Narratives are currently in beta

Key Takeaways

- Super Micro's advancements in liquid cooling and AI infrastructure are set to boost revenues by increasing energy efficiency and reducing operational costs.

- Expanding production capacity and strategic partnerships in Europe and Asia aim to improve market penetration, enhancing future earnings potential.

- Operational challenges, competitive pressures, and supply chain risks threaten Super Micro's revenue growth and margin stability, complicating inventory management and investor confidence.

Catalysts

About Super Micro Computer- Develops and manufactures high performance server and storage solutions based on modular and open architecture in the United States, Europe, Asia, and internationally.

- Super Micro's expansion into liquid cooling data centers, highlighted by significant growth in the DLC liquid cooling market share, is expected to drive revenue growth due to increased demand for energy-efficient and high-performance computing solutions.

- The development and deployment of advanced AI infrastructure through Datacenter Building Block Solutions (DCBBS), including liquid cooling technology and the SuperCloud Composer, aim to improve operational efficiencies and reduce customer costs, thereby potentially increasing net margins.

- The completion of a new manufacturing campus in Malaysia and the expansion of facilities in Silicon Valley, Taiwan, and Europe are poised to enhance production capacity, supporting future revenue growth.

- Anticipated growth in demand for new-generation GPU chips, such as Blackwell, suggests potential future revenue increases once these become available, also benefiting gross margins as new technologies typically command higher price points.

- Super Micro's focus on expanding its customer base in Europe and Asia alongside strategic partnerships with key technology providers like NVIDIA suggests a forward-looking approach that could boost earnings through increased market penetration and diversified revenue streams.

