Key Takeaways

- Strategic focus on larger, complex systems and clean energy sectors is driving revenue growth through higher selling prices and repeat orders.

- Vertical integration and internal developments enhance efficiency, reducing costs while boosting margins and supporting financial growth.

- Continued sales challenges in APAC and market demand shifts in medical devices and Latin America could pressure Sono-Tek's revenue and profit margins.

Catalysts

About Sono-Tek- Designs and manufactures ultrasonic coating systems for applying on parts and components for the microelectronics/electronics, alternative energy, medical, industrial, and research and development/other markets worldwide.

- Sono-Tek's strategic shift to larger, more complex systems has significantly expanded its addressable market and increased average system selling prices. This shift is expected to drive revenue growth as these high ASP systems are sold to production applications.

- The expansion into the clean energy sector, specifically in advanced solar cells, fuel cells, and carbon capture markets, is showing transformative results. The success in these sectors is expected to generate repeat and multiple orders, enhancing revenue due to sustained demand and higher average selling prices.

- Record-level backlog growth, increasing 26% to $11.7 million, indicates robust future sales and revenue potential. This backlog includes significant orders from the clean energy sector and positions Sono-Tek well for continued financial growth.

- Efforts to remain vertically integrated and focused on systems like Project Aries should enhance production efficiency and net margins, as internal development capabilities reduce reliance on external suppliers and improve cost management.

- Potential increase in follow-on services and spare parts packages related to high ASP systems could contribute an additional 10%-15% to revenue per total system value, supporting ongoing growth in earnings by capitalizing on service synergies from installed systems.

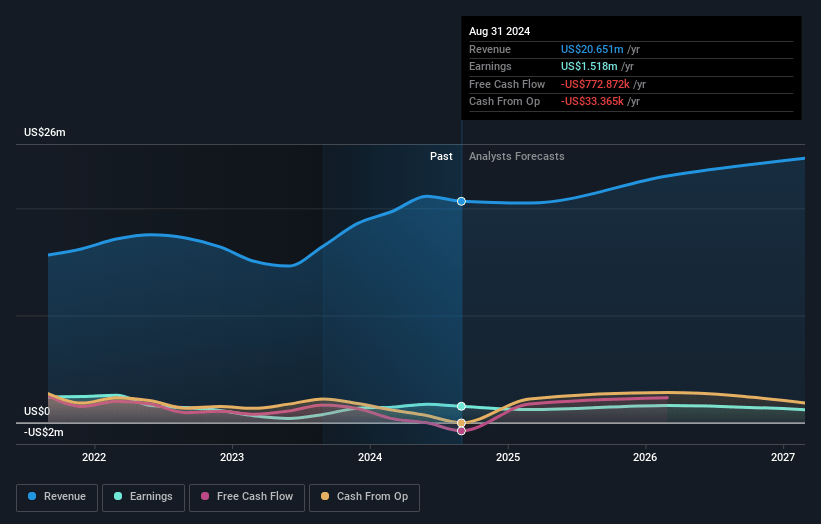

Sono-Tek Future Earnings and Revenue Growth

Assumptions

How have these above catalysts been quantified?- Analysts are assuming Sono-Tek's revenue will grow by 6.8% annually over the next 3 years.

- Analysts assume that profit margins will increase from 5.5% today to 6.7% in 3 years time.

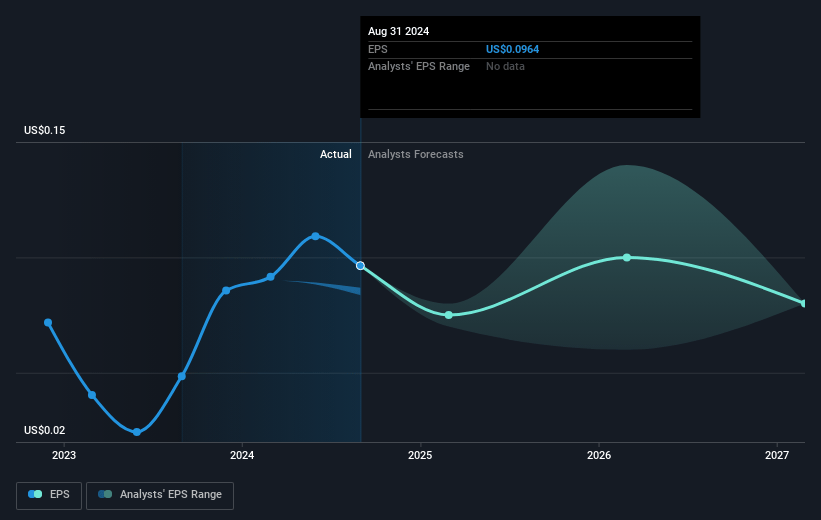

- Analysts expect earnings to reach $1.6 million (and earnings per share of $0.1) by about April 2028, up from $1.1 million today.

- In order for the above numbers to justify the analysts price target, the company would need to trade at a PE ratio of 93.3x on those 2028 earnings, up from 51.4x today. This future PE is greater than the current PE for the US Electronic industry at 19.3x.

- Analysts expect the number of shares outstanding to remain consistent over the next 3 years.

- To value all of this in today's terms, we will use a discount rate of 7.27%, as per the Simply Wall St company report.

Sono-Tek Future Earnings Per Share Growth

Risks

What could happen that would invalidate this narrative?- The weakening Chinese economy and a high level of local competition could continue to limit sales in that region, which may negatively impact Sono-Tek's revenue and market share in APAC.

- The current softening of activity in the printed circuit board manufacturing sector and continued declines in OEM sales, especially from China-based partners, could contribute to reduced revenue and profit margins.

- There is a concern about the market demand for medical devices, as noted in the decline of stent coating system sales, potentially affecting future sales and revenue in the medical segment.

- The sales dip in Latin America, largely due to the non-repeating float glass coating system order, highlights the risk of revenue volatility from large, non-recurring sales.

- The reduction in gross profit percentage due to an unfavorable product mix and the reallocation of labor expenses suggests potential pressure on margins, impacting overall earnings.

Valuation

How have all the factors above been brought together to estimate a fair value?- The analysts have a consensus price target of $8.25 for Sono-Tek based on their expectations of its future earnings growth, profit margins and other risk factors.

- In order for you to agree with the analyst's consensus, you'd need to believe that by 2028, revenues will be $24.5 million, earnings will come to $1.6 million, and it would be trading on a PE ratio of 93.3x, assuming you use a discount rate of 7.3%.

- Given the current share price of $3.6, the analyst price target of $8.25 is 56.4% higher.

- We always encourage you to reach your own conclusions though. So sense check these analyst numbers against your own assumptions and expectations based on your understanding of the business and what you believe is probable.

How well do narratives help inform your perspective?

Disclaimer

Warren A.I. is a tool utilizing a Large Language Model (LLM) that ingests data on consensus price targets, forecasted revenue and earnings figures, as well as the transcripts of earnings calls to produce qualitative analysis. The narratives produced by Warren A.I. are general in nature and are based solely on analyst data and publicly-available material published by the respective companies. These scenarios are not indicative of the company's future performance and are exploratory in nature. Simply Wall St has no position in the company(s) mentioned. Simply Wall St may provide the securities issuer or related entities with website advertising services for a fee, on an arm's length basis. These relationships have no impact on the way we conduct our business, the content we host, or how our content is served to users. The price targets and estimates used are consensus data, and do not constitute a recommendation to buy or sell any stock, and they do not take account of your objectives, or your financial situation. Note that Warren A.I.'s analysis may not factor in the latest price-sensitive company announcements or qualitative material.