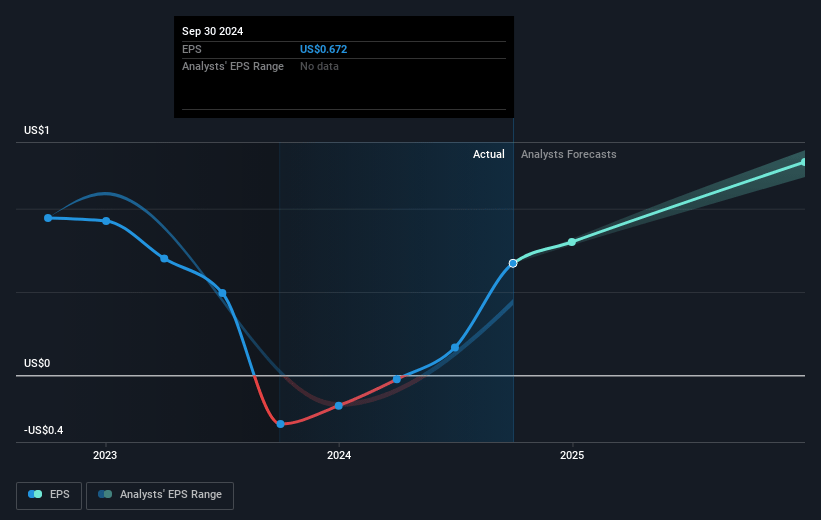

- Analysts expect earnings to reach $266.3 million (and earnings per share of $2.24) by about April 2028, up from $56.3 million today. The analysts are largely in agreement about this estimate.

- In order for the above numbers to justify the analysts price target, the company would need to trade at a PE ratio of 17.0x on those 2028 earnings, down from 36.9x today. This future PE is lower than the current PE for the US Electronic industry at 20.6x.

- Analysts expect the number of shares outstanding to grow by 0.33% per year for the next 3 years.

- To value all of this in today's terms, we will use a discount rate of 8.5%, as per the Simply Wall St company report.

TTM Technologies Future Earnings Per Share Growth

Risks

What could happen that would invalidate this narrative?- The decline in demand from the Automotive and Medical, Industrial and Instrumentation markets, due to inventory adjustments and weak demands, poses a risk to future revenue and profitability.

- Challenges in ramping up the new facility in Penang, Malaysia, which is still navigating customer audits and qualifications, could impact operational efficiency and margins.

- The ongoing consolidation of manufacturing facilities, including closures in the U.S. and Hong Kong, involves significant operational changes that could disrupt operations and affect profitability.

- Uncertainties in macroeconomic conditions, such as the impact of tariffs and geopolitical tensions, might influence supply chains and financial stability, affecting revenue and net margins.

- The $32.6 million goodwill impairment charge suggests potential overvaluation of acquired assets, which could impact GAAP earnings and investor perception of financial health.

Valuation

How have all the factors above been brought together to estimate a fair value?- The analysts have a consensus price target of $34.75 for TTM Technologies based on their expectations of its future earnings growth, profit margins and other risk factors.

- In order for you to agree with the analyst's consensus, you'd need to believe that by 2028, revenues will be $2.8 billion, earnings will come to $266.3 million, and it would be trading on a PE ratio of 17.0x, assuming you use a discount rate of 8.5%.

- Given the current share price of $20.42, the analyst price target of $34.75 is 41.2% higher.

- We always encourage you to reach your own conclusions though. So sense check these analyst numbers against your own assumptions and expectations based on your understanding of the business and what you believe is probable.

How well do narratives help inform your perspective?

Disclaimer

Warren A.I. is a tool utilizing a Large Language Model (LLM) that ingests data on consensus price targets, forecasted revenue and earnings figures, as well as the transcripts of earnings calls to produce qualitative analysis. The narratives produced by Warren A.I. are general in nature and are based solely on analyst data and publicly-available material published by the respective companies. These scenarios are not indicative of the company's future performance and are exploratory in nature. Simply Wall St has no position in the company(s) mentioned. Simply Wall St may provide the securities issuer or related entities with website advertising services for a fee, on an arm's length basis. These relationships have no impact on the way we conduct our business, the content we host, or how our content is served to users. The price targets and estimates used are consensus data, and do not constitute a recommendation to buy or sell any stock, and they do not take account of your objectives, or your financial situation. Note that Warren A.I.'s analysis may not factor in the latest price-sensitive company announcements or qualitative material.