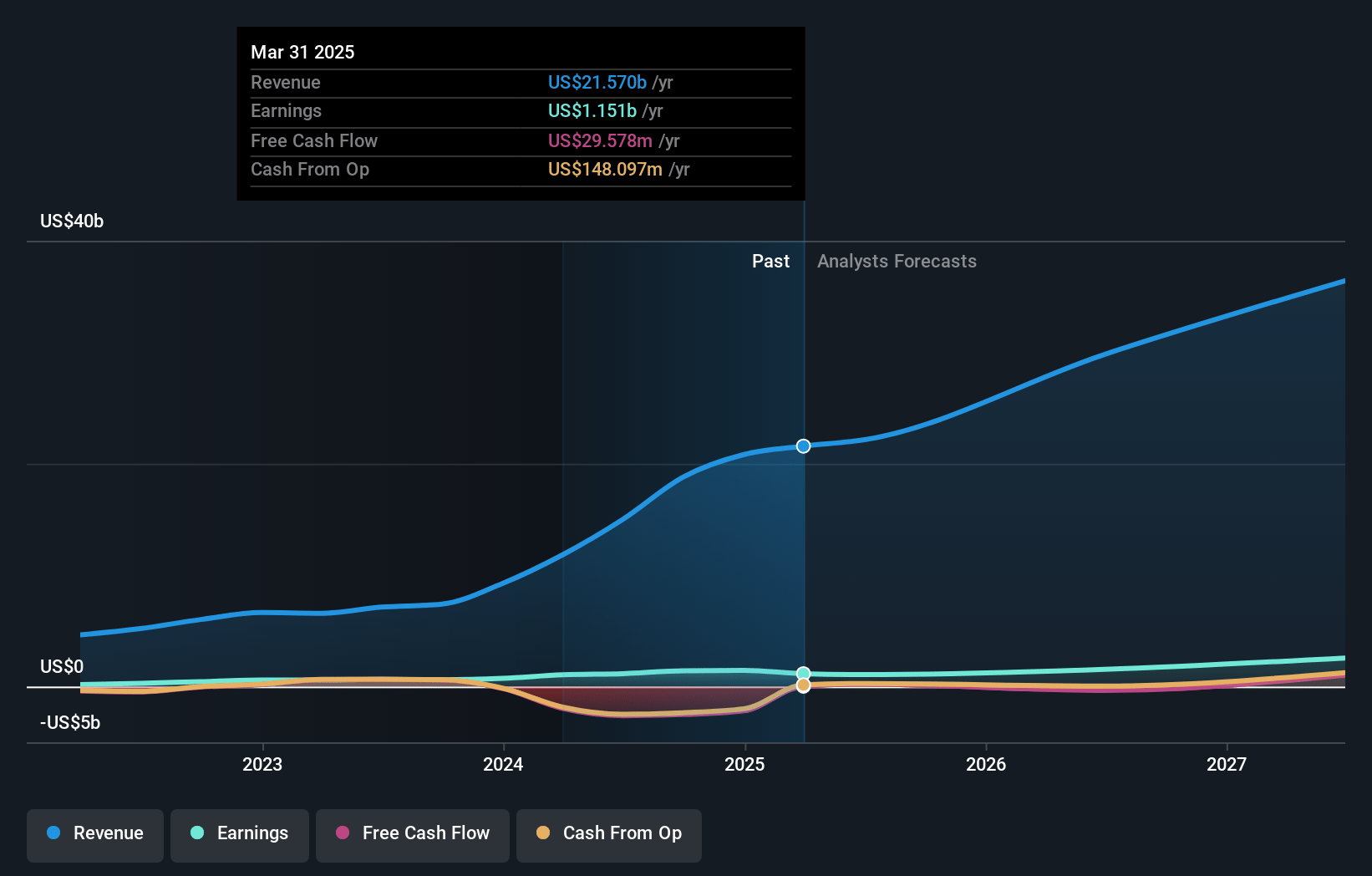

Super Micro Computer Future Earnings and Revenue Growth

Assumptions

How have these above catalysts been quantified?- Analysts are assuming Super Micro Computer's revenue will grow by 28.9% annually over the next 3 years.

- Analysts assume that profit margins will shrink from 8.1% today to 7.7% in 3 years time.

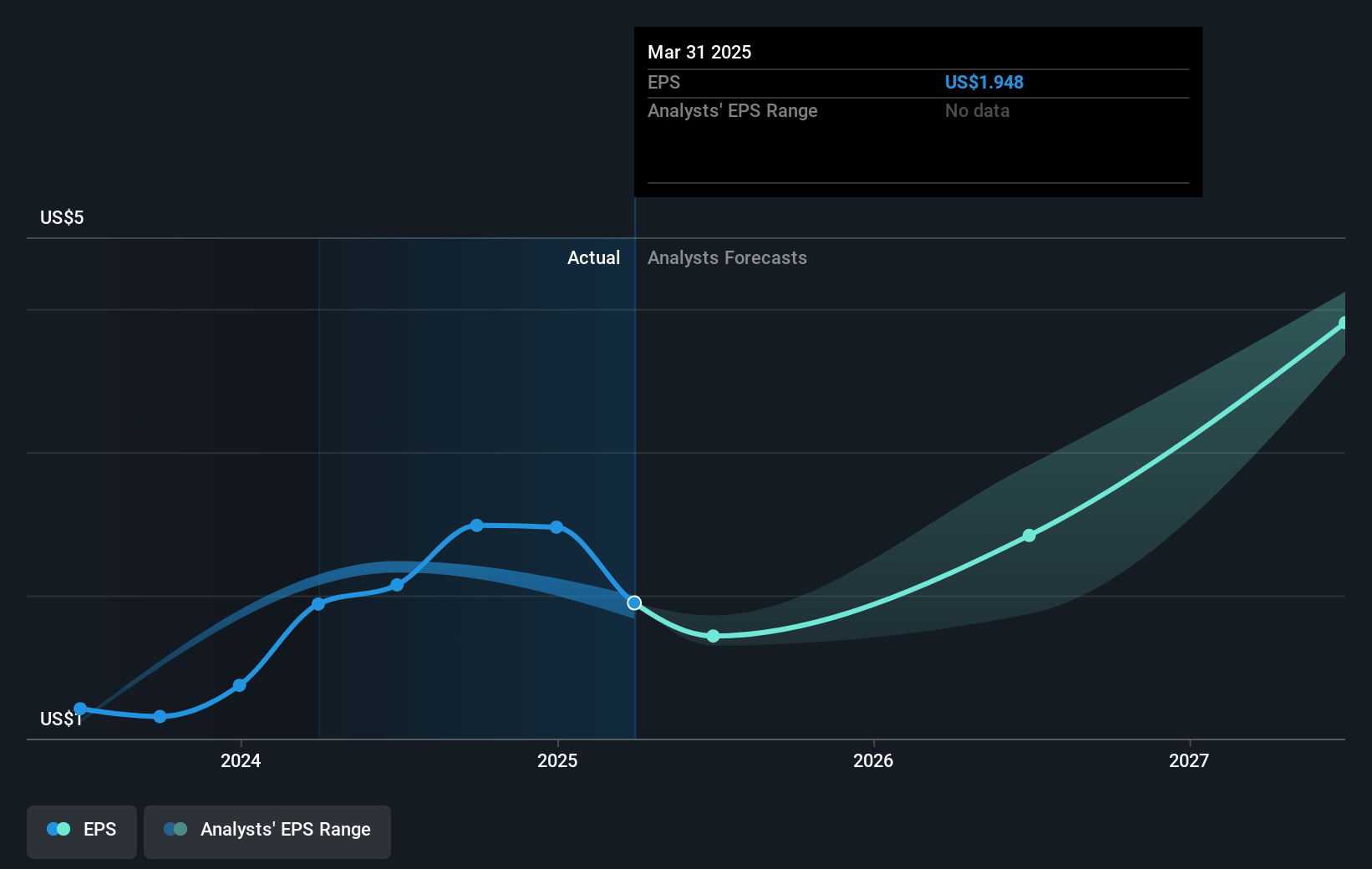

- Analysts expect earnings to reach $2.5 billion (and earnings per share of $2.96) by about November 2027, up from $1.2 billion today. However, there is a considerable amount of disagreement amongst the analysts with the most bullish expecting $4.1 billion in earnings, and the most bearish expecting $1.5 billion.

- In order for the above numbers to justify the analysts price target, the company would need to trade at a PE ratio of 17.0x on those 2027 earnings, up from 13.7x today. This future PE is lower than the current PE for the US Tech industry at 23.1x.

- Analysts expect the number of shares outstanding to grow by 12.56% per year for the next 3 years.

- To value all of this in today's terms, we will use a discount rate of 7.65%, as per the Simply Wall St company report.

Super Micro Computer Future Earnings Per Share Growth

Risks

What could happen that would invalidate this narrative?- The resignation of Super Micro's independent auditor and the delay in filing its 10-K could undermine investor confidence and result in higher scrutiny or regulatory issues, potentially affecting future earnings due to increased administrative and legal costs.

- The company's revenue came in at the lower end of its guidance and was attributed to delays in customer orders for new-generation GPU chips, indicating reliance on technological advancements that may not align with customer timelines, impacting short-term revenue growth.

- Super Micro's substantial $5 billion inventory highlights potential concerns about inventory management efficiency, which could affect cash flow if demand does not materialize as expected, leading to potential write-downs and impact on net margins.

- Increasing competition in the AI market and potential customer mix changes could pressure the company’s margins as it may have to offer more aggressive pricing to maintain or gain market share, impacting its gross and operating margins.

- Risks associated with supply chain, particularly sourcing new GPU chips from NVIDIA, could impact production schedules and revenue recognition, reflecting uncertainty in meeting demand forecasts and impacting future revenue and profit growth.

Valuation

How have all the factors above been brought together to estimate a fair value?- The analysts have a consensus price target of $40.32 for Super Micro Computer based on their expectations of its future earnings growth, profit margins and other risk factors. However, there is a degree of disagreement amongst analysts, with the most bullish reporting a price target of $93.0, and the most bearish reporting a price target of just $23.0.

- In order for you to agree with the analyst's consensus, you'd need to believe that by 2027, revenues will be $32.0 billion, earnings will come to $2.5 billion, and it would be trading on a PE ratio of 17.0x, assuming you use a discount rate of 7.6%.

- Given the current share price of $28.27, the analyst's price target of $40.32 is 29.9% higher.

- We always encourage you to reach your own conclusions though. So sense check these analyst numbers against your own assumptions and expectations based on your understanding of the business and what you believe is probable.

How well do narratives help inform your perspective?

Disclaimer

Warren A.I. is a tool utilizing a Large Language Model (LLM) that ingests data on consensus price targets, forecasted revenue and earnings figures, as well as the transcripts of earnings calls to produce qualitative analysis. The narratives produced by Warren A.I. are general in nature and are based solely on analyst data and publicly-available material published by the respective companies. These scenarios are not indicative of the company's future performance and are exploratory in nature. Simply Wall St has no position in the company(s) mentioned. The price targets and estimates used are consensus data, and do not constitute a recommendation to buy or sell any stock, and they do not take account of your objectives, or your financial situation. Note that Warren A.I.'s analysis may not factor in the latest price-sensitive company announcements or qualitative material.

Read more narratives

US$26.00

FV

0.8% undervalued intrinsic discount15.05%

Revenue growth p.a.

2users have liked this narrative

0users have commented on this narrative

7users have followed this narrative

18 days ago author updated this narrative

WA

WallStreetWontons

Community Contributor

SMCI: an "AI winner" with servers housing AI chips

Catalysts Robust Revenue Growth : In the third quarter of 2024, SMCI reported impressive revenue growth. Their revenue reached $3.85 billion, which represents a remarkable 200% year-on-year increase .

View narrativeUS$145.34

FV

82.2% undervalued intrinsic discount15.00%

Revenue growth p.a.

2users have liked this narrative

0users have commented on this narrative

14users have followed this narrative

about 2 months ago author updated this narrative